This is the first in a series of multimedia offerings that highlight insights derived from a recent BCG survey of digital maturity in manufacturing operations. Here, we discuss what sets apart the leaders, present a framework for digitizing operations, and explain the importance of an upfront digital vision. Subsequent articles will examine specific use cases at the industry level and organizational and technical enablers.

Digitizing operations is more than a nice-to-have for manufacturing companies. It’s an imperative, and they know it—more than 80% of them are actively investing in digital operations, according to a recent BCG survey. Digitization—when done right and at scale—yields impressive upsides: a 10% to 20% reduction in production and supply chain costs, a 15% to 30% cut in working capital, and an uptick in incremental revenue growth of up to 6% through enhanced productivity. Digital technology can even facilitate fundamental changes in supply chain strategy and promote resilience in a volatile business environment.

But most companies have seen mixed results. Because it’s hard to digitize operations. A company needs to invest—massively—in change management, new technical skill sets, cross-functional collaboration, strategic investments, and access to pricey talent. It must also evaluate a daunting array of new technologies and vendors. And these are just the prerequisites. Most companies are still focused on digitizing their internal operations. Few have started to weave the digital thread across the broader supply chain that runs from suppliers to internal operations and through to the end customer. Moreover, all companies face the challenge of sustaining their investments in digital operations even as more pressing issues arise.

Companies must weave a digital thread across the supply chain.

To help companies tackle the formidable challenges, BCG has developed the authoritative how-to guide for using digital technologies to transform operations. Applying our experience supporting companies, as well as the results of an extensive survey of executives across industries, we’ve identified the factors that separate the leaders from the laggards in digital operations. (See “About the Survey.”)

ABOUT THE SURVEY

ABOUT THE SURVEY

In October 2018, BCG conducted an online survey of executives from large manufacturing companies in order to understand their progress in adopting digital technology in operations. We defined manufacturing operations to include product engineering and design, supply chain management, production, and distribution and field service. The survey’s participants consisted of 250 executives and managers from global companies representing a broad array of manufacturing industries: aerospace and defense, automotive, chemicals, consumer and retail, engineered products, metals and mining, and pharmaceuticals.

The survey asked respondents to assess their digital vision and the status of adoption of 38 digital use cases. The use cases comprise a variety of applications, such as using advanced automation or analytics to address a specific pain point in operations (for example, quality or inventory).

Digitizing Operations Pays Off

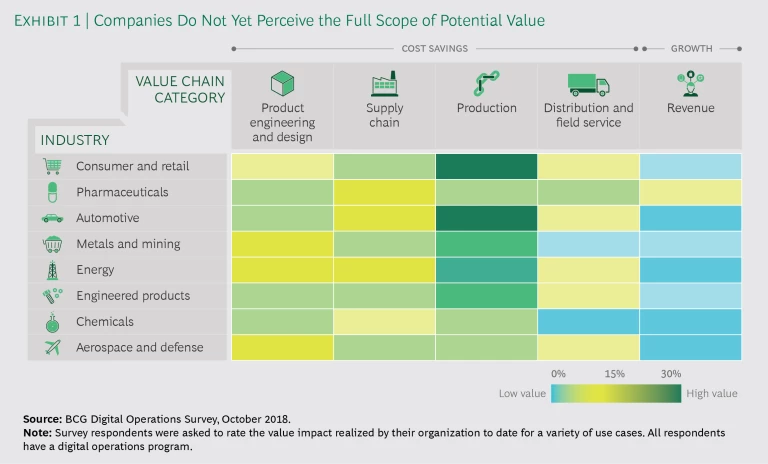

The cost savings and growth impact of digital operations along the value chain varies by industry. (See Exhibit 1.) Survey respondents pointed to production as the function in which they perceive the greatest savings and growth potential.

However, we believe that the perception of outsized savings potential in production reflects the relatively high level of digital deployments in that function to date. We see significant untapped value in the other functions as well, especially product design and supply chain. But because investments in these functions are still at an early stage, the value is not yet clear to many executives. Indeed, in supporting companies on the digital operations journey, we have seen results across the value chain that should pique the interest of every executive. For example:

- Product simulation tools are being used to validate new designs and material types, resulting in shorter lead times for the design process compared with those for iterative physical testing. Additionally, design tools are being used to reduce engineering hours by automating tasks that traditionally required manual work, such as cable or wire routing.

- Automated picking and transport of parts is being used to dramatically reduce warehouse costs and improve safety by eliminating the use of forklifts. Vertical integration with suppliers is helping to optimize inventory levels and reduce costs for expediting late orders or compensating for poor inventory visibility.

- Predictive analytics are being used to reduce occurrences of quality defects and the costs of quality problems. The analyses predict issues and recommend process changes before problems occur.

- Advanced analytics are optimizing complex decisions relating to production planning and supply chain networks, allowing companies to fulfill orders more dynamically and at a lower cost.

- Collaborative robots (cobots) are being added to assembly processes that could not accommodate the size and movements of conventional robots. Applications of cobots have become increasingly sophisticated through integration with advanced peripherals, such as vision systems and artificial intelligence, enabling higher levels of process standardization and lower conversion costs.

- Predictive maintenance analytics are enabling higher levels of machine uptime. By analyzing multiple process parameters simultaneously and over time, manufacturers can identify when and where critical maintenance needs occur.

- Forecasting tools are enabling more-effective supply chain strategies. For example, by increasing forecast accuracy, a chemical company was able to shift from make-to-order to make-to-stock as the basis for its supply chain. The change allowed the company to gain a lead time advantage over its competitors.

But Digitizing Operations Is Hard to Do

So why are companies struggling to capture the benefits of digitization? Our survey found that companies experience a variety of challenges. Several stand out:

- Lack of change management was the problem that respondents most commonly cited: 38% said that their company underinvests in training, hiring, and infrastructure to support scale.

- Almost as many (36%) said that functional siloes are impeding collaboration across the manufacturing, supply chain, and engineering departments.

- Nearly one-third (31%) said that their company lacks the necessary technical capabilities, with skill gaps in key roles such as data scientist and data engineer.

- More than one-quarter (29%) said that their company deploys technology without a clear understanding of whether it will create value, rather than targeting their technology deployments to address specific pain points.

What Sets Apart the Leaders?

To identify the factors that distinguish the leading companies, we asked surveyed respondents to assess the maturity of their digital operations program along 13 dimensions. (See “The 13 Dimensions of Digital Maturity.”)

THE 13 DIMENSIONS OF DIGITAL MATURITY

THE 13 DIMENSIONS OF DIGITAL MATURITY

Companies can use the following dimensions to gauge the maturity of their digital operations program and guide their improvement efforts:

Clarity of Vision

- Champion—organizational authority of the unit or leader that champions the digital vision

- Ambition—degree to which the digital vision demands and articulates transformational impact

- Targets—extent to which the digital vision clearly defines targets for time and impact

Uses of Digital Technology

- Solution focus—extent to which the organization focuses primarily on solutions that address operational pain points to maximize value, rather than taking a technology-first perspective

- Technology maturity—extent to which the organization understands and considers a technology’s readiness for deployment at scale before implementation

- Roadmap—level of specificity in the digital roadmap in terms of time frame and sequencing of solution deployment

Operating Model

- Reporting level—number of levels below the CEO to which the head of digital operations reports

- Organization structure—extent to which new positions and teams have been created to support digital operations at scale

- Integration—extent to which digital solution development is integrated as a “digital thread” across engineering, supply chain, and manufacturing

- Business interface—degree to which ownership of digital operations is embedded and integrated into the responsibilities of business unit leaders

Enablement

- Technology enablers—extent to which the company has set up IT and data enablers, such as a data lake, to support digital operations at scale

- Organizational capability—extent to which the company has expanded its organizational capabilities to support digital operations at scale on the basis of an evaluation of existing capabilities

- Governance—whether governance of digital projects is overseen by a centralized group or decentralized business units

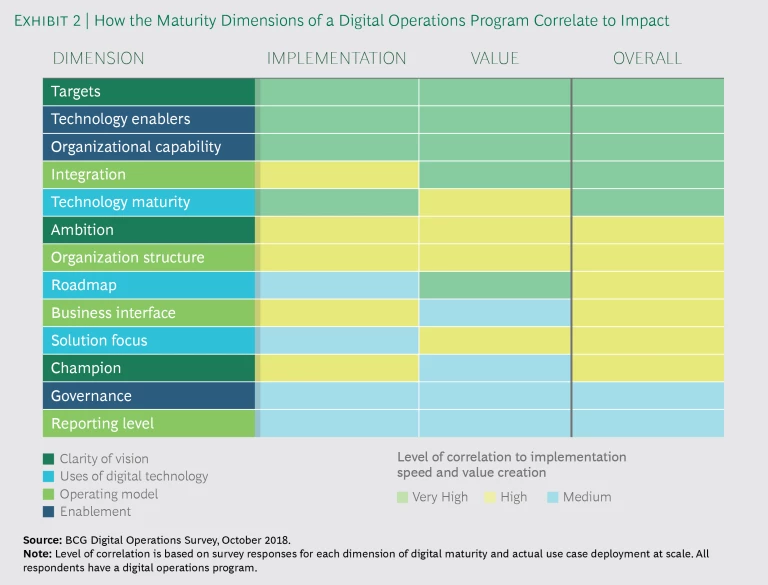

Leaders (the top decile in self-reported results) are clearly differentiated from laggards (the bottom decile) by their performance across these dimensions. The two dimensions in which leaders most excel are “targets” (setting implementation targets) and “integration” (integrating the efforts of digital operations teams and business units).

Leaders’ advanced level of performance in these dimensions translates into superior results in two ways:

- Speed of Implementation. Leaders implement 2.9 times more use cases at scale across multiple sites or functions.

- Savings and Growth Impact. Leaders capture 2.7 times greater cost savings and revenue growth (based on the average percentage effect of high-impact use cases across five operations functions).

The survey responses reveal the factors that matter most for promoting implementation speed and value generation. (See Exhibit 2.) The top three dimensions—targets, technology enablers, and organizational capabilities— highlight the importance of early enablement and planning to ensure success and create momentum. But that doesn’t mean that the other dimensions are unimportant. Dimensions that correlate less strongly to implementation success and value generation, such as integration and technology maturity, are critical to driving results over the short and long terms. Even factors with moderate correlations to success are important for moving beyond the low-hanging fruit and tracking progress.

Four Steps to Capturing the Value: Start with Vision

To overcome the challenges of digitizing operations, executives need to take four steps. We explore the first step in greater detail below. We’ll tackle the remaining steps in subsequent articles.

- Set a clear and compelling vision. A vision must be ambitious but achievable, and it must be integrated across functions. Sponsorship by an executive champion is essential to reinforce commitment and galvanize the organization to act.

- Develop a strong portfolio of use cases. A company should select use cases that will help it achieve the ambition set out in the vision. Implementation requires a strong understanding of a technology’s readiness to address pain points and a clear roadmap to guide rapid piloting and, where successful, deployment at scale.

- Establish a digital operating model. A company needs an effective organization structure to prioritize opportunities and a high level of collaboration between digital operations teams and the business units.

- Strengthen the enablers. A company needs new capabilities and talent in areas such as data science, information technology, and advanced engineering. These must be supported by a robust data infrastructure. Digital operations must also be supported by strong organizational capabilities and governance.

The concept of a “vision” sounds soft. But every leader knows the importance of setting a compelling vision to rally the organization. A clearly defined vision unites the organization behind a common objective, sets the right ambition level, and encourages innovative thinking. Because people at all levels understand what matters most, resources can be allocated more effectively.

A vision must be audacious as well as achievable. An audacious vision is bold enough to stretch imaginations, inspire innovations, and demand new approaches. It must also be sufficiently specific to excite the organization. An achievable vision is feasible enough to be useful in guiding decisions and supported by a compelling strategy. It must also be grounded in the company’s core advantages and informed by a strong understanding of where the industry is headed. Such a vision leads to measurable impact that can be realized in a reasonable time frame (for example, two to three years).

A vision must be audacious as well as achievable.

Leading organizations stand out for establishing a compelling vision that drives their remarkable success. For example, early on, Amazon set a vision “to be Earth’s most customer-centric company, where customers can find and discover anything they might want to buy online.”

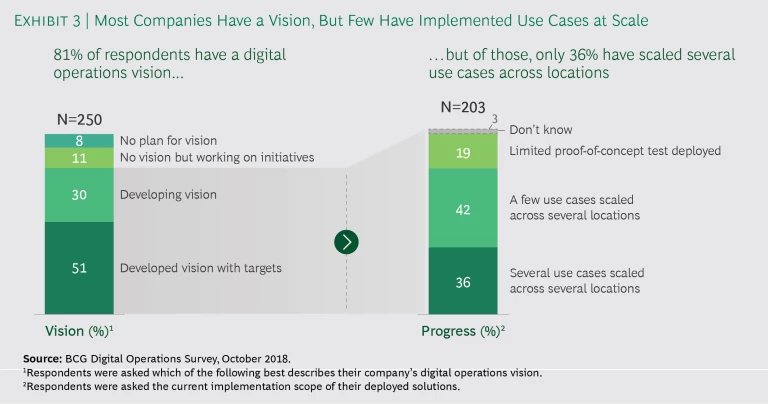

The vast majority of survey respondents (81%) said that their company has developed or is developing a vision for digital operations. However, only about one-third (36%) of these respondents said that their company has scaled several use cases across multiple manufacturing locations. (See Exhibit 3.)

An executive champion and clear targets appear to be key differentiators. Leaders are approximately 2.5 times more likely than laggards to have board- or CXO-level sponsorship of their digital vision. And 100% of leaders had clearly defined targets for digital operations.

For example, a metal producer’s chief technology officer championed an effort to use digital technology to transform business-to-business customer engagement. Ambitious targets served as catalysts for the transformation. The targets included doubling customer service levels in three years, boosting EBITDA by 2% to 4% in three years, and reducing inventory by four to ten days in two years.

Bold aspirations for operations were also fundamental to Whirlpool’s effort to become a world-class manufacturing organization. The CEO challenged the organization to become the company that other companies used as a benchmark. Targets included reducing conversion costs by $1 billion, boosting quality metrics by 50%, and achieving 100% on-time delivery.

An integrated vision across the company, with joint ownership by digital operations teams and business units, is critical to success. Leaders are approximately 2.5 times more likely to be integrated across functions. And they are about 2 times more likely to have joint ownership of digital initiatives between digital operations teams and business units.

A compelling vision that galvanizes the organization to take action is just the starting point of the digital operations journey. To realize its vision, a company must develop an integrated portfolio of use cases that targets the highest-value opportunities. Taking an industry-level perspective, the next article in this series will explore how companies can integrate a variety of use cases to drive the greatest value.