The best blockchain networks are often the hardest to create. A fundamental paradox relating to blockchain technology is on full display in the transportation and logistics (T&L) industry . By increasing transparency, these distributed digital ledgers can mitigate the mistrust that often exists among the industry’s transacting parties. Yet this same mistrust makes it hard to bring together the industry’s diverse participants into a common blockchain ecosystem.

The paradox is reflected in the slow rate of blockchain adoption revealed in a recent BCG survey of T&L executives. (See the sidebar, “About the Survey.”) The vast majority of respondents (88%) believe that blockchain will disrupt the industry at least somewhat. And most (59%) believe that the disruptions will take place within the next two to five years. But nearly three-quarters (74%) say that they are exploring opportunities only superficially or haven’t thought about blockchain at all. The most cited obstacles to wider adoption of blockchain are an absence of coordination among industry players, a limited understanding of the technology, and a lack of in-house capabilities.

ABOUT THE SURVEY

ABOUT THE SURVEY

In September and October 2018, BCG conducted an online survey of global companies in the T&L industry in order to assess their understanding of blockchain and their progress in adopting the technology. The survey’s participants consisted of executives from more than 100 T&L companies. A broad scope of T&L subsectors was represented, including air freight; courier, express, and parcel; logistics; rail; and shipping.

It would be worthwhile for T&L companies to resolve the paradox. The T&L industry is rife with sources of friction—including countless suppliers, dozens of handoffs, and ever-changing regulations—that introduce non-value-added costs and can result in inaccurate or misrepresented information. By providing an immutable single source of truth and enabling process automation, blockchain can address many of the industry’s pain points. The benefits include improvements to speed, traceability, cargo safety, and invoicing and payment processes. Such benefits can drive substantial cost reductions, helping to relieve the intense margin pressure experienced by many industry players. Companies may even be able to use blockchain to develop entirely new business models, such as those relating to virtual global networks, pooled fleets, and on-demand staffing.

Given the industry dynamics, no T&L company can do it alone. To realize the promise of blockchain, T&L stakeholders must collaborate to develop an ecosystem that forges trust and creates mutual benefits across the value chain. Each company must also work with suppliers, customers, and even competitors to understand and implement solutions that address its specific business needs. It’s time for all players across the diverse T&L value chain, including governments and regulators, to take action.

Blockchain Basics

Many T&L executives regard blockchain technology as at best mysterious or at worst ripe for exploitation. In fact, the underlying concept is fairly straightforward. Simply put, because blockchains create data transparency, they help to establish trust among participants in complex networks. And, although the data entered in a blockchain is not guaranteed to accurately represent reality, data in a well-designed blockchain cannot be tampered with.

In basic terms, here’s how it works. A blockchain is a shared digital ledger for recording and storing transactions between multiple participants in a network. Changes made to the blockchain record must be approved by participants through an automated process. Approved updates are time-stamped, cryptographically signed, and added to the block. The new block becomes part of the blockchain. Unlike traditional ledgers, a blockchain provides an immutable record of all transactions and agreements of interest to the participants—no single party can unilaterally alter the information. Because information cannot be deleted, only appended, a blockchain provides an evidentiary trail of information back to the point of origin.

To realize the promise of blockchain, T&L stakeholders must collaborate to develop an ecosystem that forges trust and creates mutual benefits across the value chain.

Blockchains can be public, private, or hybrid. A public blockchain (bitcoin, for example) is open, so that anyone with computing capacity can add to the network, maintain the ledger, and weigh in on issues requiring consensus. In contrast, private blockchains are run by one business, joint venture, consortium, or government entity. Although the controlling party cannot alter data, it has the ultimate say in the rules that govern the platform, including who can join and which members can view or append information in the digital ledger. Hybrid blockchains are controlled by a consortium of businesses or government entities that may give access to the public to view or append information or may restrict access to its members. A private or hybrid blockchain with permissioned access (that is, only authorized users can join and read and write data) provides the highest level of scalability and data privacy. Private or hybrid blockchains can be set up to require far less computing power than public blockchains.

On its own, a blockchain is not a panacea—it can only serve as a repository of data and a means to automate transactions. To enable other benefits, blockchain should be used in combination with other technologies. The embedded sensors and networked devices that make up the Internet of Things (IoT) can automate the capturing and transmission of machine-generated data, and artificial intelligence and machine learning can be used to analyze data and derive powerful insights.

If effective supporting technologies are in place, blockchain’s features and benefits can potentially overcome the main obstacles to cooperation among multiple stakeholders in a complex value chain. By providing a single version of the truth for all participants, a blockchain enables trustless transactions and reduces the risk of error or fraud and the need for intermediaries. Participants gain the ability to track the movement of items in real time and verify transactions. A blockchain ledger can also be used to set up a wide range of “smart” contracts that self-execute upon the occurrence of a specified scenario (for example, peer-to-peer payment upon delivery of goods), thereby automating repetitive processes.

An important caveat: although blockchain is often the best technology option for creating trust, traditional technologies are still the right choice for transactions and processes that involve a small number of parties who already know each other or for whom it is easy to establish a single, indisputable source of truth. A blockchain is also not yet suitable for processing large volumes of transactions or warehousing large volumes of data.

T&L Needs Blockchain

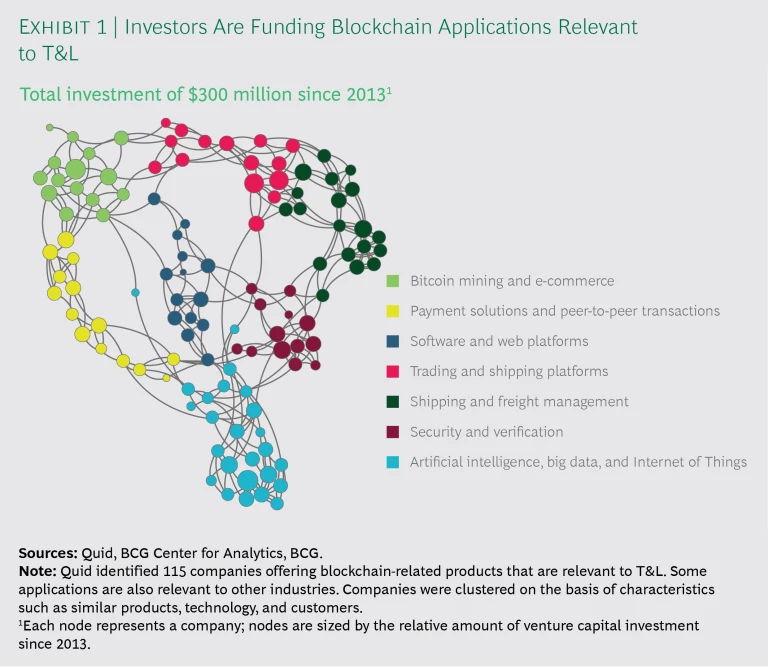

Investors are aggressively supporting opportunities to develop blockchain applications for T&L. An analysis by BCG found that, since 2013, venture capital investors have poured approximately $300 million into startup companies offering blockchain solutions relevant to T&L, including $53 million specifically in shipping and freight management , as well as in trading and shipping platforms. (See Exhibit 1.) Additionally, T&L companies have invested millions of dollars in researching and developing their own blockchain solutions. The recent growth of investments suggests that new solutions will reach the market in the next one to three years. The question is whether companies will adopt them.

Leading T&L players are beginning to explore ways to capture value from blockchains, both on an individual basis and in cross-industry collaborations. Notable examples include the following:

- A consortium of nine companies is developing a blockchain-enabled platform called the Global Shipping Business Network, with the goal of improving speed, transparency, and collaboration and promoting digitization. Participants include carriers (CMA CGM, COSCO Shipping Lines, Evergreen Marine, OOCL, and Yang Ming); terminal operators (DP World, Hutchison Ports, PSA International, and Shanghai International Port); and a software solutions provider (CargoSmart).

- Anheuser-Busch InBev, Accenture, APL, Kuehne + Nagel, and a European customs organization are collaborating in a cross-industry initiative to explore the application of blockchain to support documentation handling for ocean freight.

- Maersk and IBM have jointly created TradeLens, a blockchain-enabled shipping solution designed to promote more efficient and secure global trade. The objective is to support information sharing and transparency across the value chain and encourage innovation.

- The Blockchain in Transport Alliance seeks to drive industry-wide blockchain adoption. The alliance is a consortium of approximately 400 members spanning the T&L, consumer goods, and technology sectors and includes both established companies and startups.

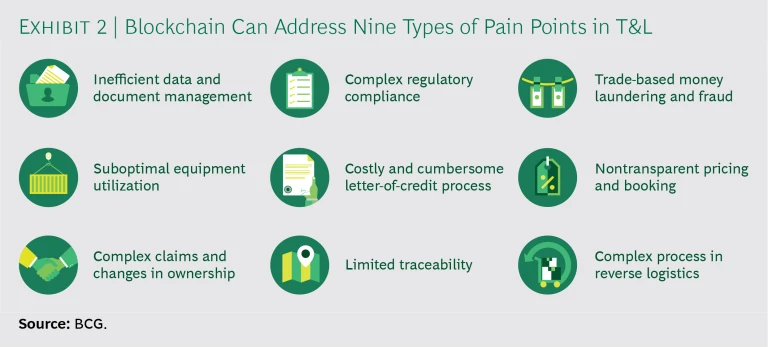

But, as our survey findings indicate, most industry participants have not taken a deep look at blockchain’s potential applications. Our analysis of the opportunities makes clear that companies should be willing to invest the time and effort to realize the technology’s promise. We found that blockchain can relieve a wide variety of pain points that impede information sharing and create costly inefficiencies. (See Exhibit 2.)

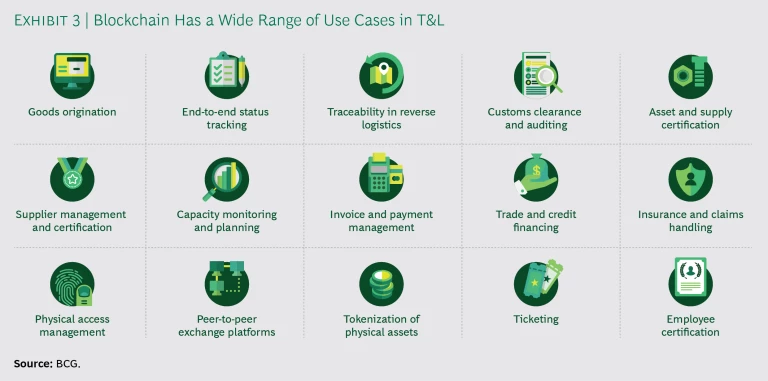

Blockchain can help the industry address these pain points by providing an immutable shared data repository, promoting trust among participants, and enabling automation of repetitive processes. The benefits can be captured through a wide range of 15 use cases. (See Exhibit 3.)

A comparison of use cases on the basis of value potential and ease of implementation points to goods origination, end-to-end status tracking, and invoice payment and management as among the high-priority blockchain applications. These use cases illustrate how blockchain can address the industry’s pain points:

- Goods Origination. Various mechanisms, including long-term trusted relationships, government regulations, or rigorous certification processes, serve as proxies for verifying provenance. The use of blockchain obviates the need for such proxies—and the associated costs. By registering materials, parts, or products on a blockchain, participants can verify where these items originated and improve quality assurance.

Leading players and startups are exploring applications of this use case in a variety of industries. De Beers is a good example. The company has worked with BCG on a blockchain-based solution to trace diamonds from the mine to finished pieces of jewelry. Although this platform, called Tracr, was initiated by De Beers and is currently in the pilot stage, it will become a solution for the entire diamond industry. A diamond tracked on Tracr carries a digital fingerprint with trustworthy information about its origins and qualities as well as critical transaction data, such as ownership transfers and processing. Tracr will help jewelers give the end customer confidence that a diamond was ethically sourced and processed. The platform also allows users to leverage its digital assets and build various kinds of new businesses on top of it. Such businesses could include diamond-backed financing, compliance services, or market exchanges for consumers—services that are not possible without the ability to digitally track and verify each stone. (See “ Does Your Supply Chain Need a Blockchain? ” BCG article, March 2018.)

Since 2013, venture capital investors have poured approximately $300 million into startup companies offering blockchain solutions relevant to T&L.

Another example is a startup called Provenance, which is working with Indonesian fishermen to use blockchains and smart-tagging technology to verify sustainability claims regarding the fish they bring to market. Such applications enable companies to not only increase supply chain process efficiency but also enhance compliance and support a brand’s reputation and quality, which ultimately protect premium price points.

- End-to-End Status Tracking. To enable efficient coordination of counterparties and just-in-time deliveries, supply chain participants demand real-time visibility into the status of assets or freight in transit. Although a coordinator (such as a delivery service) can provide status updates, it is difficult to maintain tracking when handoffs are made between parties with no previous transactional relationship. Additionally, parties have incentives to retroactively manipulate data—such as by making it appear that goods were delivered earlier than they actually were or that damaged goods were not in their control when the damage occurred.

By creating a unique identifier for each product, blockchain permits status tracking among multiple parties and prevents retroactive manipulation of data. Leading companies are pursuing initiatives to capture the benefits in their supply chains. For example, Walmart now requires lettuce and spinach suppliers to track the movement of produce from fields to stores using a blockchain database developed by IBM.

- Invoice and Payment Management. Because the multiple parties involved in T&L transactions maintain their own records and ledgers, invoicing and payments are paper-intensive processes that often entail manual entry. To check for mistakes and inaccuracies (and potential fraud), companies need to conduct a time-consuming reconciliation step before payments are released. Blockchain can be used to store and share digitized records and create smart contracts that automatically execute invoices and payments. Automated processing reduces settlement times, ensures accuracy, and detects fraud, while eliminating the need for intermediaries and paper-based processes. For example, a startup called CargoX has launched a blockchain-based bill-of-lading platform. Its features include smart contracts and the automated execution of peer-to-peer payments.

Exploring the Paradox

Considering the magnitude of the potential benefits, blockchain adoption by the T&L industry has been slower than one might expect. Adoption has been impeded by the very same obstacles relating to coordination and trust that the technology would help the industry to overcome. That, in essence, is the industry’s blockchain paradox. To resolve it, stakeholders must understand how the following two industry characteristics are inhibiting blockchain adoption:

- Fragmented Value Chain. The highly fragmented value chain of multiple unrelated parties makes the industry well-suited for blockchain application. But this fragmentation also hinders the adoption of a common blockchain standard. Of the executives we surveyed, 60% believe that a lack of coordination among industry players and the absence of an ecosystem are major barriers to blockchain adoption. Fragmentation also impedes the selection of a common technical standard. The absence of such a standard means that blockchain applications pursued by companies and consortia as standalone initiatives will likely not be compatible with each other. The limited scale of these initiatives increases the cost of adoption and diminishes the potential returns.

The challenges of the fragmented value chain are exacerbated by regulatory complexity. T&L companies typically operate in multiple countries and jurisdictions with varying, and often complex, regulatory requirements. More than one-third (35%) of surveyed executives cited regulatory compliance issues as an important barrier to blockchain adoption.

For T&L companies to trust blockchain and change their current ways of working, T&L companies need to better understand the technology's benefits and applicability.

- Limited Trust. Because T&L is a highly competitive industry, participants can be reluctant to share information. To overcome their trust issues, T&L companies have traditionally relied on longstanding relationships with other value chain participants, including intermediaries and brokers. Many companies are unwilling to share information outside of these established relationships. In fact, many companies take advantage of information asymmetry to generate revenues and profits. As a result, a substantial number of stakeholders are reluctant to abandon their longstanding relationships and give up their information advantages in favor of blockchain solutions.

Unfamiliarity with blockchain technology and its benefits appears to be an important obstacle to leveraging the technology to overcome trust issues. BCG’s survey found that only 16% of T&L executives feel that they have a clear understanding of blockchain technology and its implications for their industry. In line with this, only about 20% of respondents said that blockchain is among their company’s top ten strategic priorities. Underinvestment in technology and the absence of deep digital capabilities are likely contributing factors. For T&L companies to trust blockchain and change their current ways of working, they need to better understand the technology’s benefits and applicability.

Creating an Ecosystem to Overcome the Paradox

To resolve the blockchain paradox, T&L stakeholders must develop an industry-wide ecosystem. An ecosystem is needed to foster trust and collaboration and create a common standard that promotes scale and interoperability. By maximizing value for all stakeholders, the ecosystem would provide incentives for expedited adoption of blockchain across the value chain.

To catalyze the development of the ecosystem, a company or group of companies must serve as an orchestrator. For example, a consortium of T&L and technology players could lead the effort. Regardless of which entities take on the orchestrator’s role, it is critical that they seek to promote value at the industry level, rather than pursue their own self-interest.

The orchestrator must lead industry stakeholders in establishing partnerships and collaborations, standards and governance, and a clear value proposition.

Partnerships and collaborations among major players in the T&L value chain, including competitors, are needed to provide the foundation for an ecosystem.

Partnerships and Collaborations. Partnerships and collaborations among major players in the T&L value chain, including competitors, are needed to provide the foundation for the ecosystem. In a recent example, five container shipping players—CMA CGM, Maersk, Hapag-Lloyd, MSC, and Ocean Network Express—announced plans to create a not-for-profit association that will promote digitalization, standardization, and interoperability in their industry. The collaborative effort includes establishing common IT standards that will be available without charge to all industry stakeholders. If blockchain is among the digital solutions considered, the association could help to develop a common technical standard and an industry-wide ecosystem. Additionally, alliances, associations, and consortia must provide a venue to identify, debate, and prioritize innovative ideas and educate industry stakeholders. Providers of technology infrastructure and software must contribute their expertise to support the development of blockchain applications. And governments, port authorities, and independent regulators must engage in the ecosystem from its inception. These entities can help shape the common standards and officially endorse the ecosystem, including ensuring compliance with laws and regulations that prohibit anticompetitive practices.

Standards, Governance, and Commercial Considerations. Stakeholders must define the standards and governance required for the ecosystem. This includes:

- Policies. Policies need to address regulatory considerations, such as laws, international privacy standards, and requirements for data sharing. The stakeholders also must establish rules for authenticating the identity of network participants and agree on whether anonymity is permitted. In addition, the stakeholders must specify the types of data that can and cannot be shared and define a common taxonomy (such as field names and entry protocols) for data stored on the blockchain. Finally, they need policies covering the design and operation of the blockchain platform.

- Technical Elements. The stakeholders must define how the participants can reach consensus when recording transactions on the blockchain. They must also determine how data will be stored on or off the blockchain and how the data model will correspond to the models of the existing systems used by different participants. Last, they must determine access rights by selecting which type of blockchain to use—public, private, or hybrid.

- Governance and Decision Rights. The stakeholders must establish clear governance that articulates their respective roles and decision rights in the continuous development and evolution of the blockchain platform. First movers and early adopters play a critical role in establishing the appropriate governance, which gives them greater influence over the ecosystem’s future development.

- Commercial Considerations. Commercial considerations include the costs of designing, implementing, operating, and maintaining the solution and how the costs will be shared among stakeholders. Participants also need to determine how they must adapt their internal processes in order to use the common blockchain system.

Clear Value Proposition. All players need to see and share the value created from the common adoption of blockchain. To give visibility to the opportunities, the ecosystem must develop a value proposition that addresses the concerns of the main stakeholders. Shippers and carriers have tight profit margins and seek new ways to reduce their cost base. Other T&L industry players want to safeguard their position in the value chain: brokers and freight forwarders want to protect fee-related revenues; banks seek to maintain their commissions for issuing letters of credit; and terminals do not want to lose income related to the movement or storage of containers. Additionally, governments and regulators, as well as banks, are fighting fraud and money laundering in the T&L value chain and want to reduce the overhead associated with these efforts.

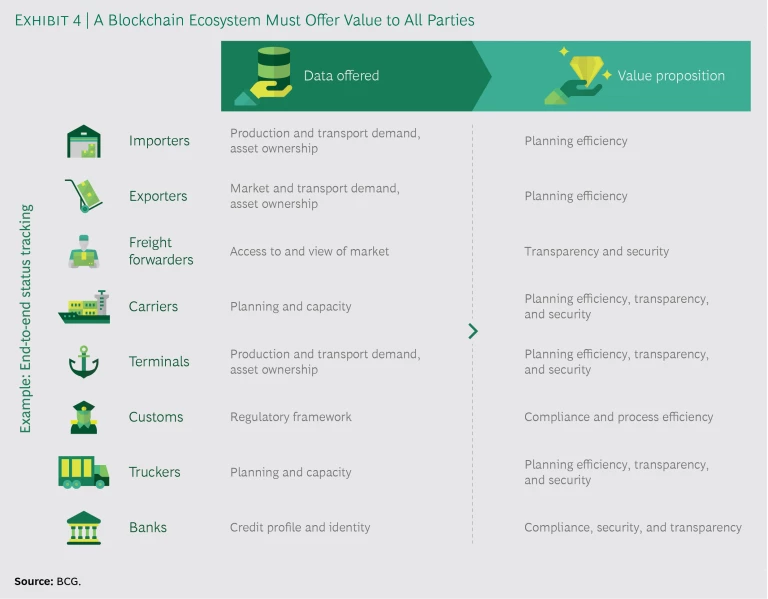

A clear value proposition will incentivize all shareholders to share data and capture the benefits of participation in the ecosystem. (See Exhibit 4.) Consider end-to-end tracking. Importers and exporters can offer data on asset ownership and demand for products and transport services, while capturing the benefits of more efficient planning. Freight forwarders can share market data, while gaining transparency across the value chain and ensuring the security of transactions. Carriers, terminals, and truckers can provide data on demand and capacity, while benefiting from improved forecasting, transparency, and utilization. Customs agencies can incorporate their regulatory framework into the ecosystem, thereby increasing compliance and process efficiency. Banks can share data on transacting parties’ credit profiles and identity, and benefit from compliance, security, and transparency.

Taking Action at the Company Level

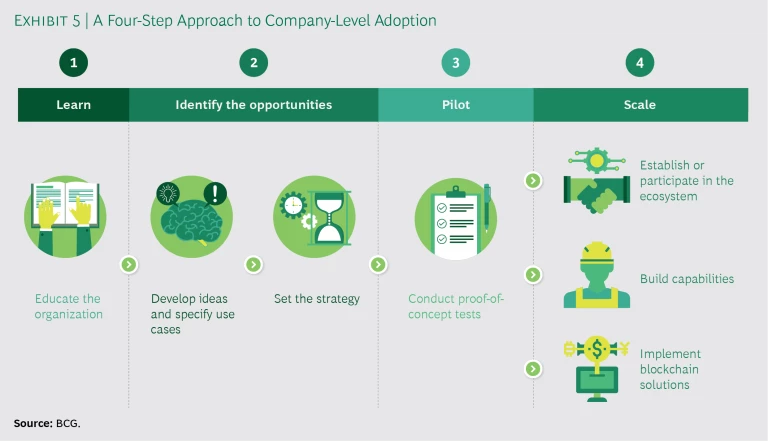

To position themselves to participate in the blockchain ecosystem, companies must take a structured four-step approach. (See Exhibit 5.)

Learn about the technology. The company should first obtain a deep understanding of blockchain technology and its potential applications in T&L. The benefits and limitations of blockchain compared with traditional technologies should be clear.

Identify the opportunities. Recognizing that blockchain technology is not a silver bullet, the company should review its current pain points and assess the technology’s potential to address them. It should identify and prioritize the most relevant use cases to examine further and establish the business case for investing in each one.

At the same time, the company should develop a clear strategy for blockchain adoption. The optimal strategic approach should take into consideration the company’s market positioning and capability gaps, the maturity of the existing ecosystem, and regulatory barriers. The company needs to decide which blockchain platforms to participate in and which to build versus buy. It should also consider the benefits and risks of taking an aggressive approach (being a first mover or fast follower) versus a wait-and-see approach. Large companies are well positioned to blaze a trail for other players by defining standards and establishing an ecosystem. Smaller companies should closely monitor these efforts and select the right ecosystem to participate in. Each company should develop a roadmap for implementing its selected strategy.

Pilot. To test the viability and feasibility of potential applications, the company should conduct proof-of-concept tests before launching blockchain at scale. Teams conducting the tests should employ an agile way of working, with short cycles of decision making.

Scale. For those applications validated in proofs of concept, the company should design plans to implement at scale and commercialize in stages. The company must participate in an ecosystem that will support the adoption of these applications or drive the effort to create an ecosystem if it does not already exist. This includes collaborating to develop governance protocols to maintain and evolve blockchain standards and architecture. The company also needs to build the required capabilities with respect to human capital, technology infrastructure, and organizational processes. These capabilities include developing IoT infrastructure, digitizing processes, and developing analytical platforms.

T&L executives have long needed to cope with limited traceability in the supply chain and a lack of trust among trading partners. To address the consequences, they have invested in checks and balances—creating claims departments, for example, and engaging third parties to provide letters of credit. Now imagine a world in which visible supply chains and transparency among partners allow these expensive protective measures to disappear. Blockchain could be the means of realizing this vision. But to make it happen, T&L companies will still need to establish trust as the foundation of a collaborative blockchain ecosystem.

With some T&L companies taking the first steps toward forming a blockchain ecosystem, other companies must decide whether to participate or adopt a wait-and-see attitude. In our view, the benefits of being among the first to join these collaborative efforts far outweigh any advantages of a cautious approach. By acting within an ecosystem, the first movers can both influence the development of standards and ensure that the blockchain solutions they would like to apply in their own operations are among those widely adopted across the value chain. Indeed, once an ecosystem achieves critical mass, late movers risk finding themselves shut out—particularly if competitors in their value chain segment are already participating. As customers increasingly demand higher levels of trust, security, and automation, no T&L company can afford to remain on the sidelines while its competitors seek to resolve the blockchain paradox.