Recent data suggests that most companies are preoccupied with reacting to the disruption caused by COVID-19 and readying themselves for a possible recession.

Yet transforming for growth is not easy. A little more than a quarter of transformations both sustainably accelerate growth and outperform competitors in creating shareholder value. To help companies increase their odds, we applied an evidence-based approach to uncover and study 735 US transformations. Our analysis identified seven success factors—spanning leadership, strategy, and culture—that can serve as the starting point for a growth transformation playbook.

Long Odds of Success

A successful transformation for growth both sustainably accelerates growth and generates shareholder value. We measure growth acceleration as the improvement in a company’s annualized revenue growth rate relative to industry averages over the five years after a transformation launch, and then we compare that with the company’s growth rate relative to industry averages before the transformation. Additionally, we measure shareholder value as the total shareholder return outperformance (TSRO) the company delivers that exceed industry averages over the five years after a transformation is launched. (See “About Our Study,” for more details on the methodology we used.)

About Our Study

About Our Study

Our analysis is based on 735 transformations occurring in US companies with $1 billion-plus market cap over the period 2004–2017. As in our previous research, transformations were identified by annual restructuring costs in excess of 0.5% of revenue. We defined a successful growth transformation as one that both accelerates growth relative to industry and delivers positive total shareholder return outperformance. A company’s growth acceleration is the difference between its industry adjusted growth rate (IAGR) in the five years after its transformation starts and its IAGR in the three years before its transformation starts. IAGR is a company’s annualized growth rate over a time period, less the median annualized industry growth rate over that same period. Total shareholder return outperformance is the annualized TSR that a company delivers in excess of median industry TSR over the five-year period after the company’s transformation begins. We based candidate success factors on the literature review and case studies. These factors were translated into quantitative proxies and analyzed using logistic regression, a statistical model that predicts the probability of a successful outcome while accounting for multiple competing effects.

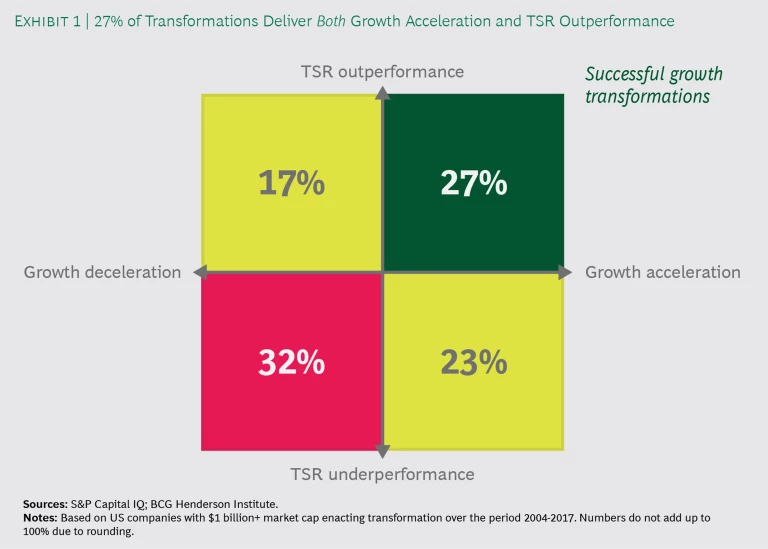

Transforming for growth is difficult; only 27% of the transformations in our sample were successful. (See Exhibit 1.) It is hard because companies need to grow in a way that also creates shareholder value: 23% of transformations actually managed to accelerate growth but failed to generate TSRO. Those that were successful, however, generated significant value—11 percentage points more growth acceleration and 12 percentage points more TSRO than an “average” transformation.

Additionally, economic stress such as that caused by COVID-19 should not dissuade companies from pursuing growth. During the 2008–2009 financial crisis, 35% of transformations led to successful growth, 8 percentage points higher than average. Although the coronavirus crisis brings many challenges, firms that can reimagine their business models for the post-COVID-19 world might find opportunities to transform for growth.

Seven Ways to Increase Your Chance of Success

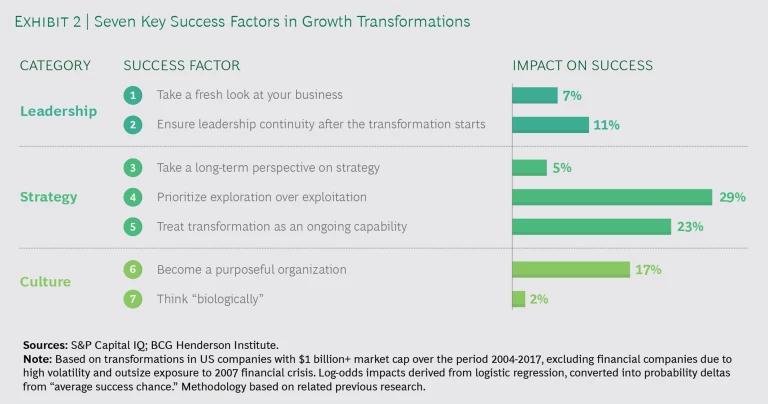

Given the long odds of success for growth transformations, it is important to understand what can be done to improve them. The seven factors that we identified as characterizing successful growth transformations in a measurable way span the categories of leadership, strategy, and culture. (See Exhibit 2.)

Leadership

CEOs play an important role in a transformation’s success. They can bridge business silos, allocate resources, and serve as role models for the necessary cultural changes. This is particularly important for growth transformations, which often can take companies into unfamiliar territory in the pursuit of new revenue opportunities.

1. Take a fresh look at your business. Transformations are not often accompanied by a CEO change. Only 14% of transformations coincide with a change in top management, barely higher than the 11% CEO churn in an average year. In line with our earlier research, however, we found that starting a transformation with a new CEO in place can boost the odds of a successful growth transformation by 7 percentage points, rising to 10 percentage points if the new CEO is also an external hire.

Many incumbent CEOs do lead successful transformations—our finding describes an aggregate pattern, not a rule. But this pattern suggests that an outsider’s perspective can be helpful when identifying growth opportunities and impediments. Incumbent CEOs who want to add an outsider’s perspective to their toolbox can break free of their traditional processes and mental models by using strategy games to explore a more expanded range of possibilities.

For example, Satya Nadella, who was hired as Microsoft’s CEO in 2014, described himself as an “insider-outsider” because of his background in the company’s Cloud & Enterprise Division rather than the then-dominant Windows division. That outsider perspective helped Nadella identify Microsoft’s existing Windows-first strategy and internal silos as obstacles to the growth potential of new offerings, which led him to initiate a transformation of Microsoft to “mobile first–cloud first” (later called “intelligent cloud”) and to increase internal collaboration. Since his appointment, Nadella has accelerated Microsoft’s revenue growth from 8% to 14% and tripled its share price.

2. Ensure leadership continuity after the transformation starts. Although new leadership at the start of a transformation increases its chance of success, we found that CEO churn during a transformation is linked to an 11 percentage point lower chance of success. Such change midstream can foster a sense of directionlessness that reduces the odds of a growth transformation’s success. A CEO change during a transformation also sends a negative signal that can erode investor confidence and lower stakeholder buy-in, decreasing the odds of success.

But there is another way to view our leadership continuity finding. Only 7% of the companies we studied changed their CEO during a growth transformation. Because CEOs are unlikely to leave a company voluntarily during a major transformation, such CEO changes at the helm are likely involuntary. They are perhaps a response to an already badly off-track transformation. Thus, our finding could actually be read as evidence that when a transformation is not going well, it is unlikely a new CEO could rescue it within the original schedule. Thus, finding the right leadership at the start of the transformation process is key.

Strategy

While specific strategies for growth vary heavily by company and context, we found three lessons that apply broadly: taking a long-term view on strategy, taking an exploratory approach to growth, and investing in a company’s ongoing transformation capabilities all increase the chances of success.

3. Take a long-term perspective on strategy. To understand the extent to which companies take a long-term perspective on strategy rather than focusing on immediate issues, we used a proprietary natural language processing algorithm to score the degree of long-term thinking expressed in companies’ annual reports. We found that companies taking a long-term perspective on strategy are 5 percentage points more likely to successfully transform for growth.

Firms that take a long-term perspective place the importance of sustainable growth and shareholder value over short-term returns. They also make strategic decisions on multiple timescales simultaneously. These firms understand that an “optimal” growth transformation may take several years to realize, and they don’t only chase short-term initiatives.

For example, in 2008 most major computer game companies used a cyclical business model: they developed a game, sold it to customers for a one-time fee, and worked toward their next launch. Activision saw an opportunity to grow customer lifetime value by switching to a subscription model based around smaller monthly payments and more frequent, incremental, updates to games from their main franchises. They did so through a merger with Blizzard, one of the few companies operating a game subscription service at the time. The newly formed Activision Blizzard turned its subscribers into a dedicated fan base by developing spinoff products that ranged from virtual card games to novels and a Hollywood movie. The steps it took to increase its customer lifetime value paid off. Between 2008 and 2018 the company grew its annual revenue by 10% (+2 percentage points compared with industry peers) while delivering an average annual TSR of 19%.

4. Prioritize exploration over exploitation. Companies can pursue growth in different ways. They can exploit existing products and services, for example, by selling more of them to existing and new customers, or they can explore new revenue opportunities. Capital expenditure (CAPEX) investments generally suggest a company has the intention of exploiting existing opportunities by expanding capacity. In contrast, R&D is generally focused on exploring new possibilities and generating new product and service offerings.

We found that growth transformations accompanied by high CAPEX spend versus industry averages are 11 percentage points less likely to succeed, while those with high R&D spend versus industry averages are 29 percentage points more likely to succeed.

Though exploration can seem riskier than exploitation, companies willing to explore can reap significant rewards.

In 2011, for example, the biopharma company Bristol-Myers Squibb began to shift from diversified health care to becoming a biopharma pure play with a strong focus on R&D. As part of the overall transformation, BMS identified immuno-oncology as an important growth opportunity that a shift in its R&D approach could unlock. Not only did BMS increase R&D spending (from 17% of sales in 2011 to 23% of sales in 2019), it also undertook several initiatives to empower the R&D function. Besides being the originator of new drugs, R&D would also become a stronger decision maker when making tradeoffs in the pipeline. As a result, BMS increased growth from -5% between 2010 and 2012 to 6% annually, and it went on to deliver 10% annual TSR between 2012 and 2019.

5. Treat transformation as an ongoing capability. Of the firms in our sample, 45% began multiple transformations between 2006 and 2019. We found that firms with a track record of at least one successful growth transformation were 23 percentage points more likely to succeed with subsequent growth transformations.

This finding suggests that companies should think of transformation as an ongoing capability, especially since the basis of competitive advantage is changing faster than ever. Companies should therefore lay the groundwork for future transformations by developing an adaptive firm with capabilities to change and respond quickly to new opportunities as they emerge—embracing an ““always-on”” approach to transformation. Firms also should build their knowledge base of successful change strategies, replacing anecdotal or heuristic approaches with the emerging science of organizational change.

Consumer credit reporting agency Equifax Inc. did just that in 2008 and the 2010s, following one successful growth transformation after another. During the 2008 transformation, the company delayered the organization and improved company processes to increase agility. It created a growth council to encourage an innovative mindset, improving the company’s response to change. As a result, Equifax was able to transform digitally in the 2010s and develop strong data and analytics capabilities, accelerating growth by serving new customer needs. Then in 2017, Equifax suffered a data breach that exposed its weak cybersecurity and led to a 34% decline in share price. Amid this controversy, Equifax relied on its transformation capabilities to quickly launch a security overhaul with the goal of restoring trust and so growing revenue and shareholder value. So far, the company’s share price has recovered, and its revenue continues to grow.

Culture

Culture shapes companies’ abilities to respond to change by influencing how individual employees handle decisions. Cultures that instill a sense of purpose and think holistically about change increase the odds of a successful growth transformation.

6. Become a purposeful organization. Our analysis suggests that companies that have a stronger sense of purpose are 17 percentage points more likely to transform for growth successfully. As a quantitative proxy for “purpose” we use an aggregate environmental, social, and governance (ESG) score that measures companies’ commitment to a range of environmental, social, and governance themes.

A strong purpose can improve the odds of a successful growth transformation because employees feel more closely engaged with it and therefore can execute it more effectively. If employees are motivated by purpose and believe that a growth transformation serves their mission, they will more likely embrace the disruption and uncertainty that often accompanies a change program. In addition, if employees’ individual sense of mission aligns with the employer’s business model, then they are more likely to take actions that lead to positive business outcomes even without managerial oversight.

For example, when the cleaning company Ecolab identified a concern among customers about access to clean water, it saw that as an opportunity due to clean water being a complementary input to the company’s cleaning products. In 2011, Ecolab acquired the water treatment company Nalco, which began its transformation into a global leader in water management and water treatment services. At the same time, Ecolab rebranded itself with a strong sustainability profile focusing on how much water the company saves globally with its solutions. This created a strong sense of purpose within the organization: Ecolab was now seen as a leader in sustainability and preserving water resources. The results have been impressive, with the company increasing revenue growth from 0% to 10% annually and delivering 18% annual TSR between 2011 and 2019.

7. Think “biologically.” Historically, managers have tended to view their organizations “mechanistically” and rely on simple cause-and-effect models to guide their thinking. But organizations are actually embedded in a dynamic, complex world in which outcomes are inherently unpredictable. Success in such an environment can mean augmenting a traditional mechanical approach with a “biological” mindset that acknowledges the uncertainty and complexity of business problems, addressing them indirectly.

We found that companies that think biologically were 2 percentage points more likely to successfully transform for growth.

Microsoft adopted such biological thinking to foster collaboration starting in 2014. Although Microsoft was an early entrant into cloud, by 2014 its market share was just 11%—far lagging market leader Amazon’s 29%.

Leveraging Multiple Factors to Ensure Success

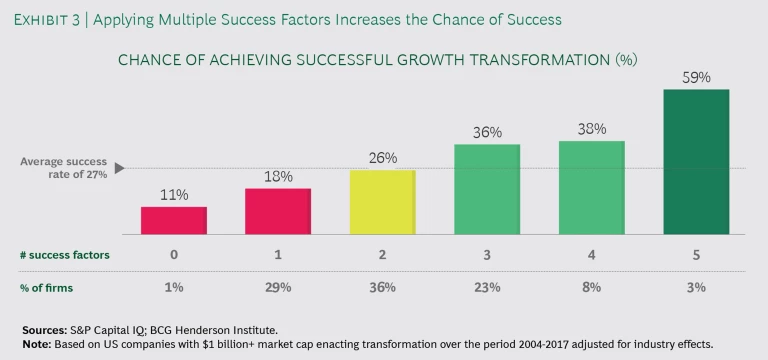

Each of the seven factors we’ve just described can individually improve the chances of success. But their effects are additive: companies that applied more factors had a correspondingly higher chance of successfully accelerating growth and achieving TSR outperformance—rising from 11% for companies with none of the factors to 59% for the small minority that applied five factors. (See Exhibit 3.)

This suggests that the starting point to a growth transformation program should combine several factors, such as making sure that the right leadership is in place with a fresh perspective, considering the long-term, investing in R&D, adopting a larger purpose and a holistic approach to change. Transformation programs are inherently risky, but by using evidence-based practices, companies can improve the odds.

Structuring a Growth Transformation

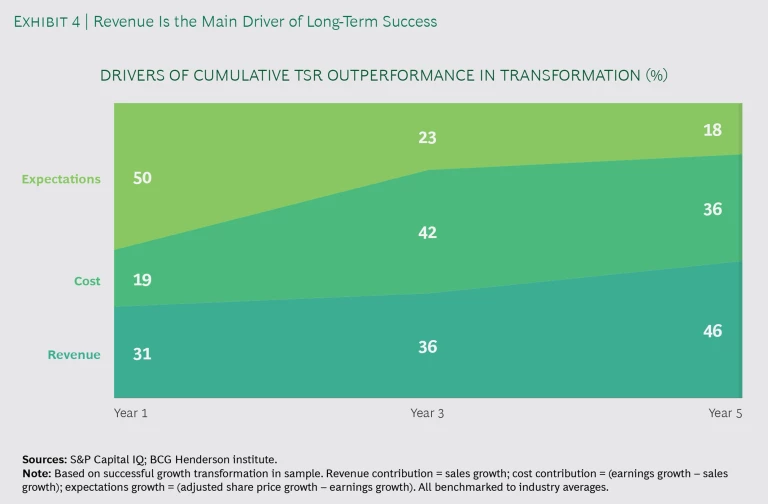

When we deconstruct total shareholder value growth into its revenue, cost, and expected future revenue contributions, we see how and when successful growth transformations create value.

Only 4% of our successful growth transformations relied solely on revenue growth to generate TSR. The remainder generated value through a balance of revenue, cost, and expectations. This suggests that companies attempting growth transformations should beware of narrowly focusing on growth at the expense of long-term profitability or future growth opportunities.

Successful growth transformations tend to deliver on each driver—revenue, cost, and expectations—at different points in the transformation journey (See Exhibit 4.)

On average, in the year a company launches a transformation, most of the TSR generated is expected value (corresponding to increased P/E multiple), suggesting that successful companies are able to convince investors of their growth stories. One-third of year one TSR, however, comes through revenue growth, perhaps representing tangible progress that demonstrates growth ventures are on the right track. By year three, cost reduction is responsible for the largest portion of TSR growth as companies refocus their portfolios and free up funding for growth investments. By year five, revenue growth is the largest driver of TSR growth.

Transforming for growth is hard to do but valuable if done right. By taking an empirical approach to change and learning from previously successful growth transformations, companies can improve their odds of transforming for growth successfully.

The BCG Henderson Institute is the Boston Consulting Group’s strategy think tank, dedicated to exploring and developing valuable new insights from business, technology, and science by embracing the powerful technology of ideas. The Institute engages leaders in provocative discussion and experimentation to expand the boundaries of business theory and practice and to translate innovative ideas from within and beyond business. For more ideas and inspiration follow us on LinkedIn and Twitter: @BCGHenderson.

BCG TURN is a special unit of BCG that helps CEOs and business leaders deliver rapid, visible, and sustainable step-change improvement in business performance while strengthening their organizations and positioning them to win in the years ahead. BCG TURN helps organizations change their trajectories by turning their upside potential into radical performance gains. The BCG TURN team consists of transformation practitioners and battle-tested experts with a proven track record in large-scale transformation. BCG TURN is invested in the sustainable success of clients, with a focus on performance acceleration and a commitment to value delivered.