Large fast-moving consumer goods (FMCG) companies have a long history of strong performance and value creation. But in recent years, they have faced intensifying headwinds of change and disruption. This new era of turbulence demands a new playbook to compete. Based on our analysis of FMCG companies that have consistently delivered shareholder value creation amid disruption, we have identified six essential actions that will prepare other companies to win in the future.

A Challenging Decade for FMCG Companies

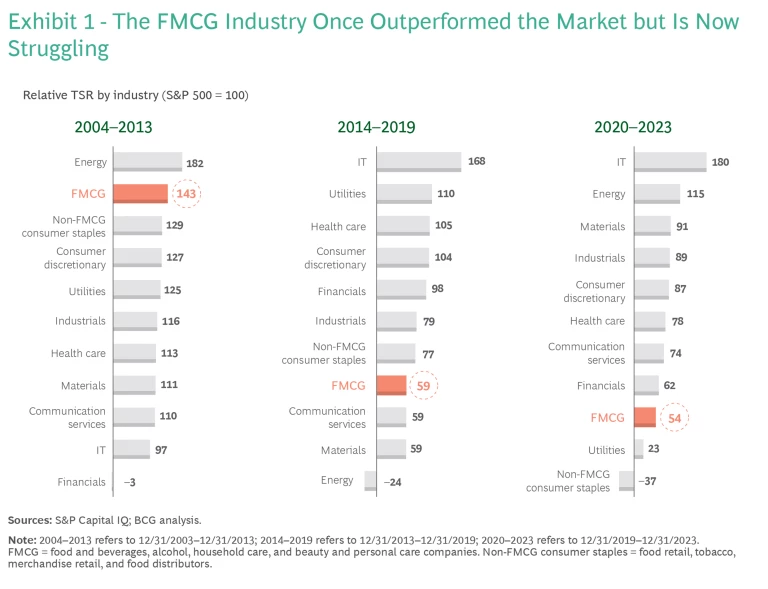

At the start of the millennium, the FMCG industry was consistently outperforming other industries in total shareholder return (TSR). The industry enjoyed steady top-line growth in mature and emerging markets and healthy returns buoyed by strong brands and scaled go-to-market systems.

But the last decade has brought a set of challenges that have disrupted the old model. Traditional scale advantages have been eroded by new technologies across the value chain, a proliferation of upstart competitors, and the growing power of key retail customers.

These fundamental changes have damaged the FMCG industry’s value creation. Since 2013, the industry has sharply underperformed most other industries. (See Exhibit 1.)

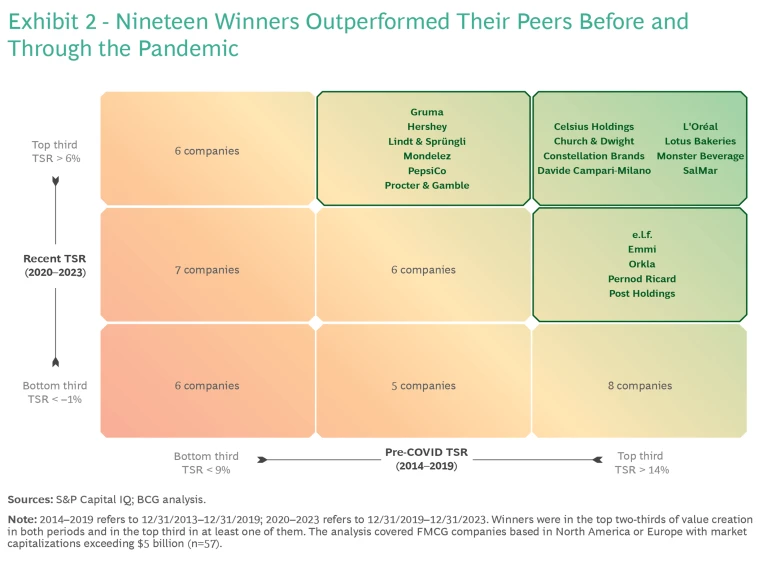

Despite these headwinds, there is still reason for optimism. A set of 19 leading FMCG companies have overcome the challenges of the last decade and delivered strong shareholder returns both leading up to and through the pandemic. The list of winners includes well-established giants such as L’Oréal, Procter & Gamble, and PepsiCo and smaller fast-growing brands such as Celsius and e.l.f. Collectively, they generated a median annual TSR of 7% from the end of 2019 through the end of 2023, compared with 0% for the rest of the industry. (See Exhibit 2.)

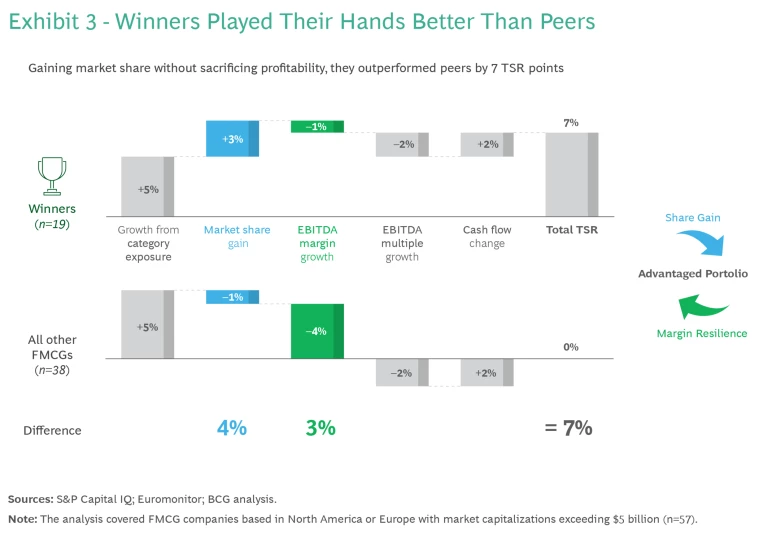

These companies did not rely simply on being in the right category at the right time. Rather, they gained market share without sacrificing their margins. They invested in balanced growth, raised prices smartly, and protected their bottom line. (See Exhibit 3.)

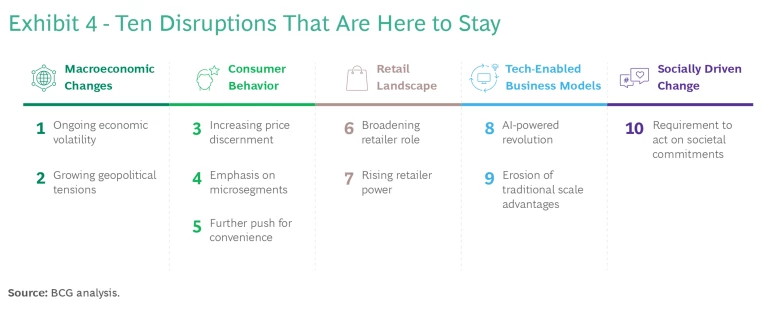

By understanding the strategies of these winners and adapting to a more challenging era, other companies can improve value creation—and prepare for the economic, consumer, retail, technological, and societal disruptions that will continue to affect the industry. Some of these disruptions will escalate in intensity. (See Exhibit 4.)

A Winning Playbook

By looking back at how their successful competitors achieved enduring TSR—and looking forward at ten ongoing disruptions—FMCG companies can chart their own paths to a prosperous future. We have identified six interlocking, self-reinforcing, and essential actions that collectively make up a winning value-creation agenda for FMCG companies. (See Exhibit 5.)

Become an always-on portfolio manager. The days of passive portfolio management are over. Consumers are increasingly selecting brands that connect with their personal values, trading up and down within categories, and seeking convenience. As consumer behavior evolves and margins continue to come under pressure, companies should shape their portfolio of brands toward more attractive spaces and reinvest in their leading brand positions.

Drive consumer-centric innovation and engagement. Companies need to understand how consumers make purchasing decisions and engage with them across many touchpoints. These skills are critical as the shopping experience continues to evolve. Winning companies will combine demand science-driven strategies with omnichannel execution across the full sales funnel. AI-enabled data and analytics and a consumer-centric organization and culture will enable end-to-end demand generation and activation.

Execute dynamic, deaveraged pricing. While most FMCG companies increased prices significantly over the past two years, winning companies mastered a set of digital enablers to improve their net-revenue-management capabilities. These levers—including dynamic, near-real-time pricing; automated pack recommendations based on market sensing; automated store-level assortment recommendations; and optimization of trade spending—can help improve EBITDA margins by five points or more.

Activate next-generation tech and analytics. The expansion of digital and AI-enabled tools allows FMCG companies to reduce costs, improve decision making, and connect with consumers in new ways. The arrival of generative AI gives FMCG companies the opportunity to leapfrog into new areas, such as AI-enabled product ideation and design, personalized marketing, and conversational shopping. Companies that remain on the AI and GenAI sidelines will fall behind more advanced competitors.

Fuel growth through productivity and cost discipline. Winning FMCG companies have better insulated themselves from economic and geopolitical uncertainty and natural disasters by creating efficient but flexible supply chains that can adapt to changing conditions. This balance of resiliency and efficiency will help companies combat ongoing economic uncertainty.

End-to-end supply chain transformation—across design, procurement, lean manufacturing, distribution, planning, and network optimization—can typically reduce supply chain costs by 10% to 25%. It will also streamline the operating model to boost agility and improve data-driven and efficient decision making.

Deliver purposeful societal impact. Climate change and social issues are increasingly informing consumers’ purchasing decisions. By creating a meaningful purpose and building sustainability and other social objectives into their business, FMCG companies can build loyalty with employees, consumers, and other stakeholders. They can also generate new revenue streams by creating sustainable products and reduce overall risk by cutting the use of energy, water, and raw materials.

Tough but Navigable Terrain

Economic volatility, consumer choice, and the strong negotiating position of retail customers are powerful dynamics in the FMCG landscape. Top companies have met these challenges by strategically investing in balanced growth.

BCG’s companies of the future work shows that that future-built, or farsighted, companies outdistance their competitors in financial performance, innovation, and employee engagement. The more prepared for the future, the greater their performance premium over peers. For FMCG companies, this landscape is an invitation for reinvigoration and reinvention. Complacency is not an option.