Social distancing requirements and sharp cuts in consumers’ discretionary income during the COVID-19 crisis have hit the medical aesthetics business hard. Many practices and medical spas are suffering significant liquidity challenges.

Still, we believe that once the pandemic is no longer a threat, the inherent demand for aesthetic procedures and their current low market penetration will help boost the industry’s growth nearly back to pre-COVID rates. Consumers everywhere are eager to resume their personal-care regimes and to undergo their recommended procedures.

To ensure this rebound, medical aesthetics players should plan and act now, rebuilding liquidity, working more closely with other industry actors such as physician practices and medical spas, and experimenting with new ways to reach consumers. They must also evaluate key trends such as digitalization and keep an eye on shifts in channel mix and on innovation in the industry.

A Tough Year, but the Fundamentals Remain Strong

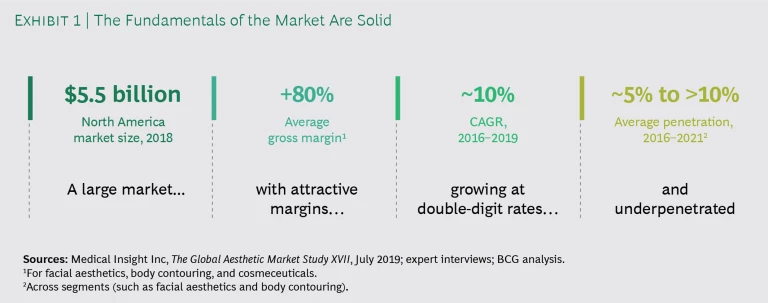

This year will indeed be difficult for medical aesthetics, with many customers and dermatologists’ offices remaining in lockdown. An industry that in North America alone was growing at about 10% annually, and whose product market was worth nearly $5.5 billion in 2018, has essentially ground to a halt. Short-term demand has collapsed and there are concerns that soaring unemployment and sharp reductions in disposable income will curb future growth.

But the fundamentals of the industry’s strength—demographics among them—are holding strong. (See Exhibit 1.) There are underpenetrated market segments among men and young people, for instance. In the US, the cohort of 25- to 44-year-olds will continue growing. And many players provide injectables—a category that recovered quickly after the 2008˗2009 financial crisis.

At the same time, pharmaceutical and beauty companies have entered the sector, attracted by its untapped potential and by the chance to grow revenue. The beauty companies understand the ins and outs of direct-to-consumer marketing and sales and are good at leveraging customer data to drive adoption. The pharma companies have deep connections among health care provider networks—notably, with primary-care physicians.

Moreover, there is no shortage of innovation—or ways to benefit from it. In much of the medical aesthetics market, the path to creating value is subject to traditional market forces, not to the strictures and complexities of health insurance. For companies with truly differentiated portfolios of products or services, there are still ample opportunities to deliver significant value.

Industry Trends to Steer By

It’s time to start preparing for a postpandemic future in which the industry is healthier, more innovative, and more resilient than before. That must start with a keen understanding of the market’s dynamics both with and without the impact of COVID-19.

The fundamentals of the industry’s strength—demographics among them—are holding strong.

Digital technology is strengthening customer engagement. More and more industry players are adopting digital tools and techniques. Nowhere is that more important than in customer relationships. Just as the pandemic has accelerated the use of telemedicine by physicians and patients, equipment and product providers are relying on digital technology in their interactions with dermatology and plastic-surgery practices. They are using online tools—from lead generation apps and cobranded ads to streaming promotional videos—to build loyalty and facilitate communication with their customers.

The mix of channels is in flux. With the market shifting from clinical to “lifestyle” procedures—that is, from largely health-related procedures, such as facial reconstruction following a vehicle accident, to purely cosmetic work, such as removal of frown lines—noncore channels such as spas, gyms, beauty shops, casinos, and other venues have been playing a larger role; in 2018, for example, spas alone accounted for more than $7.2 billion in revenue in the US, according to the “2019 Medical Spa State of the Industry Report.” However, that growth may be difficult to sustain, since these channels lack the medical licensing needed to provide the nonelective procedures for which demand is likely to remain less volatile while the pandemic lasts.

Single-asset newcomers are driving innovation. Innovations in medical aesthetics often come from companies that focus on just one technology. Their new products and services help shape consumer preferences, address unmet needs, and spark further interest in medical aesthetics. Body contouring, for example, is a relatively new treatment that is popular with millennials. Some of these “single asset” firms are innovating in business processes, too, creating new pricing models and new ways to engage with practices. But many are at risk because of the pandemic, and those without enough liquidity or without sufficiently differentiated products risk failing or being acquired.

The Right Moves to Make Now

Given the current steep drop in consumer income and the shutdown of so many practices, the medical aesthetics business cannot expect a rapid rebound in 2020. And a comeback in 2021 will not be quick. So how should industry players respond, not just in order to survive but to stay relevant and drive value in the future?

Although there is no universal playbook, the first step is the same across industries: concentrate on cash liquidity and cost cutting and strive for stability in the months ahead. That step is especially critical for many single-asset companies, many of which are cash poor and debt heavy.

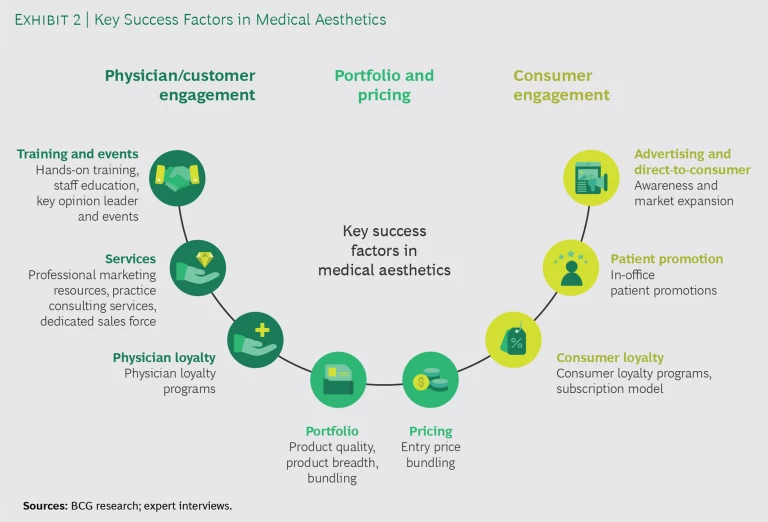

When a sense of stability has been regained, medical aesthetics firms must start planning for the expanded role they can expect to play in the medium to long term. The key success factors in their business will remain the same, but the cast of characters is already changing. (See Exhibit 2.)

The industry’s incumbents—certainly those with differentiated product and service portfolios—generally have quite a few options for how to respond. This is a good time for them to leverage their scale, securing competitive positions for when the market returns. That means building short-term business scenarios, modeling the impact of different economic environments on overall business health, and planning conservatively. In many cases, it may call for securing greater liquidity for the medium term.

The portfolio players must also prioritize their talent, investing in sales force retention and finding ways to upskill digitally. It also makes sense to evaluate potential acquisitions now—ideally companies whose innovative products complement the firm’s current portfolio and whose stock prices have fallen.

Portfolio firms can also do more to partner with the health care providers that are a primary channel for aesthetics procedures. For example, they can retool loyalty programs, create joint promotional campaigns, and extend days payable to help physicians improve liquidity. In doing so, they are more likely to be viewed as preferred suppliers when demand returns.

For companies with truly differentiated portfolios of products or services, there are still ample opportunities to deliver significant value.

For smaller companies, comeback will be much more challenging. They need to be creative and choose the market segments in which they can best differentiate themselves. One option may be to merge with or acquire other fast-growing firms to generate scale. They can also count on private equity firms, which collectively are sitting on plenty of dry powder. At the end of 2019, PE firms had $1.5 trillion in unspent capital, the highest year-end total on record. PE’s funding muscle could help many small industry innovators stay afloat and then rapidly achieve size and scale.

All these actions call for assessing a range of scenarios to identify those that offer better returns and appropriate risk tradeoffs. One option is to calculate total shareholder return using an analytical framework to help quantify potential outcomes. Businesses that pair TSR analysis with a strategic risk assessment will be better placed to identify the most attractive opportunities.

Practitioners, owners, and investors in the medical aesthetics sector have constructive approaches they can take to recover from the impact of the COVID-19 pandemic. The sooner they take them, the faster they will be able to create a robust, resilient future for their businesses.