This article is part of a series examining the competitive outlook for key global process industries and how they can prosper in an uncertain future.

The past few decades were a golden era for materials and process industries like metals, cement, paper, and chemicals. A time of breakout growth, it was fueled by falling trade and investment barriers, technological advances, cheap investment capital, and the economic opening of China, India, and the old Soviet bloc. Global steel production rose by around 150% from 1990 through 2021, and cement output by nearly 250%. Global raw material exports soared 20-fold over this period, to $2.6 trillion.

Those halcyon days are over. Which producers will the business upheaval affect the most? And how can companies adapt? In this article, we explore the implications across these industries. In a series of upcoming publications, we will examine more deeply how specific materials and processing sectors will be affected and how several of the overarching trends will evolve.

A far more difficult business environment is replacing the favorable tailwinds these industries had.

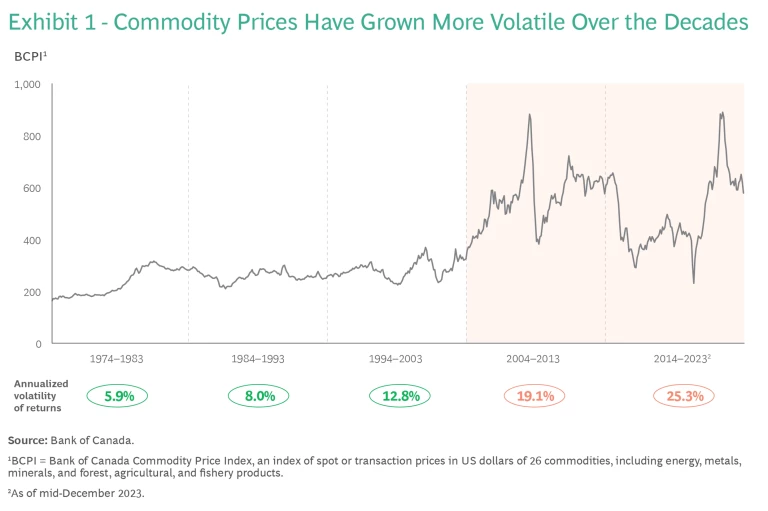

A far more difficult business environment is replacing the favorable tailwinds these industries had during the high tide of globalization and easy money. Geopolitical tensions, trade restrictions, shifting demand, supply shortages, greater regulatory and stakeholder demands for sustainability, and aging workforces are ushering in a new age of uncertainty. This is evident in material and commodity prices, which over the last few years have seen massive swings and are three times as volatile as they were at the turn on the millennium (Exhibit 1).

Because basic process industries furnish the building blocks of all finished goods, there are immense implications for company supply chains in a broad range of sectors. In the years ahead, the challenges will drive technological change and redefine industrial cost structures, global trade relationships, and the competitive advantages of both companies and nations.

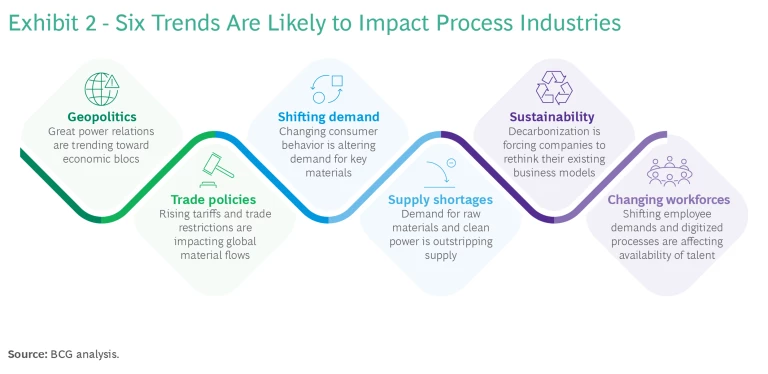

Six fundamental trends are altering the global landscape of materials and process industries.

Six Drivers of Disruption

We see six fundamental trends that are altering the global landscape of materials and process industries. (Exhibit 2.)

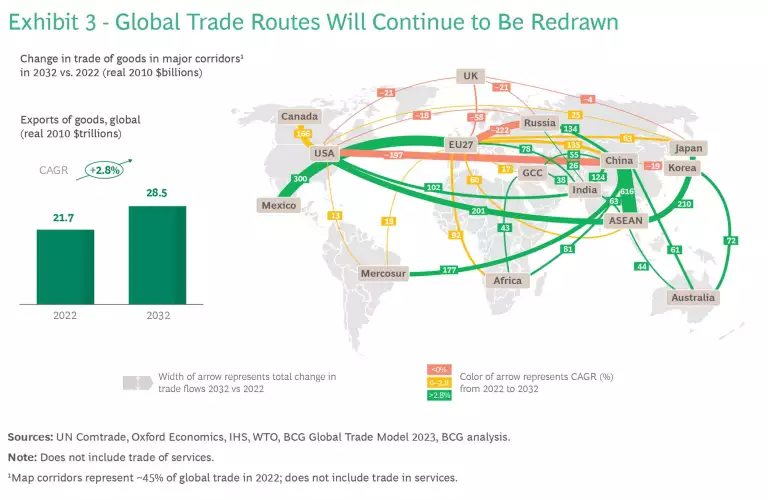

Geopolitics. Tensions between Western economies and China and Russia are disrupting decades-old global trade relationships and leading to the creation of new ones, with far-reaching consequences for materials industries. (Exhibit 3.) Europe’s chemical industry, for instance, relied heavily on Russian natural gas as a feedstock. The war in Ukraine has forced European chemical plants to rely on more expensive gas from other regions; many European plants are struggling to remain cost competitive. By contrast, chemical producers in India, the Middle East, Southeast Asia, and Latin America have opportunities to benefit from structural shifts in global trade by gaining greater access to major markets, such as China.

Trade policies. Several countries have increased tariff barriers against imported materials over the past decade in response to geopolitical tensions or in an effort to protect domestic industries and advance their national industry policy objectives. The sudden US decision to raise duties on imported steel and aluminum in 2018, for example, disrupted markets for these commodities. More recently, the EU has begun to implement new climate and ESG regulations on traded goods. The Carbon Border Adjustment Mechanism requires importers to report the greenhouse gas footprints of most materials imported into the EU; after a transition period the bloc will begin assessing levies on emissions associated with those materials. The EU also plans to launch the European Union Deforestation Regulation in 2026. The economic impact of both measures is expected to be heaviest in emerging markets, where producers are scrambling to comply and find ways to remain competitive in the world’s second-largest market. For example, up to 2% of Mozambique’s GDP is estimated to be at risk, due to potential lost market share in the EU for its aluminum exports. In absolute terms, the heaviest impact could be felt in China and India, where the new rules will apply to a range of industries. Companies will need a clear view of the new complexities in global trade and reconfigure their value chains accordingly.

Shifting demand. Technological advances, government policies, and changing consumer tastes are creating a greater need for certain materials and commodities at the expense of others. The growing need for semiconductor chips due to the AI boom, for instance, is boosting demand for high-quality silicon. The transition to clean energy sources will reduce demand for coal and gasoline, while the need for rare earth elements and composites such as carbon fiber that are important inputs in clean energy systems will continue to grow. Changing consumer behavior also has implications for materials and process industries. Falling consumption of cookies, candy, and other snacks as consumers grow more health conscious is driving demand for different packaging. Process industries must anticipate such trends and get ahead of them to take advantage of new opportunities and to avoid becoming irrelevant.

Global competition for critical inputs and energy will grow.

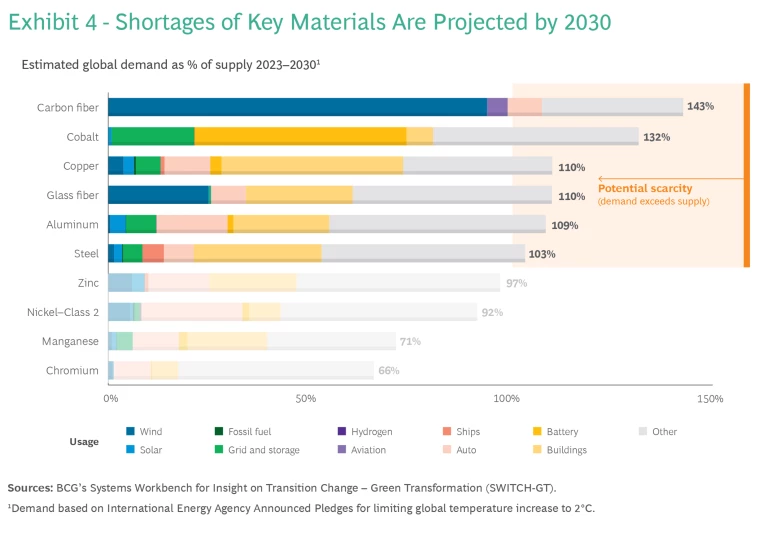

Supply constraints. Shortages and volatile prices for raw materials are becoming greater challenges for materials industries, with many critical shortages expected by 2030. (Exhibit 4.) Supplies of carbon steel scrap used in electric arc-furnace steel mills, for example, are projected to fall short of demand. Decades of aggressive extraction are depleting much of the world’s easily accessible, high-quality reserves of ore for metals, sand for concrete, crude oil for petrochemicals, and other natural resources. Companies have also grown more cautious about additional investment in processing raw materials after freewheeling capital investment in the early 2000s was followed by massive write-offs. Process industries that are under pressure to decarbonize are also likely to have to cope with a massive shortfall of clean energy: Steel and aluminum producers will struggle to secure sufficient supplies of green hydrogen to replace coal.

Materials industries must anticipate that global competition for critical inputs and energy will grow and that supplies will become tighter and more costly. As they project the impact of rising input costs on future profitability, companies producing industrial materials must think hard about their future product offerings.

Sustainability. Materials industries are under mounting pressure from investors, consumers, regulators, and other stakeholders to maintain high sustainability standards throughout their supply chains. Materials industries have begun switching to eco-friendly feedstocks. The plastics industry is investing heavily to develop biodegradable polymers; while these compounds are not yet commercially viable, the constraints of limited scale and inefficiency can be resolved through engineering, rather than requiring advances in the underlying science. Cement producers are experimenting with a range of alternative fuels and raw materials, such as sewage sludge, contaminated soil, and waste oil to generate power with a lower carbon footprint. Materials industries will need to invest in upstream business models that can deliver reliable and cheap access to alternative inputs.

Companies must also invest to improve processes that, in some cases, have changed relatively little for decades. For instance, more industries are turning to electric heat pumps that do not directly emit greenhouse gases, unlike conventional temperature-control systems that burn fossil fuels. As technology evolves, such new systems are expected to become more efficient.

There is also growing demand for products that are more durable, and therefore result in less waste. Durable plastics can reduce the Scope 3 emissions associated with everything from automobiles to medical devices by extending their lifespans and reducing the need for parts replacements. Materials producers are also being pushed to improve the circularity—recycling or reuse of inputs of their products—which will require some process industries to redesign manufacturing processes. While Western manufacturers currently lead in making the transition to more sustainable materials, emerging-market companies are also beginning to embrace this trend.

As the pressure to go green intensifies, the winners will be companies that can quickly and effectively bring new technologies for everything from biological feedstocks for chemicals to biodegradable plastics out of labs and pilot plants and into production.

Demographic shifts threaten to reshape materials industry workforces.

Changing workforces. Demographic shifts across the globe threaten to reshape materials industry workforces in the coming decades. Many sectors in developed economies will experience a wave of retirement of experienced workers who will be hard to replace, particularly in aging societies. In Japan a diminishing working-age population and challenging immigration policies will make it all but impossible to replace skilled workers in industries such as steel. In the US, low pay and job insecurity in materials industries, and the desire of the next generation to work in more technology-focused, white-collar roles, make it harder to recruit and retain talent. Furthermore, the US labor market entered a cyclical era of tightness prior to the pandemic. Companies should prepare by improving their value propositions for young talent, who will have higher expectations and more attractive career options than previous generations.

Adapting to the Turbulent New Era

These disruptive trends carry risks that will impact technology evolution, cost inputs and profitability, supply-chain relationships, and competitive advantage itself. Process industries, historically slow to adapt their business models, will have to place bets on multiple strategic choices that present both promise and uncertainty.

The confluence of forces constitutes a perfect storm for materials and process industries. But companies can, with bold action, take advantage of the turbulent future ahead.

The authors wish to thank Philipp Carlsson-Szlezak, Dave Young, Michael McAdoo, and Saurabh Harnathka for their valuable contributions to this article.