How do different sectors and industries perform at delivering successful digital transformations? BCG research shows that 70% of such efforts fall short of their objectives. In our recent report, we highlighted how companies can flip their odds of digital transformation success. This article and the accompanying slideshow explore how different industries and the public sector perform and why some sectors and segments have higher success rates than others.

The rewards of success are high: digital leaders achieve earnings growth that is 1.8 times higher than that of digital laggards—and more than double the growth in total enterprise value. Digital technologies and ways of working offer productivity improvements and better customer experiences and open up new growth opportunities and business model innovation. Successful transformations set companies up for sustained success; they won’t have to digitally transform again as they become “bionic” and master continuous innovation.

Equally, failure is costly. It can manifest itself in, for example, large IT write-downs, poor customer experiences, missed growth and productivity opportunities, loss of precious time as competitors move their digital agendas forward, and severe consequences for leadership.

In our research, we assessed the digital transformation success for 895 companies based on BCG’s work with 70 leading companies worldwide and 825 responses to an in-depth survey about senior executives’ transformation experiences. We asked all executives to assess their transformations on a scale of 1 to 10. We defined success to include the percentage of predetermined targets met and value created, the percentage of targets and value met on time, success relative to other transformations, and success relative to management’s aspirations for sustainable change.

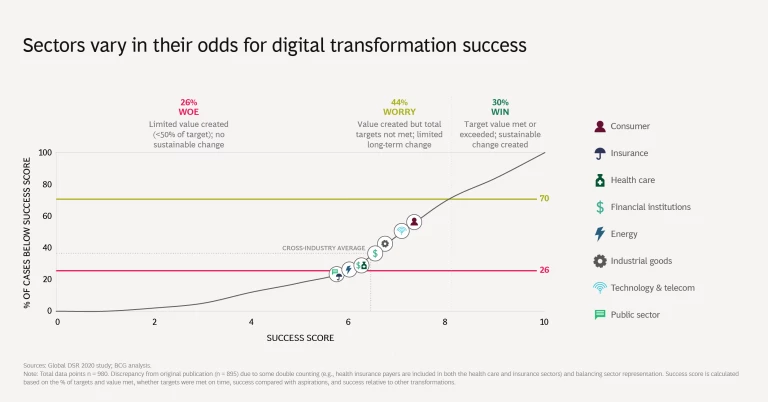

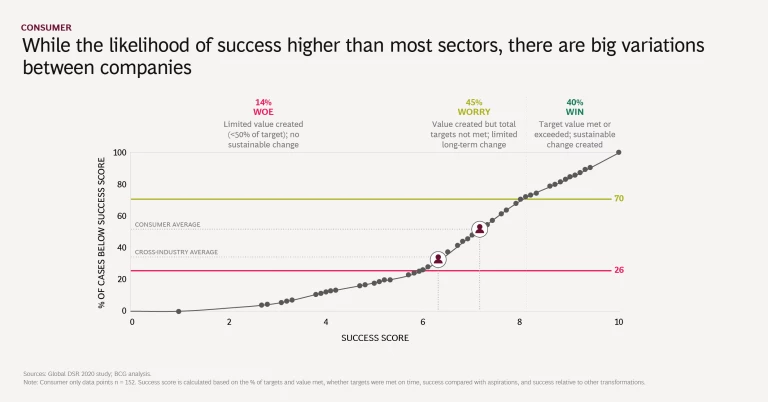

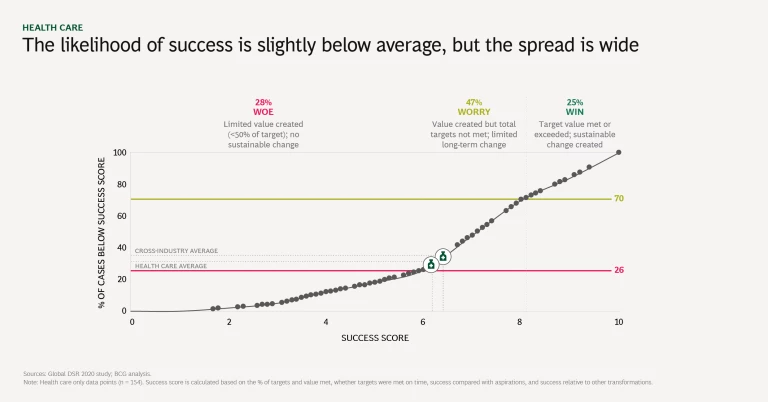

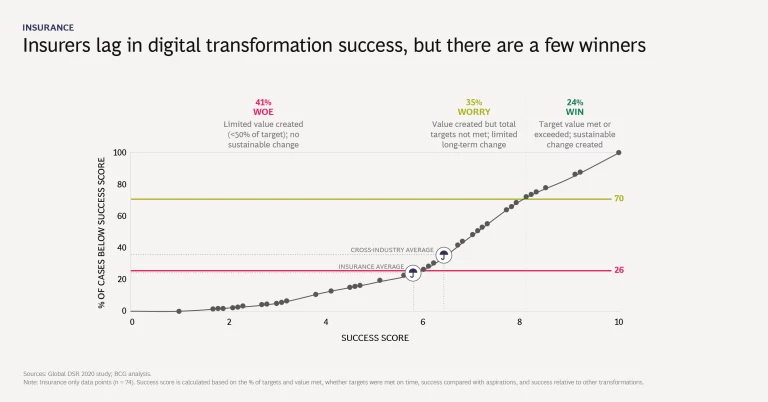

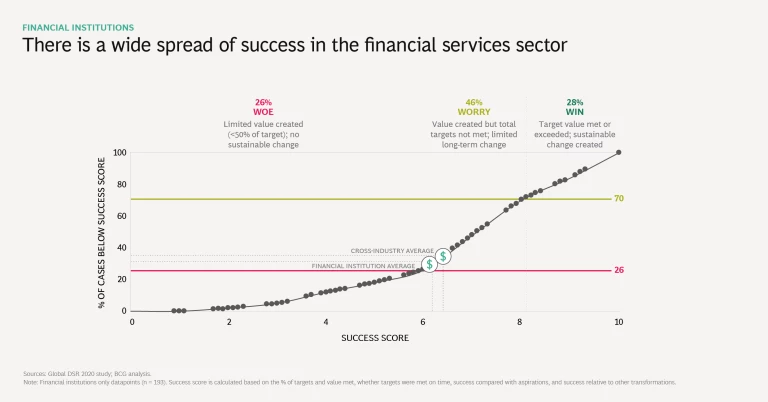

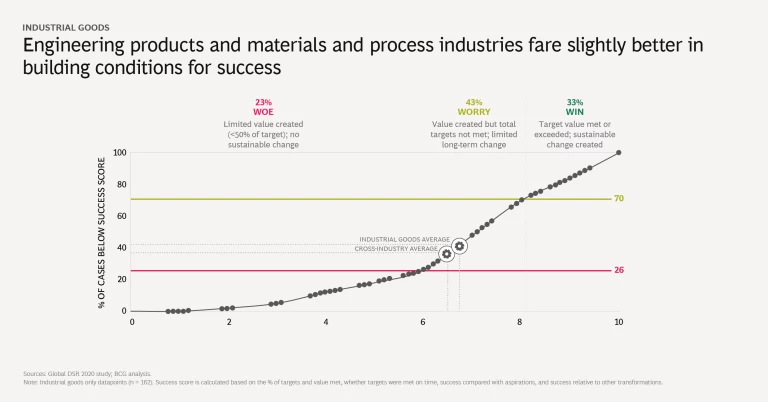

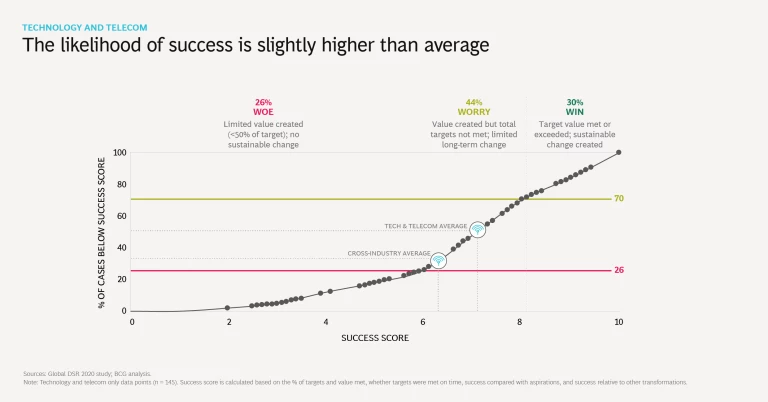

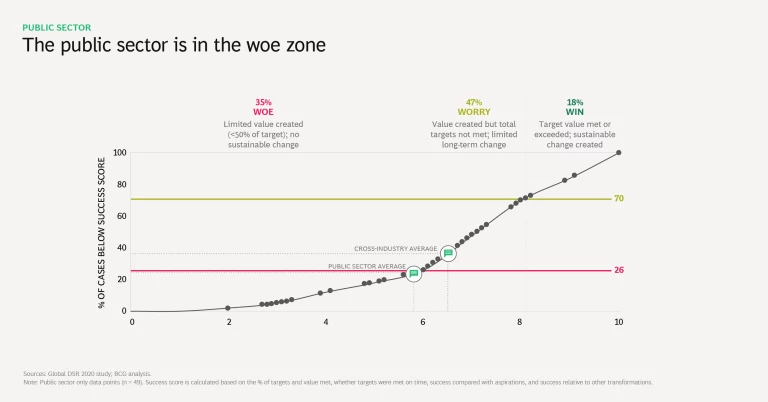

The research found that only 30% of transformations met or exceeded their target outcomes and resulted in sustainable change. As the first slide in the slideshow indicates, these are the companies in the “win” zone. Another 44% created some value but did not meet their targets and resulted in only limited long-term change; these companies are in the “worry” zone. And in the “woe” zone, 26% created limited value (less than 50% of the target), producing no sustainable change. We also found that companies’ performance against a set of six key success factors substantially dictated their odds of success (these are listed following the slideshow below).

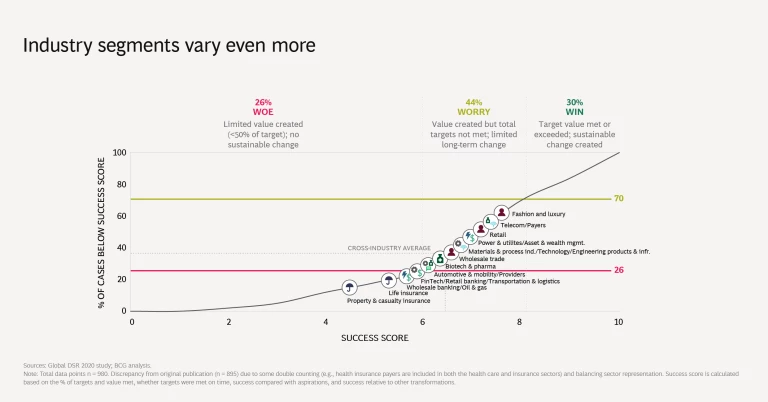

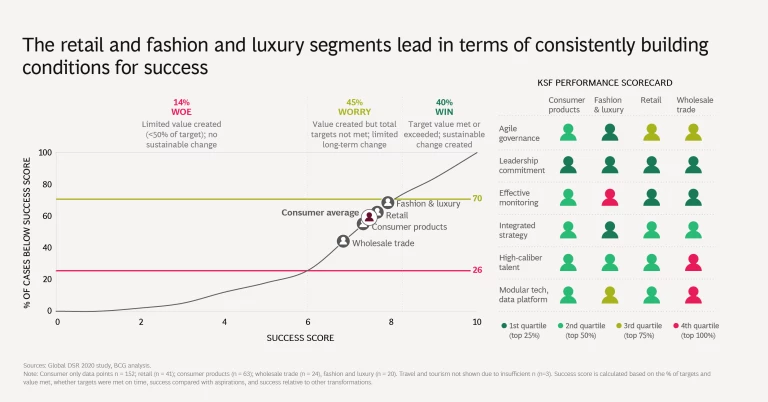

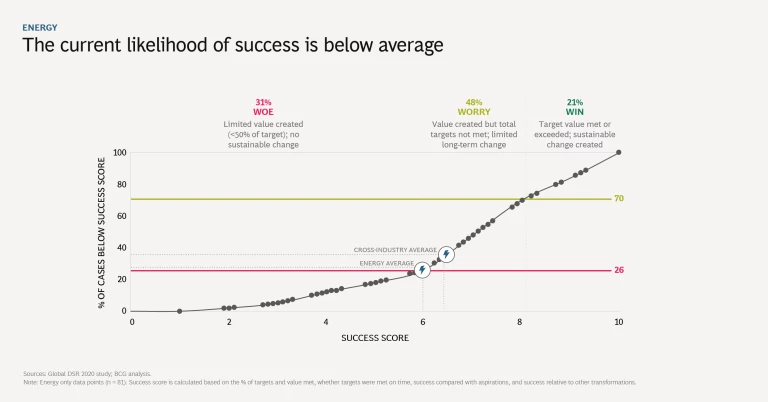

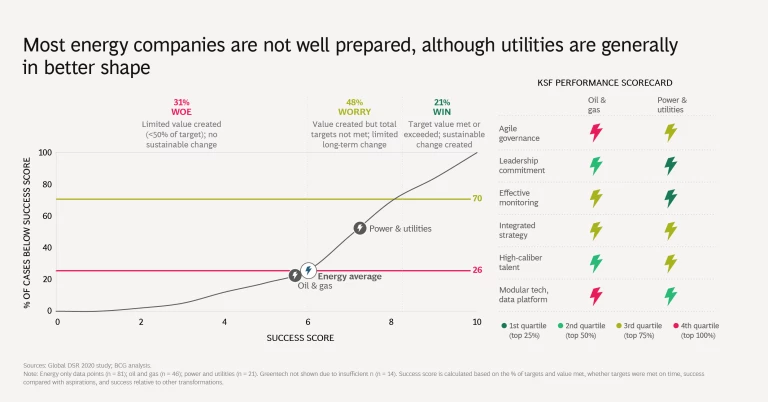

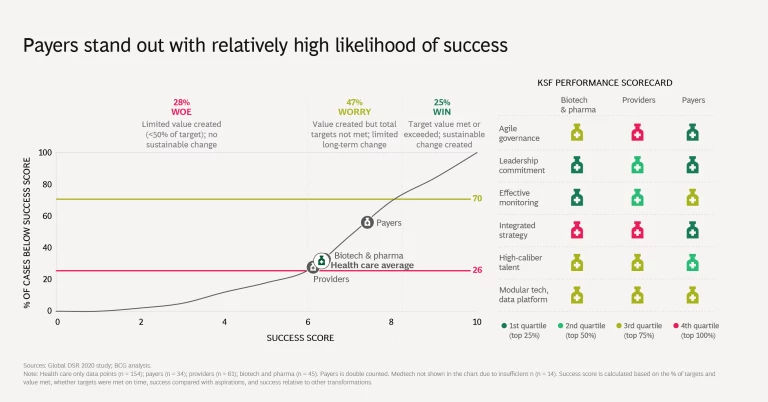

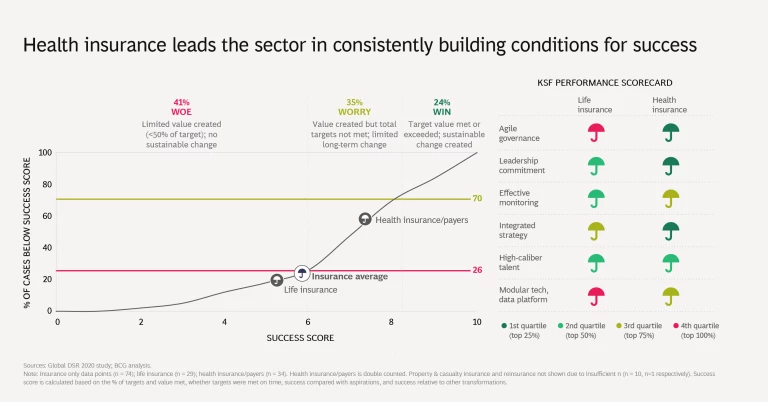

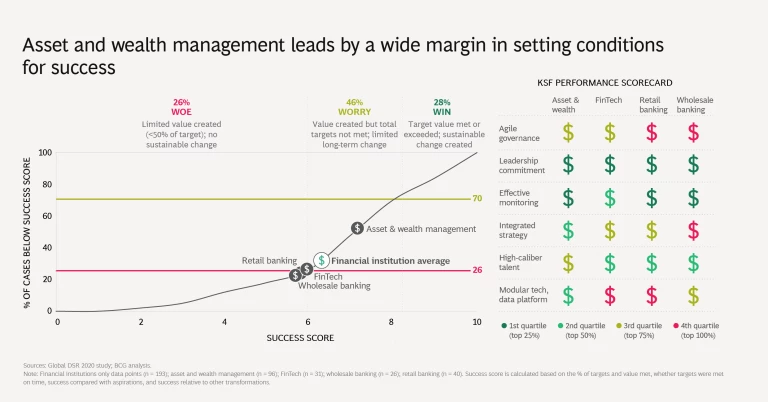

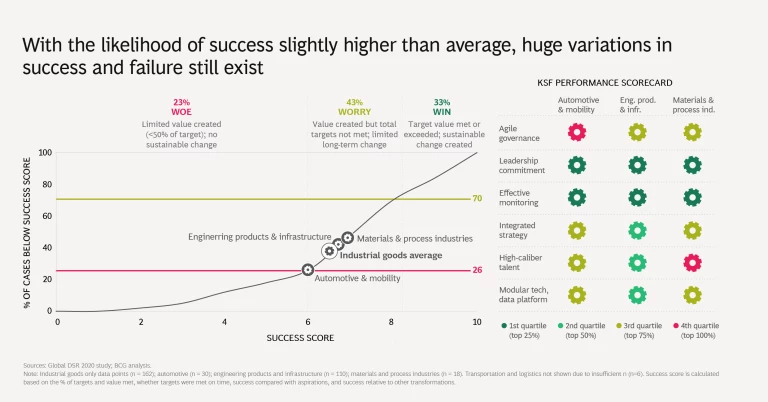

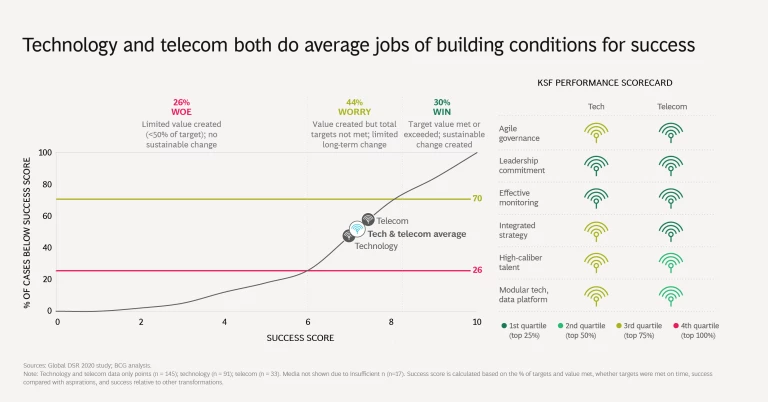

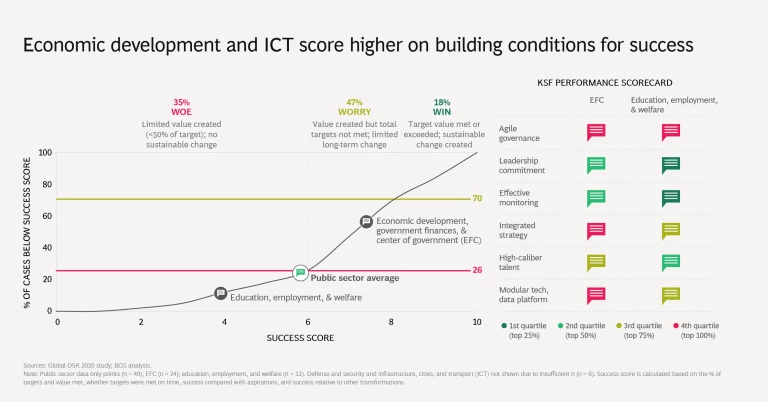

We then looked for differences in success rates by broad sector (such as financial services and industrial goods) and by narrower industry (such as retail banking and automotive). There is a significant variation in the success rate among the eight sectors, driven by how well each sector on average addressed the six success factors. Most fell into the worry zone. We found much greater variation in average success rates by the more granular industry segments. Several industries—biotech and pharma, oil and gas, and life insurance, for example—ranked on average in the woe zone, but no industry ranked as a clear winner.

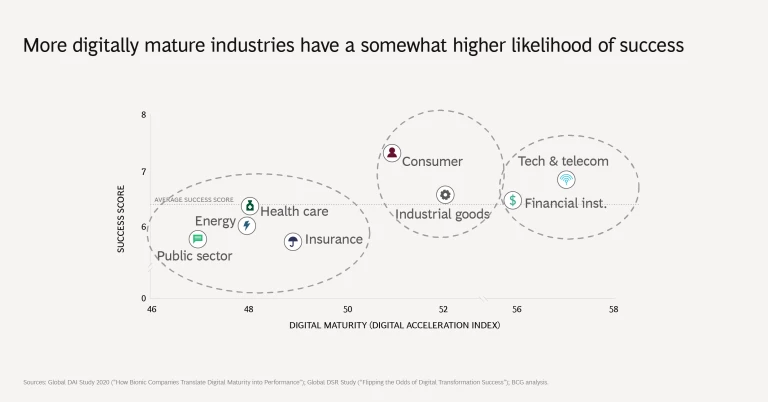

While the variation in success among individual companies is wide, even within industries and sectors, we were interested in why different sectors had, on average, different degrees of digital success. We compared the digital transformation success data with BCG’s Digital Acceleration Index data, which measures the digital maturity of companies and can also be grouped by sector.

We found some correlation between digital maturity and digital transformation success (see the third slide in the slideshow). There are three groupings across the sectors. Technology and telecommunications and financial services are the most digitally mature sectors, and they also tend to be more successful at transformation (30% and 28% in the “success” zone for tech and telcos and financial institutions, respectively). This skew by sector makes intuitive sense since, for example, many technology companies are digital natives that adopt new ways of working, possess less legacy IT, and are not locked into traditional ways of working. Banks, wealth managers, and telcos are also used to consumers with high expectations for digital experiences and journeys.

The second group, comprising the consumer and industrial goods sectors, are on average less digitally mature, but the consumer sector still has above-average odds of success, which may be explained by the rising consumer pressure for better digital experiences (as consumers benchmark their experiences with digital natives such as Uber and Airbnb).

Finally, health care, insurance, energy, and the public sector are the least digitally mature categories on average, with correspondingly lower digital transformation success rates. One can argue that the average energy company has historically placed more emphasis on engineering technologies over information and communications technology. Similarly, the public sector generally has less experience in agile approaches and is often hamstrung by legacy technology. Finally, health care and insurance may be hampered by the complex regulatory environments in which they operate.

The slideshow illustrates how companies in each sector and industry segment fared in their transformation programs and how they ranked on the six success factors. The messages are clear: there are differences, on average, on how sectors and industries perform in their digital transformations, but the differences by company or organization far exceed those by sector. There are success stories in every sector, so all organizations are able to overcome sectoral digital maturity handicaps. And no matter what sector you are in, mastering the six essential success factors will guide you to success.

The following are the six essential factors for digital transformation success.

- An Integrated Strategy with Clear Transformation Goals. The strategy describes the why, the what, and the how, which are tied to specific, quantified business outcomes.

- Leadership Commitment from CEO Through Middle Management. The company has high leadership engagement and alignment, including often-overlooked middle-management ownership and accountability.

- Deploying High-Caliber Talent. Management identifies and frees up the most capable resources to drive the transformation program.

- An Agile Governance Mindset That Drives Broader Adoption. Leaders address roadblocks quickly, adapt to changing contexts, and drive cross-functional, mission-oriented, “fail-fast-learn” behavioral change into the wider organization. They deal with individual challenges without losing sight of the broader goals.

- Effective Monitoring of Progress Toward Defined Outcomes. The company establishes clear metrics and targets around processes and outcomes, with sufficient data availability and quality.

- Business-Led Modular Technology and Data Platform. The company puts in place a fit-for-purpose, modern technology architecture driven by business needs to enable secure, scalable performance, rapid change deployment, and seamless ecosystem integration.

When tackling these six factors, companies must satisfy two conditions. First, management needs to make sure that each is adequately addressed in their planning, preparation, and execution. Although most companies in the worry and woe zones put effort into this, they did not address each factor sufficiently. Companies that did pay enough attention to each factor ended up in the win zone.

Second, it is crucial to address all six factors. Companies that adequately addressed only three or four failed. You can assess your own company’s readiness here.