Professionals and academics must do more to establish enabling relationships, technologies, ways of working, and competencies.

This is the third in a series of articles on the future of the finance function.

Finance functions must evolve to keep pace with the rapidly changing business environment. To meet the challenges, each function needs a unique vision that inspires employees to elevate their performance while enabling the organization to set clear targets for its near-term evolution. Although many finance functions recognize the need for a bold vision, few have made great strides in defining one and putting it into action.

The survey participants support our vision for the future but see only moderate progress

toward achieving it.

To help finance functions advance on this journey, we previously presented hypotheses for what a successful, value-adding finance function would look like in ten years. We then discussed how companies should think about evolving to ensure that they are well positioned going forward. To validate our hypotheses and understand the challenges to realizing the future vision, we surveyed corporate professionals and academics. (See “About the Survey.”) Overall, the survey participants support our vision for the future. But they see only moderate progress toward achieving it, and their planning for improvements remains in the early stages.

About the Survey

The survey findings point to the importance of understanding dependencies among the hypotheses. The results also suggest that there are valuable opportunities to share knowledge among industries and different-sized companies as organizations pursue finance function excellence. To support this transition to the future vision, universities should continually adapt academic curricula to the evolving business requirements and provide practical know-how to corporate professionals.

A Vision for the Near-Term Future

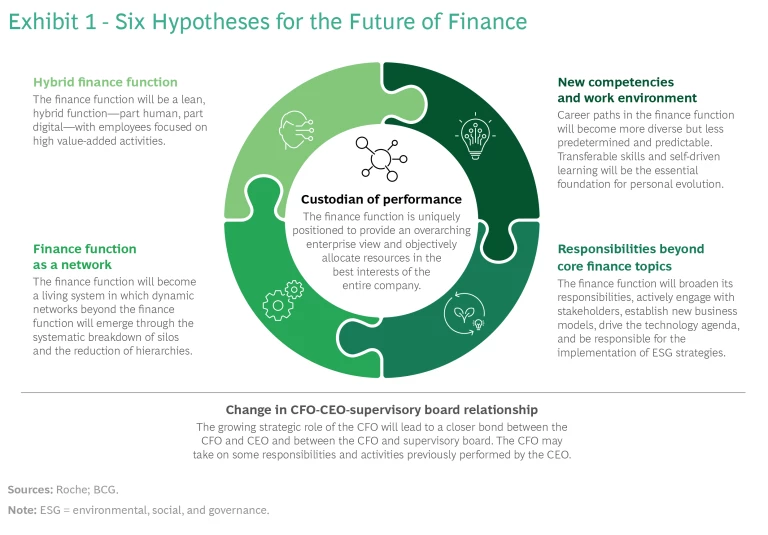

Our hypotheses for the finance function’s near-term future are intended to serve not as a universal blueprint but as an inspiration and starting point for having the right discussions. We see the finance function as a company’s custodian of performance—steering activities and resource allocation at the enterprise level to achieve strategic objectives. (See Exhibit 1.) To fulfill this role, CFOs need closer relationships with the CEO and supervisory board. Integrating human work and the digital ecosystem into a hybrid finance function is essential. The finance function also needs new ways of working in a networked organization, taking on responsibilities beyond its core topics and deploying new competencies.

Since the publication of our previous articles, we have added “change in CFO-CEO-supervisory board relationship” as a sixth hypothesis to reflect the importance of these relationships in realizing the future vision.

Support for the Vision, but Progress and Planning Lag

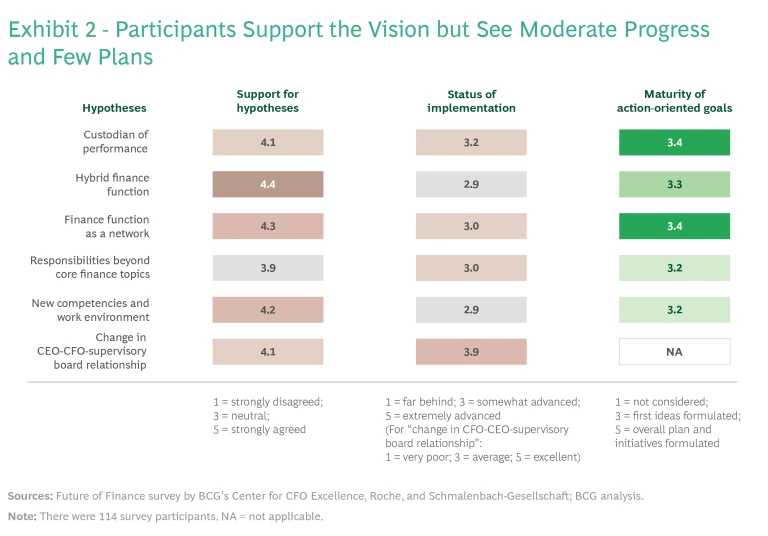

Survey participants generally agreed with the bold vision for the future of the finance function reflected in the hypotheses. (See Exhibit 2.) Out of the six hypotheses, respondents assigned the highest importance to hybrid finance and the lowest to responsibilities beyond core finance topics.

But participants reported only moderate progress in achieving the changes reflected in each hypothesis, with the greatest potential for improvement in hybrid finance and new competencies. Across all hypotheses, academics assessed the status quo to be less advanced than professionals did—especially with respect to becoming the custodian of performance.

Most executives indicated that their company has formulated initial ideas for action-oriented goals related to each hypothesis but not a comprehensive transformation plan. They have made the least progress in developing plans for new competencies and responsibilities beyond core topics.

Delving Deeper into Each Hypothesis

A closer look at the findings reveals nuanced perspectives and discrepancies that highlight the changes required to realize the vision of the future.

Custodian of Performance and Change in Relationships

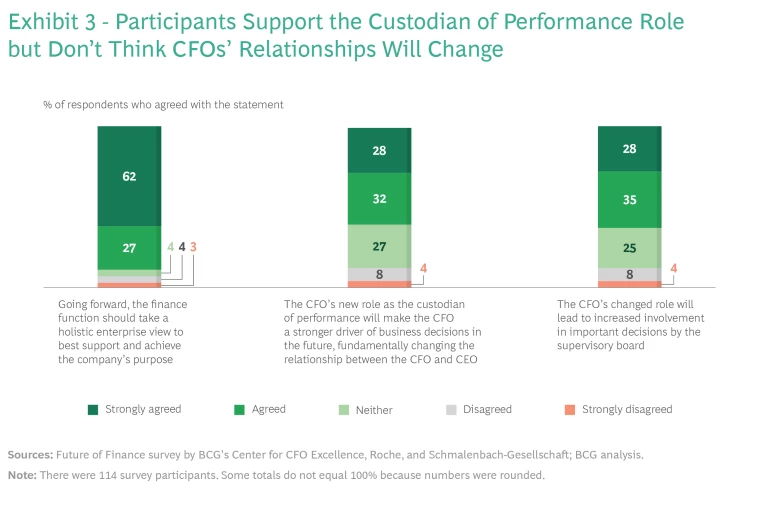

Participants embraced the concept of the custodian of performance. But they seem skeptical that CFOs’ relationships with their CEO and supervisory board will change significantly to enable this role to become a reality. (See Exhibit 3.)

Consistent with the objectives of the custodian’s role, a vast majority of participants (89%) agreed that the finance function should take a holistic view in order to actively support the company’s overall purpose. In line with this, they see the CFO’s role as evolving from business partner to strategic partner and value driver. Today, the CFO typically serves as a sparring partner to the CEO on financial and business issues. In the future, respondents expect that the CFO will work strategically with the CEO and supervisory board on topics such as holistic resource allocation and will take on CEO-level issues and actively contribute to supervisory board discussions.

But only 28% of participants strongly agreed that CFOs will become stronger drivers of future business decisions and have a fundamentally different relationship with the CEO. Similarly, only 28% strongly agreed that the CFO’s new role will lead to greater involvement in important supervisory board decisions.

Why do so many participants doubt that CFOs will become more active in driving enterprise-level decisions? One reason could be that only 22% of respondents believe that their finance function is aligned with the company’s purpose and strategy. Moreover, despite embracing the custodian of performance role, only 64% of participants agreed that CFOs can or should solve the challenge of multidimensional resource allocation (such as among business units or between units and functions). Alignment and effective resource allocation are prerequisites for enabling CFOs to play a strong role in making and implementing business decisions.

Hybrid Finance Function

Participants strongly support the concept of hybrid finance. Nearly all (99%) believe that the finance function must continuously anticipate the changes triggered by digitization and apply technology to increase its value contribution. Additionally, 88% agreed that these changes will cause job profiles to evolve, given that employees need to administer the digital ecosystem and ensure appropriate quality control. But the consensus was weaker regarding whether the function’s value contribution will actually change. Only 39% of participants strongly agreed that hybrid finance will enable the function to perform a greater share of highly value-adding activities.

Networked Function, Responsibilities Beyond Core Topics, and New Competencies

These three hypotheses are interrelated. The finance function must define how its organization will operate and the topics it will focus on going forward. It can then identify the new competencies needed to realize this vision.

Participants agreed that the finance function needs new ways of working in a networked organization to keep up with changes in how finance experts collaborate within the function, with other functions, and with external stakeholders. Many respondents believe that less hierarchical methods of collaboration will offer a significant advantage when competing for talent.

Survey respondents agreed that the responsibilities of the finance function are moving beyond its core topics.

Respondents also agreed that the responsibilities of the finance function are moving beyond its core topics. Two-thirds (68%) believe that the finance function will take on additional responsibilities, including helping to shape the company’s technology agenda and using finance expertise to enable new business models. Participants see environmental, social, and governance (ESG) topics as increasingly important: 82% agreed that the finance function will play a leading role in the development and implementation of ESG strategies (for example, KPIs, resource allocation, risk management, and governance models).

Participants’ views on new competencies are in line with this expansion of responsibilities—95% agreed that, while finance know-how will continue to be essential, the ability to continually improve technical and digital skills will gain importance.

Perspectives by Company Size and Industry and from Academia

Participants’ views of the hypotheses, as well as the current state and progress of improvement ideas, varied across company sizes as well as industries and differed between the corporate sphere and academia.

For instance, businesses with revenues of less than €5 billion were slightly less enthusiastic in their support for the hypotheses, appear to be less advanced today, and have fewer specific improvement ideas.

Respondents from the industrial goods and health care industries had the most positive views about the hypotheses. Participants who work in industrial goods, banking, and consumer goods and services reported being least advanced with respect to current status and formulating improvement ideas.

Compared with corporate professionals, respondents from academia expressed less support for the hypotheses and judged the status of the finance function to be less advanced. This may reflect a tendency for academics to be more critical, aiming at a more comprehensive and proven framework to deliver the future.

Recommended Actions

Participants’ responses reveal disparities between the status quo and the vision of the future, as well as a scarcity of already proven approaches for concrete actions. Given these findings, we propose ways for businesses and academia to close the gaps.

For Businesses

Corporate professionals need to adopt an enterprise mindset, recognize the interrelated nature of the hypotheses, and participate in knowledge-sharing opportunities. The hypotheses are intended to provide inspiration as they discuss action-oriented solutions and define clear goals for their future work.

Focus on the corporate purpose. Aligning the finance strategy as closely as possible with the company’s purpose is essential to ensure that professionals maintain an enterprise mindset and make decisions that are in line with the company’s overarching direction. Ideally, each decision entails making the optimal tradeoff of resources—among business units, between business units and functions, and among functions. To steer performance on the basis of the corporate purpose, professionals need to broaden their perspective beyond traditional financials. For example, sustainability and societal impact have become increasingly important considerations.

Understand your ambition and the dependencies. To derive appropriate steps for implementing the finance function of the future, professionals need a strong understanding of the options. Initiatives to realize the vision must consider how closely the different aspects intersect and the dependencies for successful implementation. For example, to be a custodian of performance, the CFO must participate in decision making with the CEO and board, and to expand the finance function’s responsibilities, the organization needs new competencies.

Gain exposure to new ideas and initiate concrete actions. The survey results highlight that companies have reached different stages in evolving toward the future of the finance function. Some have made progress in all aspects, while others have focused on a specific area, such as digitization. A company’s industry (and the related regulations), ownership structure, and size play a role in determining how and where the finance function evolves. Even so, professionals can benefit from learning how their counterparts at other organizations are seeking to improve their finance function.

There are many ways to initiate knowledge sharing among finance functions—in both direct interactions and forums such as conferences and roundtables. Even companies that are strongly advanced in realizing the future of the finance function can benefit, as there is doubtless further room for improvement in specific subtopics. Each function should prioritize the opportunities to address its blind spots and come away from the knowledge-sharing sessions with concrete improvement actions.

For Academia

Academics can support corporate professionals by refreshing their curricula and providing practical know-how.

Closer interaction between academics and business practitioners will be essential.

Update the academic curricula. The survey results indicate that companies need help from academia in understanding how to achieve their ambitions. Universities should refocus academic work to meet the new challenges of transitioning to the finance function of the future. Curricula must be flexible enough to support the ongoing development of the finance function without neglecting finance fundamentals.

Closer interaction between academics and business practitioners will be essential. To enhance the relationship, universities can provide additional case study seminars in collaboration with companies. This setup ensures that students learn how to apply their knowledge in a real-world setting. It can also be helpful for academics and practitioners to become involved in associations, such as Schmalenbach-Gesellschaft für Betriebswirtschaft e.V., that provide an institutionalized framework for the exchange between business administration theory and practice. As an applied science, business administration needs to be compared with the reality of entrepreneurial activity in order to continually identify and explore relevant issues and critically question its knowledge and database. The real challenges of rapid change can only be identified and tackled jointly by academics and practitioners.

Provide actionable, interdisciplinary support. Although the topics and challenges are clear, companies seem to lack the know-how to solve their specific problems and implement solutions. To help professionals succeed in their ambitions, academics can propose new processes and support the development of new competencies, especially relating to major topics of academic research (for example, finance, IT, and sustainability). Given the expanding roles of professionals, interdisciplinary programs are needed.

To enable an interdisciplinary approach, universities can provide new modules that combine IT, sustainability, and finance topics and show how they are interlinked. From an accounting perspective, such a module could contain information about the proposed Corporate Sustainability Reporting Directive (CSRD) or the IFRS Sustainability Disclosure Standards from the International Sustainability Standards Board (ISSB) and link this sustainability information to financial accounting. Another example might be a module that introduces software or programming languages, such as Python, and applies them in a finance setting.

Each company will have its own journey to realizing the future of the finance function, depending on its specific starting point and ambitions. Our study reveals common gaps and discrepancies, however. Many participants share the goal of transforming the finance function into the custodian of performance. But they must do more to establish the enabling relationships, technologies, ways of working, and competencies. Success requires rigorous planning by companies and support from universities to meet the challenges.

About Roche

The Roche Group, headquartered in Basel, Switzerland, is active in over 100 countries and in 2021 employed more than 100,000 people worldwide. In 2021, Roche had a market cap of CHF ~300 billion, invested CHF 13.7 billion in R&D and posted sales of CHF 62.8 billion.

About Schmalenbach Gesellschaft

The professional foundation of the non-profit association is laid by 28 working groups with more than 600 representatives from academia and practice. Schmalenbach-Gesellschaft organizes conferences, in particular the annual “Schmalenbach-Tagung” in spring and “Deutscher Betriebswirtschafter-Tag” in autumn. “Schmalenbach Journal of Business Research” (SBUR) is the joint official journal of Schmalenbach-Gesellschaft and The German Academic Association of Business Research (VHB). The association’s interactive website, “schmalenbach-impulse.de,” provides a high-caliber platform for thought leaders and practitioners.

About BCG’s Center for CFO Excellence

They focus on improving capital allocation to ensure a productive return on investments and to outperform competitors. Aiming to orchestrate company-wide transformations, BCG helps drive the corporate value agenda, identifying the best strategy for renewing the organization’s finance systems and increasing transparency and insight. If you would like to learn more about CFOx, please contact one of the BCG authors or visit cfox.bcg.com.