The global asset management industry’s assets rose to nearly $120 trillion in 2023, reverting from a decline the year before. However, asset managers are facing a variety of challenges to their growth. Investors are gravitating to passively managed funds and other products that have lower fees even as asset managers’ costs increase. Their efforts to create new products that would differentiate them from competitors have largely fallen short, with investors sticking mostly to established products with reliable track records. Historically, the industry has been able to weather these pressures thanks to revenue growth that has been largely driven by market appreciation. In the years ahead, however, market appreciation is expected to slow, creating further challenges to the industry.

In the face of these pressures, asset managers will need to rethink the way they operate in order to maintain the growth and profitability of past years. The most viable way forward is by using an approach that we call the three Ps: productivity, personalization, and private markets. Asset managers should increase productivity, personalize customer engagement, and expand into private markets.

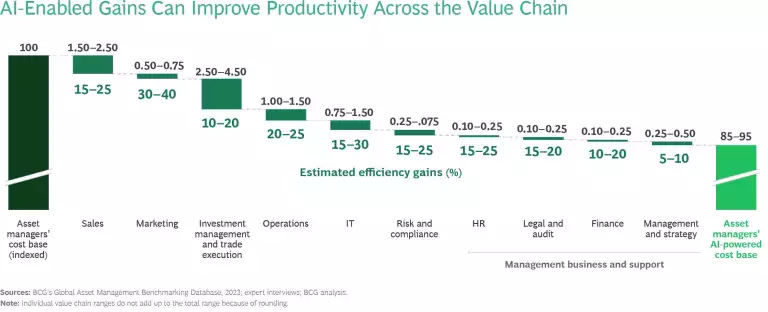

As the artificial intelligence (AI) technological revolution gathers momentum, asset managers have an opportunity to invest in AI and integrate it into their operations in ways that can enhance a three Ps strategy. AI can boost productivity by enabling improved decision making and operational efficiencies. (See the exhibit.) It can be leveraged to create and manage personalized portfolios at scale and to tailor the customer experience. And AI can enhance the efficiency of deal teams in private markets and boost their ability to drive value creation. In adopting AI to facilitate these key moves, asset managers should view the technological possibilities as transformational tools for their organization.

As part of this year’s report, we surveyed asset managers with collectively more than $15 trillion in assets under management to gather their views on the role of AI in their business. The vast majority of survey respondents expect to see significant or transformative changes in the short term, and two-thirds either have plans to roll out at least one generative AI (GenAI) use case this year or are already scaling one or more use cases.

Waiting is not an option when it comes to investing in AI. The technology is rapidly developing, and asset managers that do not start their journey now risk being left behind.