It’s happening without a lot of attention or fanfare, but the metaverse is spurring a transformation in health care. Innovative companies backed by substantial funding are achieving a rare trifecta—increased access, better outcomes, and lower costs—in areas such as medical and surgical imaging, mental health, and medical training.

Even though the metaverse is still in its early stages of development, most areas of health care are already experiencing its impact. Rapidly advancing technology and increasing adoption suggest significant disruption to come. Providers and payers need to determine now how they will engage with these developments. They should start with an understanding of the range of use cases already in the market, as well as those under development, and then define their vision for how these next-generation technologies can benefit them and their patients. On that foundation, they can decide where to invest strategically and how to prioritize their own use case development so they can evolve with the market rather than follow it.

The Metaverse in Health Care Today

To many, the metaverse invokes gaming and entertainment, but the underlying technologies have real uses in health care today. These include extended reality (augmented reality, virtual reality, and mixed reality, or AR, VR, and MR, collectively referred to as XR); Web3 technologies and applications, such as blockchain and virtual assets; and M-worlds, the live virtual “places” where users gather and create content. So far, the majority of health care use cases involve XR. The technologies are being used in several diagnostic and therapeutic applications, as well as in medical training and meetings and conferences. Companies are also experimenting with blockchain for applications that range from supply chain verification to the storage and management of health care data.

Metaverse technologies can create value for companies in multiple ways, including the following:

- Improving access to care by connecting patients and providers regardless of location

- Enhancing the accuracy of diagnostics and the quality of surgery with advanced technologies

- Reducing costs in care delivery, medical training, and data management

- Opening new possibilities for storage, sharing, and access to data (patient, claims, and provider)

- Enhancing the experience of patients and insurance plan members and diversifying revenues with new offerings

- Lowering operating costs by streamlining such functions as recruiting, learning and development, and payment

As is common with new technologies, startups are driving much of the development activity. (See the sidebar, “Where the Action Is in the Health Care Metaverse.”) Many already have viable products in the market that are being used by major providers. For example, in mental health and neurological treatments, XR-based mental-health therapies—many of which are already FDA approved—are being used to treat anxiety, phobias, PTSD, and general stress. They improve both access and quality of care by increasing the number of care options available, and they are often less expensive and more efficient than traditional mental-health therapies. Examples include Sympatient, which offers a VR-based anxiety treatment that addresses agoraphobia, social phobia, and panic disorders through exposure therapy. Similarly, Oxford VR has developed a platform that provides patients with exposure therapy through “in situ treatments" in a safe space where many different conditions can be simulated.

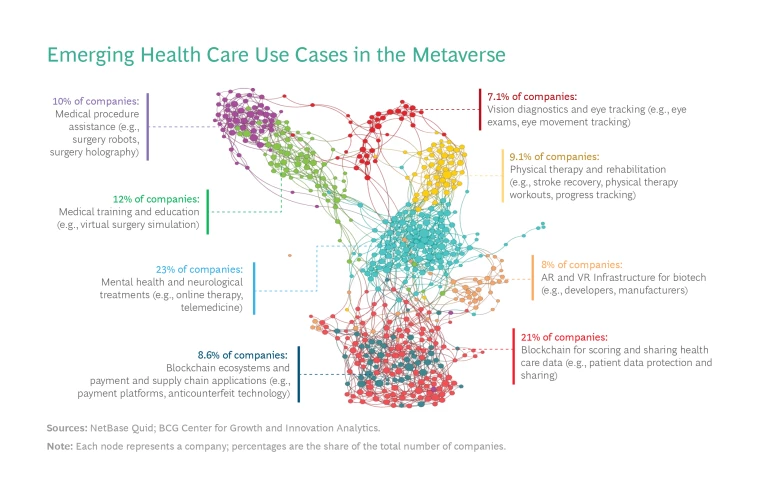

Where the Action Is in the Health Care Metaverse

Where the Action Is in the Health Care Metaverse

Health care metaverse startups received $2.2 billion in private funding during the period we assessed, with investment increasing at an annual rate of nearly 30%. The funding activity took place in all stages of the patient journey (patient engagement, care delivery and management, and payment), as well as in the backing development of enablers and support functions (such as medical personnel, health care data and analytics, and operations).

The majority of use cases that we identified (70% of companies, 90% of funding) use some form of XR and are relevant to providers or payers. Mental health, medical training, and medical-procedure assistance (such as AR-assisted surgery) are the most active XR-related areas. AR and VR infrastructure, medical-procedure assistance, and medical training receive the most funding. Many of the applications (such as training, mental health, physical therapy, vision diagnostics, and AR-supported surgery) are in use by major providers and payers today.

About 30% of companies are developing blockchain technologies, but they receive only 10% of total funding dollars (suggesting that the technology is more nascent and the funding rounds smaller). Blockchain applications include patient data protection and sharing and payment platforms, which have relevance for payers and providers alike.

Major providers such as Johns Hopkins and the Mayo Clinic are using AR to assist in medical procedures, including surgical preparation and execution in spine surgeries and catheter placement. The technology, which enables full (as opposed to two-dimensional) visualization of the patient’s anatomy, improves error rates, speed, and outcomes. Active companies include SentiAR (interactive 3D displays of heart tissue), Augmedics (spinal-cord visualization), and Medivis (superimposed medical images during surgery).

In physical therapy and rehabilitation, XR improves access to care by providing treatment (including stroke recovery, physical-therapy workouts, and progress tracking) regardless of physical location. XR also can lower care costs with home-oriented treatment models and progress monitoring using built-in body sensors. The technology is already being employed by major providers, such as Northwestern Medicine Marianjoy Rehabilitation Hospital. Innovations include XRHealth’s VR-based physical-therapy program, which enables providers to pair patients with therapists who create personalized plans of care administered through VR. GestureTek Health has created VR physical-therapy games that put patients in virtual worlds and allow clinicians to monitor and adjust the parameters of activity for varying levels of treatment.

Major providers are using AR to assist in medical procedures, including surgical preparation and execution in spine surgeries and catheter placement.

To get a handle on how established health care players are approaching the metaverse, BCG surveyed providers, payers, and biopharma and medtech companies in November 2022. We found that a majority of companies are already experimenting with these technologies. Almost three-quarters of health care providers and more than one-third of payers reported using XR, blockchain, or M-worlds in some capacity. While payers reported less use of XR (not surprising, since most XR use cases today are provider centric), they use blockchain more than other players, at 25%. Given the nascency of the metaverse generally, the high levels of use reported by health care companies point to expanding adoption. Indeed, about 90% of executives said they believe that the importance of the metaverse, and their companies’ involvement, will increase.

Despite the number of companies experimenting with metaverse technologies, far fewer have implemented formal programs. Only 17% of providers and 6% of payers have started or are scaling pilot programs. Most payers and providers have yet to define their vision and take a strategic posture regarding the use of metaverse technologies.

The Pace of Adoption Will Accelerate

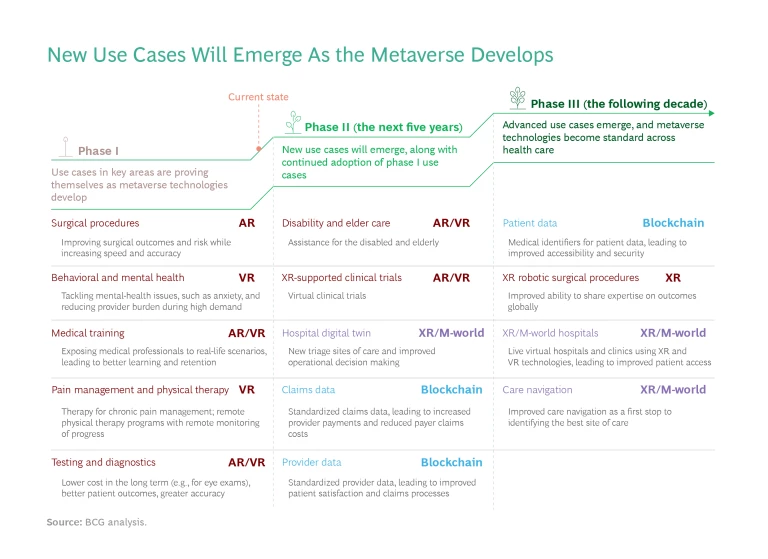

Our research suggests that the metaverse in health care is developing in three phases. We are currently moving from phase one, the period of initial experimentation, to phase two (the next five years or so), which will be defined by the broader adoption of current use cases and the emergence of new use cases as technologies advance. Phase three (the following decade) will see the development of more advanced use cases and the establishment of metaverse technologies across many areas of health care. (See the exhibit.)

As the health care metaverse develops, there will likely be more disruption in more areas. XR-based use cases have already caused many providers to try new approaches in training, therapy, surgery, and diagnostics. As we move into phase two, these use cases will proliferate, and new blockchain—and, potentially, M-world—applications will emerge in such areas as disability and elder care, clinical trials, hospital digital twins, and claims and provider data management. A bit further in the future, phase three will be defined by a convergence of the various underlying technologies, enabling advanced use cases, such XR and M-world hospitals, end-to-end care navigation, remote-VR robotic surgeries, and storage of patient data on a blockchain. At that point, metaverse technologies will be standard in most areas of health care.

The speed of metaverse development in health care depends, of course, on the broader adoption of the underlying technologies. There are strong indications that this is underway in three key areas: technology, content, and enterprise use.

Stay ahead with BCG insights on the health care industry

Better and cheaper XR headsets are coming to market. Both incumbent and new hardware players (such as Meta, Microsoft, and Apple) are expected to drive advances in XR technology, which, in turn, will push the installed base toward critical mass. Our research also suggests the continued convergence of AR and VR devices toward MR headsets with improved capabilities (such as Meta’s Cambria and Apple’s rumored 2023 device). Meta’s Mark Zuckerberg has pointed to 10 million units as the basis for a self-sustaining ecosystem, a milestone that the company’s Quest 2 crossed in the first half of 2022.

As more companies in both B2B and B2C industries interact with users in metaverse environments, new content and solutions from both incumbents and startups are powering a maturing ecosystem and accelerating broader adoption. The integration of new technology with current systems will help to eliminate current content bottlenecks.

Perhaps most important, the number of enterprise strategies incorporating the new technologies is expected to grow in the coming years. Hybrid work will make the metaverse a strategic necessity for attracting talent. Much of the metaverse action to date has been in B2C, but B2B applications are increasingly catching up and may ultimately be where much of the business value is generated. Retail, fashion, and apparel companies have been among the first movers, and a growing list of major companies in the technology, telecommunications, health care, and automotive industries, among others, have become active.

New content and solutions from both incumbents and startups are powering a maturing ecosystem and accelerating broader adoption.

In health care, 77% of providers in our survey and 94% of payers expect their metaverse involvement to increase over the next few years, and none believe their involvement will decrease. Almost two-thirds of providers and half of payers believe investment is needed now or in the next two to three years, suggesting that investment in metaverse technologies will increase, driving advances and adoption.

Assessing the Potential

The metaverse has acquired sufficient traction in health care that providers and payers need to develop a strategy based on the vision they set for their involvement. Some companies and health systems may aspire to be leaders in metaverse adoption. Others may choose to experiment with the technologies, and still others will want to stay on the sidelines and watch. A few may decide that the metaverse has only limited application for them.

Whatever the assessment, it should be made while the window of opportunity is fully open. Early adopters can gain extra value in multiple ways, including the following:

- Learning Curve. Early participation enables companies to stay ahead of the curve and move quickly as use cases scale up.

- Network Effects. Early movers can establish valuable partnerships and alliances ahead of competitors.

- First-Mover Advantage. Organizations can accumulate data and talent ahead of the competition.

- Reputational Impact. Early movers gain a disproportionate share of voice and recognition as leaders.

- Innovation. Companies can create new channels for engagement with patients and members.

To extract the most value from the metaverse, providers and payers need to evaluate how the technologies best fit with their current strategies and operations. The first step is developing a perspective on how the metaverse will grow in areas important to the company or health system and then identifying high-value use cases that align with its strategic goals. This analysis should include an assessment of investment patterns, technology advances, and adoption trends, particularly with respect to high-potential use cases. It should also encompass the health care-specific hurdles that need to be overcome, including factors related to digital infrastructure, regulation, patient data, and reimbursement.

Once management sets a metaverse vision and prioritizes use cases, payers and providers can take four additional steps to build the necessary capabilities for successful implementation. First, explore designing a user experience (UX) for metaverse interactions that delivers both value for users and ROI for the organization. An appealing, user-friendly UX design is essential in health care, as the efficacy of therapeutic use cases is directly tied to the user experience. Good design includes ease of use for a broad patient audience, the ability to customize to specific patient needs, and an engaging interface that users enjoy.

Second, create a digital-twin strategy. Start embedding metaverse use cases into regular operations early. Look for opportunities to develop use cases that support the current strategy and future business development. For example, digital twins—virtual, real-time representations of patients generated using multiple data sources—have a host of current and potential applications in treatment, monitoring, management, and training and development.

Third, develop the capabilities you need to compete. Assess internal talent, identify gaps, and establish a plan to hire or otherwise acquire the necessary skills and technology. Finally, establish a mission control office, including a control center with clear mandates and processes to monitor and oversee the metaverse effort.

Organizations need not make this journey alone. Partnerships with other health care organizations, technology developers, and vendors can accelerate progress and help ensure selection of the best use cases and establishment of the proper supporting infrastructure.

Getting Started Today

Whatever their vision turns out to be, organizations can take a series of no-regret steps to build understanding and relationships:

- Experience the metaverse. Buy some headsets, organize demonstration sessions, and expose the organization to new possibilities. For example, BCG has opened an “office” in the metaverse to help build awareness, interest, and experience among our partners, staff, and clients.

- Form a crew. Bring together experienced and passionate people in a loose structure that facilitates regular interaction and collaboration.

- Collect use cases. Create ways to brainstorm and evaluate the highest-value use cases.

- Foster partnerships. Initiate discussions with potential partners and peers to build knowledge and experience.

- Follow the trends. Stay up to date on technology investments, adoption trends, and changes in regulation.

Metaverse technologies are already increasing patient access to care, improving medical training, improving outcomes in several diseases and surgeries, and lowering costs in multiple areas. Providers and payers that move quickly can drive these use cases to scale while developing other applications. Early movers stand to reap significant value from the emerging technologies.