Companies in all industries are launching cost transformations, and chief financial officers (CFOs) are the most likely candidates to lead those programs. CFOs, after all, have a deep understanding of their organizations, they’re able to maintain an independent perspective on other functions, and they focus on results.

To establish a track record of successful cost reduction, CFOs should start with the function they directly oversee: finance. Finance functions are ripe for cost optimization: they’re people- and software-intensive, often with repeatable processes that can be improved through technologies like AI.

Systematic cost programs offer sizable, quick opportunities to reduce costs—by 15% to 35%, in our experience.

What’s more, many finance organizations haven’t undergone systematic cost programs yet. For that reason, they offer sizable, and quick, opportunities to reduce costs—by 15% to 35%, in our experience—along with significant nonfinancial benefits such as faster execution, streamlined interfaces and ways of working, and the elimination of silos. Once CFOs have reduced costs in their own function, they’ll have the experience and credibility to lead those efforts across the rest of the organization.

Stay ahead with BCG insights on corporate finance and strategy

The Growing Need for Cost Transformation

Across virtually all industries and geographic markets, costs are at the top of the C-suite agenda. Inflation, volatile interest rates, tariffs, and uneven consumer and business confidence are squeezing profit margins.

Moreover, companies need to unlock resources for other strategic initiatives. A recent BCG study found that 33% of corporate leaders see cost management as the most important strategic priority for 2025, and roughly two-thirds plan to reinvest those gains into growth and innovation. For that reason, many companies are launching cost transformations. (See “The What and the How of Transformation.”)

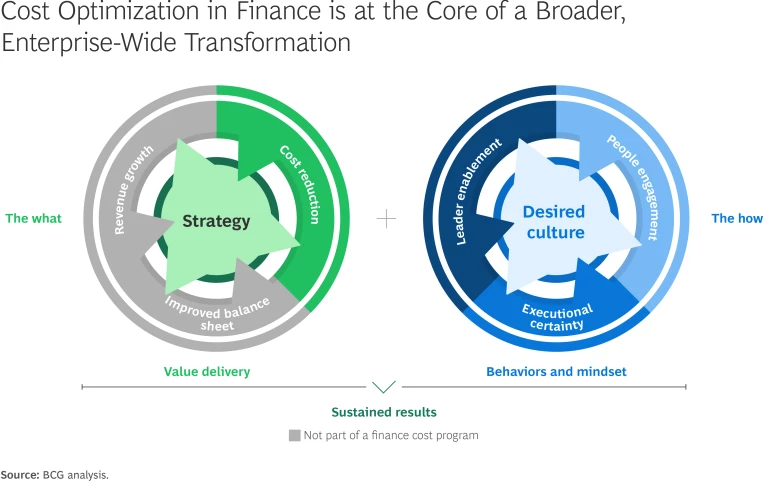

The What and the How of Transformation

To unlock value, many organizations focus on the structural elements of a transformation—the “what,” in other words. But in BCG’s experience, lasting change only happens when companies also address the “how”: changing the behaviors and mindset of employees to ensure that new ways of working take root and the gains are sustainable. (See the exhibit.)

Yet major change programs can be disruptive for organizations. Uncertainty about the overall impact, ambiguous communication, lack of experience with similar situations, and ineffective oversight can reduce the odds of success. Even when they succeed in the short term, many cost programs don’t deliver sustainable gains—and companies end up repeating the process two or three years later.

That’s why starting with a cost program in the finance function makes sense. Achieving ambitious cost targets within finance sends a signal to the entire organization, generating buy-in across all functions to drive the broader program to success. From there, CFOs and their teams can provide an overarching perspective on the company and the implications of a cost program; they can also offer financial guidance and support with structured program management.

The Benefits of a Cost Program in Finance

When a CFO-led cost program in finance succeeds, it generates two categories of benefits: financial and nonfinancial. Financial benefits include an improved cost base, a better cash position, access to financing under improved terms, and positive reactions from investors and analysts rewarding the push for a leaner and more effective function.

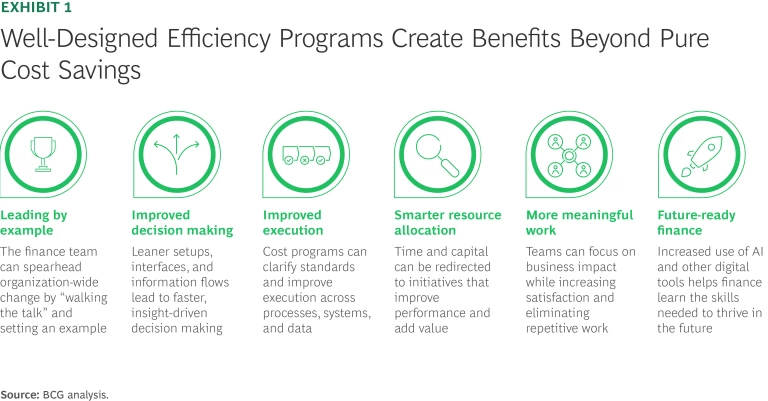

Yet the nonfinancial benefits can be nearly as significant. (See Exhibit 1.) Streamlining the finance function eliminates silos, reduces friction and bureaucracy at organizational interfaces, and leads to more agile communication—both within finance and between finance and the business functions. Optimizing processes leads to improved decision making through timely, accurate insights, while harmonized standards increase consistency across teams. And automating manual processes improves the way resources get allocated, freeing frontline employees and managers to focus on higher-value activities.

Along the way, the CFO builds a strong argument for a more comprehensive cost program across the entire enterprise.

To maximize the financial and nonfinancial benefits of a transformation program, CFOs must always maintain a balance between efficiency gains and quality. Efficiency should never impact the CFO’s main objective: delivering accurate, timely, and insightful financial support to the organization.

BCG research shows that best-in-class CFO organizations maintain their effectiveness while simultaneously achieving efficiency targets. To do that, CFOs must assess which activities drive critical outcomes and reallocate resources accordingly, avoiding efficiencies that hinder compliance, risk management, or decision-making capabilities.

Several companies have already launched highly successful programs to reduce costs in the finance function. Two examples:

- A consumer company struggled due to a diverse set of business units, manual processes, and heterogeneous data and IT systems. To improve, the CFO developed a cost-optimization plan to redesign the organization and streamline processes—identifying potential savings of roughly 30%.

- At a pharmaceutical company, the CFO designed a program to improve the finance function from the ground up, including improved processes and an updated split between internal and outsourced activities. Even though the finance function had previously undergone a cost program, the new effort identified overall savings of 20% in finance, building the CFO’s credibility for a broader, company-wide cost program.

Six Measures to Reduce Costs in Finance

Lessons from these and other cases highlight six levers that CFOs can use to reduce costs within finance.

Optimize the organization. Optimizing the organization includes streamlining management layers and increasing leadership spans in finance, along with reducing satellite locations (such as in other countries) and consolidating teams into larger, centralized units. These steps make finance more efficient by eliminating silos and reducing duplicated efforts at multiple sites. They also simplify IT architecture, which increases potential cost benefits.

Streamline process designs. Leading finance organizations use technology to help teams automate some processes and eliminate redundancies in others—making transactions and areas like financial planning and analysis more efficient and scalable as a result. In addition, finance can eliminate exceptions, aligning processes to make them consistent across entities and documenting target designs so that changes take root. Ultimately, streamlined designs create opportunities to outsource process steps or entire processes via shared services centers.

Reduce manual work. Eliminating manual tasks through standardization, centralization, and automation reduces errors, accelerates processes, and decreases labor costs. It allows finance teams to focus on higher-value analytical and strategic activities, fostering innovation and improving overall productivity.

Upgrade systems and tools. At many finance organizations, technology has proliferated over time, leading to incompatible systems and data sets across entities and outdated solutions carrying high maintenance costs and licensing fees. Modern solutions implemented with a clear design strategy can deliver much greater insights while reducing operational costs. Streamlined solutions create economies of scale in software licenses and reduced expenses for customization—and they offer greater cybersecurity as well.

Harmonize and simplify data. Finance is often the repository of many sources of data within the organization, making data management and governance a critical priority. Harmonized data and strong governance among sources (for example, finance and sales) ensure that high-performance systems and tools have accurate, up-to-date, available data. CFOs can generate efficiencies by systematically cleaning, integrating, preparing, and processing data, creating a single source of truth for all company data.

Capitalize on digital solutions. Digital solutions create a multiplier effect, increasing the cost optimization potential of all five other levers. This is particularly true for automation and AI, which has led to dramatic gains in process execution and unlocked significant value for our clients. These tools also have proven their worth in areas such as fraud detection, risk analysis, and simplifying data.

How CFOs Can Get Started

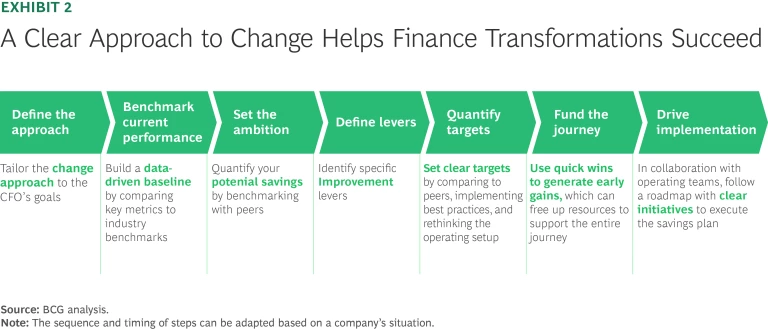

In our experience, cost optimization efforts in finance should start with the following steps. (See Exhibit 2.)

Define the approach. Get a clear understanding of the initial situation, specific challenges, and the organizational landscape to tailor the overall approach, including how to communicate the plan for the cost program.

Benchmark current performance. Benchmark the organization against a large set of companies in similar situations—both within the industry and beyond—to set an objective qualitative and quantitative baseline. Tools such as BCG’s CFOx Index Panel, which builds on insights from approximately 1,300 CFO organizations, can help evaluate a company’s starting point and provide recommendations. The tool identifies strengths and weaknesses across all finance subfunctions, addressing 100 categories including strategy, setup, and processes, and it highlights potential improvements and cost-reduction opportunities. It also includes dedicated modules for digital finance, efficiency levers, and AI (including GenAI).

Set the ambition. Define the overall ambition for cost savings, including specific processes and areas where cost efficiency needs to improve and other qualitative improvements that can be made.

Define levers. Collaborate with the transformation team to define the most relevant improvement levers. Typically that includes three to five areas of change, with 20 to 30 underlying initiatives.

Quantify targets. Quantify the savings potential and timelines for all levers in detail. Targets must be ambitious enough to create real impact while also being achievable for the organization.

Fund the journey. Sequence activities to prioritize quick wins early on, freeing up key employees’ time to assist in the transformation and creating lighthouse examples that make change tangible. The most impactful starting point depends on the individual situation, but changes in organization design, processes, or systems setups all can generate rapid gains and build momentum for the broader effort.

Drive implementation. Set the right implementation process, sequence, and team. This requires a tailored approach that takes the specifics of the organization into account while prioritizing initiatives, allocating resources, and setting clear responsibilities for each initiative.

CFOs have an explicit mandate to oversee their own function as well as the broader cost performance of the entire company. By leading a cost-optimization effort in finance, CFOs can not only improve the efficiency and effectiveness of the function but also use it as a springboard for a broader cost-optimization program. In that way, CFOs can help position their company for long-term success.