The New Drug Modalities 2025 report builds on the 2023 and 2024 analyses to offer an up-to-date perspective on the evolving biopharmaceutical landscape. As in prior years, we tracked the progress in six major novel modalities in terms of the number of products, pipeline revenue, and deal activity. Our goal was to determine which modalities industry analysts consider to be progressing most rapidly, which hold the greatest promise, and what these findings imply for patients as well as biopharma sponsors.

This year’s report includes a new feature: an assessment of the clinical pipeline of Chinese companies. These firms now have more than 4,000 clinical-stage new-modality drugs in their pipelines, second only to the US. Furthermore, large pharma deals increasingly feature assets originating from China.

New Modalities Experiencing Accelerated Growth

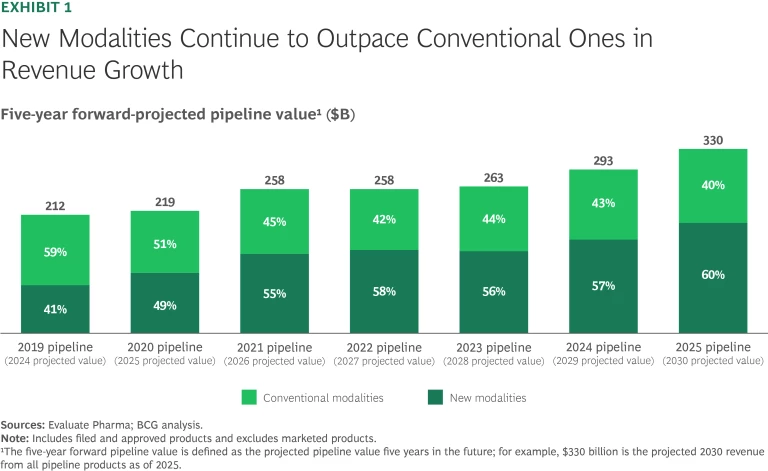

After remaining relatively stable for the past three years, projected new-modality pipeline value has risen to $197 billion in 2025, a 17% increase from 2024, far outpacing conventional modalities. This growth, the greatest in any year since 2021, is not consistent across modalities. It is driven primarily by antibodies, proteins and peptides (specifically GLP-1 therapies), and nucleic acids. (See Exhibit 1.)

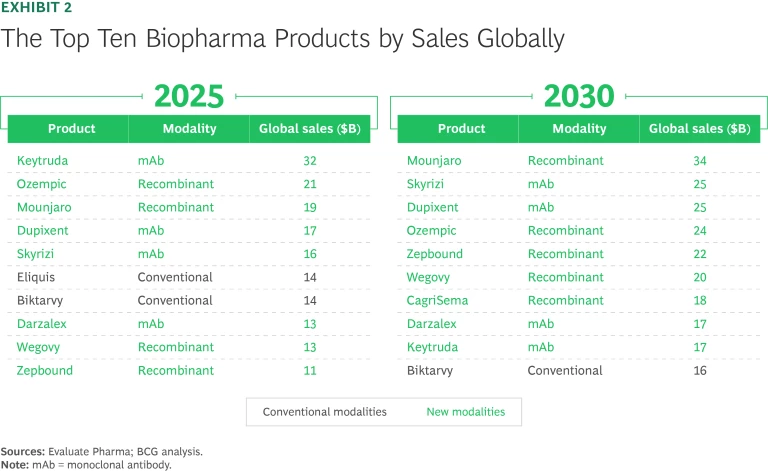

Eight of the ten best-selling biopharma products in 2025 are new-modality drugs. (See Exhibit 2.) Three of the top ten are newcomers to the list: GLP-1 agonists Mounjaro, Zepbound (both from Lilly), and Wegovy (Novo Nordisk). These three recombinant proteins have replaced conventional drug Jardiance (Boehringer Ingelheim and Lilly) as well as two monoclonal antibodies (mAbs), Stelara (Johnson & Johnson) and Opdivo (Bristol Myers Squibb). Analysts project that nine of the top ten products by revenue in 2030 will be new-modality therapies, including five GLP-1 agonists.

Where the Industry Is Betting Big—and Small

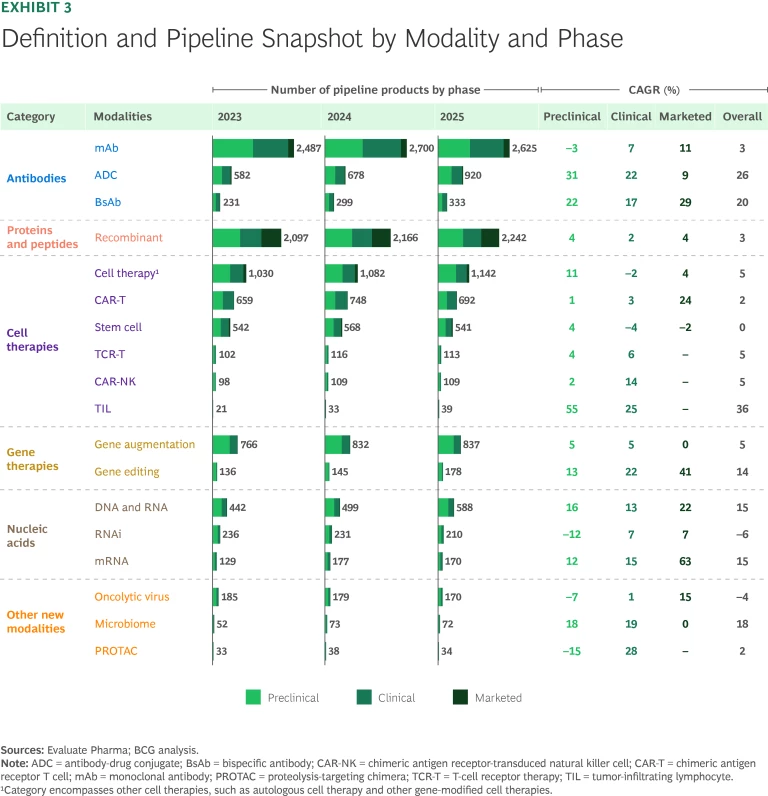

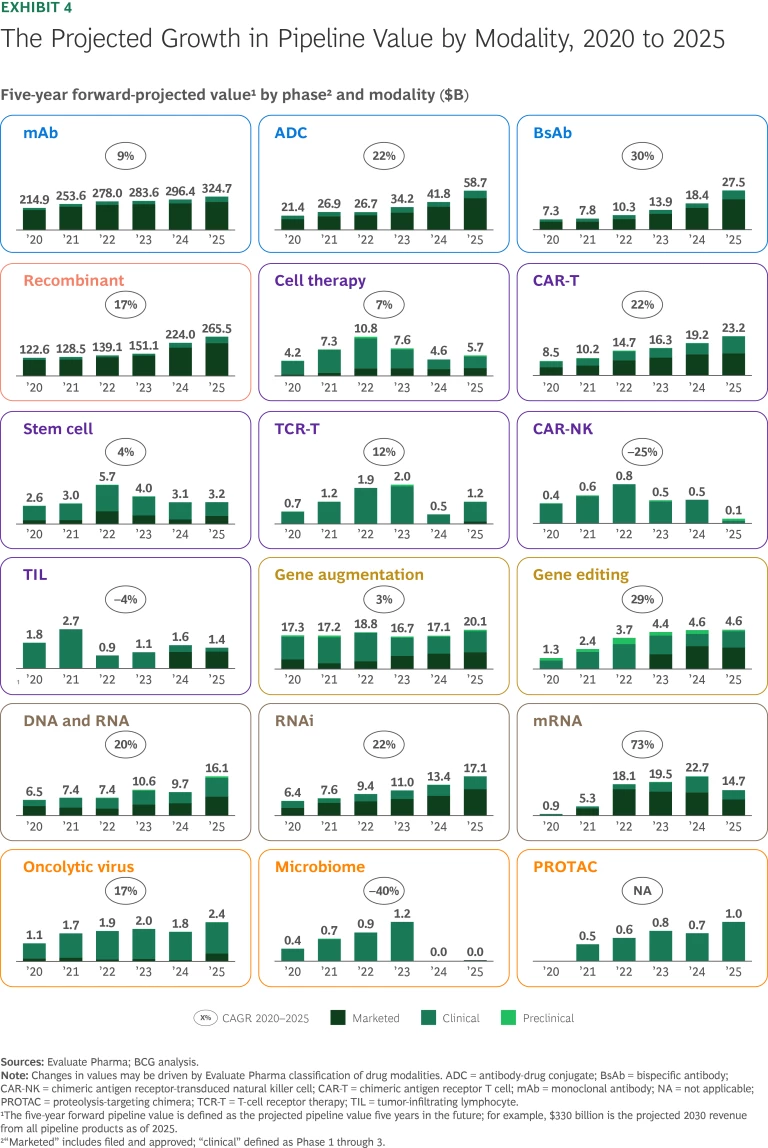

As in our previous reports, the 2025 analysis tracks the growth of six modality categories by focusing on the number of pipeline products and pipeline revenue. (See Exhibits 3 and 4, respectively.) The projected growth reflects an underlying belief in the modality’s economic potential and products’ ability to progress through the pipeline.

Antibodies: Strong, Stable Growth

Even though antibodies are the oldest of the new-modality categories, pipeline progress, revenue growth, and industry interest remain robust with continued launch of blockbuster drugs and expansion into therapeutic areas beyond oncology:

mAbs. The mAbs clinical pipeline—the largest among the new modalities—is still going strong, with 7% more clinical-stage pipeline products and 9% higher pipeline value than last year. mAbs continue to expand beyond oncology and immunology with pipeline progress in neurology, rare diseases, gastroenterology, and cardiovascular diseases. Apitegromab (Scholar Rock), a treatment for spinal muscular atrophy, is under priority review by the FDA and has the highest revenue forecast of any mAb in development outside of oncology and immunology.

The mAbs pipeline is likely to feel the impact of a stipulation that H.R. 1 has added to the Inflation Reduction Act (IRA). From now on, the Centers for Medicare & Medicaid Services (CMS) will determine which drugs are eligible for maximum fair price (MFP) negotiation based on the date of approval for the product’s first nonorphan indication. Consequently, companies could pursue approval for a rare disease indication first to keep their new drugs exempted from MFP selection for longer. This is particularly relevant for mAbs, which have the largest rare-disease pipeline of all new modalities.

- Antibody-Drug Conjugates. ADCs have seen growth in expected pipeline value of 40% during the past year and 22% CAGR over the past five years. This trajectory can be attributed to approvals of products like Datroway (AstraZeneca and Daiichi Sankyo) for breast cancer, which has the highest peak sales forecast of ADCs approved in the past year.

- Bispecific Antibodies. Forecasted pipeline revenue for BsAbs, a platform that targets two antigens, has risen 50% in the past year. This growth is due to a strong pipeline of products such as ivonescimab (Akeso and Summit) as well as commercialized therapies that have received expanded FDA approvals, like Rybrevant (Johnson & Johnson and Genmab). CD3 T-cell engagers are the BsAbs with the most clinically validated mechanism of action (MoA). They are used in seven of the top ten BsAbs as ranked by forecasted 2030 revenue.

Stay ahead with BCG insights on biopharma

Proteins and Peptides: Rapid Growth of Recombinant Drugs Driven by GLP-1s

Over the past year, products leveraging the recombinant platform have seen an 18% revenue increase, fueled by GLP-1 agonists. Several evolving dynamics could impact the growth of GLP-1 agonists, particularly in the US:

- Medicare and Medicaid Coverage. While CMS does not cover GLP-1 agonists for obesity, the current administration is reportedly considering pilot programs that could give Medicare Part D plans and state Medicaid programs the option to do so.

- IRA MFP Negotiation. Ozempic, Rybelsus, and Wegovy (all Novo Nordisk) have been selected by CMS for MFP negotiation, with the price to be negotiated in 2025 and go into effect in 2027. It will be important to monitor the impact that these negotiations might have on the pricing of competing GLP-1 therapies.

- MFN Pricing. After signing an executive order compelling pharmaceutical companies to deliver most-favored-nation prescription drug prices to US patients, President Trump specifically referred to the disparity in obesity medication pricing. Lilly said it will increase the list price of Mounjaro in the UK while maintaining access for National Health Service (NHS) patients. The full impact of MFN pricing on GLP-1s remains to be seen.

- Pharmaceutical Consumerism. GLP-1s are also shaping a new frontier of direct-to-patient (DTP) programs. In 2024, Lilly launched LillyDirect, a digital health care platform with telehealth prescriptions, and a Zepbound Self-Pay Journey Program. Novo Nordisk subsequently introduced NovoCare Pharmacy, a DTP option for uninsured and underinsured patients. Other companies are following suit. For example, Pfizer and Bristol Myers Squibb recently announced a DTP program for Eliquis, their blockbuster factor Xa inhibitor.

Cell Therapies: Quickly Evolving, with Mixed Results

The chimeric antigen receptor T-cell (CAR-T) pipeline continues to grow rapidly. Other emerging cell therapies have encountered challenges including clinical delays and failures, high manufacturing costs, and limited adoption:

- CAR-T Therapies. CAR-T continues to have its greatest patient impact and market value in hematology, while the results in solid tumors and autoimmune diseases have been mixed. Multiple companies are now pursuing in vivo CAR-T, which could overcome the logistical challenges of traditional CAR-T therapies and even have the potential to bypass allogeneic CAR-T.

TCR-T, TIL, Stem Cell, and CAR-NK Therapies. Although emerging cell therapies have shown some signs of clinical progress, analysts continue to take a conservative view of their revenue potential.

In 2024, Tecelra (Adaptimmune) became the first T-cell receptor therapy (TCR-T) to receive approval for treating synovial sarcoma. But adoption has been limited. Adaptimmune recently sold Tecelra and several pipeline products to US WorldMeds for $55 million.

The pipeline for preclinical and clinical-stage tumor-infiltrating lymphocytes (TILs), which is focused primarily on treating solid tumors, has grown over the past few years. Amtagvi (Iovance), approved in 2024, is the only TIL on the market and is forecasted to be a blockbuster.

Stem cell therapy has also seen clinical progress. In 2025, Ryoncil (Mesoblast), a treatment for pediatric steroid-refractory acute graft-versus-host disease, became the first mesenchymal stromal therapy to obtain FDA approval.

Chimeric antigen receptor-transduced natural killer cell (CAR-NK) agents have experienced less success, however. Several companies have recently shifted away from this modality after disappointing clinical results.

Gene Therapies: Stagnating Growth amid Safety Issues

The gene therapy space has had its share of challenges. Recent safety incidents involving gene augmentation therapies have led to halted trials and regulatory scrutiny. In 2025, for example, the FDA temporarily paused shipments of Elevidys (Sarepta) because of safety concerns, and the European Medicines Agency (EMA) recommended against the product’s marketing authorization owing to efficacy concerns. Gene augmentation therapies have also faced commercialization issues. Pfizer halted the launch of hemophilia gene therapy Beqvez, citing limited interest from patients and physicians.

On the gene-editing front, Casgevy (Vertex and CRISPR) remains the only approved CRISPR-based product, and forecasted revenue for the treatment has been stable. But there is also evidence of progress for this modality. In 2025, Sarepta received the first FDA platform designation for its vector technology, China approved its first hemophilia B gene therapy, and Durveqtix (Pfizer) secured a positive Committee for Medicinal Products for Human Use (CHMP) recommendation in Europe.

Nucleic Acids: New Sources of Growth After COVID-19

DNA and RNA therapies and RNAi are growing quickly, while mRNA continues to decline significantly as the pandemic wanes:

- DNA and RNA. This has been one of the fastest-growing modalities over the past year. Projected revenue, up 65% year-over-year, is driven primarily by recently approved antisense oligonucleotides such as Rytelo (Geron), Izervay (Astellas), and Tryngolza (Ionis).

- RNAi. These therapies remain on a steady upward path. The approval of Amvuttra (Alnylam) for cardiomyopathy, new approvals including Qfitlia (Sanofi) for hemophilia A and B, and continued pipeline progress have fueled a 27% increase in pipeline value during the past year.

mRNA. The downward trend in pipeline value that we observed last year is accelerating, with forecasted five-year forward revenues dropping from $23 billion in 2024 to $15 billion in 2025. The US Department of Health and Human Services’ recent cancellation of nearly $500 million in grants and contracts for mRNA vaccine development creates further uncertainty about the long-term trajectory of the modality.

In this environment, companies are pivoting to new use cases, as the recently approved respiratory syncytial virus (RSV) vaccine mResvia (Moderna) illustrates. In addition, flu vaccines and in vivo CAR-T therapies are under development for high-potential markets. These include mRNA-1010 (Moderna), which has the highest growth prospects of any mRNA flu vaccine.

Other New Modalities: Continued Slow Growth

Proteolysis targeting chimeras (PROTACs) and other new modalities remain nascent, with clinical pipelines growing slowly or stagnating:

- PROTACs. Several PROTACs in development have struggled to prove higher efficacy than traditional therapies. But the FDA has recently accepted the NDA for vepdegestrant (Pfizer and Arvinas) for the treatment of ESR1-mutated ER+/HER2– advanced or metastatic breast cancer. And BMS’s treatment for prostate cancer and BeOne’s BTK degrader have entered Phase 3 trials.

- Microbiomes. Growth of the microbiome modality has continued to stall. While three products are already on the market, the category has yet to gain commercial traction, and analysts do not forecast significant value.

- Oncolytic Viruses. The value of the oncolytic virus modality is still growing as pipeline products progress. Among the most promising is cretostimogene grenadenorepvec, which CG Oncology plans to submit to the FDA in 2025; analysts believe this therapy has blockbuster potential.

Significant Deal Activity in the New-Modality Space

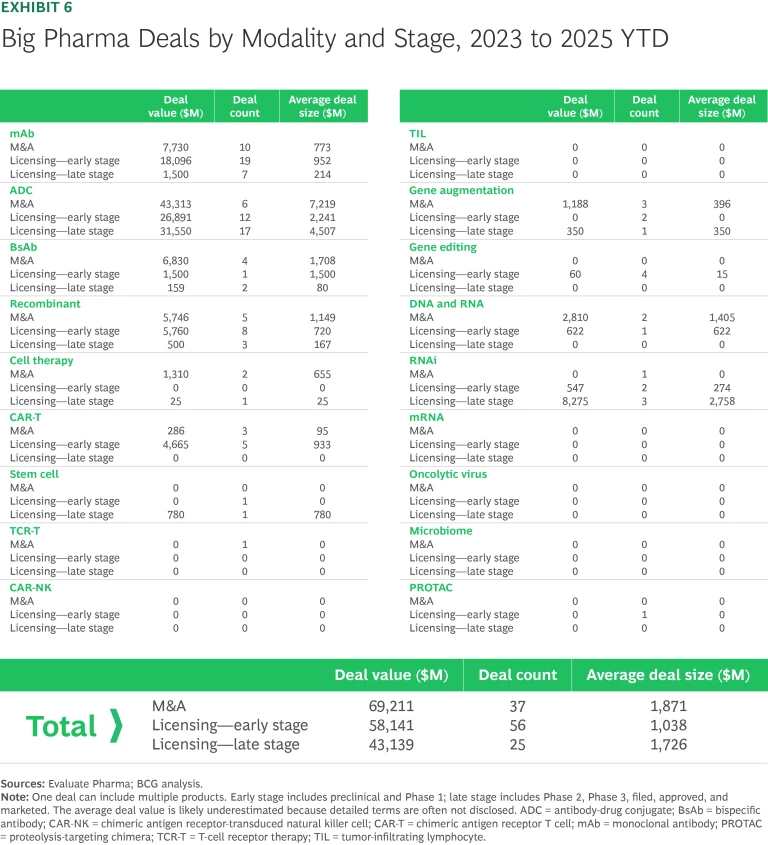

Acquisition and licensing deals are a good barometer for where large biopharma companies see the most value and are placing their bets. We assessed acquisitions and licensing deals for early-stage (defined as preclinical or Phase 1) and late-stage (Phase 2 or later) assets over the past three years. Our analysis did not include deals for research projects.

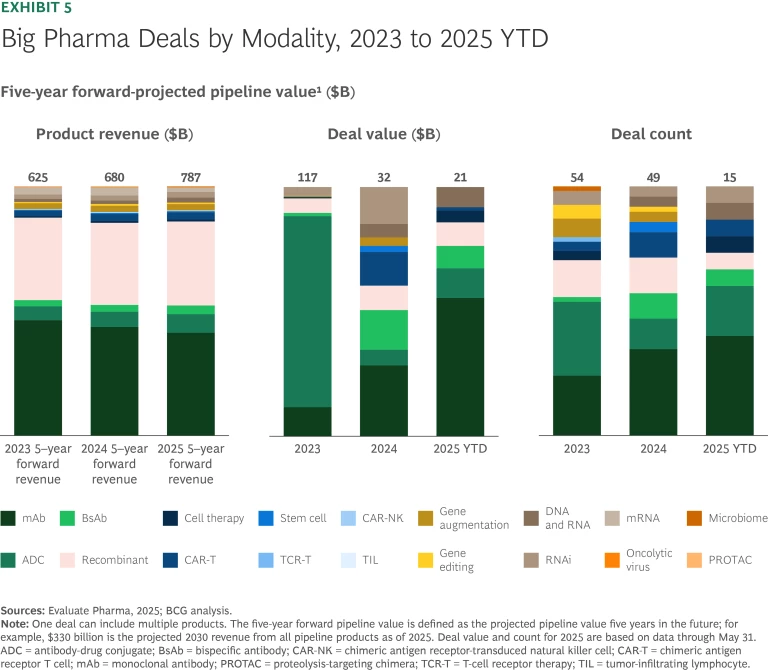

From 2023 through 2025 year-to-date, the top 20 biopharma companies spent approximately $170 billion on new-modality deals. (See Exhibit 5.) This is likely an underestimation of total deal value, since not all deals or deal values are disclosed. The 2023 Pfizer/Seagen acquisition remains the largest deal during this period. Deal value dropped by about 75% in 2024 but has shown signs of recovery in 2025.

M&A and early-stage licensing accounted for most big-pharma new-modality deals from 2023 to 2025. (See Exhibit 6.) Approximately $70 billion of the $170 billion was spent on 37 acquisitions. The rest was spent on 81 licensing deals, with early-stage deals outnumbering late-stage deals two to one.

Deal activity during this three-year period was disproportionately concentrated in antibodies, accounting for more than half of large biopharma deals and over 75% of total deal value. So far this year, big pharma companies have struck a total of seven antibody deals valued at more than $1 billion: AstraZeneca/Harbour BioMed, AbbVie/Xilio, Novartis/Anthos, and AbbVie/Simcere in mAbs; Boehringer Ingelheim/Lonza and Roche/Innovent in ADCs; and Sanofi/Dren Bio in BsAbs. This concentration indicates sustained industry confidence in validated biologic modalities with a well-understood MoA, strong regulatory precedents, and scalable commercial potential.

For other modalities, deal activity in 2025 has been lower than in previous years. Still, signs suggest that the industry believes in their potential. The recombinant, gene editing, and DNA and RNA areas have witnessed notable deals including Novo Nordisk/United Laboratories, Lilly/Verve Therapeutics, Novartis/Regulus Therapeutics, and Sarepta/Arrowhead.

China, a Growing Force in New Modalities

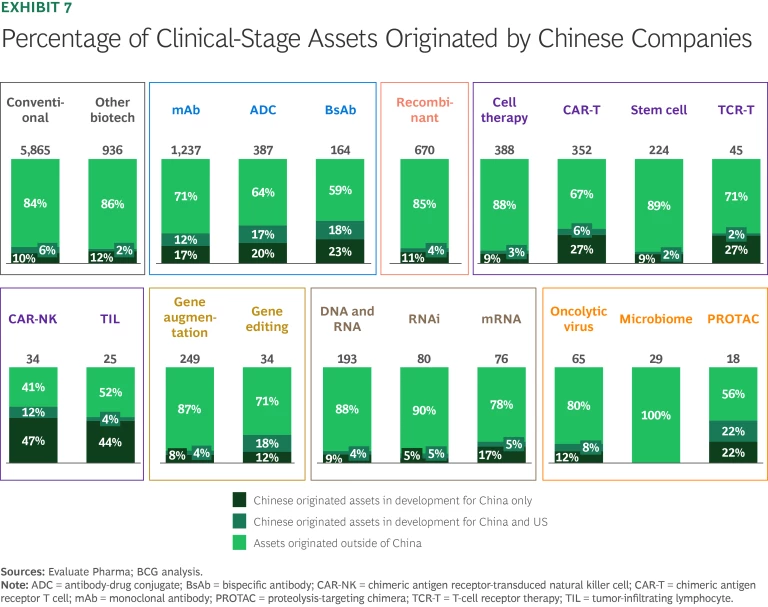

Recent clinical advances and pharma deals increasingly feature products originated by companies based in China. The growing number of assets in the Chinese pipeline has made China a hub for new-modality innovation. More than 30% of assets in global antibody and cell therapy pipelines originate there. (See Exhibit 7.)

China’s leadership in drug innovation is a relatively recent phenomenon. Historically, Chinese-originated therapies were concentrated in a small number of validated MoAs and marketed for the domestic population. Today, Chinese companies are originating innovative assets with unique targets or combinations of targets. Nearly half of Chinese clinical-pipeline assets have novel MoAs that so far do not have competing products in Phase 3 or on the market globally.

Chinese assets have attracted the interest of global biopharma companies. This year, more than 40% of the top 20 biopharmas’ deal expenditures—higher than in any other year in our analysis—involved assets originating in China.

Several new-modality products with Chinese origins have already been approved and commercialized in the global market. Carvykti (Johnson & Johnson and Legend Biotech), an innovative CAR-T therapy for multiple myeloma, has been a commercial success, and mAbs Anniko (Akeso and Chia Tai-Tinquing Pharmaceutical) and Tevimbra (BeOne) recently received FDA approval. We expect to see a continued increase in products developed in China reaching global markets and in large biopharma companies looking to China for inorganic assets.

We have seen substantial growth this year in large and established new modalities such as antibodies, proteins and peptides, and CAR-T therapies. Emerging modalities have progressed more slowly, hindered by safety concerns, clinical setbacks, and commercialization barriers. Still, areas like gene therapy and nucleic acids notched notable advances and high-value deals, reflecting sustained industry interest and confidence in these platforms.

The authors thank BCG colleagues Martin Macias, Sofia de la Morena, Lea R’Bibo, and Yifei Weng for their contributions to this report.