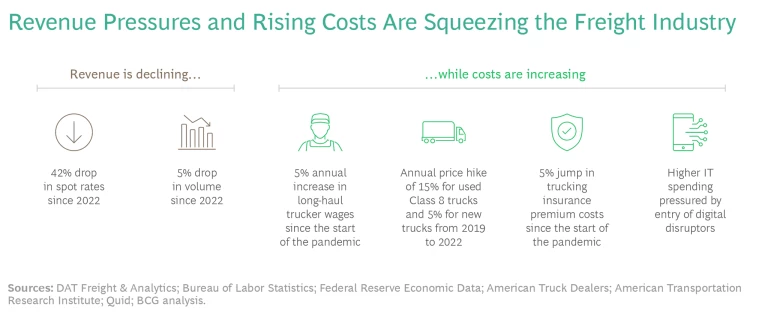

Freight transportation spot rates and volumes are dropping at the same time that labor, vehicle, insurance, and IT costs are on the rise. Together, these forces have created a big squeeze on freight and logistics companies. (See the exhibit.)

We expect cost pressures to continue as companies upgrade their fleets to electric vehicles that are two to three times more expensive than traditional diesel trucks. Pair elevated costs with economic uncertainty, and the result is a truly challenging freight environment.

In response, some industry players are already taking near-term steps to improve their situation. They’re reevaluating contract terms and improving their employee value proposition to attract and retain drivers and other deskless workers in the field. They’re also adopting AI and machine learning for multiple uses, including improving safety, which can cut down on insurance claims.

Nevertheless, to survive and thrive, freight and logistics players must consider broader structural changes, including streamlining and modernizing their enterprise’s organization structure and operating model. And if they haven’t already done so, they must embrace digital transformation and automation throughout their operations, to better compete with well-funded digital disruptors.

Between a Rock and a Hard Place

The pandemic era was kind to the freight transportation industry. E-commerce orders and other economic trends contributed to higher freight rates and increased volumes. Both of those fell back to earth during the post-pandemic era, however, even as key operating costs began to rise.

Near-Term Actions

Freight and logistics companies can adapt to difficult market conditions by making multiple near-term changes that boost revenue and reduce costs. Indeed, many players are already undertaking these moves.

Optimize contracts. Monitor volumes against contract terms to ensure that the company isn’t offering discounts to shippers that are not living up to their side of an agreement, and make adjustments accordingly. Use technology to track contract terms, volumes shipped, customer billings, and the like to prevent revenue leakage and bring discipline to these processes.

Bolster sales by looking beyond price. Strengthen customer relationships by selling on more than price alone. Offer value-added services and loyalty programs. Create digital sales channels as a cost-effective way to stay in touch without commoditizing your service. Measure sales on metrics above and beyond volume, including on profit and on product and customer mix. Be willing to let go of volume that isn’t profitable.

Offer more to deskless workers. To counter pressure from rising wages and high turnover, improve the employee value proposition for drivers, package handlers, and other so-called deskless workers beyond direct pay. Previous BCG research found that most of the top factors that motivate deskless workers to quit a job involve the organization’s failure to meet the employee’s emotional needs, including feeling fairly treated and appreciated, doing work that’s meaningful and enjoyable, and having a good relationship with a manager or boss. An employee value proposition that accounts for these worker preferences might include improving the working environment such as by establishing more predictable schedules for long-haul drivers, with fewer nights on the road. It might also include offering more comprehensive benefits, such as guaranteed hours, a transparent career path, more opportunities for training, and better front-line managers.

Use AI and machine learning for multiple use cases, including to improve safety and reduce claims. Apply advanced analytics to identify factors that contribute to safety risk. With that information in hand, design preventive measures to reduce accidents and thereby lower insurance costs.

Long-Term Structural Changes

To survive the big squeeze, freight players must also look beyond near-term actions and make structural changes. We see four specific opportunities that companies can capitalize on in order to stay competitive.

Redesign the organization and operating model. The new realities of the freight industry call for a leaner cost structure, which may in turn necessitate an organization redesign. Map out a redesign blueprint that removes unnecessary layers and duplicate roles while optimizing spans of control—decisions about who reports to whom. Redefine roles and responsibilities, governance models, and business processes to support the reimagined structure.

Optimize the freight network. Assess freight hubs, stations, warehouses, and the like in the company’s physical network to identify nodes that can be modified or eliminated in light of demand and network flows. Revisit routes to pinpoint opportunities to redesign and optimize freight flows to improve costs, strengthen service quality, and enable future growth. Reoptimizing freight flows is a better strategy than chasing utilization, which can be unprofitable.

Review pricing and services. De-average pricing to focus on specific segments and subsegments of the market—for example, for verticals, shipment types, and lanes. Revisit customer service levels to prevent overservicing (providing more services than those stipulated in contracts), or add accessorial charges to agreements to reflect higher costs. Set up agile pricing processes that include regular structured reviews to ensure that pricing continues to match services rendered.

Go all in on digital. Upgrade digital capabilities throughout the business to streamline front-end customer touch points and back-end processes. As part of an upgrade, increase use of application programming interfaces or electronic data interchange to improve integrations with shippers and thereby increase stickiness. Deploy digitized real-time customer reporting tools and interfaces, and use robotic process automation to replace manual workflows. Explore developing new digital business models to drive incremental revenue and stave off tech-based logistics disruptors.

There’s no getting around it: current freight industry market dynamics are challenging. But given the circumstances, freight players that embrace bold moves to redesign their business accordingly will be in a better position to thrive and win.