Luxury brands spent decades turning design, aspiration, and high-quality goods into a $380 billion global behemoth. The coronavirus pandemic changed it all in a few short months. Sales have plummeted, leading to forecasts for a precipitous decline in 2020 revenue and massive uncertainty about the ability of many brands to rebound. The long-term impact of the crisis on brands will be just as dramatic, accelerating shifts in consumption and consumer preferences that will upset the existing equilibrium of power.

BCG believes that industries of all kinds—including luxury—will go through a three-phase recovery from the COVID-19 crisis, one that we call “Flatten, Fight, and Future.” Based on our discussions with luxury brands’ C-suite leaders, we believe the industry faces a protracted Fight phase, where regions gradually restart their economies but business outlooks remain uncertain because of the potential for the virus to reemerge. At the same time, brands are grappling with a fundamental shift in what “luxury” means, as consumers become more environmentally and socially aware and digital channels become more important as sources of inspiration and sales. Companies that respond by streamlining operations, redefining luxury to be less conspicuous and more inclusive, and investing in new ways of doing business are more likely to not just power through these uncertain, changing times but emerge stronger for the future.

The End of Luxury’s Golden Era

The crisis has slowed a decade of growth across luxury categories that was buoyed by a bullish global economy and the relative affluence of Chinese consumers, who in recent years accounted for 35% of luxury purchases worldwide. Growth was further spurred by the democratization of luxury goods ushered in by lower opening price points, excitement over new categories such as high-end sneakers and casualwear, and collaborations between labels.

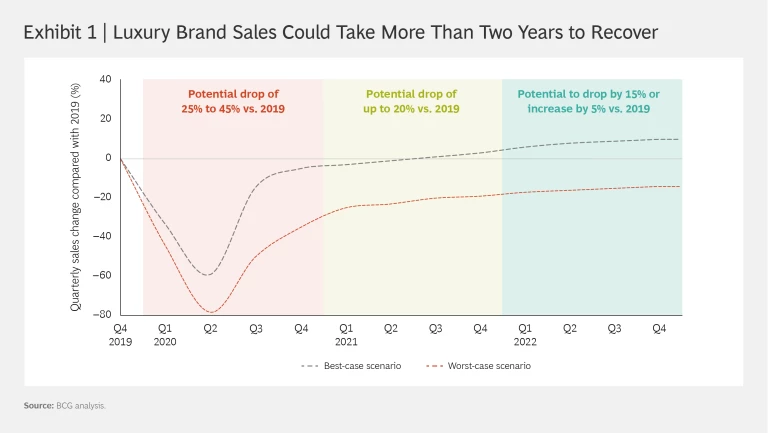

Now, even the most optimistic forecasts show sales of luxury goods dropping 25% to 45% in 2020. (See Exhibit 1.) In a best-case scenario, where a vaccine becomes available or the economic ramifications of the pandemic are not too severe, people will resume shopping and traveling and give a boost to luxury goods sales. But in a worst-case scenario, where a vaccine takes longer to develop or the recession is more severe, companies will struggle to regain momentum and people’s ability and willingness to buy luxury goods will suffer.

Taking these factors into account, we expect that the industry’s recovery will be gradual. Although performance will vary across individual categories, we believe that a worst-case scenario could cause overall sales in 2021 to be 20% lower than in 2019, followed by a somewhat smaller decline in 2022. By 2023 and beyond, we expect sales in most categories to return to precrisis levels.

For now, though, the new reality is upending the status quo in several ways.

Current events are reshaping how people think and behave. The COVID-19 crisis and recent protests to end racism have made existing social inequities even more apparent and people less comfortable with easy and conspicuous affluence. The COVID-19 pandemic paused travel and travel-related shopping for the foreseeable future. It’s also driven more people to shop online, including those who avoided it in the past. Luxury slowly had begun to become more diverse and inclusive. In light of the current state of the world, that move is now nonnegotiable.

Category sales are shifting. Although consumers are spending less on luxury goods during and immediately after lockdown periods, brands whose products are perceived to be timeless have not and will not be affected as much as those that are more dependent on fashion trends and fads. In addition, categories that are further along in incorporating digital platforms and technologies into sales and distribution channels should fare better.

We believe skin care, makeup, footwear, and leather goods are in the best position to rebound. Sales in these categories are less tied to seasons, holidays, or other key moments than are others, and online sales are already relatively strong. We expect that sales in these categories will decline in 2020 but recover faster than others, potentially reaching precrisis levels in 2021 or 2022.

By contrast, watches and jewelry will on average face more challenges because of their continued strong reliance on sales through physical and wholesale channels, and because of the extreme drop in international travel. Today, e-commerce accounts for only 10% of watch sales and 5% of jewelry and eyewear sales. Ready-to-wear brands also will struggle; any revenue they realize from a seasonal rebound could be offset by the need to offer discounts to sell off excess inventory. We expect sales in these categories to drop by 35% to 50% this year and not reach precrisis levels until at least 2023.

Watches and jewelry will on average face more challenges because of their continued strong reliance on sales through physical and wholesale channels.

Countries are recovering at different rates. China experienced the worst of the crisis ahead of most other places, and the Chinese economy has already recovered to the point where GDP growth is forecast to surpass the 2019 increase and continue to expand. Sales of luxury goods in China are expected to rebound and end the year as much as 10% above the 2019 mark, as more Chinese who normally shop for luxury goods when they travel stay home and spend in the country.

By contrast, European countries such as France, Italy, and the UK could suffer from the effects of the crisis well beyond 2020. In those countries, less international travel and weak local demand amid prolonged economic fallout from the crisis will continue to hurt sales of luxury goods. In the US and Japan, consumers expect the crisis to create a recession, and they plan to spend less on luxury goods as a result. In the US, the luxury market will be further hurt by the closings of some department stores and high-end retailers, as well as by the current social and political climate.

Online channels are blossoming. Some luxury brands had been cautious about venturing into e-commerce because it doesn’t fit consumer expectations for a high-end shopping experience. But as more people bypass shopping in person for the convenience and relative safety of buying things online, luxury brands must accelerate sales through online channels.

The crisis hit department stores especially hard, and we expect them to continue to be affected unless they adopt more personalized “clienteling 2.0” sales practices and expand digital sales channels.

Challenges and Opportunities

Shifting economic, consumer, and societal trends present challenges and opportunities for luxury brands and retailers.

Demand for sustainability grows. Addressing consumer interest in sustainability is now table stakes for the industry. Brands must rethink their entire value chain to ensure that it is environmentally and ethically sound. Such a reevaluation could lead them to make a number of changes, including sourcing more materials locally, reducing their carbon footprint, providing more support for local communities, and supporting animal rights.

Diversity and inclusivity are must-haves. The year 2020 will be known as one of turmoil, but hopefully also one of change. The luxury business, as with all industries, must use the opportunity to make diversity and inclusivity a priority for their workforce and customers.

A quieter style of luxury emerges. The next decade will be one of uneasy affluence, with shoppers in many parts of the world reverting to less conspicuous forms of luxury. In a recent BCG consumer survey, more than half of the respondents expected their preference to increase for luxury items that are understated and everlasting. Chinese consumers, however, continue to prefer luxury items with embellishments, logos, and other visible adornments, a difference that could polarize luxury values between East and West.

Midterm tourist sales remain low. Because travel in most parts of the world is on hold, brands must find a way to make up for the revenue lost from a decline in sales to tourists, in particular the sales to individuals of ultrahigh net worth. To make up the difference, many brands will need to prioritize replacement of the revenue lost from Chinese tourists with sales to local markets.

Digital channels accelerate. Before the crisis, e-commerce accounted for 10% to 12% of luxury sales worldwide. Lockdown periods created a boom in online shopping, including higher sales to e-commerce novices. We expect new shopping behaviors to endure beyond the crisis, similar to how the SARS crisis in Asia was the turning point for digital and online platforms there. We also expect online shopping behaviors to continue to include not only transactions but also the inspiration stage of the purchase journey, which now accounts for a large portion of consumers’ online shopping-related activity. Generation Z shoppers—those aged 5 to 25—in particular devote half of the time they spend making a purchase either seeking inspiration or inspiring others. More than 70% of the age group globally and 82% in the US decide what to buy during the inspiration stage of the purchase journey.

The market is significantly more volatile. The full extent of COVID-19‘s impact on the industry and the impending recession remains to be seen. To navigate the uncertainties, brands must develop the ability to track, analyze, and act on signs of trends in demand. Data analysis will play a larger role in such intelligence gathering, allowing brands to create and deliver the right merchandise to the right place at the right time. We also expect to see more industry consolidation, with size and scale becoming even more important than they were in the previous decade.

How Luxury Brands Can Win in the New Reality

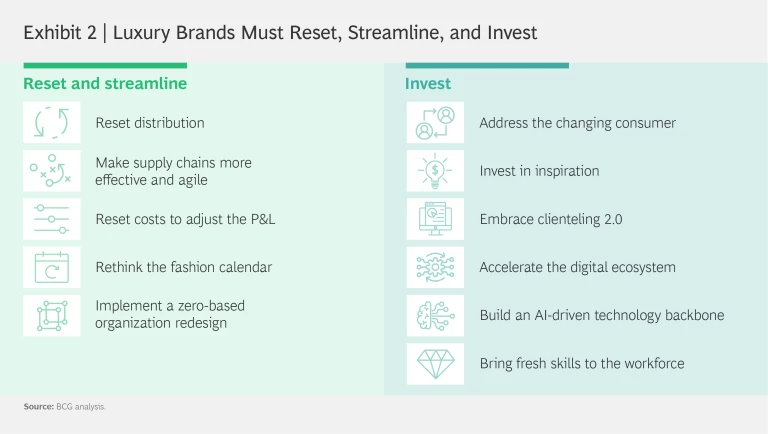

Brands that address challenges and opportunities without delay will be in a better position to navigate the new reality. In the initial Flatten phase, luxury players prioritized protecting their people and cash. Some switched to making personal protective equipment, hand sanitizer, and other essentials. In most regions, brands now are transitioning to the Fight phase, where they need to reset and streamline operations and invest in areas that will drive advantage into the Future phase of the new luxury reality. (See Exhibit 2.)

Reset and Streamline

Companies must rethink what, when, and how they sell in order to recalibrate operations to meet a changed sales picture.

Reset distribution. To reengineer distribution, brands must bolster their presence in key cities in the regions where they operate, because as long as travel restrictions inhibit tourist-related purchases, those areas will represent a larger portion of sales. To attract more local clientele, brands must step up their value proposition, offering more merchandise that’s relevant to local shoppers, sourcing more merchandise closer to home, and spending more on local marketing.

Because department stores continue to operate under pressure, brands must take care to partner with successful enterprises even as they build out their direct-to-consumer channels—including their own stores. We expect brands to sell through multiple digital channels, including their own websites, digital-only pure players such as Net-A-Porter and Farfetch, and social networks. In addition to selling merchandise, digital channels have become essential inspiration points in the prepurchase phase of the consumer journey. To win over luxury buyers, brands must invest in boosting their visibility in these channels, offering such amenities as virtual try-ons and giving customers a more personalized shopping experience. We also expect the recessionary economies in some regions to accelerate growth of platforms that sell preowned merchandise. Luxury brands will need to determine if and how to engage with these platforms.

Because department stores continue to operate under pressure, brands must take care to partner with successful enterprises even as they build out their direct-to-consumer channels.

Make supply chains more efficient and agile. To respond faster to shifting market conditions, reduce time to market, and decrease exposure to market volatility, brands must reinvent their supply chain and renegotiate supplier relationships. To create a more agile supply chain that allows them to be more flexible, brands may need to shift from high-volume manufacturing partners to producers that operate more factories located closer to customers. That way they can cut delivery times and improve time to market. They would also have redundant coverage should factories in certain areas shut down because of a public health crisis or become inaccessible owing to trade wars. We expect some brands to integrate vertically, particularly large companies and conglomerates that would benefit from acquiring manufacturing capacity if controlling the means of production could earn them a competitive edge.

Reset costs to adjust the P&L. To counter the near-term reality of lower revenue and preserve operating profits, luxury brands must reshape their P&L. They must adjust costs across the board, including such fundamentals as the cost of goods sold, rent, and personnel.

Rethink the fashion calendar. Even before the crisis, the fashion and luxury industries were working to reconcile the disconnect between the long-entrenched cycles for unveiling, delivering, and marking down merchandise and the reality of consumers’ shopping habits, preferences, and needs. The crisis has intensified the need to change in order to reduce expenses, increase margins, and operate more sustainably, among other things. Such a change is no small undertaking. It would require overhauling a brand’s entire fashion calendar, including the number of collections it produces each year and when, where, and how those collections are shown and delivered. And it would have a trickle-down effect on wholesale and e-commerce channels.

Implement a zero-based organization redesign. Implementing a zero-based organization redesign is another way that luxury brands can make their cost structure leaner and more agile. In the process, a company considers what it would need if it were to launch today, and then it puts those systems in place, including data analytics to forecast and augment decision making and identify cost savings. A zero-based reorganization could lead a company to adopt a bionic operating model, one that seamlessly integrates the capabilities of people and technology. A bionic operating model also gives brands the chance to digitize product development and their supply chain to be more agile and effective.

Invest

If brands successfully revamp operations, they may be able to free up the resources necessary to expand into new sales channels and to invest in such areas as data analytics and artificial intelligence.

Address the changing consumer. Luxury brands haven’t always made consumer concerns the center of their business. They need to now, starting with making diversity and inclusivity a key objective, with clear plans and performance targets. Efforts to become more diverse should encompass personnel at all levels—from retail staff up to and including the C-suite and board. Brands also need to make sustainability a key pillar in everything they do. This is not only about growing consumer demand. Going green now could serve as a hedge against rising commodity prices and the stricter environmental regulations that are expected in some parts of the world. Brands must take similar steps to address consumer demand for purpose and social consciousness in the companies they patronize. To remain relevant to the next generation of customers, they must do a better job of sharing their purpose and values, and demonstrating their heritage and authenticity. And underlying all this will be the need to, with some notable exceptions, cater to a quieter, less conspicuous form of luxury that is characterized by temperance, slow fashion, and quality.

Invest in inspiration. If consumers are spending more time in the inspiration phase of the purchase journey, then brands need to be there as well, including on social channels such as Instagram and WeChat. To be culturally credible, brands need to cultivate an image that’s both aspirational and accessible, and they must make it easy for their audience to communicate and interact with them. Brands can use their social channels to show how they participate in social, civic, environmental, and other causes. To be as transparent and authentic as possible, they should also collaborate with third parties—to deepen their awareness of local groups and subcultures—and support cultural pioneers and the circles they direct.

Embrace clienteling 2.0. As shopping preferences and habits evolve, brands must develop tools for engaging with high-end customers. In the next decade, we believe this will mean focusing on clienteling 2.0, combining people and data by, for example, using machine learning to share relevant information with salespeople in order to improve how they engage with customers. A number of brands and retailers are already testing this concept; some found success during pandemic-generated lockdowns, after turning store associates into digital stylists and having them engage with consumers and sell merchandise directly through WeChat and Instagram. In our client work, we’ve seen companies that implement clienteling 2.0 boost sales by 10% to 15%.

Accelerate the digital ecosystem. Many luxury brands have been slow to embrace digital channels, but given how many people shopped online for the first time during the pandemic—including some who bought luxury goods—they need to catch up, and quickly. Brands must create online experiences that feel exclusive and beyond what nonluxury retailers offer. Experiences should take into account not just shopping and purchase transactions but also related activities such as fashion shows, private showings, personal shoppers, white-glove delivery, and other customized services.

Build an AI-driven technology backbone. Adoption of artificial intelligence (AI), advanced analytics, and other components of an enterprise-wide technology backbone will become a key differentiator in the industry. If the Fight phase of crisis recovery continues for some time, it may be difficult to predict product trends, at least in the near term. Brands can use AI to steer the way, doing pulse checks on buying patterns, for example, to improve demand tracking and analysis and gain insights that competitors might not have. AI also can help brands manage manufacturing and stock in a more agile way. The benefits include improved in-season inventory management and markdowns. And it can help them customize their value proposition to a hyperpersonalized level.

Bring fresh skills to the workforce. The pursuit of talent with the necessary skills will be one of the luxury industry’s biggest challenges in the coming decade. The industry needs data engineers, data scientists, analysts, and other digitally savvy talent—all people whose talents make them highly sought after. There will also be a need to upskill existing talent as AI and advanced analytics continue to transform all areas of the value chain.

The times and changing attitudes are redefining the meaning of luxury, forcing brands to rethink every aspect of their business. The key imperatives are operating more sustainably, ensuring diversity and inclusivity, embracing digital capabilities, and integrating people and technology. Companies with timeless, classic products and the cash to upgrade to these new ways of doing business will consolidate power at the expense of brands that fail to act.