GLP-1 drugs are delivering major health benefits, helping patients shed up to 20% of their body weight and reducing the risk of diabetes, heart attack, stroke, and kidney disease. But as these breakthrough therapies rapidly gain ground, medtech companies are confronting a pivotal question: How will a world with fewer obesity- and diabetes-related complications reshape demand for their devices and services?

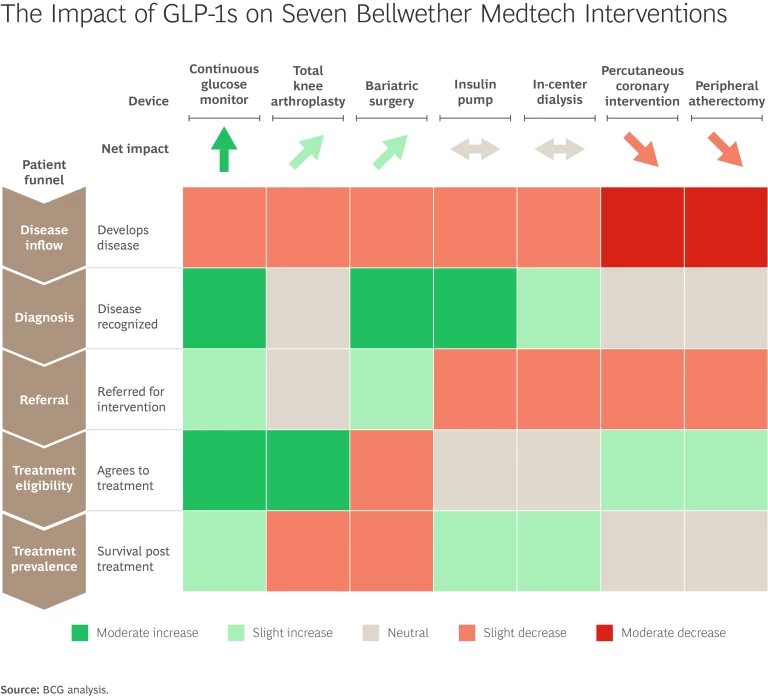

To assess the potential impact of GLP-1s on medtech, BCG surveyed 550 physicians across the specialties that are most likely to see their practices affected by these therapies. We asked clinicians to estimate how GLP-1s might influence demand for several “bellwether” medtech interventions such as glucose monitors, bariatric surgery, and in-center dialysis over the next five to ten years.

For each therapy, we pressure tested the impact of GLP-1s across the patient journey by comparing clinician responses to published literature. Our analysis suggests that while GLP-1s will drive some changes in care delivery, medtech remains well positioned, with ample opportunity for growth and innovation. Our detailed findings are available in the BCG report “The Impact of GLP-1s on the Medtech Industry: Strategies for Thriving in a Changing Market.” To request a copy of the report, please contactHC_Marketing@bcg.com.

While GLP-1s will drive some changes in care delivery, medtech remains well positioned, with ample opportunity for growth and innovation.

GLP-1s’ Projected Impact on Key Medtech Interventions

While GLP-1s will reduce the sheer number of patients coming into the funnel across the specialties we surveyed, how that will affect those fields will vary given the differential effect of GLP-1s on diagnosis, referral, interventions, and maintenance. (See the exhibit.)

For a closer look, here are our findings across seven bellwether devices and procedures:

- Continuous Glucose Monitors (CGMs). GLP-1 medications may actually drive greater use of CGMs among people with type 2 diabetes as more people seek treatment for obesity and are diagnosed in the process. While CGMs are still far more common among those with type 1 diabetes, rising diagnosis rates and efforts to expand CGM adoption in the type 2 population point to strong growth ahead for this market segment.

- Total Knee Arthroplasty (TKA). In the orthopedic and bariatric surgery segments, GLP-1s will bring more patients into the funnel. An estimated 30% of prospective TKA patients are ruled out each year because their BMI exceeds approximately 35. With GLP-1s, motivated TKA patients can find an easier path to treatment, though time will tell how their success rates compare with those of the overall population, given that real-world adherence to GLP-1 therapies is low. Up to half of patients discontinue treatment within the first year due to side effects, cost, and the inconvenience of injections, among other reasons.

- Bariatric Surgery. Even though the share of patients eligible for weight loss surgeries, such as sleeve gastrectomy or gastric bypass, might decrease, the publicity surrounding GLP-1s has generated a significant increase in the number of patients clinically diagnosed with obesity. If the medication either fails to bring about desired results or patient adherence lapses, this larger pool of bariatric surgery patients may result in new patient referrals.

- Insulin Pumps. GLP-1s are likely to have a neutral impact on insulin pump use. While the drugs can delay the need for insulin dependence, patients who eventually require pumps tend to have had poorly controlled diabetes for more than a decade. Since about half of patients stop using GLP-1s within a year, the effect on long-term insulin pump adoption is expected to be minimal.

- In-Center Dialysis. In-center dialysis is the most common treatment for patients with end-stage renal disease. While GLP-1 usage may slow the progression of chronic kidney disease, patients usually try these drugs only after other treatments, so the overall impact on reducing dialysis demand will be limited. What’s more, GLP-1s also reduce the risk of cardiovascular events, the leading cause of mortality in this group, which means patients on dialysis may live longer. As a result, the overall effect of GLP-1s on in-center dialysis is likely to be neutral.

- Percutaneous Coronary Intervention and Peripheral Atherectomy. GLP-1s offer strong cardiovascular protection to reduce the rate of heart attacks. They also improve blood sugar control, which helps reduce peripheral vascular disease. However, given high discontinuation rates, we expect only a modest decline in procedure volumes over the next five to ten years for percutaneous coronary intervention and peripheral atherectomy. Furthermore, patients who do progress to these procedures are more likely to have complex conditions that require more advanced, higher-value devices, such as intravascular lithotripsy rather than standard stents or balloons. For medtech executives in these areas, staying competitive will require investment in innovation to avoid commoditization, along with a commercial strategy that aligns marketing spending with future growth potential.

We are just entering the GLP-1 era, and its full impact on medtech remains to be seen, especially for conditions with cardiometabolic drivers. While GLP-1 drugs may reduce demand for some devices, the overall impact on medtech companies is likely to be less disruptive than many fear. Medtech companies that stay ahead of the curve—by understanding where GLP-1s will shift patient care and adjusting their strategies accordingly—will be best positioned to lead in this new landscape.