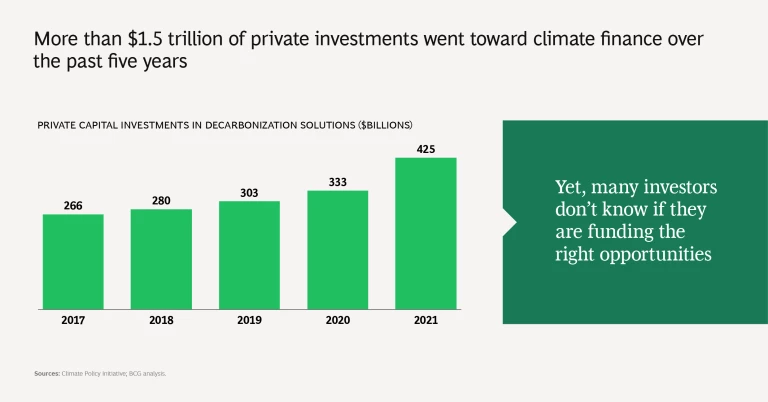

More than $1.5 trillion in private investments went toward climate finance over the past five years. Undoubtedly, private capital plays a key role in contributing to the $150 trillion in investments required to achieve net zero globally by 2050. However, many investors are unclear if their capital is delivering meaningful climate impact by reducing, removing, or avoiding greenhouse gas emissions.

Is climate impact measurable? Can it be integrated into the investment process? And is there a way for investors to do so without requiring a team of technical experts with PhDs in data science? For double bottom-line investors such as GenZero, a Singapore-based investment company focused on accelerating decarbonization globally, setting climate impact targets would also be an important North Star to guide investment decisions.

Given the nascency of where the industry is in measuring and setting targets on climate impact, GenZero partnered with Boston Consulting Group to develop a robust and practical framework to evaluate, estimate, measure, and eventually report the climate impact of decarbonization investments.

Cracking the Climate Impact Measurement Conundrum

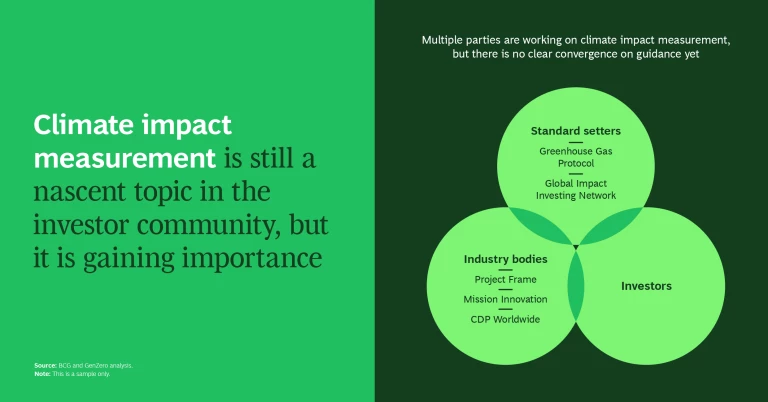

Climate impact measurement is gaining importance across the investment community. Several industry bodies are working to develop a common nomenclature, as well as data and reporting standards, but these efforts are still evolving. In the meantime, the window of time to take meaningful action on climate change is narrowing.

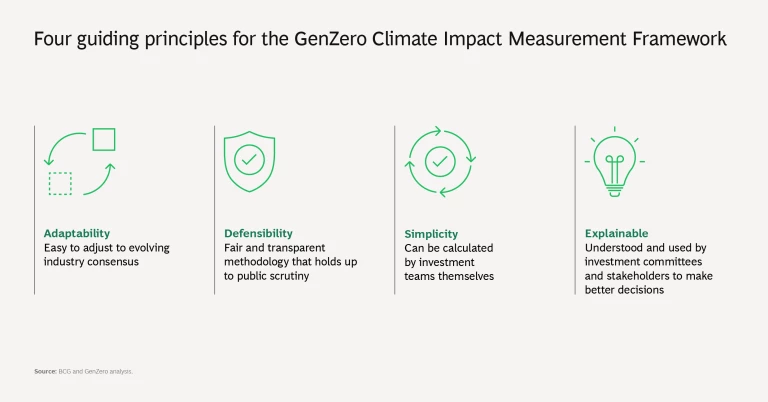

Recognizing the increased urgency to provide investors with a viable way to evaluate different decarbonization opportunities, GenZero partnered with BCG to develop the GenZero Climate Impact Measurement Framework. The goal was to create an approach that would be simple for investors to use, easy to understand, adaptable to evolving market norms, and able to hold up to external scrutiny. It was important also to tailor the framework to GenZero’s investment mandate and strategic objectives and incorporate industry best practices.

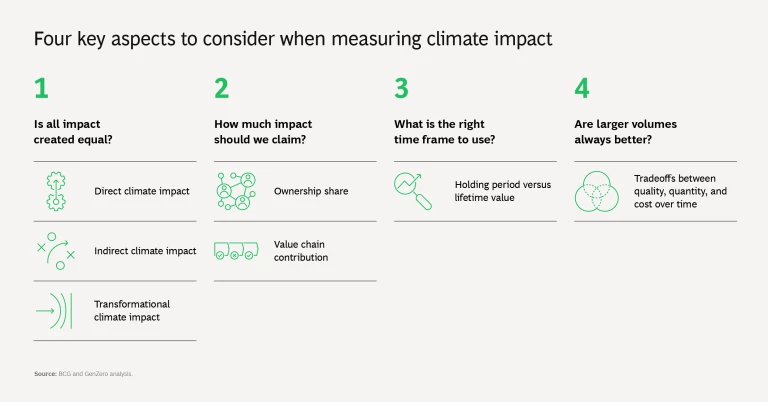

To accomplish these goals, we considered four key aspects of climate impact measurement. We summarize the main points here in hopes that other interested investors might find them useful as they embark on their own measurement journeys.

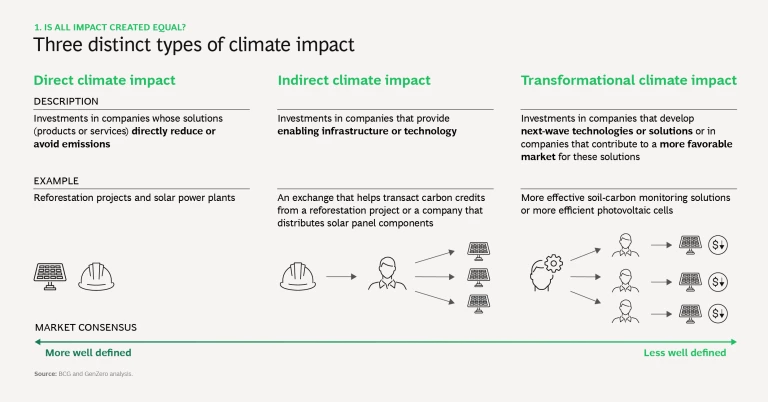

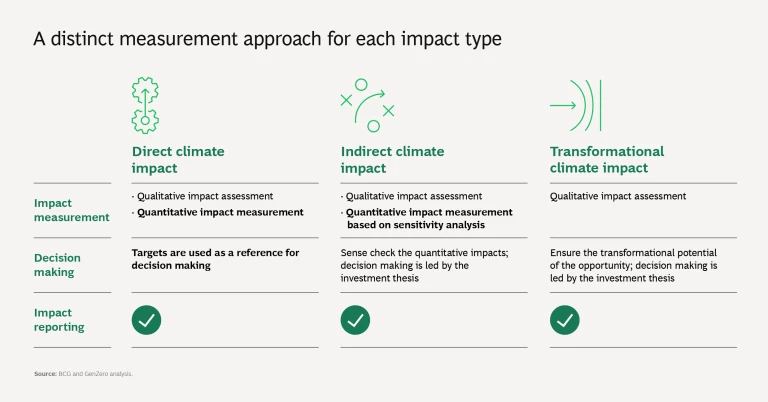

Is all impact created equal? Different investments play different roles in decarbonization. A reforestation project, for example, can involve planting trees that remove carbon directly from the atmosphere as well as technologies that monitor tree growth to verify the amount of carbon removed. Both initiatives can be valuable, but each has different investment characteristics that influence the timing, magnitude, and measurability of impact. To account for this, the framework classifies climate impact into three types:

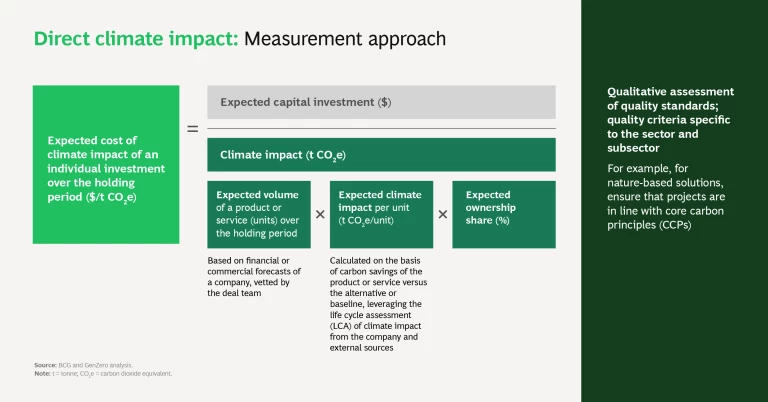

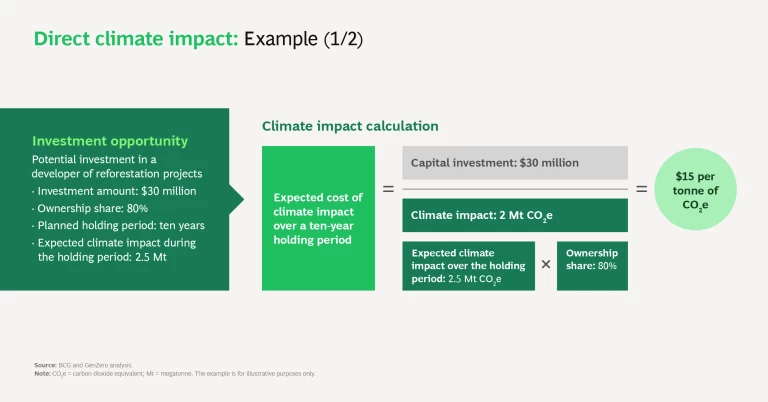

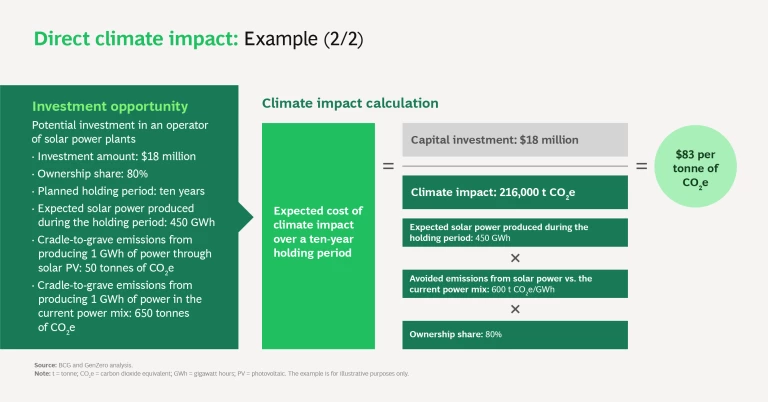

- Direct Climate Impact. Investments in companies whose solutions directly avoid, reduce, or remove emissions—solutions such as reforestation projects and solar power plants.

- Indirect Climate Impact. Investments in companies that develop technology or infrastructure that enables emission reduction, such as an exchange that helps transact carbon credits from a reforestation project or a company that distributes solar panel components.

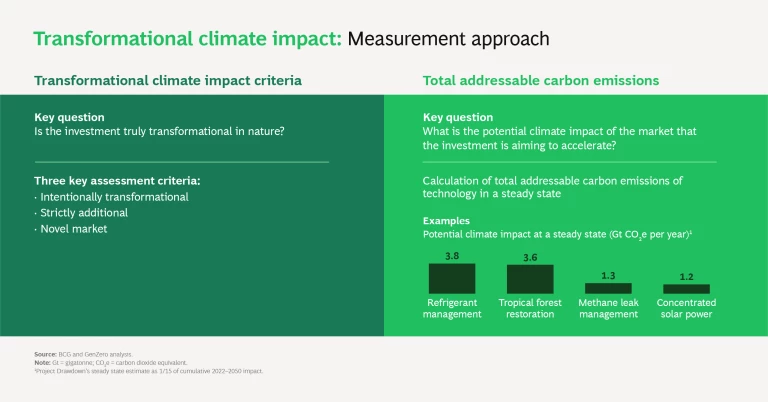

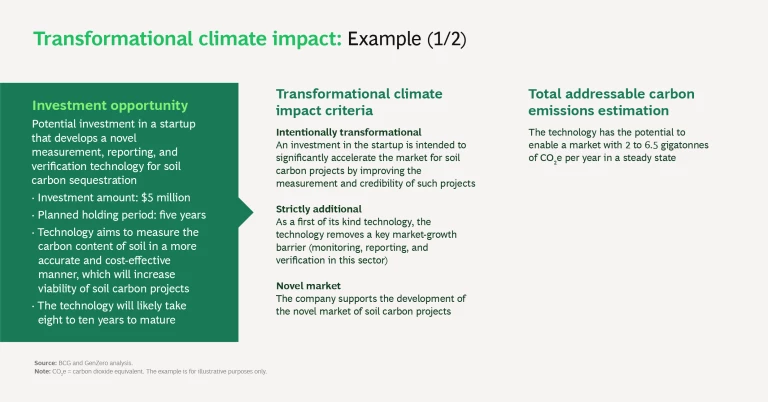

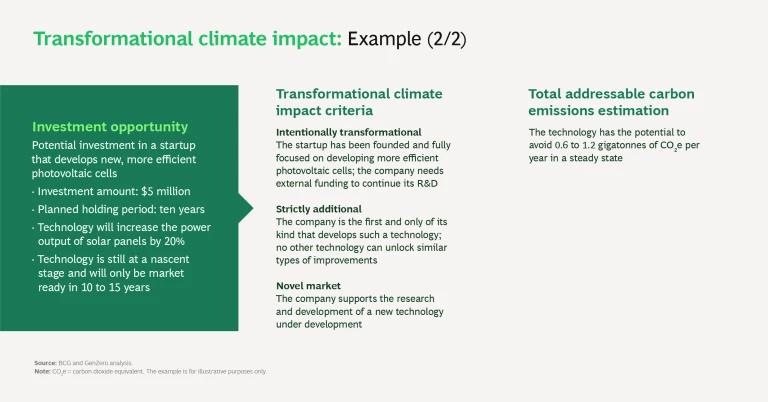

- Transformational Climate Impact. Investments in companies that develop next-wave technologies—such as more effective soil-carbon monitoring solutions or more efficient photovoltaic cells—that may result in accelerating the adoption of emissions-reducing solutions in the longer term.

All three climate impact types are essential to support a low-carbon future, and they form part of GenZero’s mandate. To account for their different impact characteristics, the framework provides specific measurement guidance for each type. This classification allows investors to better understand and compare the climate impact potential of their various investments and prioritize them according to their investment mandates. GenZero has set targets for direct climate impact and will prioritize investments that have more measurable decarbonization impact in the near-to-medium term.

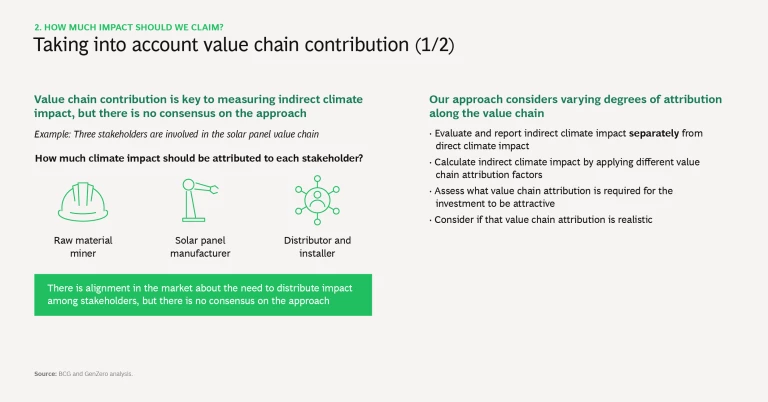

How much impact should we claim? Given widespread concerns around greenwashing, investors are under pressure to be transparent about quantifying climate impact. But determining appropriate attribution is difficult in practice for two reasons:

- Varying Ownership Share. Companies can be backed by multiple investors, but the size and stage of their investments may vary widely, raising the question of how much climate impact to claim. For example, should an investor with a 20% ownership stake claim 20% of the total climate impact that the company is generating, or should they claim 100%? While the investment community remains split on the optimal approach to take, the framework proposes to measure climate impact in proportion to the ownership share to reduce the risk of double counting.

- Different Value Chain Contribution. Delivering climate solutions, as with any other product or service, typically requires multiple actors along the value chain. Do raw materials providers, assemblers, distributors, repair services, and operations all hold the same weight? The intuitive answer may be no. But because there is no market consensus on how to calculate relative attribution at present, the framework proposes, as a start, to measure and report indirect climate impact separately from direct climate impact and consider the implications of varying degrees of attribution across the value chain.

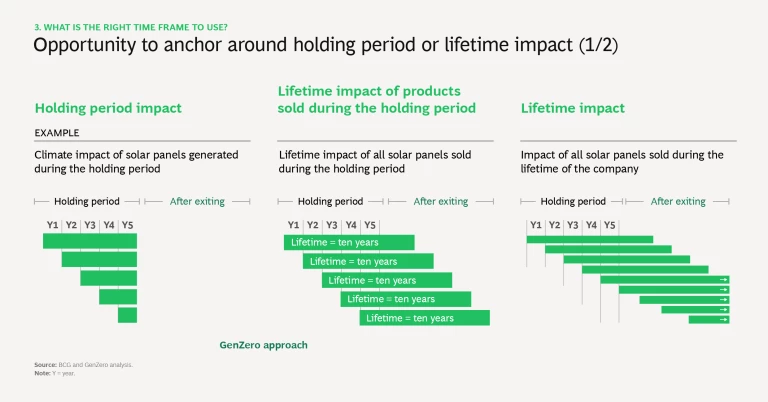

What is the right time frame to use? The next consideration we thought through was equally complicated: what timeline should investors use to measure impact—the holding period, the lifetime value, or a combination of both?

There is no one right answer. But the question is crucial for investors to address because different approaches can result in very different impact quantification and incentivize different investment behaviors. For example, using the full lifetime impact from deploying a decarbonization product or solution independent of the actual investment holding period can artificially inflate results—and could prompt some investors to enter and exit investments quickly while still recording the full lifetime benefit. Conversely, limiting impact to what is generated solely within the investment holding period may deter investors from making investments in early-stage solutions. To address these issues, the framework took a conservative approach, measuring the impact generated during the holding period and balancing investments in near-term and longer-term solutions through portfolio allocation.

Stay ahead with BCG insights on climate change and sustainability

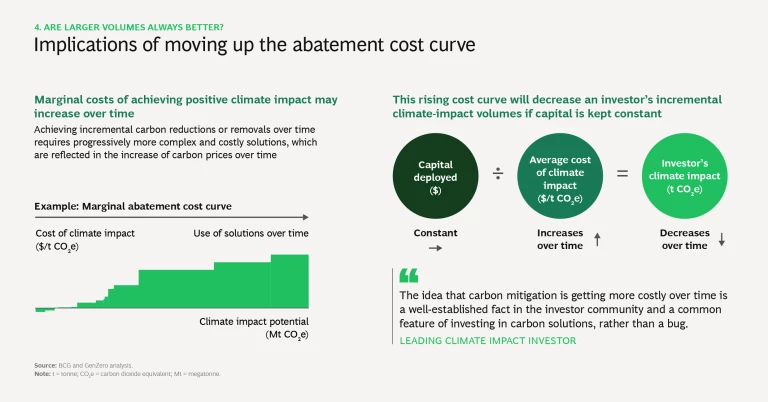

Are larger volumes always better? Investors generally operate under a more-is-better approach and usually step up their expectations on growth and returns over time. But the decarbonization landscape is different. The journey doesn’t end after the most cost-effective solutions have been capitalized. Instead, what a continued climate transition requires is the next wave—solutions that may take longer to mature and are more costly to develop, deploy, and scale.

Financing these next-wave solutions is critical to achieving net zero, especially in hard-to-abate sectors. However, these investments require a different mindset—a willingness to support solutions that can have a significant impact over the longer term. For example, investors should consider nascent technologies that can remove carbon emissions at scale in the future versus mature solutions that reduce or avoid emissions today. In addition, investors should expect that the annual climate impact generated in absolute volume terms may plateau or even decline as investors venture into more complex and costly solutions.

The framework recognizes the tradeoffs between quality, quantity, and the cost of abatement over time, and it advocates building a diversified portfolio of decarbonization solutions to accelerate a global transition, instead of solely maximizing the volume of impact.

Climate impact measurement is no longer a nice-to-have investment practice but a critical component to reach net zero. Investors globally should begin integrating climate impact measurement into their investment processes—and the time to do so is now. While the work on common standards continues, pragmatism should take precedence over perfection.

We share this framework in hopes of galvanizing greater discussion and action on climate impact measurement and fostering greater convergence in market practice.

The authors are grateful to the many industry leaders who graciously shared their time in the development of the framework.

© BCG and © Carbon Solutions Platform Pte. Ltd. 2023. All Rights Reserved.

The companies in which Carbon Solutions Platform Pte. Ltd. directly and indirectly owns investments are separate legal entities. In this article and presentation, “GenZero” is sometimes used for convenience where references are made to Carbon Solutions Platform Pte. Ltd. and its subsidiaries in general.