Digitization has transformed marketing. Rising expectations (from both consumers and top management), increasing complexity in technology and tools, and an accelerating pace of change have become marketing facts of life. They have also led to an expanding ecosystem of partners and suppliers offering an ever-widening array of products and services.

Shortly before the outbreak of COVID-19, BCG surveyed top marketing executives in three major markets in Europe: France, Germany, and the UK. (A companion article presents our research in the US.) While the business landscape for marketers (as well as for everyone else) has fundamentally changed in 2020, we believe that our findings and conclusions are still valid. The ability of European marketers to leverage the marketing ecosystem will become even more important as they seek to react nimbly to an uncertain environment and demonstrate relevance to consumers in the post-COVID recovery.

Here are the headlines. Marketers use plenty of partners—no surprise there. Only 3% of the companies we surveyed do not tap external resources. The 97% that do cited a variety of areas of assistance, including technology, media planning and buying, creative development, measurement, data science, and branding. Marketers were upfront about the reasons they look for help. They understand that using partners boosts ROI: 80% reported increased ROI over the past three years, in particular from improvements in technology, targeting and segmentation, and measurement capabilities. But 95% feel pressure to improve still further.

The good news is that marketers have lots of options in the rapidly expanding ecosystem of agencies, consultants, marketing technology (martech) providers, and others vying to assist companies in the digital marketing arena. Nine out of ten marketers reported using more channels today than they did three years ago. But while the help may be welcome, the complexity adds another layer of challenge for CMOs and their teams to address.

Where Marketers Are Looking for Help

Marketers in the three markets we surveyed look to the ecosystem for help with a number of specific needs, among them speed to market, access to innovation, high-quality thought leadership, and ease of execution. (See “About this Report.”) But navigating the European ecosystem is inherently challenging thanks to fragmented national markets, data regulation and consumer sensitivities, differences in culture and access to talent, and companies’ own corporate challenges.

About this Report

About this Report

Following our 2019 assessment of marketing measurement capabilities, Facebook commissioned BCG to study the growing marketing ecosystem. We broadly define the marketing ecosystem as the collection of organizations that supports marketers in reaching a particular audience and creating, delivering, and improving their communications and engagement with customers or consumers. These participants include agencies, consultancies, martech providers, and traditional and digital media companies.

This report was produced in collaboration with Facebook and the findings outlined herein were discussed with Facebook executives, but BCG is responsible for the analysis and conclusions. Our research included a quantitative survey of 315 marketing leaders and interviews with 35 industry experts across the UK, France, and Germany between December 2019 and February 2020. The survey was conducted by Gerson Lehrman Group. To qualify for the survey, respondents had to be based in the UK, France, or Germany and employed by companies with more than €45 million (£40 million) in annual revenue and more than €10 million (£8 million) in annual marketing spending. Respondents also needed to have a title of manager or higher (65% were vice presidents or higher), focus on marketing/advertising, and be an active participant in, responsible for, or accountable for making external partnership decisions.

Market Fragmentation. Geography, language, culture, and regulation all contribute to a highly fragmented “European” market. As one marketing executive pointed out, a UK TV commercial about baking brownies is useless in France. There is no one-size-fits-all approach, but marketers still need to balance local and pan-European capabilities. “Although you will always need local market access and understanding, a pure national lens no longer suffices,” said an executive at a German martech startup.

Data Regulation and Consumer Sensitivities. Heightened consumer sensitivity with respect to data sharing and usage puts pressure on companies to go further than simply demonstrating the value of their product or service. They must also show that they are responsible about collecting and using consumer data and that consumers receive value in exchange for sharing their data. Regulatory and policy changes add both new rules and uncertainty for marketers. They must navigate the implications of Europe-wide regulations such as the General Data Protection Regulation (including interpretations that vary by country), as well as country-specific regulations and emerging privacy rules from large tech players, such as restrictions introduced by Apple and Google on third-party cookie sharing. Marketers in France (77% of those surveyed) and Germany (62%) view the latter as having a greater impact than other regulatory or policy changes, including the GDPR.

Talent and Culture. Skilled digital marketing talent remains scarce and the competition for it is fierce and expensive. Smaller companies (those with revenues of less than €900 million) feel the talent shortage most acutely: they were twice as likely to cite “access to skilled talent pool” as a top challenge.

Even for those that can bear the cost, location can present a barrier. “There is a general shortage of talent, but there's two sides to it,” said a senior marketer at a German sports marketing company. “The big hubs, like Berlin or London, attract a lot of very good tech talent. But if you are located anywhere else or cannot offer a competitive package, it becomes very difficult to make your case and attract the right people.”

Marketers in Europe also struggle to adopt new ways of working, such as agile methodologies and a “test and learn” culture. These approaches not only facilitate partner collaboration and speed campaign development and time to market, they are also increasingly critical to attracting top tech talent. “The US has more of a fail-fast culture that is embodied by everybody,” said a senior vice president at a digital marketing consultancy. “Failure of every nature still bends people’s pride in the UK.” The CEO of a London-based adtech startup put it this way: “In the US, our customers want to buy a competitive advantage, but in the UK, we see customers that want to buy something that reduces risk.”

Corporate Challenges. Priorities differ across companies and markets, of course. Around 40% of our respondents said that one of the top reasons they look to partners is to increase speed to market. At the same time, more than 40% of respondents in the UK and almost 35% in France pointed to access to innovation. In Germany, the top priorities after speed to market are “desire for flexibility” (38%) and “quality of thought leadership” (32%).

The good news is that marketers have lots of options in the rapidly expanding ecosystem of agencies, consultants, martech providers, and others vying to assist companies in the digital marketing arena.

A big issue in all three markets is that many marketers do not believe they are partnering effectively. The vast majority of marketers (94% in France, 86% in Germany, and 84% in the UK) still think there is considerable room for improvement in how they use partners. These companies cited cross-channel management, cross-channel measurement, and attribution as the most significant challenges in achieving their target ROI. These are all areas where effective partnerships can help. More than 20% of survey respondents in each market noted that to increase partner value, there must be clear ways to evaluate partner performance and value delivery and to align on incentives.

A Vast and Sometimes Confounding Array of Options

European marketers looking for help have plenty of options, both in their home markets and across Europe. But their efforts are complicated by the rapid expansion of the ecosystem, which is adding complexity and blurring traditional boundaries.

Ecosystems expand. The marketing ecosystems in France, Germany, and the UK all increased in size and complexity from 2010 through 2019. In the UK, the ecosystem grew especially quickly, outpacing national GDP growth by about 70%.

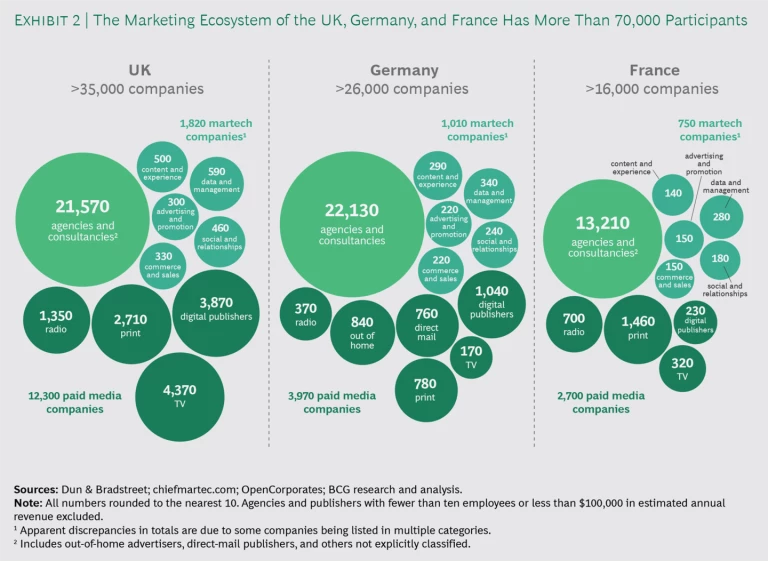

More than 70,000 agencies, consultancies, martech vendors, and media companies now operate in the three countries combined.

Agencies still play a large role: 80% of UK marketers and 60% of marketers in France and Germany use agencies, according to our survey. Still, we estimate that agencies’ overall share of the ecosystem has declined in recent years from about 36% to about 33%. Digital media companies and martech providers have driven much of the overall ecosystem growth, with both segments expanding more than 10% annually. There are now more than 2,200 martech providers operating in the three markets (out of more than 7,000 globally).

Boundaries blur. As the ecosystem expands, players in all segments are building or acquiring new capabilities to provide more robust, innovative, and integrated solutions to clients. Some of this diversification has occurred through consolidation. Agencies have sought to add to their offerings in order to remain competitive (the acquisition of Epsilon by Publicis is one example), a trend that most experts we spoke with expect to continue. Large consultancies also have moved into areas traditionally occupied by agencies, frequently though acquisition. (Accenture Interactive has acquired more than 30 agencies globally.) Marketing cloud providers, such as Salesforce.com and Adobe, have looked to maximize their portion of the value chain by acquiring other platforms and capabilities. (Adobe acquired Marketo in 2018, and Salesforce acquired Evergage 2020.) Overall, as an executive at a “big six” agency in Paris told us, “The lines have blurred between the sectors of the marketing ecosystem. Today’s agencies, consultancies, martech providers, and publishers all compete with each other in various areas.”

Among digital media companies, Facebook and Google continue to hold their leadership positions in paid media. Estimates in 2019 by eMarketer put the two companies’ combined share of paid digital media at 75% in France and Germany and 68% in the UK. (Google's estimated share of paid digital media in the UK, Germany, and France was 39%, 49%, and 50%, respectively, while Facebook's was 25%, 26%, and 26%.) Amazon, bolstered by its 2019 acquisition of Sizmek, is capturing increasing business; more than 40% of marketers in the UK, Germany, and France advertise on Amazon today.

While digital media spending has overtaken traditional media in the UK, traditional media continues to capture the majority of spending in France and Germany, where TV advertising remains a key channel. “For French marketers, TV advertising … still needs to be a crucial part of the marketing mix, much more so than in the UK,” said a former marketing executive at a €10 billion global CPG company.

The lines are disappearing, however, as leading traditional media companies expand into digital media to keep pace with the evolution in spending. Axel Springer, a leading German publisher, now gets 74% of its advertising revenue from digital channels.

The help may be welcome, but the complexity adds another layer of challenge for CMOs and their teams to address.

In addition, an explosion of specialized new entrants, enabled by the first wave of advances in digital marketing, is enhancing the diversity of the ecosystem. And the need for local expertise has led to opportunities for smaller, local players to carve out niche roles (agencies that localize content, for example). Marketers in Germany and France, in particular, prefer local partners. “The great thing about digital tech is that you can market almost anywhere in the world, but you still have to have a local understanding, and often local agencies can give you that,” said the former head of marketing for Europe at a €10 billon B2B technology company. Local complexities have also created an opportunity for innovative martech startups. For example, London-based startup Synthesia uses artificial intelligence to translate creative treatments into different languages while adjusting the facial movements of actors so they appear to be speaking naturally.

Platforms such as Google, Facebook, Salesforce.com, Adobe, and others are fueling the growth of more specialized players like Smartly.io, which offers campaign management and content creation tools specifically for social media. Ecosystem players have even identified opportunities to help marketers in-house. For example, Jellyfish, a London-based digital agency, has grown rapidly by helping clients build their own programmatic buying capabilities.

New local players continue to emerge in digital hubs such as London and Berlin, but also increasingly in France, where venture capital investments have gained speed; French venture investment has increased 35% annually, from about €2.2 billion in 2017 to about €4 billion in 2019.

Maturity varies. The rapid pace of expansion and specialization puts a strain on even the most mature and sophisticated marketers, and as we have documented previously, the digital maturity of marketers varies substantially—especially in Europe, where it varies greatly across borders as well. The UK is several years ahead of France, Germany, and Europe in general when it comes to digital’s share of paid media, and the same is also the case with programmatic-buying penetration. (See Exhibit 3.)

Senior marketers expect the broad ecosystem to continue to grow in a similar manner for at least the next several years. Most expect spending on partners of all types to increase, with martech and media partners the biggest beneficiaries. In our survey, 65% of marketers in the UK, 77% in Germany, and 73% in France said they expected to spend more. In the UK, agencies may experience further disintermediation, with only 32% of marketers planning to spend more on agencies, compared with 58% in Germany and 70% in France. Marketers cite personalization, artificial intelligence and machine learning, and connected cross-channel experiences as the top forward-looking opportunities. They will likely drive further growth as marketers seek help with managing the technical complexity of these tasks.

Sorting Through the Thicket

The downside of all this activity is that the niches of the ecosystem have become so specialized so quickly that marketers can struggle to keep up. There are more and more areas where they must decide what they will build and what they will buy, and they often need to rely on additional partners to help them navigate. “Marketers in my industry struggle to keep up with the evolution of all the tools available,” said the marketing director at a major insurance company. “We need external help to keep up to date.” All the additional support adds to the need to coordinate partners in pursuit of a common goal.

Successful marketers follow five rules to make this complex, evolving ecosystem work for them:

- They accept that they cannot and should not build everything in-house.

- At the same time, they ensure that their organizations are set up to fully leverage the ecosystem, and they invest in internal data capabilities.

- They make external partners an extension of internal teams.

- They measure impact with concrete metrics that are understood throughout the organization, and they regularly reevaluate partnerships in light of the results.

- Internally and externally, they make regulatory compliance routine, and they keep an eye on consumer trends and opinions so they are prepared for future changes.

Don’t build everything in-house. The complexity of marketing today means there are simply too many critical capabilities to support in-house, and agencies are no longer sufficient one-stop-shop partners. Most marketers need to work with a stable of partners, selecting each one based on its particular value proposition. This puts a premium on coordination and on motivating multiple partners to act in unison.

The key for most marketing functions is achieving the right balance between internal and external capabilities, a task complicated by the fragmentation in Europe discussed above. When deciding whether to outsource a marketing activity, companies should consider not just the implication for competitive advantage but also the need and ability to scale each activity across borders. (See Exhibit 4.) They should also factor in the impact on talent, budget, time constraints, and speed of execution. For most companies, it will be critical to build differentiated internal capabilities in areas that provide a strategic advantage. Oft-cited examples include branding and data science. Businesses are already solving problems with hybrid solutions that combine in-house, agency, and partner resources. Instead of building or buying solutions, businesses are building and buying. Build-operate-transfer models have proven successful as a way to develop a capability through a partnership and ultimately bring it in-house.

Most marketers today are not well positioned to build their own differentiated martech capabilities. They are better off relying on partner platforms with open ecosystems that offer immediate scale. “One of our competitors had about 100 developers working on it for three years, and they still weren't successful in building an adtech stack … You really have to go with external partners,” the director of marketing at a German publisher told us. Media buying and localizing content, too, are candidates for outsourcing, as they benefit from the knowledge of local players.

Data-driven marketing is a source of competitive advantage, and most organizations understand that they must invest internally to unlock its potential. Done right, investing in internal capabilities yields key strategic benefits, such as better targeting and better understanding of the ROI of each channel. Companies need three principal layers of capability for data-driven marketing: data architecture (data engineering and collection and integration of first-, second-, and third-party data), data intelligence (data science and predictive analytics), and execution (channels for consumer engagement). In our experience, leading companies generally maintain a portion of the first two in-house in order to build institutional knowledge on data availability and to maximize flexibility. The execution layer has become largely commoditized and for the most part is easily outsourced.

Gaining access to data requires building relationships based on trust with consumers. Transparency and clear communications on how data is used, for what purpose, and the benefits that accrue to consumers from sharing their data are prerequisites and best handled by the company itself rather than by third parties.

Organize internally to leverage the ecosystem. Many companies may find that they are in for a culture change that extends beyond the marketing function and requires alignment across the organization. In our experience, it is almost impossible to improve results without establishing a data-driven, “fail fast, learn fast” culture that embraces open feedback and review cycles. Each company will need to optimize its own mix of channels by testing and learning internally. “Build your own ability to judge the ecosystem,” advised a senior vice president of marketing at a €10 billion consumer tech company. “Google and Facebook [and other partners] can't do that for you. Understand the true ROI of every channel—that’s how you differentiate today.”

The right talent is imperative. In our experience, about 10% of value is driven by data and algorithms, 20% by technology, and the remaining 70% by process and people. Even companies that outsource technical functions need technical talent to engage with and manage partners. Given the scarcity of technical talent, training or retraining current employees, hiring externally, and looking across borders when local talent is prohibitively expensive all become viable options. “Many CMOs today over-index on tech and don’t focus enough on people and process,” said the senior vice president of a marketing cloud company.

Make external partners extensions of your team. Marketers in Europe cited “partner understanding of your business needs” as a top success factor in maximizing the value of partnerships. They put a premium on finding partners who understand their business as if they were full-time employees. They also work to strengthen this understanding with frequent communication and agile ways of working, and they seek partners that can help them adopt this culture internally.

Companies cited cross-channel management, cross-channel measurement, and attribution as the most significant challenges in achieving their target ROI.

Full transparency, cross-company collaboration tools, and direct data sharing that can be accessed in real-time (with proper compliance) are prerequisites for effective collaboration. May companies try to co-locate frequently, and they establish regular check-ins (such as weekly standups) that, when possible, include all partners to ensure cohesiveness across the ecosystem.

Measure impact with concrete metrics. With multiple external partners working on the same campaigns across different countries, consistent and agreed-upon KPIs are key to effective execution. “Agreeing on and communicating the same KPIs to all partners is crucial to aligning interests. Most campaigns stumble because they neglect to do this,” said a former CPG executive.

Using metrics and KPIs that are meaningful for the whole organization helps build consensus around a single measurement strategy. The CFO should not measure success any differently than the CMO or an agency. Quantifiable metrics that are credible outside the marketing organization (to the CEO or CFO, for example) will help create early alignment on what success looks like. Standardized metrics (such as customer acquisition or revenue) across the marketing organization and alignment on concrete short-term (six months or less) and long-term (one year or more) goals hold partners accountable. All such goals, of course, should be set within the context of the larger marketing strategy.

Marketers should evaluate partnerships regularly (quarterly or monthly, for example) against established KPIs and overall strategic goals. “We sit together with our partners every quarter to benchmark them against their peers on the market,” said the general manager for Germany, Austria, and Switzerland at a leading martech provider. “There is a direct link between performance and how you evaluate your partners.”

Companies can also run small-scale pilots with potential partners to identify possible higher-ROI alternatives and demonstrate value before committing significant budget. “Run ten pilots with potential new partners every year. If you’re an enterprise, each pilot might cost €50K, but you only need one or two of them to work out to make it all well worth it,” said the CEO of a leading adtech company.

Make regulatory compliance routine. Legal guidance is often necessary in order to fully understand the implications of regulatory changes and to build a path to compliance that takes into account country-specific regulatory interpretations and policies. At the same time, companies should avoid the temptation to overly restrict potential data uses because of a lack of customer consent. Our research has shown that when customers understand the benefits, they are much more willing to give permission than companies are to ask.

To reduce the internal burden, control costs, and track ongoing compliance, marketers can consider using technology partners such as consent management providers. These can help educate internal and external people and ensure that compliance is an integral part of each new partnership. “You have to build awareness about the importance of transparency and consent across the organization, especially in engineering, analytics, and business functions, in order to make sure the right protections are built into each new use case,” said a senior strategist at a leading marketing cloud platform provider.

Marketers can also explore other (second-party) data partnerships as the use of third-party data declines, as well as opportunities to improve the digital experience for customers and strengthen trust as they build out GDPR compliance.

Here are three key questions to explore when evaluating your current partner strategy. (See Exhibit 5.)

- Is the partnership catalyzing growth by, for example, furthering the accumulation of institutional knowledge, providing access to thought leadership, or enabling skills transfer through collaboration or enhanced automation of capabilities?

- Is the commercial value evident? Has tracked progress against stated short- and long-term ROI targets in the first six months demonstrated incremental commercial value? Is there a willingness to tie terms and fees to ROI?

- Is the value proposition still the best available? Has it kept pace with the evolving ecosystem?

Marketers have their work cut out for them. Complexity will only increase, and competition will continue to rise. The ecosystem provides essential assistance and capabilities. Those that take the time to approach it strategically, with clear goals and expectations determined in advance, will gain the most value and the biggest advantage.