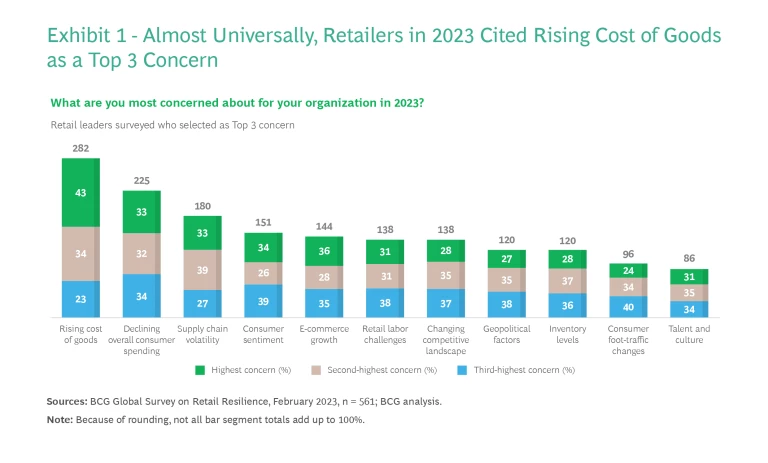

Although the global economy is finally stabilizing after several grueling years, the world is resettling in ways that are much more challenging for retailers than was the case before the pandemic. To understand the current climate, BCG and the World Retail Congress surveyed more than 550 senior retail leaders around the world and across 12 sectors. In analyzing this survey, which marks our tenth annual partnership, we found that retailers show signs of optimism about the economy, but they also share the same top concerns: rising cost of goods, declining consumer spending, and supply chain volatility. (See Exhibit 1.)

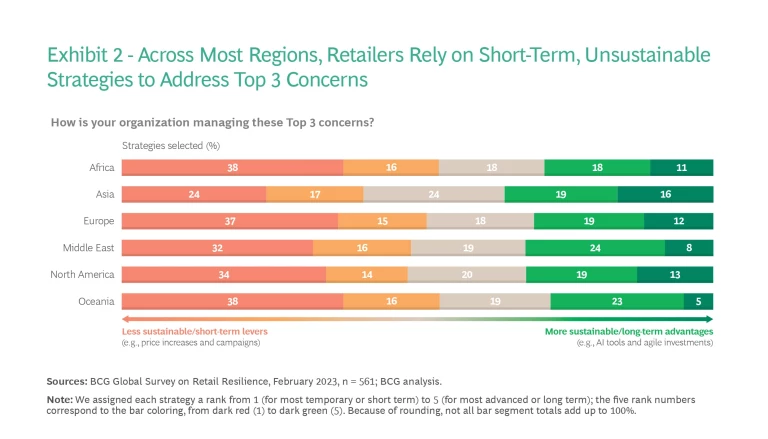

Most retailers are addressing these concerns with traditional solutions, with some success, but the vast majority are missing out on an opportunity to embrace solutions powered by artificial intelligence (AI) that promise to improve resilience and deliver long-term structural advantage. (See Exhibit 2.) This report highlights how AI and advanced analytics technologies can help retailers address their top concerns, deliver an immediate boost to growth, and become more resilient.

The Relentless Rise in the Cost of Goods

Costs for retailers, as measured by the producer price index (PPI), are much higher in 2023 than they were before the pandemic, and they have grown faster than the cost increases passed on to consumers, squeezing margins for retailers. In response to the higher costs of goods, retailers tend to stick with the basics. Approximately 55% of respondents said that their organizations are raising consumer prices, and 52% are renegotiating with suppliers.

But these are short-term, temporary levers that in some instances may damage the brand. In contrast, AI enables organizations to take into account a wide range of real-time variables—from nearby competitor prices to social media trends—while also holistically evaluating the product interdependences (such as cannibalization) at play. By using AI to develop this next-generation pricing capability, a retailer can de-average its approach to make it specific to individual customers, stores, or channels while still optimizing for overall profit.

Consumers Are Under Intense Pressure

Economists in most regions expect growth in consumer spending to slow in 2023, though to different degrees. Many retailers are testing multiple approaches to cope with a more sluggish demand environment. The most common option under consideration is loyalty program investments (45%), followed by product offering optimization (44%), and then by price promotions (40%) and digital customer experience investments (40%). By and large, however, retailers are neglecting AI, which is a powerful way to meet growing customer expectations for a personalized experience and overcome the trend toward declining consumer spending.

In a previous study, BCG found that consumers with a highly personalized experience were about twice as likely to add items to their baskets as shoppers without a personalized experience. Moreover, AI can help retailers build intelligent and long-standing competitive advantages by capturing customer attention and, ultimately, improving customer loyalty. Customers who had highly personalized retail experiences gave 20% higher customer loyalty scores than did customers who had low levels of personalization.

Supply Chain Woes Continue to Drive Complexity

Not surprisingly, supply chain complexity and ongoing volatility remain a top concern for retailers. Almost half of survey participants who cited supply chain complexity as a top concern are trying to improve their inventory management tools. Retailers have a relatively untapped opportunity, however, to embed AI in these solutions. By incorporating AI’s predictive power with more real-time factors along the entire supply chain, retailers can better understand and address the root causes of volatility from producer to customer. These inputs include current and predicted stock levels, geopolitical disruptions, local competitors, social media trends, customer website clicks, and local weather forecasts.

Stay ahead with BCG insights on the consumer products industry

Combined with the ability to simulate and optimize various scenarios, these AI-enabled insights can help retailers prepare more accurately for needs over the long term while being proactive with regard to supply and demand volatility in the near term.

Think Quick Wins to Get the Journey Started

AI has vast potential not only to address retailers’ immediate concerns about costs, consumer spending, and the supply chain, but also to unlock strategic and financial value along the entire retail value chain. Although these benefits are enticing, the prospect of introducing AI into a business can be daunting. Our report presents retailers with a focused, business-led approach to AI composed of small steps that start by addressing today’s concerns and delivering quick wins while also thinking big picture and creating sustainable advantages.

In both the near future and the more distant future, uncertainty will prevail around the world. We believe that AI is the critical enabler that retailers need to bolster their resilience, while also creating sustainable structural advantages.