Regulators are turning up the heat on digital platforms, but traditional remedies are clearly not adequate. Viewing antitrust through the lens of trust may provide answers.

Major digital platforms are coming under increasing scrutiny by regulators, stakeholders, and the general public worldwide over their burgeoning market power and trade practices. Since 2019, virtually every top platform has been investigated, charged, or fined. In just the past few months, among other actions, Italian regulators levied a €1.1 billion fine against Amazon for antitrust practices, the EU upheld its €2.4 billion antitrust fine against Google, and a US Senate panel has advanced a bill prohibiting the major tech platforms from favoring their own products and services. And the pace shows no sign of abating.

The disenchantment underlying this scrutiny is swelling on all sides. Lawsuits by software app developers are on the rise, as is the public’s growing unease over privacy protections. These concerns, moreover, are not restricted to Big Tech: a Pew Research Center study found that 81% of Americans feel they have “very little to no control” over the data that companies collect about them and that the potential risks from companies’ data collection practices outweigh the benefits. As debate escalates among regulators, legislators, and academics about the fairest course of action, one point becomes increasingly clear: traditional regulatory remedies are insufficient for tackling these issues.

Digital platforms are a different animal than traditional corporate structures. So, as we examine their market power and practices, rather than rely solely on a traditional antitrust perspective, it might be constructive to view them through an additional lens: the lens of trust. Here we present a picture of the growing problems digital platforms face, highlighting both the reasons they elude traditional regulatory schemes and the traits that enable them to gain unfair advantage over their stakeholders. We explore the problem of antitrust through the lens of trust—and consider the implications such a perspective has for the companies, their stakeholders, and regulators.

The Rising Antitrust Tide

Especially since COVID lockdowns have shifted more and more social interaction online, tensions have been brewing within and around digital platforms, triggering regulatory actions, lawsuits, and consumer backlash. In 2020, the US Congress completed a scathing report following its multiyear investigation of competition in digital markets. The EU introduced sweeping new regulations under the Digital Services Act and the Digital Markets Act, which impose fines of up to 6% of a company’s annual revenue. In February 2021, Australia passed a new law requiring Facebook and Google to pay local media outlets and publishers for stories posted on their sites. And in April 2021, China’s anti-monopoly regulator issued Alibaba a $2.8 billion fine (4% of the company’s 2019 revenues) after a probe determined that the company had abused its market position for years.

During her 2020 presidential bid, US Senator Elizabeth Warren vowed to “break up Big Tech.” She’s not alone in this ambition: lawmakers across the political spectrum are beginning to advocate for drastic measures similar to the landmark actions by the US government that broke up Standard Oil in the early 1900s and AT&T in the 1980s. Political leaders are arguing that Big Tech companies control the key resources in their industries, claiming that their market power is so strong that they can squeeze their suppliers, exploit their employees, dictate market prices, and stifle innovation.

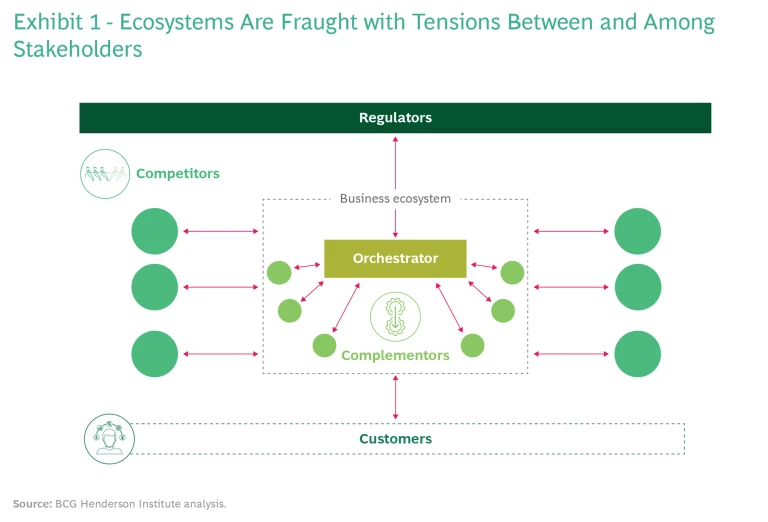

It is not just regulators that are at loggerheads with platforms; all parties in relationships with ecosystems seem to be strained (see Exhibit 1). Epic Games, a contributor to Apple’s App Store and Google’s Play Store, is currently in a legal battle over the imposition of 30% commission fees on app purchases and the prohibition of third-party purchasing methods. Cydia, an App Store rival, filed a 2020 class-action lawsuit accusing Apple of “illegally squash[ing] all competition.” The aforementioned Pew Research study revealed that 79% of Americans are concerned about how companies use their personal data; indeed, 59% of respondents have little to no understanding of how companies are using the data they collect.

The rapid spread of tech-enabled business ecosystems and the power that their creators wield as rule makers, judges, and juries of their ecosystems have caught stakeholders off guard. All kinds of platforms—from property rental services to ride-hailing providers to workforce marketplaces—are facing similar criticism as they gain traction and disrupt markets around the globe.

What needs remedying is not merely the threat of the monopoly power of business ecosystems, but also the deficit of trust in the relationships and transactions between stakeholders.

The focus of the current debates, however, may well be one-sided. We contend that market regulation, so focused on antitrust in this case, ought to also consider the problem with ecosystems from the perspective of trust. The two concepts are, of course, not semantic opposites. But this play on words underscores our point that what needs remedying is not merely the threat of monopoly power, but also the deficit of trust in the relationships and transactions between ecosystem stakeholders.

Why Existing Regulatory Remedies Fall Short

Keeping up with the profound changes brought about by the digital economy has been a challenge for regulators. They especially struggle with adapting to new business structures, such as the ascendant business ecosystem model.

So what exactly is a business ecosystem? We define it as a dynamic group of largely independent economic players, generally orchestrated by one participant, which creates products or services that together constitute a coherent solution. This orchestrator builds the ecosystem, encourages others to join, defines standards and rules, and acts as an arbiter when a conflict arises. Ecosystem complementors contribute to the final solution by directly providing customers with products or services that enhance the value of other ecosystem components. Examples of complementors include app developers for mobile operating systems, vendors in a digital marketplace, and weather data providers in a smart-farming ecosystem.

Existing regulatory frameworks are not designed to deal with the novel ecosystem model with its complex web of interdependencies and blurry boundaries.

As a business model, the ecosystem competes with such other organizational forms as the hierarchical supply chain, the integrated company, and the open market model. As a general concept, the business ecosystem is not entirely new; for example, during the Renaissance, the Medici orchestrated a large network of various participants among whom the transactions were not necessarily monetary. However, advances in digital technologies have catapulted the business ecosystem to renewed prominence. Today, 22 S&P100 companies are orchestrators of major ecosystems, representing 40% of the index’s total market capitalization.

Existing regulatory frameworks are primarily designed to deal with contractual buyer-supplier relations, open-market transactions, and integrated conglomerates—not this novel model with its complex web of interdependencies and blurry boundaries. There are six major characteristics that make ecosystems so difficult to control through traditional regulation:

- Market Ambiguity. Business ecosystems typically bring together players from different industries to collectively deliver a value proposition. It is therefore a less straightforward exercise to define the actual market or markets in which they play, identify their direct competitors, and quantify their market share.

- “Soft” Company Boundaries. In a business ecosystem, every participant has less independence than it would have in an open market, but more freedom than it would have in a contractually based, hierarchical supply chain. Furthermore, it is not obvious where the orchestrator’s sphere of influence ends or what constitutes an internal versus external activity.

- Non-monetary Value Exchange. In many ecosystems, features other than price serve as the decisive competitive factor. Attention markets, zero prices, and big data, as well as more general factors such as quality, innovation, and privacy, are gaining importance. The control of data and attention is what matters, not the control of physical resources. Economic policy expert Robert Shapiro calculated the value of the average American internet user’s personal data gathered by “free” internet services such as Facebook, Google, and Twitter to be roughly $202 per year.

1 1 Robert J. Shapiro, “What Your Data Is Really Worth to Facebook,” Washington Monthly, July–August 2019. Such analysis, of course, is a complex undertaking, and as data mining and targeting become more sophisticated, the value of personal data will only continue to rise. In short, determining the value of these non-monetary features remains a major challenge for regulators. - Dynamic and Fluid Structure. In a business ecosystem, relationships between orchestrator and complementors and among complementors are generally not defined through a contract. Consequently, the composition of the ecosystem and the distribution of power within it can change rapidly. Often, the distinctions between competitive and collaborative relationships are blurred, and orchestrators can influence these relationships unilaterally through their established governance models. Moreover, orchestrators can also act as complementors to the ecosystem, directly competing with their partners.

- Potential for Hypercompetitive Advantage. The unique characteristics of the ecosystem model—network effects, learning effects, economies of scale and scope—enable many ecosystems to overcome the conventional limitations to growth. This can eventually lead to a winner-takes-all (or winner-takes-most) dynamic. For large platforms, this dynamic amounts to a seemingly invincible competitive advantage. Yet ecosystem orchestrators ultimately face limitations as well as new competitive threats. As their technologies become commoditized, the barriers to entry fall and the pressures to innovate increase. Their own complementors, which control key resources, can more easily jump ship and either join the competition or start their own competing service.

- Relatively Limited Threat to Consumer Welfare. Unlike in the past, the end customer is generally not the party most in need of protection in this scenario. Apart from the potential misuse of personal data (a serious concern that we discuss later), consumers are not held hostage by ecosystems. They generally enjoy lower prices, greater convenience, and a seamless experience—historically, the converse of their fate in a traditional monopoly situation. Instead, it is complementors that are more often vulnerable to unfair treatment or advantage.

Although many regulators are attempting to address the risks posed by digital platforms’ unique features, the classic approach to antitrust is ill-equipped to do so. Most regulators lack adequate tools for preemptive intervention, and ex-post remedies often prove to be either toothless or too late.

The Potential for Misuse of Power

Much of the current regulatory discussion centers on platforms’ growing economic might and its impact on the overall macroeconomic landscape. But as our colleagues pointed out in a recent Fortune article, regulatory intervention is usually triggered by consumer grievances or general public indignation over company behavior that is perceived to be unfair or wrongful.

Direct Competitors’ Concerns

Direct competitors to business ecosystems (and thus regulators) are primarily concerned that platforms will exploit regulatory arbitrage opportunities or misuse their market power within and across industries to gain unfair competitive advantage.

Exploitation of Regulatory Arbitrage Opportunities. Because leading business ecosystems do not fit neatly into the standard industry classifications covered by regulation, they can capitalize on their extra-jurisdictional nature. Through regulatory arbitrage, they can gain unfair competitive advantage.

For example, lodging services can avoid being classified as hotel companies and thus circumvent the requirement to collect occupancy taxes. And although they curate and monitor content, social media platforms can escape classification as publishers through the safe harbor provision of Section 230 of the US Communications Decency Act, which provides them a legal shield from responsibility for third-party content.

Misuse of Market Power Within the Industry. Historically, antitrust regulation was designed to squelch unfair market dominance—combating both restraint of trade and anticompetitive practices across industries as well as monopoly power within an industry, which could enable price fixing and the control of supply. Such was the case with Standard Oil, one of the world’s first and largest multinational corporations, which was declared an illegal monopoly in 1911 and broken up. AT&T faced the same fate after a years-long battle ending in 1984. Thanks to network effects, ecosystems can scale faster than traditional companies and therefore have a natural tendency to dominate their markets. Authorities are especially concerned about large platforms’ ability to smother competitors and expand their control.

Companies are being accused of violating competition laws through their acquisitions and emerging cross-ownership structures. The ride-hailing industry has recently drawn increased regulatory scrutiny for this reason. After years of cutthroat regional battles, many of the largest platforms have invested in their direct competitors while simultaneously withdrawing from some regions.

Misuse of Market Power Across Industries. Digital convergence across industries blurs traditional market boundaries. Business ecosystems built on cross-industry cooperation are at the forefront of this evolution. As walls come down, platform orchestrators are well positioned to storm adjacent territories by leveraging data and network effects in their core markets.

Ecosystem orchestrators can unilaterally change the rules, thus potentially sowing mistrust among their partners. A sudden modification can financially ruin thousands of complementor businesses.

Moreover, the skills it takes to manage an ecosystem yield competitive advantage to orchestrators, even in domains unrelated to their core business—a situation contrary to the classic paradigm of conglomerate discount, in which a diversified group of businesses is valued at less than the sum of its parts. Some experts see the growing power and ambition of big tech companies not merely as a threat to free markets but also as a threat to democracy or national sovereignty.

Ecosystem Complementors’ Concerns

Ecosystem complementors are mainly worried about opaque rules of play as well as orchestrators’ commoditization efforts and unfair competitive behavior within the ecosystem.

Arbitrary Changes to Governance Rules. Complementors must abide by the ecosystem’s governance model, yet commonly cite the lack of transparency and “legal certainty” within the ecosystem. Orchestrators can unilaterally change the rules, thus potentially sowing mistrust among their partners.

For example, many complementors to social media platforms are frustrated by the obscurity of unannounced changes in the rules and algorithms. A sudden modification in permitted content, monetization practices, or search appearances can financially ruin thousands of complementor businesses.

Orchestrator’s Commoditization Efforts. Even where a high level of transparency in the governance model exists, complementors that contribute predominantly to a single ecosystem can be vulnerable to an orchestrator’s abuse of its position as an intermediary to commoditize complementors. Complementors risk losing direct access to their customers and transaction data while lacking the ability to switch to another platform or leave without incurring considerable costs.

To counteract this vulnerability, Spotify, Epic Games, and other complementors of mobile operating systems established the Coalition for App Fairness in the fall of 2020 to fight what they perceive as unfair practices by the leading app stores. They are urging regulation that would empower complementors and protect them against orchestrator overreach.

Orchestrator’s Direct Competition with Complementors. Orchestrators not only define the governance model but can also provide products or services that compete directly with complementors or control areas of operation entirely by, for example, instituting their own payment system. Such decisions may be driven by the desire to strengthen platform performance—say, eliminating a bottleneck or pursuing innovation—or by the desire to capture a bigger share of value. Given their conflicting interests, orchestrators can be—and indeed, have been—tempted to misuse their position. Examples include bundling their own complementary services with the platform’s core offering or capitalizing on their access to complementors’ data to make their own offering more competitive—a practice ultimately deemed unlawful by regulators.

Customers’ Concerns

Finally, customers are concerned about the misuse of their private data and the platforms’ information monopoly, as well as their vulnerability through their exposure on only a couple of mega-platforms.

Misuse of Customer Data. Platforms gather an immense amount of data and can use it in both positive and negative ways. The lack of transparency of algorithms and internal practices puts customers in a vulnerable position and can give orchestrators unfair power over them. Prominent instances of data abuse, such as the Cambridge Analytics scandal, clearly damaged consumer trust in platforms, and consumer concerns over data privacy have been growing. In a global survey conducted by Cisco, nearly half (48%) of the 2,600 respondents indicated they had already switched platforms or providers because of their data policies or data-sharing practices.

Abuse of Monopoly on Information. In recent years, social media platforms have come under fire for content and algorithms that critics claim have resulted in spreading fake news and hate speech and creating echo chambers. Both the EU and the US are pushing for regulation in this area. For instance, in the US Congress, Democrats, concerned about the ill effects of misinformation, want to increase tech platforms’ restrictions, while Republicans believe such restrictions amount to silencing alternative (and, in particular, conservative) viewpoints. Critics across political lines worry that censorship is chilling public discourse on vital topics that deserve discussion and debate.

Misuse of Customer Attachment. Like complementors, end users can find it difficult to cancel platform membership. For one thing, the network effect in a large ecosystem raises switching costs for individuals considerably. In some cases, an orchestrator’s policy of restricting access to or limiting the portability of one’s own data can make switching services even harder. And sometimes consumers simply have no alternative. For example, in the same year when the #DeleteFacebook campaign was launched (2018), Facebook’s user base grew 9%, and today stands at roughly 2.8 billion monthly users.

What Makes Antitrust Concerns a Trust Problem?

Trust, which has long been defined as the willingness of one party to be vulnerable to the actions of another, is integral to the functioning of a business ecosystem. This is because an ecosystem’s partners must learn to rely on each other, knowing that no external force compels them to do so. At the same time, power imbalances and the potential for power misuse by the orchestrator render this mutual trust fragile.

In an ecosystem’s incipient stages, the orchestrator must persuade complementors and customers to join the ecosystem before the proof of concept is realized. Early partners must trust the commitment and staying power of the orchestrator and the other partners in order to achieve critical mass so that network effects kick in and the ecosystem can take off. In contrast to that of traditional supply chain models, ecosystem governance cannot rely on hierarchical control. Our earlier analysis found that trust was a proximate factor—albeit not necessarily the root cause—in the failure of 57 of the 110 unsuccessful ecosystems we studied. When trust is broken, value is destroyed.

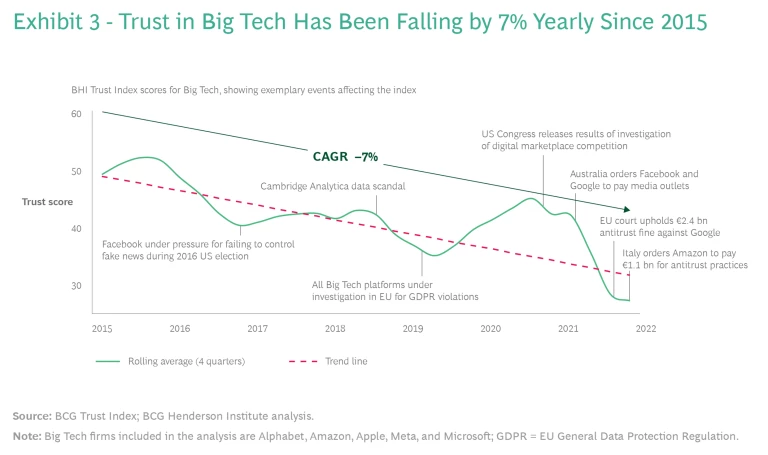

As the BCG Trust Index shows, the erosion of trust in the leading ecosystem companies in recent years is measurable (see Exhibit 3). The index methodology involves scraping trust-related text from traditional news sources and social media and then using an NLP (Natural Learning Processing) engine to assess the text’s sentiment and compute an aggregated trust score. According to the index, Big Tech’s aggregated trust score has been falling at an annual rate of 7% since 2015. The language used to describe this downward trend, in the scraped headlines as well as in academic studies, reflects an increasing focus on antitrust investigations, anticompetitive behavior, and class-action lawsuits over privacy and data breaches.

In conversations with clients from many sectors, we repeatedly hear: How will these growing digital platforms affect my business? And as an ecosystem complementor, how can I ensure that the orchestrator is not abusing its advantage? Many consumers (even digital natives) who recognize that these platforms enhance their lives are increasingly concerned about being tracked and controlled by them. So, as trust with ecosystem orchestrators erodes, the question is: What can we—should we—do about it?

Adding a Trust Perspective to the Debate

The growing calls worldwide for regulatory action and the sheer volume of antitrust legislation already proposed clearly suggest that change is in order. But as studies have shown, regulation and trust often have an inverse relationship. Regulation can come at a deeper cost; it is not a panacea.

A trust monitoring mechanism can help orchestrators to foster trust in their ecosystems, mitigate the sources of distrust across their key stakeholder groups, and actively shape the regulatory discourse.

If distrust is not addressed directly, it can trigger a vicious cycle and deepen among stakeholders. Economist Philippe Aghion and his research team demonstrated a strong negative correlation between government regulation and measures of trust, both at the public and the transaction levels.

Indeed, many orchestrators are already taking deliberate measures to strengthen trust in their ecosystem. In our previous paper on building trust in business ecosystems, we identified seven classes of trust instruments that ecosystems can use to establish systemic trust. Access rules, for example, ensure that the right members join and remain engaged; contracts guarantee mutually beneficial interactions through binding agreements; incentives encourage participation and cooperation; control mechanisms guide interactions and behavior; transparency measures make past and present behavior visible to all; intermediation facilitates interaction by establishing a neutral middleman; and mitigation practices ensure a beneficial outcome even amid disputes or in adverse situations. After struggling with an increased number of fraud cases, eBay, for example, took proactive steps to strengthen control in its ecosystem. It beefed up its financial protection policies, user guarantees, and operational guidelines.

When combined with a trust monitoring mechanism similar to the BCG Trust Index, these instruments allow orchestrators to foster trust in their ecosystems, mitigate the sources of distrust across their key stakeholder groups, and actively shape the regulatory discourse. Yet while improving ecosystem-level trust is a rational strategy for individual companies, it is unrealistic to expect this alone to solve the trust problem. The negative behavior of individual actors can have a spillover effect on competitors. Therefore, ecosystem orchestrators should also work together with their peers to establish effective self-regulation for their respective domains.

Self-regulation has proven to be successful in engendering trust in different contexts throughout the 20th century; consider, for example, the Motion Picture Association of America’s movie rating system (established in 1968) and the Forest Stewardship Council’s Sustainable Forest Initiative (1993). It has even been pursued effectively in digital platforms and ecosystems. DOT Europe, an industry association of leading internet-based businesses, is a good example. The organization, which is dedicated to combating illegal practices through sound governance and ethics, released the Online Responsibility Framework to stay ahead of the EU’s Digital Services Act.

More generally, ecosystem orchestrators, together with regulators, should seek to establish generally accepted principles of sound ecosystem governance, elements of which could later serve as the basis for legal codification. In this pursuit, we can find lessons and inspiration from the development of corporate governance practices. Following the scandals involving Enron, WorldCom, and a number of other corporations in the early 2000s, corporate governance principles began cropping up worldwide. Led by the OECD’s Principles of Corporate Governance, an international benchmark was slowly established that outlined ways to evaluate and improve the legal, regulatory, and institutional frameworks for corporate governance—and thereby restore trust in corporations.

Considering antitrust issues of digital platforms and their business ecosystems as a crisis of trust between the orchestrator and its stakeholders can be the first step toward a solution.

What might such an ecosystem governance framework look like? At the very least, the governance model should be explicitly formulated and made accessible to the affected stakeholders of the ecosystem. Beyond that, BHI research has identified four essential qualities of good ecosystem governance:

- Consistency. The governance model is clear and simple—no more complex than necessary and easy to understand for all stakeholders. It is comprehensive, free of contradictions, and consistent over time to provide a predictable framework for all partners.

- Fairness. Good ecosystem governance strives to ensure fair and trusted dealings with all stakeholders and inhibits the misuse of orchestrator power. It complies with local laws and norms and avoids inappropriate biases in, for example, data algorithms and access.

- Effectiveness. The governance model fosters collaboration and alignment between participants, ensures the quality of the ecosystem’s products and services, and encourages members’ active participation and growth of the ecosystem.

- Flexibility. The governance model must be regularly monitored with instruments and early warning indicators to identify emerging governance issues. It should also be flexible enough to adapt to changing circumstances and new challenges.

Considering antitrust issues of digital platforms and their business ecosystems as a crisis of trust between the orchestrator and its stakeholders can be the first step toward a solution. Orchestrators have a wide range of trust instruments at their disposal with which to strengthen the systemic trust in their own ecosystems. They should also work with their peers to establish effective self-regulation in their domain. Finally, they should strive to develop and adhere to a generally accepted framework of sound ecosystem governance. By taking responsibility for fortifying trust, ecosystem leaders can support reasonable regulation, thus strengthening their economic benefits to all stakeholders and preserving their social license to operate.