Imagine if your company could measure, customize, and charge for—in real time—the value your products or services create for each customer. Seized to its fullest extent, such an opportunity would enable you to provide more value to more customers and still earn more money.

Progressive pricing is turning that idea into reality, one that more sensibly aligns with today’s digital products and services than traditional industrial-era pricing models could ever do. This innovative approach—already embedded in the sharing economy and in other sectors such as financial services—scales prices up or down on the basis of the value an individual customer derives. While progressive pricing might sound too good to be true—even a violation of the rules of traditional economics—technological advancements and the rules of digital economics are already making it possible. Indeed, the relationship between firms and customers is shifting so quickly and fundamentally that this approach will soon be a competitive necessity, not merely an intriguing alternative, as companies make the measurement of discrete customer value a core competence.

Progressive Pricing Defined

We use the term “progressive” as it’s used in contexts such as tax systems. But unlike taxes, the levels of prices under progressive pricing are value-based, not means-based. Think of the price that a customer pays as an investment in a desired level of value. Each paying customer receives a proportional return on that investment. The prices align properly to value without penalizing customers—by denying access to some customers because of an artificially high price barrier or by charging some customers their maximum willingness to pay while others enjoy a big surplus (the difference between the value they derive and the price they pay).

At first glance, progressive pricing seems to violate the rules of traditional economics, which assume that customers buying the same product or service will pay the same price. But today’s technologies and the pervasiveness of data have put an end to “same.” Firms now can and do differentiate their products and services by individual customer and differentiate their prices accordingly.

Progressive pricing enables that differentiation by pushing the logic of discrete price points to its practical limit, offering each customer a fair, personalized product and price point. What makes this possible are the properties of digital economics, built on the idea that added value is customizable at zero marginal cost. Instead of optimizing a small number of price points, the firm optimizes a continuum of prices. The key element is a value-sharing algorithm that dynamically sets prices specific to the value an individual customer derives based on time, location, and occasion.

In that sense, progressive pricing stretches familiar ideas on price optimization and yield management far beyond their current implementation, creating a win-win that continually improves for firms and for customers. Companies fuel more innovation by expanding their markets at higher profitability than under a traditional fixed-price approach, while customers enjoy an ever-expanding value surplus.

How Progressive Pricing Works

Because progressive pricing offers unprecedented opportunities for companies to discriminate by segments of one and by markets in real time, those businesses no longer need to choose between gaining more customers or more money. They can calibrate value at the individual level, which means they can offer lower prices to previously unserved customers without endangering the higher prices they charge to customers who have always derived—and desired—a higher level of value.

Ride-sharing companies already use a version of such pricing in their day-to-day operations. For example, at the end of a concert or sports event, when hundreds of customers are requesting pickups at the same time at the same location, the cost of a ride goes up in line with that demand. Customers who group together, walk to a different location, or wait even half an hour to request a ride will likely see the price change based on how those conditions changed. But this kind of pricing logic is not unique to ride-sharing. China’s Meituan Dianping, which operates the world’s largest on-demand food delivery service, used its “proprietary real-time intelligent dispatch system” to make more than 14 million food deliveries per day in an average time of 30 minutes. When a surge occurs, Meituan offers its drivers higher commissions to ensure there is enough capacity to keep the service running.

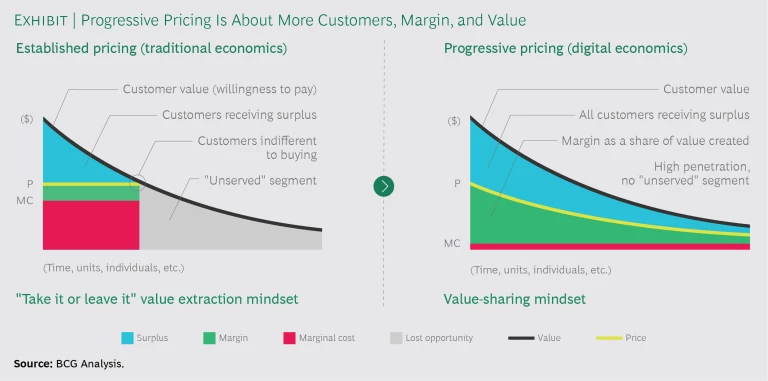

The exhibit reveals the four most important differences between progressive and traditional pricing approaches:

- Market Expansion. Every customer has an opportunity to use the product or service, with price and value carefully and consciously adjusted to the customer’s current situation. The gray area on the left side of the exhibit disappears.

- More Consumer Surplus. Customers as a whole retain more value. The blue area is larger on the right than on the left.

- More Profit. The firm earns more money. The green area is larger on the right than on the left.

- A Renewed Sense of Fairness. Progressive pricing is a fairer way to determine prices, because customers pay a price proportional to the value they receive, rather than paying the same fixed price others pay. But the firm must make the case for this perceived fairness. Google AdWords has done an excellent job of that by using an auction system where advertisers bid on keywords to get their ads placed in Google search results. The advertisers effectively set the prices.

Progressive pricing works because measurement technology has finally caught up with the demands and pressures of digital economics. It works because instead of “paying a price,” customers now “make an investment in value” and expect a fair and measurable return on that investment.

As “smart” products proliferate and the dream scenario we described in our introductory paragraph becomes commonplace, progressive pricing is turning into a competitive necessity. (See “How the Internet of Things Will Change the Pricing of Things,” BCG article, December 2017.) Such pricing represents a win for everyone involved.

For companies, progressive pricing actively controls and manages the creation and sharing of value with all customers. But when a firm instead sets prices using traditional approaches, it risks having its added value coopted or “stolen” by companies that have implemented progressive pricing. If a business tries to apply traditional pricing approaches to its data-driven innovations, it is liable to provide such services as incremental add-ons to existing products or, worse yet, to set a fixed price that is too low—too far to the right side of the demand curve (see the exhibit). Such a price might yield a critical mass of customers, but the margins and overall profit will be insufficient to fuel further innovation.

For customers, every individual’s price is at least as favorable under progressive pricing (see the right side of the exhibit) as it was under the traditional economic approach (left side). In other words, every customer derives a surplus greater than or equal to that derived under a traditional pricing approach. That last point is especially important to customers who get squeezed under traditional models. Customer value declines as we move from left to right on the left side of the exhibit, toward the intersection at price P, where the customer surplus (the blue area between the willingness to pay and the price) dwindles to zero. Many customers who buy derive little or no surplus under this model. Progressive pricing, in contrast, leaves the customer with more surplus value and the firm with more margin, thanks to zero marginal costs and a value-sharing algorithm instead of a small number of fixed (“optimal”) price points.

Calibrating this value-sharing algorithm is crucial. It takes both a large number of customers and high margins to capitalize on the future profit opportunities inherent in the data that customers have entrusted to the firm. The new winning paradigm is that the firm continues to innovate, because it has a pricing model that supports both a larger customer base and higher margins. When a company lacks one of those two elements, it ultimately falls behind firms that have both and can therefore innovate continually. This is an area where start-ups have an advantage over incumbents. Start-ups’ data-driven innovations must stand alone—meaning those firms have no choice but to adopt a progressive pricing model that generates the growth in both customers and profits necessary for survival.

Neither traditional pricing approaches nor yield management (a limited form of progressive pricing) generates such growth. Conventional yield management, which allows companies to customize prices in low-marginal-cost situations, has conditioned customers to accept tiered services and dynamic prices. But it faces two constraints. It generally applies to segments or tiers rather than individuals, and it applies primarily to markets constrained by a fixed, perishable capacity (such as airlines, hotels, sports events, concerts). Neither constraint applies to progressive pricing, which pushes customization and real-time price discrimination to their extremes by enabling a business to serve all customers in a market profitably at prices set relative to real-time value.

Why Progressive Pricing Is Inevitable

Two trends are already transforming progressive pricing from an ideal into profitable day-to-day reality, not only in native 21st century industries but also in much older, mature ones. The first is the fact that innovation today isn’t dependent on costly physical improvements to products; the second is the omnipresence of mobile technology, which has enabled companies and customers to forge unprecedented links with each other.

Consider the first trend. The vast majority of value-added innovation in most industries now occurs through the use of data, software, intellectual property (brands, patents, and so on), and intelligence embedded, all of which have zero marginal cost. For instance, in the high-tech sector, software rather than the associated hardware increasingly accounts for the added value for networking storage.

But such innovations are by no means limited to high-tech. At the other extreme, innovative data-driven services are starting to transform the market for smokestack commodities, such as asphalt. For hundreds of years, making better asphalt meant improving durability, viscosity, or other physical features. Thanks to sensors and software, asphalt now joins the Internet of Things. “Smart pavement” can reduce maintenance costs and improve road quality by self-diagnosing the location of damage, flood waters, or other potential hazards. Down the road, the added value and the profits from asphalt will also come from the pavement’s ability to “read” in rich detail the vehicles and passengers riding on it, enabling everything from optimized urban traffic flows to location-based services.

At the same time, continual, voluntary exchanges of data between customers and firms enable firms to personalize their products and practice price discrimination simultaneously. For the first time, firms can easily propose a fair, individualized price in real time on people’s mobile/connected devices. Companies in areas as diverse as online searches and connected in-home devices also currently offer customized, individualized solutions to any individual customer or segment of one who opts-in to share personal real-time data. Choices about whom to serve and under what terms become more precise and concurrent, supplanting traditional exante decisions burdened by guesswork.

Implementing Progressive Pricing: Four Imperatives

Making progressive pricing a profitable day-to-day reality can happen only if firms change how they create, define, and measure value so that they can share it fairly. These are no easy tasks. Progressive pricing may be inevitable, but its implementation remains a high-investment, high-reward undertaking.

The good news is that advanced analysis and interpretation of the data exchanged between firms and customers makes it is easier than ever both to quantify value precisely and to understand individual customers’ purchase decision process. This marks a watershed change. Under traditional pricing practices, firms usually know their marginal costs in detail but know customer value less precisely and can only infer it by segment. Today, with pervasive data and almost unlimited test-and-learn analytical capabilities, companies can derive more precise estimates of value by customer and situation, and also know that their marginal costs are zero.

The transition from traditional pricing approaches to progressive pricing requires fundamental changes in how a company thinks about customers, value, and prices. To achieve progressive pricing, companies will need to fulfill four imperatives.

Invest to innovate with data, software, and artificial intelligence. The vast majority of value-added innovation involves delivery of services at zero marginal cost rather than the improvement of costly physical products. But firms will incur significant fixed costs as they invest to innovate, create, and customize value. The technology and intelligence required to simultaneously deliver value at zero marginal cost and at individualized prices likewise warrant heavy upfront investment. But these investments confer two important advantages. First, the firm can now offer innovations as a continuous stream rather than as a series of discrete, timed events. Second, the firm has a stream of rich customer data to analyze in order to fuel more innovation. This leads to our second imperative.

Become a trusted custodian of customer data. Companies need to establish and reinforce a bond of trust between themselves and potential customers, so that customers perceive that the benefits of sharing their data far outweigh any risks. One of the surest ways for companies to reinforce trust is to transform the data customers have provided into a set of steadily improving services that they can’t resist. But businesses don’t use the data only to create more direct value for customers. Perhaps more important, the sharing of data allows the company to better predict customer wants and needs by analyzing purchasing patterns.

To accomplish all this, a firm must have access to and control over rich streams of customer data. The controversy involving data exposure between Facebook and Cambridge Analytica in early 2018 highlights two of the trickiest hurdles to meeting this prerequisite: permission and protection. Firms must put measures in place to ensure that customers’ data is protected from third parties and used only for purposes the customer has agreed to.

Make your value explicit, transparent, and personal. Customers perceive a considerable risk when they share their data, which means they not only warrant a return on that investment but in some cases a risk premium as well. Firms must therefore be explicit about how much value they create, ideally on a customer-by-customer basis rather than at the traditional segment or market level.

This challenge transcends the objective ability to measure value precisely, which often reduces itself to narrowly defined buckets of “save time” and “save money.” Companies must first step back and reimagine the concept of value in their market. How can a business combine its own capabilities with the close personal knowledge of its customers to create something that fundamentally changes a customer’s life? Once that task is accomplished, how can the firm help customers perceive a price-value relationship that makes sense for both parties? It all boils down to this: Can you define value, measure it, and get everyone to agree on what that value is? This leads to the fourth imperative.

Redefine fairness. As we said earlier, the calibration of the value-sharing algorithm is decisive. Traditionally, a fair price is a price others have paid. When prices vary, customers generally perceive the differences as fair if they are justified by costs. This basic understanding of fairness is challenged in a world with no marginal costs, where prices can vary widely from one customer and situation to another. To put a progressive pricing model in place, firms must redefine fairness and make the case that the criteria that drive price differences are fair. One example is supply and demand. Customers understand that the prices of concert or airline tickets vary over time because of demand for a limited supply. Likewise, consumers understand that sitting closer to the stage or flying first class is a more valuable experience than sitting in a faraway seat or flying economy. Another example is the savings that are associated with a product or a service. Firms can also help customers understand that prices can vary as a fixed proportion of value, such as when an investment manager’s fees are based on the ROI delivered.

Progressive pricing extends the ability to discriminate by price into areas where customers’ exposure to dynamic price variation may not be as extensive. Businesses will therefore need to define and communicate the fairness principles behind their algorithms. They need to emphasize that value is shared with customers rather than extracted from them, and do so in a way that customers can understand and embrace. The only constraints on how value gets defined, and by what metric, is the supplier’s ingenuity and creativity and the individual customer’s perception of fairness.

The definition of fairness and the value-sharing algorithm may require a new price metric. While we couldn’t possibly go through the range of all potential metrics in a brief report such as this, we can reiterate the underlying premise behind such metrics: value. Most firms are accustomed to expressing prices in units of product or some other basic metric such as hours. If they can instead calibrate prices in terms of a unit of value, then the price per unit of value can remain constant and the amount a customer pays can scale in proportion to the value demanded. That is the essence of fairness.

The combination of industrial-era pricing models with digital products and services was always an unhappy marriage. Businesses lacked a viable alternative approach that would bring advanced technologies, digital economics, and the needs of both companies and customers into alignment. Progressive pricing fills that void. Companies will need patience and ingenuity to implement it, but the benefits progressive pricing offers surpass traditional pricing approaches by extending the benefits of newer approaches such as yield management.

The BCG Henderson Institute is Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration from the Institute, please visit Featured Insights.