Digital adoption has accelerated across the world during the pandemic, giving European health care providers an excellent opportunity to learn from global examples as they continue to deploy digital tools to improve patient outcomes, operational efficiency, and business viability. Simultaneously, patients’ desire for better access to health care is pushing providers in this direction. Indeed, patients have long been clamoring for many of the digital tools that have become commonplace during the pandemic—such as video appointments, remote monitoring, and use of digital interfaces to manage their care.

Now a big question is whether providers in Europe will backslide after the pandemic and revert to old ways of working that, in many cases, are still preferred by health care professionals. Or will they seize the momentum and invest more in digital and continue to transform? If so, what hurdles must they overcome? To get at these questions, BCG conducted a Provider Digital Benchmark survey that assessed the digital maturity of 24 European providers in ten countries. We found that the digital maturity of European health care providers was lower than that of other regions and identified four key reasons for this, as well as some key success factors for addressing these issues.

Europe Struggles with Digital Maturity

The benchmark survey of European providers was based on BCG’s Digital Acceleration Index, which surveyed over 2,300 companies in ten industries across the world. Globally, health care scored low on the digital maturity index—eighth place out of nine industries. And, it turns out, European health care providers are low performers among their global peers.

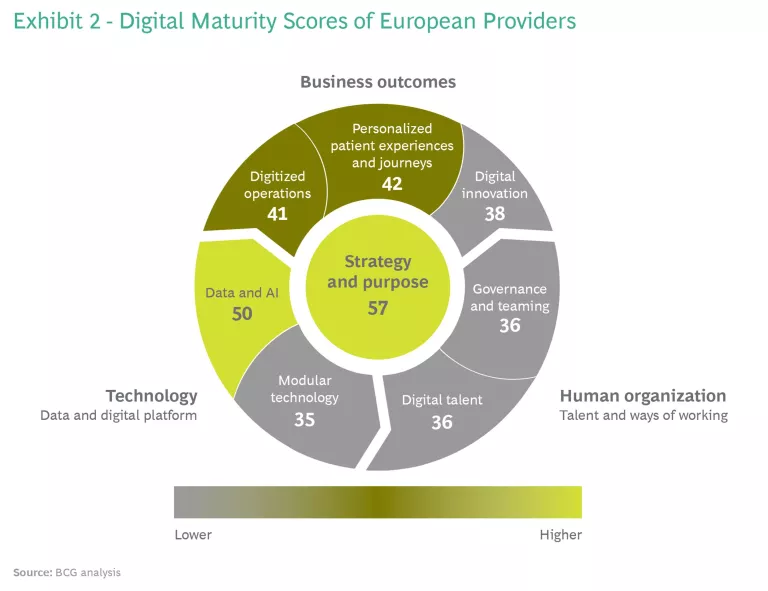

Our benchmark survey—based on self-assessments by each provider of its strategy and outcomes, as well as the enabling technology and human organization—found that all health care organizations globally scored 52 out of 100, US health care providers scored 48, and European providers scored 44. (See “Methodology.”) Of course, those are just averages; there are providers in Europe that already enjoy relatively high digital maturity.

Methodology

In contrast to Europe, competition among US health care providers encourages significant digital investment in areas where they can differentiate themselves and drive financial benefits. The competition there is so intense that some US providers have even started their own venture capital funds to foster new technology and innovation. That said, US providers have by and large struggled to extract value from digital investments in a timely manner. Many investments made ten years ago are just beginning to generate value.

While digital investments are growing in Europe, the motivation to invest and innovate to improve care and services and to drive revenue is not nearly as intense given the greater involvement of government in health care systems. The UK government has pledged £395 million for digital transformation to be invested in selected providers through its Global Digital Exemplar program, the French government has pledged €500 million to support the digital transition of the health care system, and the German government has pledged €4.3 billion for digital health innovation among providers.

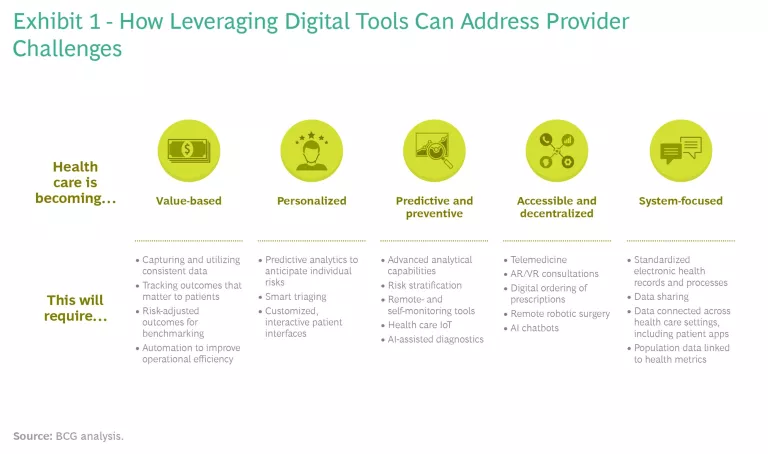

While those investments show promising commitment to digital, European governments and providers need to refocus their efforts to speed up the digital revolution, leverage the opportunities digital tools provide, and address the dramatic changes reshaping the industry. Health care is becoming more value-based and personalized, and it needs to become more predictive, preventive, and accessible. Greater digitalization is a key enabler to addressing all these challenges—a fact that has been amplified by COVID-19. (See Exhibit 1.) In today’s environment, Europe has something of a second mover advantage. There is an opportunity to learn from others about how to extract value from digital investments more quickly.

We dug deeper into the benchmark survey results of European providers to understand why providers are struggling with low digital maturity and explore what steps they could take to accelerate digital transformation. While providers vary in digital maturity, there was broad consistency in areas of strength and weakness. Many have digital strategies in place. Many have implemented electronic health records for fully digital data collection, and have strong workflow and process digitization.

What’s driving the low digital maturity of European providers is clear: above all, it’s about people.

What’s driving the low digital maturity of European providers is clear: above all, it’s about people. While many European providers are working with cutting-edge technology and infrastructure in parts of their operations, very few are getting the full value of that investment, because they are not paying enough attention to human behaviors, capabilities, and ways of working. We identified four key reasons for low digital maturity.

Failure to Make Digital a Priority

While many providers recognize the importance of digital tools to improve their care and efficiency, most do not see them as fundamental to normal clinical and administrative operations. Just 25% of respondents are focusing on digitizing back-office operations, and just 38% focus on digital and data in clinical research innovation.

In the words of one respondent: “Digital and data analytics are seen as ‘things’ that need to be delivered, rather than a key component of everything we deliver.” Another noted that because many providers need to achieve “in-year” benefits, it’s difficult to plan for multiyear digital transformations.

Not surprisingly, many providers have low digital ambitions, with a third saying they do not even aspire to be digital leaders. One said that end-to-end customer journeys “is not a digital area but rather a cultural and strategic area. Digitization is not our main focus toward this.”

Moreover, the attitudes of leaders and clinicians remain very conservative. Indeed, CIOs told us that one of the biggest barriers to digital transformation they face is bringing management on board and getting leaders to prioritize these efforts. This is in stark contrast to the US, where many CEOs are personally sponsoring digital transformations.

Challenges in Translating Strategy into Impact

Many providers have digital strategies in place but struggle to translate them into business outcomes. (See Exhibit 2.) New digital tools often run on legacy infrastructure, which makes it difficult to gather, analyze, and integrate findings into decision-making. One respondent said: “We collect the data, we analyze the data, but we are not good in creating value out of our data.” Another said that “patient outcomes are measured, but they are not used enough in strategic decision-making.”

Another reason for their struggle to translate strategies into impact is that providers often focus on their own isolated digital initiatives and don’t coordinate with other local provider organizations. This impedes the building of joint governance structures, clinician buy-in, broad standardization, and the ability to create a seamless patient journey. “We need to evolve towards a model of interoperability that ensures the exchange of information without constraints on implementations, avoiding ad hoc integrations,” said one respondent. Another added: “We handle a rather limited slice of the pie for a given patient condition, and although we can measure the costs and hard outcomes for the slice [we are far from being] able to measure it for the whole patient journey.”

Lack of Investment in Digital Talent

European health leaders are not putting a premium on recruiting digital talent, and they are not investing enough to train their employees. Our survey found that European providers are performing poorly on almost all the human elements of digital maturity.

When we asked, “Are you a leader in attracting and hiring digital talent and creating a talent ecosystem?” providers had an average score of 40, below their overall digital maturity score of 44. When it came to ongoing training, setting learning goals, and fostering a shift from human-operated to human-designed processes, they scored an even lower 32.

The results for governance and teaming were worse still. European providers scored just 28 when asked “Does your organization have a platform of end-to-end processes…to support the objectives of front-line services?” And very few providers use a dedicated team to help accelerate the digital transformation. In other industries, these teams are more common. They take an unbiased, holistic, integrated approach to the digital transformation, report directly to senior leadership, and act as the organization’s focal point for innovation.

External Barriers to Digital Transformation

The three reasons described above for low digital maturity all relate to internal barriers. But there are also external barriers to contend with. Providers need to align their digital transformations with government agencies. “The current governance and financial model of the government puts roadblocks in agile digital development,” one respondent said. Another added: “The hospital’s digital maturity is governed by the payer’s digital strategy and governance. We are dependent on their maturity to reach our goal.”

Moreover, providers can run into privacy and legal issues when trying to apply big data analytics and AI to patient data. Another challenge has been governments’ reluctance to reimburse for therapies delivered through digital channels. Here there has been progress during the pandemic. For example, Germany raised the cap on the percentage of clinical interactions with patients that can be virtual.

Passing the Inflection Point

Overcoming these four challenges won’t be easy, and our research shows that many health care organizations pursuing digital transformations often get stuck along the journey. Their digital initiatives remain isolated, one-off use cases, locked in individual areas of the hospital. Stakeholders may resist change or revert to old ways of doing business, and the provider never develops the full set of capabilities necessary to scale digital and ensure it becomes the new way of doing business.

To avoid getting stuck, health care organizations must pass a critical inflection point by doubling down on their digital transformations.

To avoid getting stuck, organizations must pass a critical inflection point on their digital journeys by doubling down on their digital transformations, refocusing their efforts on the basis of the capabilities they have built and what they’ve learned so far from digital use cases. They need to ask themselves:

- Have we prioritized the right high-value use cases?

- Is the organization and talent set up to scale?

- Are the right data enablers and technology platforms in place?

- Are we investing sufficiently in finding digital talent and developing digital capabilities?

Getting the answers right to these questions will help the provider scale use cases, accelerate organizational transformation, and gain value. There are already plenty of examples of companies that have focused their efforts this way and moved past the inflection point:

- Mehiläinen, a private health care provider in Finland, has developed a patient-facing digital platform for online booking, digital meetings, prescription renewals, reviewing lab results, and consultations. Mehiläinen is also offering the platform to health care providers around Europe.

- Moorfields Eye Hospital, an ophthalmology provider in London with more than 20 satellite sites, has established a cross-specialty department of digital medicine to professionalize the digital transformation of clinical care—including AI implementation and digitizing care pathways. For example, it has recently implemented a virtual front door for the emergency room and a digital eye care hub that collects outpatient data so the doctor can review all that information at the same time more efficiently.

- Humanitas Medical Care, a hospital group based in Milan, has developed an AI research center to improve diagnostic processes and clinical decision-making. For example, by applying AI it can identify hip- and knee-replacement patients whose pre- and postoperative stays in the hospital can be reduced.

Keeping the Transformation on Track

Despite the recent digital strides, most providers remain risk averse, and their commitment to digital could waver as the worst of the pandemic passes. Medical professionals might, for example, happily revert to old, established ways of working. That is why it’s so critical that providers seize the momentum and keep the digital transformation on track.

With this in mind, we have identified practices to help tackle the four challenges outlined above and keep the digital transformation on track. (See Exhibit 3.) Indeed, several health care providers have already used these practices to improve results. One major government hospital developed an interactive capacity-planning tool, trained its staff to use it, and expects to save around €120 million in the first year alone.

Even before the pandemic, digital was among the top three concerns for CEOs of health care providers. Today we are at a crossroads. A reset is necessary, and providers cannot afford to backslide. Europe has not been at the forefront of digital adoption; providers, however, are well suited to benefiting from digital transformation since national health authorities can facilitate data collaboration, the sharing of best practices, trials of equipment, and assessment of results. European providers need to keep up the momentum, construct a bold vision, and build a long-term strategy.