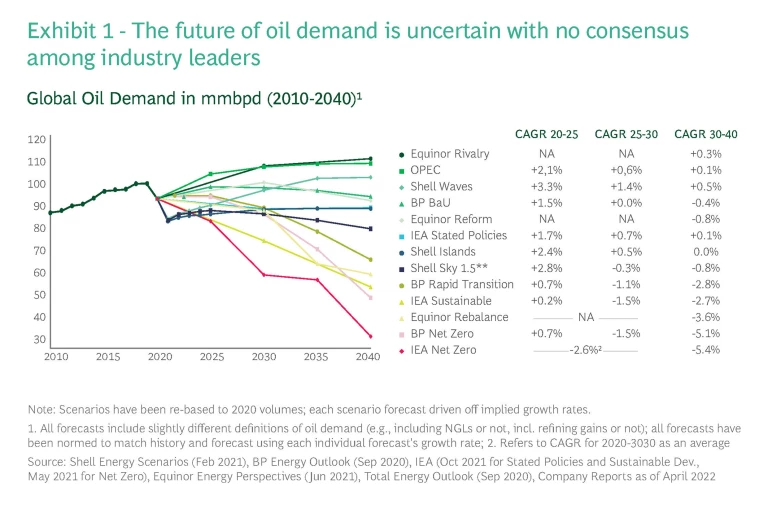

Major developments continue to impact global Oil and Gas (O&G) markets. Oil prices hit $9/bbl in 2020 at the beginning of the pandemic, and are now above $100/bbl. This event-driven volatility is on top of longer-term market disruptions. Around the world, countries, and businesses are committing to net-zero emissions, often by 2050 and with significant interim targets by 2030. This translates into great long-term demand uncertainty—models show up to 300% divergence in future oil demand scenarios (Exhibit 1)—as well as a strong push toward cleaner energy and decarbonization.

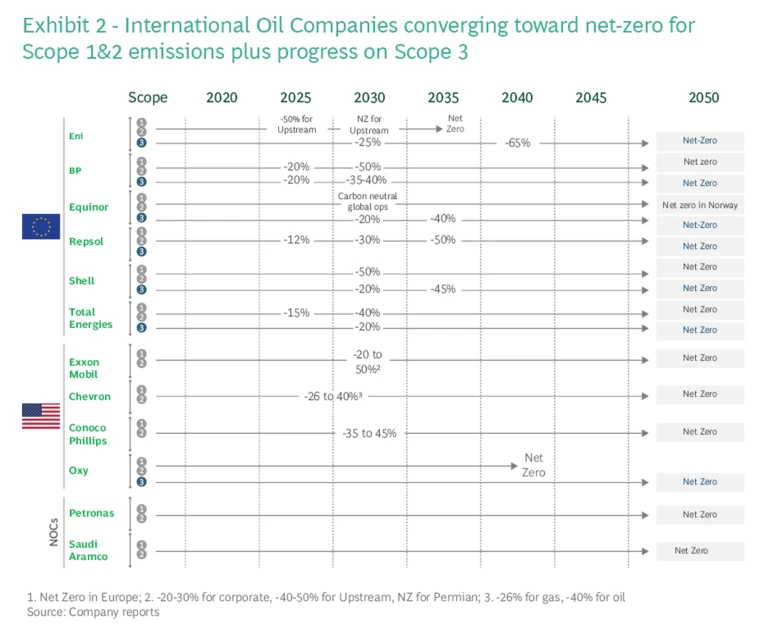

Investors, governments, and the public are pressing O&G companies to decarbonize their operations (Scope 1 and 2 emissions) and further commit to Scope 3 CO2 reductions (Exhibit 2), intensifying scrutiny of their social license to operate. More tangibly, governments are adopting policy and regulatory incentives, and restrictions with direct cost impact including carbon taxation. Meanwhile, the accelerating development of digital technologies is opening up risks and opportunities along the entire O&G value chain, including enabling the demand for more consumer-centric services.

In this tumultuous context, O&G players’ strategic directions are starting to diverge. Whereas their portfolios have long been similar in allocation across asset classes, that is now changing. Some—including many major International Oil Companies (IOCs)—are making material commitments to low carbon alternatives, even shifting strategic focus from oil to “energy”. Others are redoubling their efforts to extract value from more traditional hydrocarbon portfolios, alongside decarbonization targets. With their explicit resource extraction mandates, government revenue-generating responsibilities, and geographic limitations, National Oil Companies are typically following this latter strategic path.

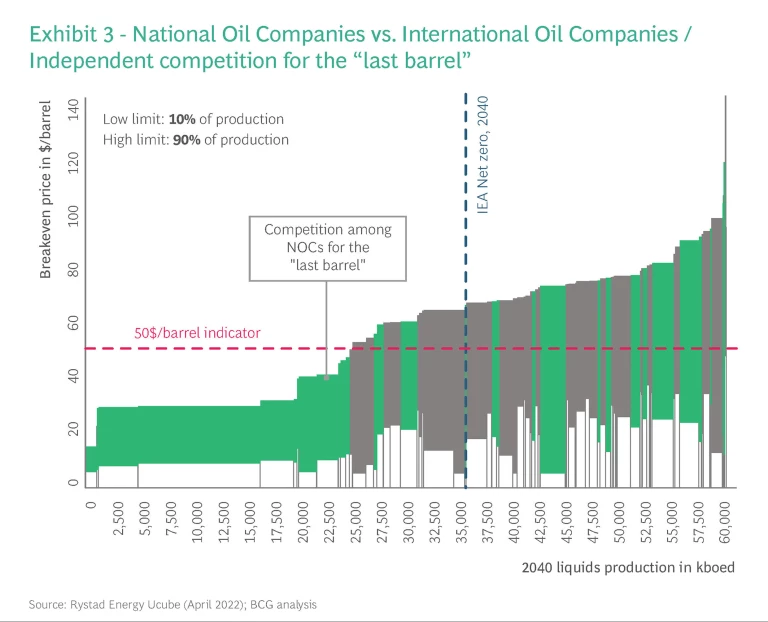

In a more aggressive demand in reduction scenarios (e.g., IEA Net Zero), oil demand could be reduced to approximately 35 mbpd by 2040— approximately one-third of the current global demand—and oil price to $30-40/bbl, with widespread carbon taxes. As demand decreases and IOCs deemphasize or exit the business, National Oil Companies will need to assume industry leadership in advancing more efficient and lower carbon operations. They will face steep competition with their relatively low-cost, and increasingly low-carbon peer group for the “last barrel” (Exhibit 3). National Oil Companies control most of the world’s hydrocarbon reserves, and their share of production is increasing as IOCs refocus. Middle Eastern National Oil Company's cost position and Scope 1 & 2 carbon intensity are among the most favorable in the world, meaning they are in the best position to stay in the business. However, without interventions, National Oil Companies' future cost position is deteriorating as their fields mature and new developments become more expensive.

National Oil Companies will need to adapt their operating models to this new environment. Given the long lead time to change operations and the technological advances required to enable meaningful change, it is important to act as soon as possible. Transformation of this magnitude demands an integrated approach. We discuss key steps and enablers for establishing a new operating model in this report. The current high price environment provides a unique window of opportunity for National Oil Companies to redesign for a cost and carbon-conscious future.

Three Steps to a New Operating Model

Successful O&G companies must establish radically new operating models that embed a cost and carbon-conscious culture in their organizations. IOCs have already started to transform their operations. After decades of maintaining a long upward trajectory, O&G companies’ total shareholder return (TSR) has underperformed the S&P for the past 3-, 5- and 10-year investment periods with little relief in sight. IOCs have realized that current upstream operating models are not sustainable; oil price volatility, oversupply, and energy transition are forcing them to evolve. Individual portfolio strategies may differ, but it has become clear that success in any future model requires radically new ways of working. To a similar extent, National Oil Companies are also in the same position as IOCs, and a transformational change is a requirement.

Transforming an O&G company’s operating model is a 3-step journey starting with a pre-requisite.

Before starting their transformation journey, National Oil Companies need to rethink their operating model and clearly link it with their strategic objectives to deliver the needed future production, cost, and greenhouse gas reduction impacts. This requires them to think through what role the center should play, which activities will require the most management attention, how decisions should be made, and what types of new capabilities will enable the delivery.

1. Transform the way to operate

After defining the new model, the first step is to transform the way a company operates. This starts with redefining its operating philosophy— a term encompassing its vision, mission statement, principles, aims, and key business practices. Essentially the operating philosophy is a blueprint for “how we do things”. National Oil Companies will need to build cost and carbon considerations into all aspects of their operating philosophies. This may include embracing the lean approach to continuous improvement – optimizing operations, eliminating waste, and increasing customer value. It may be anchored around key operational shifts, like commitment to unmanned operations. It may involve new approaches to staffing and capacity building, for example through the establishment of multi-skilled operations teams. The new operating philosophy must then be systematically implemented through each of the company’s assets.

2. Streamline core processes and rationalize activities

The next step is to streamline processes and rationalize activities with a cost focus. This begins with simplifying core production, maintenance, and safety processes. This simplification removes unnecessary steps and eliminates unwanted redundancies, making full use of newly available technologies and information. It includes reducing the volume of activities such as routine checks. At this stage, companies should optimize their ratio of corrective to preventative maintenance, and preventive maintenance planning and frequency. This is also the time to revisit and rationalize the integrated operational planning process, correcting gaps and cutting non-value-added work.

3. Develop a digitally enabled holistic operating model for the future

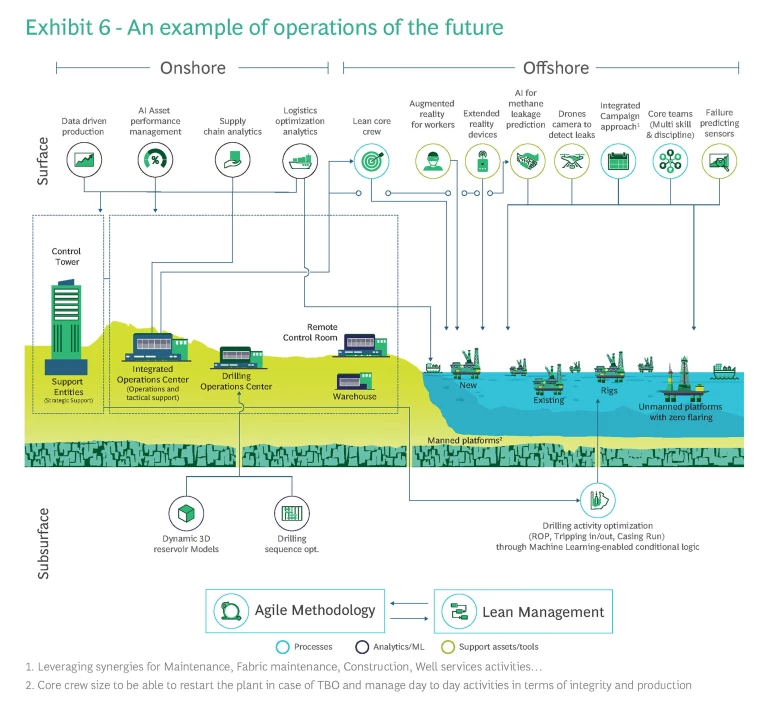

Digitalization—including big data and predictive analytics, robotics, Artificial Intelligence (AI), Machine Learning (ML), and the Internet of Things (IoT)—has the power to strengthen and enable every aspect of O&G companies’ operations. The third step in the transformation journey is to develop a digitally-enabled and holistic operating model for the future. This means building advanced capabilities and fully leveraging the range of digital tools. Companies must be able to move at pace from localized pilots to integrated large-scale implementation delivering maximum impact. For example, a National Oil Company might create an onshore advanced Integrated Operations Center to support remote operations. Regardless of specific digitalization tactics and projects, companies must orient their digital processes to enable and monitor decarbonization efforts.

The value of switching to a new operating model

The value of implementing lean operating models is clear, as they can deliver 30-40% efficiency gains across the whole O&G upstream value chain. This includes levers such as applying deeper resolution reservoir models and linking them with production optimization that can result in a 4-6% increase in existing well production and an 80% shorter cycle time in early design and evaluation. Additional levers include applying AI/ML models and digital twins to predict non-productive-time events and optimize oil recovery of current fields can result in a 2-6% production increase and utilizing predictive maintenance and management by exception to increase uptime can lower maintenance expenses by 15-25%.

Enabling the Transformation

Like any organizational transformation effort, implementing a new operating model requires a detailed roadmap, a defined team with clear accountabilities, active change management, risk assessments, and supporting IT systems. For National Oil Companies, an integrated transition approach will focus on these critical levers (Exhibit 5.)

Activities and processes

Building agile working principles into traditional upgrades, projects, and maintenance activities will increase the organization’s ability to collaborate across functions, accelerate delivery, and course-correct quickly. Establishing campaign models and optimizing tool time can reduce maintenance manhours by 20-30%. Leadership and oversight practices will also need to evolve. Managers should focus their time and resources on issues that deviate from the norm, empowering teams wherever possible to make their own decisions and actions. Establishing a new operating model does not happen just inside the company but within an ecosystem of partners. National Oil Companies will need to evolve their relationships with suppliers, customers, and even competitors to create strategic partnerships for outsourcing, insourcing, R&D, and capability development.

New ways of working

National Oil Companies must aim to create dynamic platform organizations, with the work practices and governance structures that drive talent attraction and retention, accountability, and workforce efficiency. This includes adapting to post-COVID era remote working norms and procedures and leveraging emerging best practices. Remote operations provide multiple benefits: they reduce safety risk and emission footprints and also improve organizational efficiency. Beyond future-proofing their general talent-related processes, companies must develop a comprehensive plan to build and advance in-house digital and decarbonization expertise.

Technology

A critical technology-enabled capability is capturing data and converting it to insights through AI/ML. National Oil Companies must establish data/AI platforms, value tracking systems, and digital use cases to improve the quality and speed of decision-making. New O&G business models often prioritize remote and/or automated operations enabled by technology. Deploying technology solutions to automate or perform operations remotely will be central to National Oil Companies' future competitiveness.

Digital use cases can deliver significant quantifiable benefits. For example, optimizing maintenance management often results in 5-15% gains in manpower efficiency, as well as a 10-20% reduction in maintenance OPEX. Leveraging production analytics can increase throughput by 0.5-2%, while actively pursuing production optimization through a data-driven approach can improve various dimensions of performance, e.g. reducing well test time by 30-40%. Advanced analytics can optimize logistics, including vessel routes and capacities, reducing costs by 5-10%.

Decarbonization

Decarbonization must be central to every National Oil Companies' future operating model, in line with their countries’ net-zero commitments. It starts with emission tracking: implementing a consistent digital/AI-enabled tracking and reporting system across assets and operating units. Companies then need to reduce energy demand and improve energy efficiency at every stage of their operations, increasing heat and energy recovery and improving reservoir recovery. Most O&G producers have substantial opportunities to reduce direct emissions from natural gas flaring, venting, and fugitives through equipment retrofits, new infrastructure, and improved O&M practices. Where possible, they should switch to low carbon power and heat. In addition, National Oil Companies should look for opportunities to capture process-related carbon byproducts for use or long-term storage (CCUS). Digital technology can significantly help decarbonization through multiple use cases. For example, AI can dramatically improve methane leakage prediction, waste heating value optimization, energy storage optimization, and GHG emission monitoring.

Cost and Carbon-Conscious Culture

It is clear from the changes described above that introducing a new operating model is a profound and complex shift. It touches every part of an organization: the definitions and relative importance of key success metrics; how and what decisions are made; how resources are allocated; what talent and technology are critical to success; and relationships with stakeholders, including other players in the value chain. Mobilizing the organization and ensuring successful long-term change demand a corresponding transformation of culture. National Oil Companies will need to create new cost and carbon-conscious cultures – both significant departures from traditional norms.

Changing culture takes time. National Oil Companies must anticipate and commit to multi-year journeys to transform their cultures along with their operating models. These elements are critical for successful culture change:

- Leadership. Continuous, unambiguous support, drive, and direction from top management, with buy-in from all key stakeholders including National Oil Companies' governments.

- Consistency across all operating units and assets. Clear integrated governance with a network of cultural change ambassadors at each location.

- Focus. A central team to drive the change effort and engage the whole organization.

- Accountability. End-to-end accountability from initiative ideation to execution for cost reduction and decarbonization initiatives.

- Communication. Frequent, engaging, targeted communication to create buzz, increase awareness, and foster participation and commitment.

- Integration into people systems. Learning and recognition programs to build culture, upskill and reward employees.

Successful companies will find ways to combine management’s top-down drive for efficiency with an empowered organization’s knowledge and experience to continuously identify and implement cost and carbon saving initiatives.

Today’s oil price environment and market context make this the ideal time for National Oil Companies to introduce operating models that will become the new benchmarks in upstream operations. Implementing lean operating models can deliver 30-40% efficiency gains across the whole O&G upstream value chain. In addition, they reduce operators’ carbon footprints and contribute to a safer operating environment. Success demands an integrated approach. This includes redefining activities and processes, introducing new ways of working, embracing digital and technology solutions, and prioritizing decarbonization. National Oil Companies will need to create agile cost and carbon-conscious cultures to enable the types and pace of change the future will bring. None of these is easy and the effort will take years. But this is a moment of great opportunity. And failing to start now can risk their future market positions and ability to compete for those final barrels.