As the race intensifies to achieve global net-zero emissions by 2050, BCG estimates that governments, industries, and investors will need to contribute between $100 trillion and $150 trillion to address climate change. To achieve that, private investors need better mechanisms to understand how to integrate carbon into investment decision making.

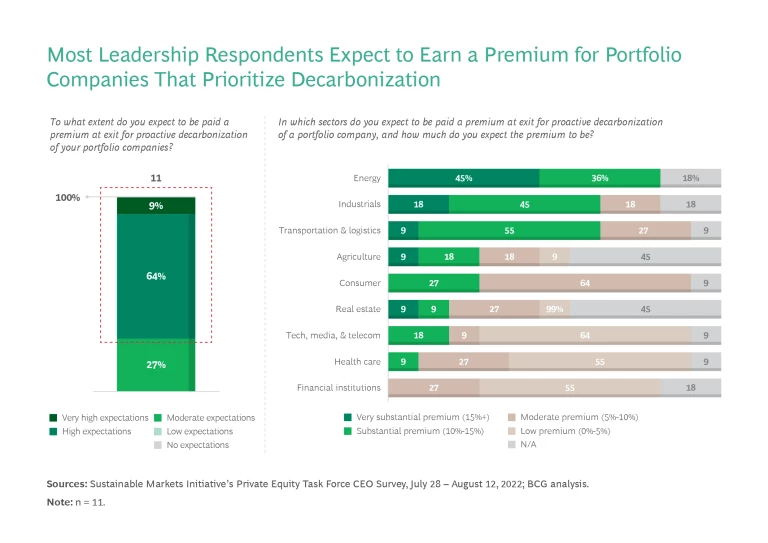

This has been a hard question to answer since, historically, carbon has not been consistently priced into asset valuations. Even so, many private market investors say carbon is already affecting their decisions. According to a survey of leaders in private markets by BCG and the Sustainable Markets Initiative’s Private Equity Task Force, about 70% report high or very high expectations they will earn a premium for a portfolio company that prioritizes decarbonization (see the exhibit), and about 65% have high or very high expectations they will be penalized if a portfolio company makes insufficient progress.

Given the need to more accurately price carbon into asset valuations, the Private Equity Task Force and BCG have developed voluntary best practices guidance—in alignment with established investment methodologies and current data environments—that private equity firms can consider as they take steps toward valuing carbon in the investment process. The framework includes four components that impact carbon-adjusted earnings before interest, taxes, depreciation, and amortization (EBITDA), and one that impacts exit multiples. The ones that matter most may vary by geography and sector.

- Regulated carbon costs: These costs are imposed by regulations or compliance markets, often on a specific sector in a geography, and result in actual cash outflow today and directly lower profitability.

- Internal carbon costs: Firms or portfolio companies may choose to self-impose an internal carbon price on emissions in markets without regulated carbon pricing—or impose an incremental price in markets with regulated pricing. This internal carbon price may be based on expected future carbon costs (for example, from a firm’s specific net-zero commitments that will require the purchase of carbon credits).

- Indirect carbon impacts: A company may incur additional costs or benefits based on the behavior of other market participants—such as customers, lenders, and employees. The impact could be felt on both revenue (a change in demand from sustainability-minded customers, for example) and costs (such as a change in insurance and financing rates).

- Decarbonization value creation: By using abatement levers such as switching to renewable energy sources to reduce regulated and internal carbon costs and increase indirect carbon benefits, companies can create value. But these levers often require some form of investment or expense.

- Carbon-adjusted multiple: Investors need to decide when to adjust a market multiple. If the investor cannot ascertain the forward impacts of carbon (such as the current relative carbon performance, future carbon price outlook, and the decarbonization strategy impact on future performance) in trailing 12-month EBITDA, then it may need to adjust the market multiple.

Early movers offer some important lessons for how others might begin this journey.

That framework represents merely the start of a longer journey for private markets, and each firm will need to decide how to best incorporate carbon into its decision-making processes. Fortunately, early movers offer some important lessons for how others might begin this journey. For example:

- Implement firm and portfolio carbon footprinting to understand the baseline and set priorities among abatement efforts.

- Consider carbon-related costs and benefits in your investments to better prepare for a decarbonized future.

- Define an approach to climate risk and opportunity, and integrate it into strategy to provide clarity across the firm and portfolio.

- Mobilize the organization and grow internal capabilities to ensure the firm is able to embed carbon-related costs and benefits into decision-making processes.

Private markets need to take immediate steps to better understand how carbon affects valuations. The cost of inaction is ever increasing. Ideally, investors will consider the guidance we provide here, which offers a catalyst for action and a way to support firms as they embark on a long-term journey toward energy transition.

The authors would like to thank Adinah Shackleton, Head of ESG at Permira, who contributed to this article.