Of the three quantum technologies with high-powered applications for business—quantum computing, quantum communications, and quantum sensing—the least well known is the latter. Ironically, quantum sensing is the technology with which we have the most practical experience: lasers, photovoltaic cells, and medical-imaging machines all use quantum sensors.

The reason for this lack of familiarity may lie in the difficulty of monitoring the technology’s development thanks to its highly diverse applications. But this diversity, combined with the relative ease of scaling (compared with quantum computing, at least), is fueling research in multiple fields and will soon start to unlock new use cases in health care, semiconductors, satellites, and military and defense manufacturing.

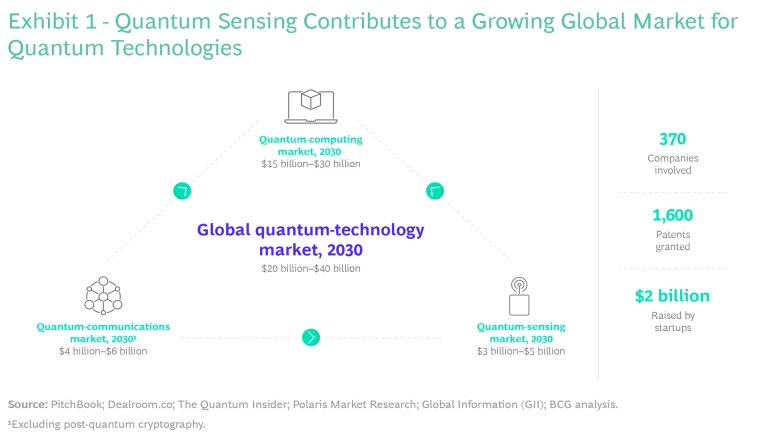

We recently observed that for large companies, enterprise-grade quantum computing is coming into view. We also expect new uses for quantum-sensing technology to emerge in the next decade, potentially with disruptive effect. Some 1,600 patents already have been granted, and startups raised $2 billion in 2022. The total attainable market for sensors is projected to reach $170 billion to $200 billion by 2030 and we expect the global quantum-sensing market to reach $3 billion to $5 billion by 2030 (or a 2% to 3% share of the wider sensor market), which will help propel the global market for all quantum technologies to $20 billion to $40 billion. (See Exhibit 1.)

Sensing What You Cannot See

The first wave of innovation enabled the commercialization of important technologies such as transistors and modern communications, as well as magnetic resonance imaging (MRI) machines, digital cameras, and other imaging devices. The second wave will deliver two principal benefits over existing capabilities.

First, shrinking size enables transportable devices, which will create new measurement use cases. Until recently, some metrics could only be assessed in laboratory settings using bulky equipment. Size reduction paves the way to embedding quantum sensors in all manner of things, including planes, cars, and mobile phones. The ability to measure gravity is important in climate research, for example, and quantum gravimeters will benefit from taking in more data points than traditional devices.

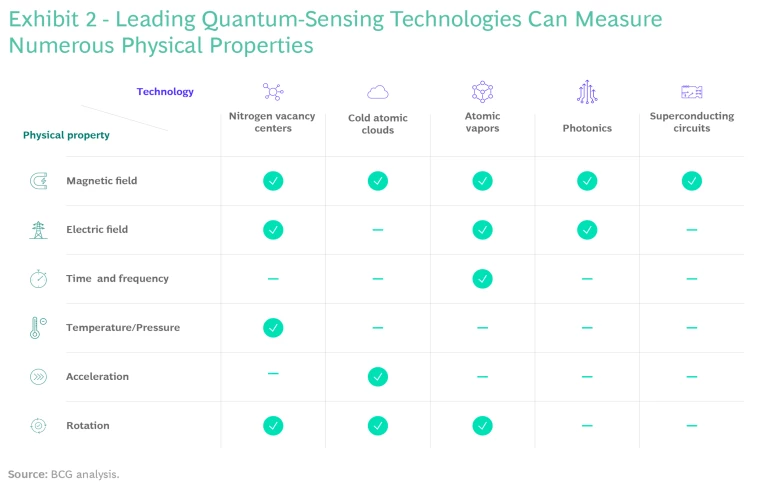

Second, the extreme sensitivity of quantum sensors will deliver greater precision in various types of measurement, such as time, frequency, acceleration, temperature, pressure, rotation, and magnetic and electric fields. (See Exhibit 2.) This could have a transformative impact in many areas, including defense and aerospace, health care, electronics, and geology and energy. Several applications involving quantum sensing (such as lidar) may have an impact on mass-market products, such as automobiles, in the medium to long term. Niche use cases are already being addressed, and more will soon be commercial realities—perhaps in the next three to five years for the most mature.

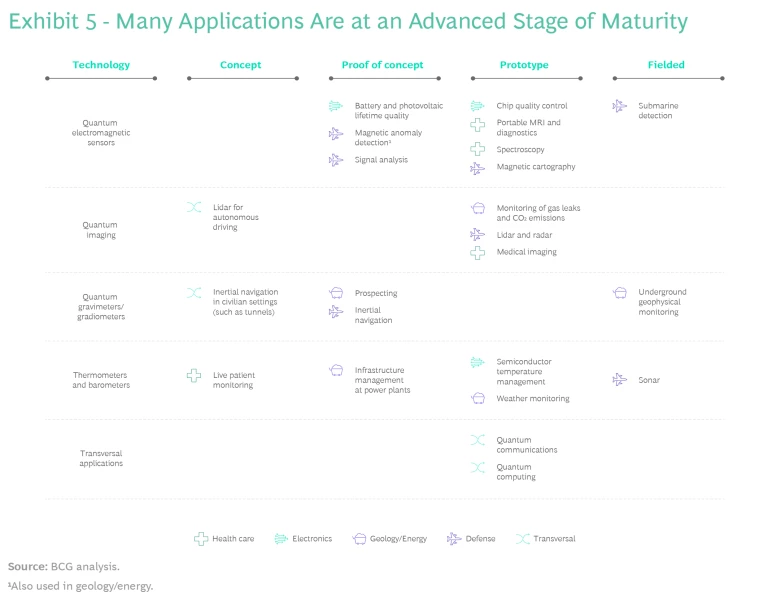

The principal quantum-sensing technologies being explored today can be grouped into five categories, each with different capabilities.

Quantum Electromagnetic Sensors. These devises rely on three technologies to measure electromagnetic fields dynamically and with high precision: NV (nitrogen vacancy) centers, atomic vapors, and superconducting circuits. In the defense sector, QES can be used to detect stealth targets or intercept communications; in health care, their use in brain activity imaging and nanoscale spectroscopy can enhance diagnostic accuracy and reliability.

Quantum Imaging. Quantum technology improves imaging resolution and range by leveraging quantum mechanics. Quantum lidar creates precise 3D maps and improves distance measurements; quantum radar enhances the detection and localization of objects with higher resolution and reduced noise. Quantum-imaging resolution is useful for detecting stealthy, concealed, or rapidly moving targets, such as in border surveillance or military operations.

Quantum Gravimeters and Gradiometers. Gravimeters (which measure the strength of a gravitational field) and gradiometers (which measure changes in a gravitational field) are used to monitor subsurface geophysical phenomena such as underground cavities and geothermal reservoirs. By detecting minute changes in gravitational forces with greater sensitivity, quantum gravimeters and gradiometers can more accurately locate underground structures and resources, thus improving hydrocarbon prospecting.

Thermometers and Barometers. Using cold atomic clouds and superconducting quantum interference devices (SQUIDs), thermometers and barometers can more accurately evaluate temperature and atmospheric pressure. Sometimes integrated with sonar to detect submarines, these tools can also be used to improve measurement of environmental parameters in aircraft.

Transversal Applications. Quantum sensors, quantum communication, and quantum computing are enriched when used in combination. Use cases are being explored in weather forecasting, fraud detection, traffic optimization, and drug interaction prediction, among other areas.

The Challenges to Adoption

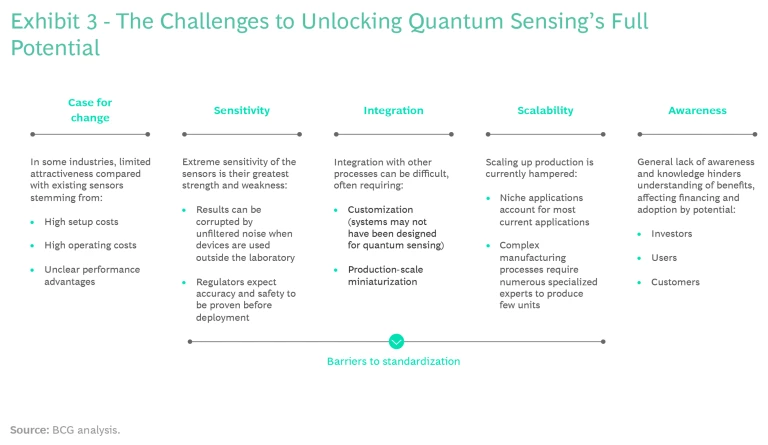

As with any emerging technology, challenges need to be overcome. The biggest challenge for quantum sensing may be making the case for change. (See Exhibit 3.) In some industries, the upfront costs, high operating costs, and unclear performance advantages limit the technology’s attractiveness, at least in the short term.

The extreme sensitivity of quantum sensors, difficulties with integration, and limited scalability are barriers to standardization, which is a prerequisite to market penetration and growth. Indeed, sensitivity is both the greatest strength and the greatest weakness of these devices, since results can be corrupted by unfiltered noise when sensors are used outside the laboratory. Regulators, as well as customers, expect predictable accuracy and safety.

Integrating quantum sensing with other processes can be difficult because additional miniaturization and customization may be needed. Scaling up sensor production is currently hampered by the mostly niche applications now in use and by complex manufacturing processes that require numerous specialized experts to produce relatively few units. Finally, a general lack of awareness and knowledge hinders understanding of the benefits of quantum sensing, which affects both financing and adoption.

Where the Action Is and Will Be

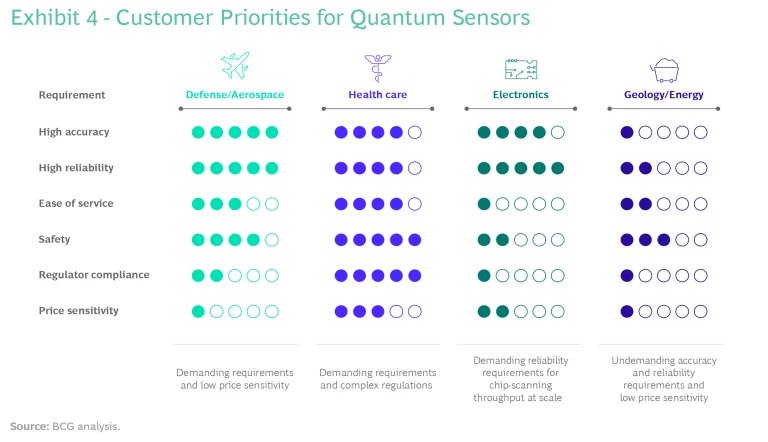

Each stage of the quantum-sensing value chain—components, sensing, applications, and services—is maturing at its own rate, making prediction difficult. (See “The Quantum-Sensing Value Chain.”) The strategic nature of the defense industry’s needs and activities—and its lower price sensitivity compared with other industries—has made defense the principal driver of the quantum-sensor market. So far, most quantum-sensing use cases have been prototyped and fielded for defense purposes.

The Quantum-Sensing Value Chain

Achieving the benefits of scale requires breaking into the commercial market. The speed with which applications come to market may depend not only on addressing customer priorities but on proving through military use that the technology is efficient. As with other technologies, such as microwaves, GPS, and virtual reality, civil applications will benefit from the technology’s maturity, from knowledge transfer based on the experience of the defense industry, and from economies of scale—all of which will contribute to more affordable prices.

Three other sectors in addition to defense stand to benefit, each with its own priorities. (See Exhibit 4.) Medical and pharma users have demanding requirements in multiple areas, such as sensitivity and size, because of mission-critical functions, safety criteria, and regulation. Electronics manufacturers value great accuracy and reliability and the ability to perform at scale (think of the millions of chips manufactured every year). Users in geology and energy have low price sensitivity and may be the least demanding in terms of performance; safety requirements are their top concern.

Prototypes for many applications in these industries are emerging. Defense and medical applications appear to be the closest to market maturity, but there are strong advantages for quantum sensors in electronics and geology and energy as well. (See Exhibit 5.)

- Magnetic anomaly detection monitors the presence of metallic objects such as submarines and mines. Quantum sensors enable deployment of the technology on small, unmanned aerial or underwater platforms. The capability could be deployed in other spheres as well, such as in autonomous cars to enhance the detection of objects. This use case is in the proof-of-concept stage in defense and in geology and energy.

- Portable MRI machines can expand the use of this imaging technology by significantly reducing the size of the scanners, allowing them to be used in isolated or underserved areas. The use case is in the prototype stage; further progress is needed to reduce both size and price.

- The use of quantum sensing in chip quality control, which has been prototyped by the electronics industry, enables faster scanning and higher resolution of defects. The last major barrier is the ability to standardize and industrialize the manufacturing process. Once this is overcome, the 20% scrapping rate at most of today’s semiconductor manufacturers will be lowered significantly, reducing waste and alleviating supply chain pressures.

- Underground geophysical monitoring senses seismic and volcano activity. Quantum gravity sensors provide state-of-the-art performance and have been fielded by energy companies. Further civil engineering applications, such as in infrastructure monitoring of roads, dikes, or industrial plants, will develop once the devices shrink in size.

- Inertial navigation using quantum sensors provides accurate positioning in areas where global navigation satellite systems such as GPS are either blocked or not precise enough (which can impair vertical positioning, for example). GPS signals are easy and cheap to jam. Defense organizations such as the Air Force Research Laboratory are deploying inertial navigation in missile guidance systems so that they do not rely solely on GPS. The technology is also useful in civilian settings such as road tunnels. Sensors are at the proof-of-concept stage at laboratory scale. Mass deployment will require miniaturization and cost reduction. Inertial navigation could leverage quantum sensing in industries such as automotive and aerospace and defense and may eventually, if miniaturization and unit costs allow, become an integral component of future smartphones.

- Self-driving cars require enhanced perception capabilities in order to accurately detect and track objects, pedestrians, and obstacles in real time and at high speed. This application is still in the early stages of development. Market readiness requires progress in quantum hardware (to better detect light sources), robust and reliable error correction techniques, lower cost, and smooth integration with autonomous vehicles and with existing infrastructure, such as roadways, streets, and intersections.

Like its quantum cousins—computing and communications—quantum-sensing applications will not be plug and play. To pilot and ultimately take advantage of new developments, companies will need internal skills and partnerships with established players. Even if the use cases seem distant, the time to prepare is near. As with other deep technologies, early movers can lock in talent and alliances that will give them a big head start when quantum sensors enter the mainstream.