“Vitality shows in not only the ability to persist but the ability to start over.”

—F. Scott Fitzgerald

Why do some companies relentlessly explore, innovate, reinvent, and thrive while their peers stagnate? In partnership with Fortune magazine, we developed an index of corporate vitality to understand and quantify the factors predictive of long-run growth. This index, the result of a multi-year research effort, powers our fourth annual Fortune Future 50—a ranking of the world’s 50 most vital large, public companies.

Today’s leading companies face an increasingly dynamic and uncertain business environment. Accelerating product lifecycles and technological advancement drive a relentless pace of change, and aging demographics are driving a long-term decline in global growth. As a result, long-run, sustainable corporate growth and value generation appear more elusive than ever. To overcome these challenges, leaders must build the organizational capacity for innovation and reinvention to find the new opportunities that will drive tomorrow’s success.

Crucially, the superior performance of vital companies during the current crisis demonstrates that vitality does not only pay off in good times—it pays off in bad times as well. This durable benefit makes corporate vitality an essential perspective and metric for leaders as they reimagine their corporations for the future.

How We Identify Vital Companies

Conventional measures of business performance (such as growth, market share, and profitability) tend to be backward-looking and assess the performance delivered by the current operating model. Yet outperformance is increasingly temporary, indicating that what it takes to succeed in the future will be different from what it takes to succeed today. Leaders must use forward-looking metrics to gauge their company’s fitness for the future.

Our corporate vitality index leverages machine learning methods to select and calibrate predictive factors based on their empirical relationship with long-term growth. Drawing on wide-ranging data sources, the metrics are organized into five pillars: market potential, strategy, technology and investment, people, and structure.

Our methodology allows us to identify and measure key factors that are often overlooked or underappreciated. For example, through a natural language processing analysis of SEC filings and annual reports, we observe increased vitality among companies that adopt a long-term strategic orientation, serve a broad purpose in society, and take an approach that embraces the uncertainty and complexity of business. We also examine diversity across all levels of the organization and find that diverse workforces are demonstrably more vital, confirming earlier findings. And, in analyzing various dimensions of ESG performance, we find that doing well on social issues is also good for generating long-term sustainable value. (See “How We Measure Corporate Vitality.”)

How We Measure Corporate Vitality

The second pillar is Company Capacity: our assessment of a company’s ability to deliver on future market potential. It comprises 19 factors—drawn from a larger group of variables and calibrated against historical data for their ability to predict long-term revenue growth—and accounts for 70% of the index. These factors are grouped into four areas:

- Strategy. To a dataset of 15,000 SEC filings and annual reports, we apply a long short-term memory neural network (a natural language processing model that incorporates word order and context) to characterize a company’s strategic orientation on three dimensions: long-term orientation, focus on a broader purpose beyond financial performance, and “biological thinking.” We also assess the company’s clarity of strategy articulation from earnings calls and consider the company’s governance rating (according to Arabesque, a pioneer in ESG analytics).

- Technology and Investment. We assess a company’s capital expenditures and R&D expenditures (as a percentage of sales, compared with sector averages); the growth of the company’s patent portfolio (from a global database of patent filings) and the portfolio’s digital intensity (the share of patents in computing and electronic communication areas); and the quality of the company’s startup investment and acquisition portfolio (based on comparison with the best-performing global venture capital funds).

- People. We measure the gender diversity of a company’s management and larger workforce; the age of its executives and directors; its leadership stability (represented by the frequency of executive and director turnover); the geographic diversity of its directors; and the size of its board.

- Structure. We measure the age of a company (since founding); its size (based on revenue); and its growth track record (over the prior three years and six months).

Companies were excluded from the Fortune Future 50 ranking if on average they had negative cash flow from operations over the prior three years, indicating elevated performance risk.

Especially in turbulent times, it is important to recognize that achieving future growth also requires companies to first survive the present. Therefore, we exclude from the index companies with consistently negative cash flow from operations, an indicator for the fragility of any growth potential.

Trends in Vitality

Patterns among the Future 50 provide a fascinating window into important trends in the business landscape. As in prior years, a regional breakdown of the index points toward a bipolar future. More than 80% of the world’s 50 most vital companies are located in North America or Greater China. While this may seem surprisingly skewed, the distribution echoes recent global growth trends: more than 70% of the fastest-growing companies over the past three years also come from these two regions. (See Exhibit 1.)

While Greater China remains overrepresented among highly vital firms, its share in the Future 50 declined by 8 percentage points compared with last year. However, when we broaden our list to the top 200 companies, China’s share remains in line with last year—signaling that movement out of the top 50 is likely linked to specific considerations for select industries and companies rather than a broader sign of declining vitality.

Finally, while Europe’s share in the Future 50 has increased slightly for the second consecutive year—now comprising four companies total—the region remains underrepresented among the world’s most vital companies. Some digital natives rank highly on the list, such as Adyen (#6 in the Future 50) and Spotify (#10), indicating that European companies can thrive in a world of technological bifurcation, but the region has yet to do so at greater scale.

Europe remains underrepresented among the world’s most vital companies.

Companies in the information technology and communication services sectors once again make up the majority of the Future 50. This is particularly true in developed markets, where technological innovation is the main driver of growth; B2B software businesses are especially highly represented, making up seven of the top ten companies. In emerging markets, where growth is driven more by increasing disposable income and consumption, highly vital firms are more commonly found in the consumer discretionary sector. Many such firms serve middle-class consumers in traditionally offline sectors, such as restaurants and education. The highly vital tech firms that do appear in emerging markets tend to be B2C businesses, such as Xiaomi (#19) and Tencent (#45).

We also see a clear shift toward health care this year. The sector now makes up 22% of the Future 50 (up from 12% in 2019). The current crisis has tested the capacity for innovation and reinvention in businesses across all sectors, but perhaps nowhere more so than in health care. While the short-term impact of COVID-19 on highly vital health care firms is varied—some gained access to key global markets while others weathered the temporary deferral of elective procedures—the sector has demonstrated strong growth potential for a future in which consumers will likely be more health-conscious.

Although tech-related industries are overrepresented at the top of the ranking, we see a wide range of vitality within all sectors—an indication that sector alone neither guarantees nor precludes vitality. For example, Fastenal Company (#46 in the Future 50) is in construction materials distribution—not traditionally a vital industry. Nevertheless, in 2014 the company began experimenting with an innovative “onsite” location strategy by servicing customers from locations that are physically within a customer’s facility, with inventory specific to the customer’s needs. After identifying the strategy as a promising growth driver, Fastenal rapidly scaled up its new model. The ongoing reinvention has resulted in the opening of more than a thousand “onsite” locations, and site count is increasing by 40% annually.

Finally, our index continues to indicate that a diverse workforce has a greater capacity to innovate and reinvent. Though a substantial gap still exists to achieve parity, 50% of the companies in this year’s ranking have executive teams at least one quarter female—compared with 24% of all other large firms. (See Exhibit 2.) Companies that embrace the business imperative of diversity will be better positioned to generate the wide range of ideas required to build future growth potential.

Vitality Begets Superior Crisis Performance

A crisis understandably draws the focus of leaders toward managing short-term issues. One might therefore think that what it takes to build long-term growth potential differs from what it takes to outperform in crises. Yet the evidence shows that throughout the current crisis, vital companies have grown faster and created more value. In the year following publication, companies on the 2019 Future 50 list produced a cumulative shareholder return of 56%, compared with 6% for the MSCI World stock index.

A closer look at the market shock and recovery periods triggered by COVID-19 highlights how vital companies gained advantage. Resilience during crises can create advantage along three dimensions: lower initial impact of a shock, higher recovery speed, and greater recovery extent. Highly vital companies were particularly advantaged in the latter two stages (See Exhibit 3.)

Vital companies have faster recoveries. The most vital companies returned to pre-shock levels in 15 weeks, while the MSCI World index took more than six months. Many of the capabilities that help companies achieve sustainable, long-term growth also help them recover more quickly in crises. Highly vital companies tend to have more diverse organizations, an adaptive approach to strategy, and a structure that fosters greater agility. When a crisis hits, these attributes aid vital companies in deploying a diversity of response mechanisms, experimenting to find the actions required to restore functionality, and implementing them swiftly.

Vital companies achieve a greater extent of recovery. The most vital companies are now more than 20% above their pre-shock baseline, whereas their peers are still only back to where they started. Companies achieve a greater recovery extent by better positioning themselves for a post-shock future. Because vital companies have the capacity to reinvent their business for new challenges and opportunities, they are in an ideal position to seize on this opportunity. In particular, vital companies are more likely to maintain a long-term strategic orientation when facing a crisis (as opposed to focusing solely on immediate challenges), invest in future growth models to capitalize on accelerated trends, and leverage their portfolio of growth options to capitalize on shifts in demand.

Crisis performance is not separate from long-term growth potential. In fact, the two are inextricably linked. Our research indicates that nearly two-thirds of long-run outperformers do better than peers in crisis periods.

How to Build a Vital Company

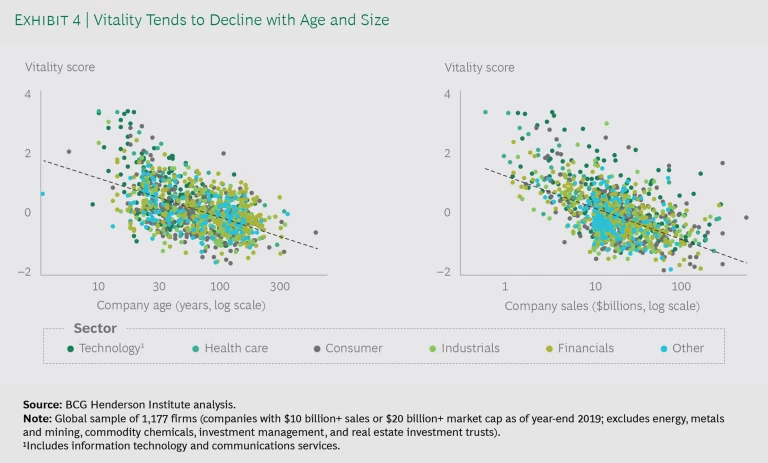

Companies tend to struggle to maintain vitality as they mature. Scale breeds complexity, organizational models become entrenched, and the strategic focus of management teams shifts toward narrowly defined, short-term goals. As a result, we see the capacity for innovation and reinvention decline markedly with age and size. (See Exhibit 4.)

Fortunately, this decline in vitality is not inevitable. For forward-looking leaders, our index and analysis point to principles that help to overcome this challenge and maintain corporate vitality.

- Continuously develop future growth options. History shows us that long-term trends may arrive sooner than we anticipate. Vital companies reinvent themselves and grow sustainably by creating a sufficient pipeline of bets across different timescales. They achieve this by fostering an entrepreneurial spirit within the company, encouraging the workforce to explore new ideas—instead of only exploiting existing ones. Leaders must learn to challenge their existing mental models and build organizations that compete on imagination.

- Think differently about strategy. The top-down, classical approach to strategy is ill-suited to today’s dynamic and uncertain business environment. Leaders must master new strategic capabilities, such as adapting to unpredictable changes and shaping new markets, to create competitive advantage. They must also broaden their conception of strategy—beyond financial maximization within the traditional boundaries of the firm, to serving a broader social purpose and collaborating in larger ecosystems.

- Use forward-looking business metrics. The accelerating pace of change means outperformance cannot be expected to sustain itself indefinitely. To thrive sustainably, leaders must use forward-looking metrics to complement the traditional measures of business performance. For example, vital companies may measure the percentage of sales stemming from new products or offerings, or the frequency and diversity with which fresh ideas arise within the organization.

- Find opportunity amid crisis. All crises eventually create opportunities. Competitively, the question is how soon leaders can look ahead, detect, and embrace this opportunity. Measuring and managing vitality is therefore not merely a task for stable times. Amid crisis and heightened volatility, a commitment to innovation and reinvention can yield fresh sources of competitive advantage and growth. Leaders who seek to maintain vitality in stable times but abandon the principles in crisis risk losing out on future growth.

Change and uncertainty will outlast the current crisis. By building the capacity for innovation and reinvention, companies can enjoy the durable benefit of corporate vitality.