The development and delivery of two mRNA COVID-19 vaccines (one by Pfizer and BioNTech and the other by Moderna) in less than a year is an extraordinary pharmaceutical success story. Little wonder that the technology behind these miracle drugs is getting lots of attention. In fact, RNA was making significant headway in several therapeutic areas before COVID-19 took center stage, and we expect the additional interest and investment now flowing into the field to accelerate progress even faster.

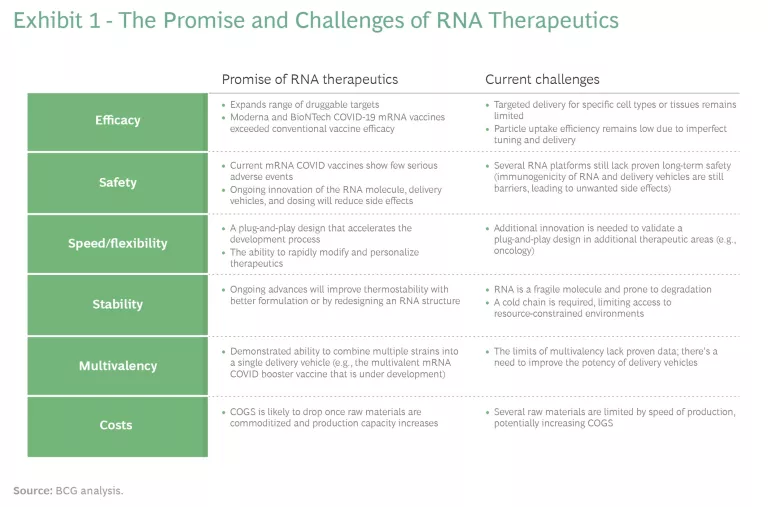

Several attributes make RNA one of the most promising new treatment technologies. (See Exhibit 1.) These include a fit-for-purpose molecular design and functional versatility against a wide range of “druggable” targets. While RNA still faces long-term safety and efficacy (as well as likely cost) challenges, recent advances suggest material technology improvements are coming soon. We believe that the success of mRNA COVID vaccines will propel a sooner-than-expected wave of RNA innovation in the industry. Major pharma companies need to take stock and determine how they want to participate (or watch) as the coming wave builds. Those that want a role in shaping the wave should move now if they haven’t already started.

The Promise and Challenges of RNA

RNA treatments have multiple benefits over other modalities, such as DNA-, protein- and small- molecule-based strategies. RNA’s combination of characteristics means that these treatments are ideal candidates for addressing highly acute medical conditions and deadly diseases that require rapid action. RNA treatments dramatically expand the range of druggable targets for illnesses and conditions, including previously out-of-reach intracellular proteins. As we have seen with the mRNA COVID vaccines, the timeline from target identification to preclinical proof of concept can be as short as several months. Since mRNA drugs can be designed to directly target the underlying cause of a disease and stop (or even reverse) its progression, they have the potential to be highly efficacious—and to achieve greater potency than protein-based drugs. They can also be personalized and designed to act on patient-specific genetic lesions. And their transience and specificity make relevant applications possible with fewer side effects.

There are still major long-term safety and efficacy challenges, arising from instability, poor cellular uptake and fast clearance, off-target effects, and immunogenicity. Such challenges include making RNA more recognizable by the human immune system and developing molecular delivery vehicles for specific tissues. Moreover, in many cases the underlying cause of the disease is unknown, so it is impossible to apply the mRNA modality. Most strategies that have been used to address these challenges leverage the ability to modulate RNA stability and translation as well as the delivery approach (such as chemical modification and lipid nanoparticle encapsulation). Recent advances suggest that technology improvements—including novel delivery and control strategies—are working.

Prior to the pandemic, RNA treatments were focused on rare genetic diseases with small target markets. Examples include Usher syndrome Type 2 (with 15,000 patients in the US and the European Union Five) and Hurler’s syndrome (with 3,000 patients in these countries). RNA therapeutics are now in clinical development to treat more common ailments, such as cancer and cardiovascular disease.

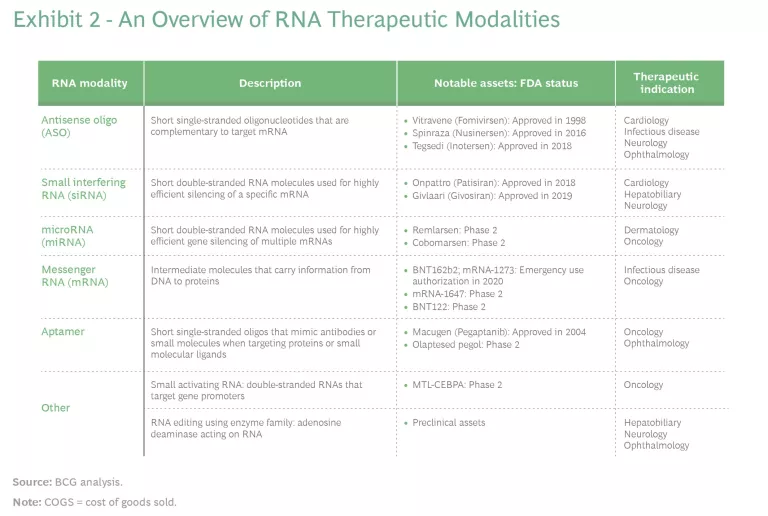

Indeed, as some countries emerge from the pandemic and others continue to fight it, infectious diseases may seem like the ideal application for RNA. But other therapeutic areas are also the subject of significant research and investment activity, including oncology (vaccines and therapies), genetic disease, cardiology, and neurology. (See Exhibit 2.)

There is even some—mostly preclinical—potential for use in combating autoimmune diseases. (See the sidebar.)

More Therapies on the Horizon

Antisense, or loss-of-function, molecules include antisense oligonucleotides (ASOs), small interfering RNAs (siRNAs), and microRNAs (miRNAs). Gain-of-function molecules (of which mRNA is the most prominent), comprise mRNAs, aptamers, and other technologies, such as RNA editing and small-molecule RNA modulators.

ASOs are short single-stranded oligonucleotides that complement the target mRNA to which they bind and regulate protein expression. Example treatments include indications for cystic fibrosis, Huntington’s disease, and other rare genetic diseases, such as a severe type of inherited retinal dystrophy. A commercial example is Tegsedi for hereditary ATTR amyloidosis (hATTR), a multisystemic disease.

Small interfering RNAs (siRNAs) are short double-stranded RNA molecules used for highly efficient gene silencing. They utilize the RNA interference (RNAi) pathway that depends on RISC (a multiprotein protein complex) to degrade a target mRNA.

MicroRNAs (miRNAs) are short double-stranded RNA molecules used for highly efficient gene silencing of multiple mRNAs. A big focus of clinical studies for miRNAs has been different types of cancer. Other areas of potential are rare genetic diseases, hepatitis C, hemophilia, and some cardiovascular and CNS indications.

Messenger RNA, the single-stranded intermediate molecule between DNA and a protein, has taken center stage in the fight against COVID. Its rapid degradation leads to limited concerns regarding long-term effects, such as genomic integration, but there are challenges in fine-tuning its in situ expression, which can cause toxicity and translation at off-target sites. The unstable nature of mRNA and issues related to its recognition by the immune system have challenged clinical applications. While delivery to specific organs is still a major hurdle, advances in delivery strategies—such as lipid nanoparticle vectors—and chemical modification have enabled clinical developments.

RNA aptamers are short single-stranded oligos that mimic antibodies or small molecules when targeting proteins or small molecular ligands. They can be targeted with high affinity and specificity. A notable commercial example is Macugen, which is used for the eye disease age-related macular degeneration (AMD). Other clinical developments target cancer and other chronic diseases. These assets are, in effect, analogs to small molecules or biologics in terms of their mode of action.

Other RNA molecules, such as small activating RNA (saRNA) and single-guide RNA for CRISPR-Cas9 (which can be considered under the gene therapy category as well), are being actively investigated. The former is being trialed for treatment of liver cancer. The latter is still in its infancy, but it brings RNA therapies to the forefront of gene-knockout strategies and is expected to see widespread use in devastating diseases such as AIDS, cancer, and muscular dystrophy.

Current State of the Technology

The success of the COVID vaccines has ignited substantial interest in RNA-based therapies. Multiple recent transactions suggest this to be the case, including successful fundraising rounds by RNA companies. The collaboration, option, and licensing deal between Gilead Sciences and the mRNA company Gritstone bio is another example. The strong prepandemic momentum has accelerated; an increasing number of assets in late development, capacity expansions, and process improvements could all help pave the way for proving cost-effectiveness to payers at an individual-asset level.

Now, makers of these therapeutics are moving from an initial focus on rare genetic diseases toward more common indications in major treatment areas.

Before 2020, RNA therapeutics were already poised for rapid growth, with five products (Spinraza, Onpattro, Tegsedi, Exondys 51, and Evrysdi) already available and growth in annual revenues for launched assets projected at 38% from 2019 through 2024. Now, makers of these therapeutics are moving from an initial focus on rare genetic diseases toward more common indications in major treatment areas. Prior to 2020, 25% of treatments were concentrated at later clinical stages.

The key challenges for RNA treatments include targeted cell delivery and expression control, both of which affect efficacy. Treatments need to be designed with sophisticated and tailored delivery strategies and high-precision control of RNA activity (which is particularly relevant for mRNA therapeutics). Dose optimization and immunogenicity from naked RNAs and delivery vehicles have had a high failure rate between the second and third phase trials (as much as 75% of prepandemic trials failed). Because this is new technology, the long-term safety of chronic use remains unknown.

High costs are also an issue. RNA's instability creates manufacturing and distribution challenges related to storage and transportation (when ultralow cold storage is required, for example), which add to the technology’s high costs. Limited experience with commercialization and real-world outcomes means that dosing frequency can be unclear and lead to challenges in the pricing approach. In addition, the infrastructure for outcome-based payments is still immature. Before the pandemic, regulatory guidelines were still under development, but these have advanced over the past year.

How Will Big Pharma Play?

Whether a company decides to use RNA-based technology depends on its portfolio and strategy. To compete in RNA therapeutics, companies need specialized capabilities—related to R&D and manufacturing infrastructure, for example—and fundamental IP. We see three types of players:

- Specialists. Resilient RNA developers have endured the disillusionment of the early 2000s. Some of these companies have since enjoyed significant pandemic-driven investments, which have enabled them to build capabilities at scale (BioNTech and Moderna are the leading examples). Specialists can be classified into mRNA-based (BioNTech, Moderna, CureVac) and RNAi-based (Alnylam, Ionis) companies.

- Partners. Many top pharma companies prefer to partner with specialists. These partnerships typically involve R&D collaboration and licensing deals at the individual-asset level in such areas as CNS and cardiovascular disease. We suspect that the pandemic has caused more big pharma manufacturers to explore the partnership approach.

- Observers. Typically, these are either big players that do not see a threat in emerging RNA tech for existing therapies in which they have a strategic interest or companies that dropped investments during the early 2000s because of disillusionment with slow progress.

Specialists lead the current RNA ecosystem. They have the key sources of advantage, including intellectual property, talent, development know-how, and manufacturing capability at scale. But many still need partners. The alliance between BioNTech (specialist) and Pfizer (a partner that is fast becoming a specialist) on the COVID vaccine is one model that demonstrates how big pharma can provide key operations and commercial capabilities to bring new treatments to market—and build their own specialized capabilities in the process. Pfizer’s CEO told The Wall Street Journal in March that his company gained a decade’s worth of experience working with BioNTech and now plans to develop additional vaccines that target other viruses and pathogens using mRNA technology. Pfizer is adding at least 50 people to work on mRNA R&D, and the company will leverage the manufacturing network it assembled during the pandemic to compete. More recently, Sanofi has launched a dedicated mRNA-focused center of excellence, with the goal of accelerating its mRNA vaccine portfolio that it developed in collaboration with Translate Bio (the company has recently has entered into a definitive acquisition agreement with Sanofi). Novartis’s chairman has expressed interest in exploring mRNA technology.

Specialists lead the current RNA ecosystem. They have the key sources of advantage, but many still need partners.

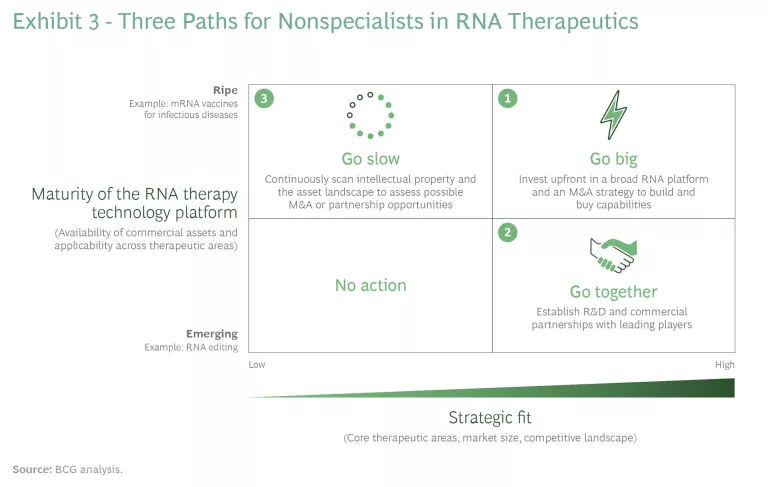

From a strategic point of view, nonspecialists need to evaluate the level of maturity of RNA treatments in their therapeutic areas of interest. Some treatments are gaining maturity quickly (mRNA vaccines for infectious diseases and ASOs/RNAi for rare diseases, for example) while others are still emerging, including mRNA vaccines for oncology and RNAi therapeutics for CNS and cardiovascular diseases.

Nonspecialists have three possible paths, and their choices depend, in large part, on starting points. (See Exhibit 3.)

- Go big. This option is primarily for companies that perceive a threat (because of the potential for disruption) or an opportunity in one or more therapeutic areas of interest. Players will need a comprehensive strategy and to establish a strong position, perhaps leveraging a broad RNA technology platform that allows them to play in multiple therapeutic areas of strategic interest. This path will likely include M&A to build internal capabilities and expertise.

- Go together. Big pharma companies can pursue partnerships or other alliances at the individual-asset level, particularly for assets that are not considered strategic but are nonetheless of interest. Companies should aim to establish R&D collaboration to provide capabilities at scale and bring emerging RNA treatments to market. As an example, there may be a particular opportunity to partner with diagnostic players in rare diseases. A diagnostic strategy and access to the capabilities it requires could unlock significant value. There are doubtless a significant number of patients with rare genetic diseases that are in the scope of RNA therapies who have yet to be properly diagnosed. The right diagnostic strategy could easily expand the addressable market.

- Go slow. Some companies will not perceive RNA treatments as a major threat. These players should still keep an eye on the market, including the IP landscape and asset progression through clinical trials. RNA can have a broader-than-expected impact, particularly when used in combination with other therapies. Slower-moving companies should not discard the possibility of adopting external innovation models that could help them support and invest in next-generation RNA therapeutics that are in preclinical or early clinical stages.

Companies that want to “go big” or “go together” could dramatically improve their positions in the medium to long term with one particular move. These players could invest some resources into fundamental R&D on a next generation of treatments that would provide a source of advantage, such as delivery strategies, RNA expression control, or manufacturing.

The next wave of RNA is coming, and pharma companies need to figure out where they stand. Those with significant positions or strategic interests in the therapeutic areas where RNA shows the most potential cannot sit on the sidelines. A good place for all companies to start is to review their current portfolios to determine where they need to take offensive or defensive action ahead of the wave that is taking shape.