Three big trends—geopolitical realignment, rapidly advancing AI, and slowing global growth—are challenging the ways in which companies operate. Perhaps most significant, the system of rules-based multilateral trade relationships that most multinationals have known for decades is being replaced by blocs and clusters, each with its own emerging rules for doing business. These new trade coalitions could well become incompatible with one another. At the same time, companies are not moving as quickly or as expansively as they should be to acquire future-oriented capabilities and embrace new models of advanced technology.

CEOs need new or updated global operating models to adapt to this fast-changing world, but too many are caught up in fighting the immediate trade and geopolitical fires that the changes have ignited. These near-term needs are urgent, but CEOs must still broaden their focus to take in longer-term considerations if they are to establish competitive advantage for the future.

Immediate Priorities Rule…

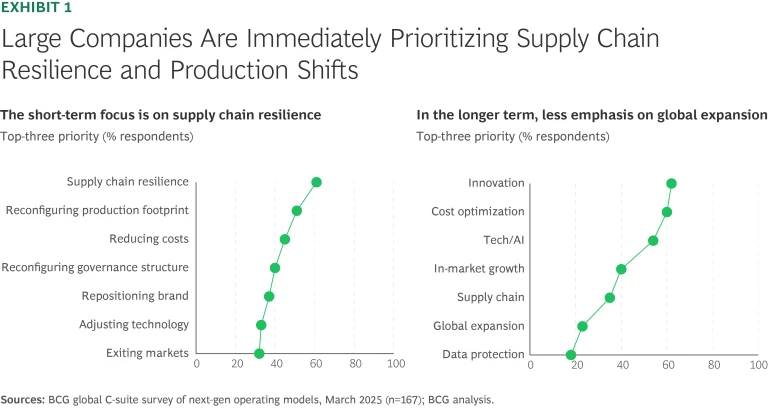

For CEOs today, operating models may be on the agenda, but firefighting is job one. In March 2025, we surveyed more than 150 executives in almost 20 countries about their companies’ near- and longer-term priorities. Among large companies (annual sales of more than $5 billion), more than 60% are strongly focused on supply chain resilience as an immediate need. (See Exhibit 1.) More than 40% are prioritizing cost-cutting measures. Only about 35% of respondents said that building up AI and technology capabilities is a near-term need.

These are rational responses to the current environment, in which uncertainty prevails. But companies also need to distinguish short-term noise from longer-term signals and address structural changes, such as the decoupling of longstanding trading relationships, the rise of the Global South, and trade route disruptions. For example, increasingly diversified supply chains call for new governance models that can handle more fragmented manufacturing networks. Avoiding regulatory risk often requires new ways of working. Maintaining scale economies and functional expertise while decentralizing may necessitate more modular organizational structures and significant cost reductions at the center.

…but the Best Leaders Also Embrace Opportunity

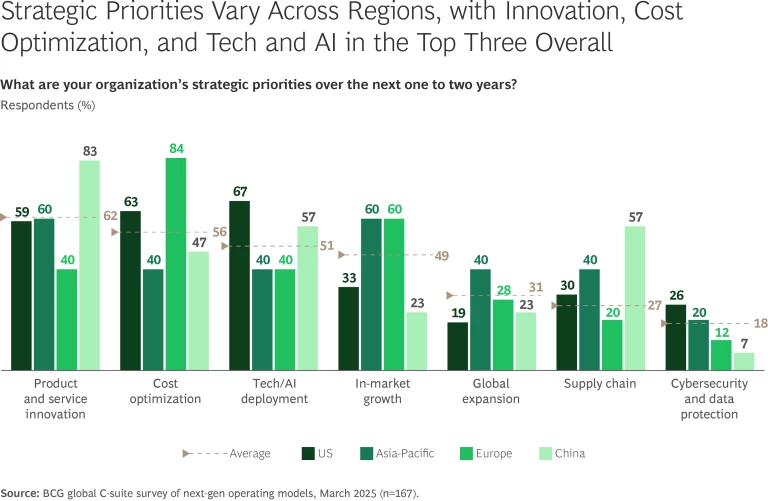

Our research shows that over the next couple of years, companies will be focused on strategic priorities, including product and service innovation, cost optimization and—importantly—the deployment of technology and AI; 67% and 57% of companies in the US and China, respectively, cite the latter as a major area of focus. (See “Regional Variations in Corporate Priorities.”)

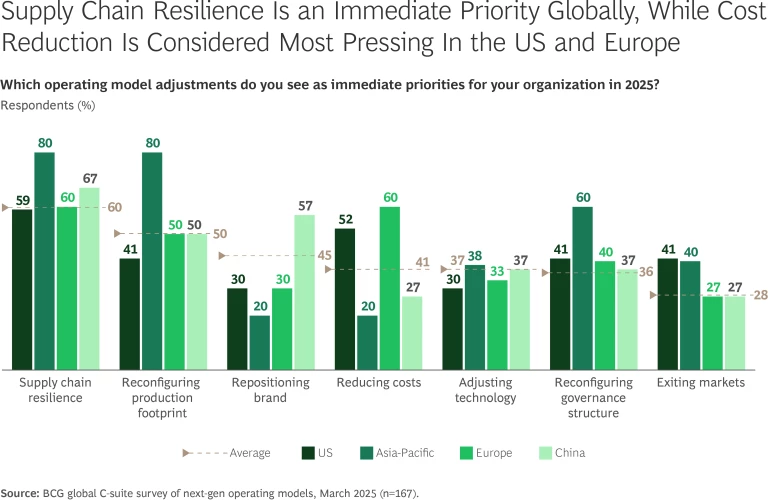

Regional Variations in Corporate Priorities

For example, most companies in most regions see supply chain resilience as a core priority (about 80% of Asia-Pacific firms and about 60% of companies in the US and Europe). But when it comes to cost reduction, 50% to 60% of US and European companies see this as an immediate priority, compared with only 20% to 25% of companies in China and Asia-Pacific. About 60% of Chinese companies see brand repositioning as an immediate priority, versus about 30% of US and European firms. (See the exhibit below.)

But too many firms are trying to achieve value through specific use cases or changes to corporate functions. In our view, CEOs and their C-suite colleagues need to go further, thinking though a series of questions that get at the core of their operating models:

- Which markets to play in given geography- and technology-related constraints and opportunities (including the repercussions from operating in one country)

- How to rethink geographic resource allocation from the market back through the supply chain to ensure optimized resilience, market proximity, and cost

- How to remodel in-house and external value streams to boost the successful use of large-scale partnerships in light of the need for greater flexibility and speedier shifts in how the company operates

- How to ensure access to talent in such areas as leadership and human–machine interaction

- How to embed alignment and accountability in the new model

Leading companies are already moving to adapt to new realities and put in place the foundation for future operations. For example, many manufacturers are reviewing their global footprints. Some are doubling down on (or at least committing to) investments in the US; others are planning to move to contract relationships and collect royalties or licensing fees.

Take the case of a top automotive supplier that is relocating its headquarters functions, including R&D and operations, from Japan to China in order to tap more directly into the vitality and innovativeness of China’s electronics ecosystem. The company plans to both substantially expand its business with Chinese OEMs and establish a global center for innovation in automotive electronics. Another example: a global, US-based tech hardware manufacturer that plans to move 90% of production for North America out of China by 2025, relocating those operations to Mexico and Southeast Asia to reduce risk.

Top firms are aggressively embracing advanced technology, but in our experience, not all of them are thinking broadly enough about the potential for new global models of human–machine collaboration, nor are they planning for access to talent in a world of polarized tech hubs. They are not reassessing the highest-value roles for their staff or considering how to replace layers of traditional white-collar work with next-level workflow automation.

Stay ahead with BCG insights on international business

The Backbone of Competitive Advantage

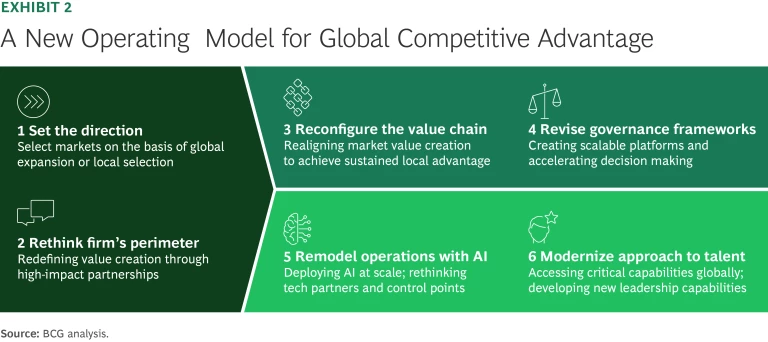

We are now in an age of post-globalization, and the backbone of future competitive advantage is a new operating model that addresses six requirements. (See Exhibit 2.)

Set the direction. If the recent past was often about geographic expansion and tighter global integration, the future for many companies will be about regional and local selection. CEOs need to set their navigational North Star, choosing either global or regional scale and then selecting the markets in which they want to play. They should be transparent with employees and investors about the opportunities and vulnerabilities of the current company footprint as well as of expansion into countries where they are seeking more local growth. Factors to assess in each local market include economic trends, the competitive environment, government regulation, workforce qualifications, and digital infrastructure.

Rethink the firm’s perimeter. Companies do not have to do everything in-house. Partnerships can create new engines for value creation, and in some markets they may be the only way for companies to operate. One European telco is rebuilding its approach to partnerships from the ground up, replacing a one-size-fits-all model with a strategy that prioritizes partnerships and engagements in a handful of adjacent technologies with high potential for growth.

In the face of US tariff changes, a Chinese e-commerce platform has ceased direct shipments from China to the US, transitioning to the sourcing and fulfillment of products from within the US through partnerships with local sellers, as well as expanded domestic warehousing.

In such cases, partnership management capabilities move from a “nice to have” to a critical strategic capability. The COO takes on the role of chief partnership officer, whose core challenge is maintaining effective governance across highly dispersed networks. An effective risk management process to prevent partners from causing disruption to core operations is key.

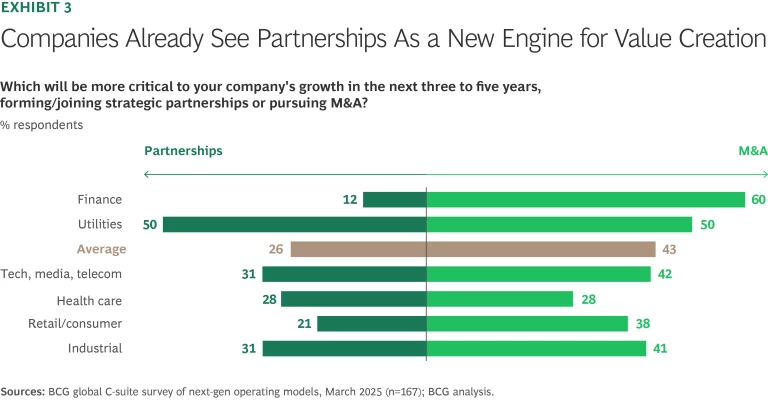

Our latest research shows that executives in a majority of companies in multiple industries see strategic partnerships as more critical than M&A over the next three to five years. (See Exhibit 3.)

Reconfigure the value chain to achieve sustained local advantage. The principal value chain challenge lies in striking the right balance between tailoring operations to regional markets and maintaining the global cost competitiveness that comes from scale. For example, a European automaker is reallocating production to the US from China, Sweden, and Belgium to avoid the impact of tariffs.

Companies need to engage in a country-level analysis that applies both a demand lens (what it would take to succeed in a specific market in terms of customer demand, government pressure, and other factors) and a supply lens (the broader supply chain and SG&A cost implications, risks, and opportunities). One major Chinese mobile technology company has introduced a fully independent operating system, including its own app ecosystem, that reduces dependence on US software amid rising tech tensions. It plans to expand the number of available apps from 15,000 to 100,000 by the end of 2025.

Revise governance frameworks. Companies must strike a careful balance between local autonomy and global strategic coherence, which requires empowering fast regional decision making while ensuring that local operations have access to global platforms that enable scalability and cost efficiency. Companies need to be decisive and transparent about which authorities and resources are decentralized and remove (or repurpose) redundant legacy resources and authorities at the center.

Global businesses face two main challenges when they compete in emerging markets: a lack of in-depth understanding of local conditions and a perception (at least at the corporate center) that these markets are too small to justify investment in R&D. The solution to both challenges may lie in decentralizing R&D to regional and local innovation centers. In addition, our research shows that firms that invest in culture change programs see a 20% to 30% improvement in the quality of decisions made locally.

Remodel operations with AI. Deploying AI at scale means operating in fundamentally new ways. Many companies are already automating back-office solutions. Now they need to turn to enabling the replacement of middle-management layers and automating functions such as reporting, monitoring, and content creation, as well as even more advanced tasks such as independent decision making (with appropriate human oversight). To effect this transformation, companies will need strategic partnerships with AI and tech providers. These, in turn, call for clear management of strategic control points and clarity on data-sharing policies to ensure that the company maintains ownership of critical capabilities and IP.

AI will also be essential to bolstering cybersecurity defenses—if only because bad actors are already using the technology to strengthen their attack capabilities. Moreover, the tech stack must be able to support new functions. For example, modular, multicloud architectures, supported by geographically fenced data governance and compliance monitoring, are needed to ensure swift adjustment to shifting regional regulations and geopolitical tensions. Managing data security and regulatory compliance in accordance with varying privacy laws across markets could require market-specific governance norms or even, in some instances, data siloing.

Modernize your approach to talent. Tapping into talent pools becomes more difficult in a world of geopolitical divides, aging populations, and reduced geographic mobility (from visa restrictions and other immigration barriers). Large companies are investing in local skills-building programs and embracing hybrid work models, while leveraging global talent pools through virtual jobs and global talent hubs.

Companies also need to take a fresh perspective on the drivers of behavior and performance. One global food and beverage company, for example, has developed a leadership program that combines globally consistent frameworks with local execution. Active in 25 countries, it allows employees to co-create their career development at key points in their tenure. An IT company is investing $65 million in training programs to develop a next-generation semiconductor workforce in the US.

Augmenting Traditional Operating Models with Innovative Interventions

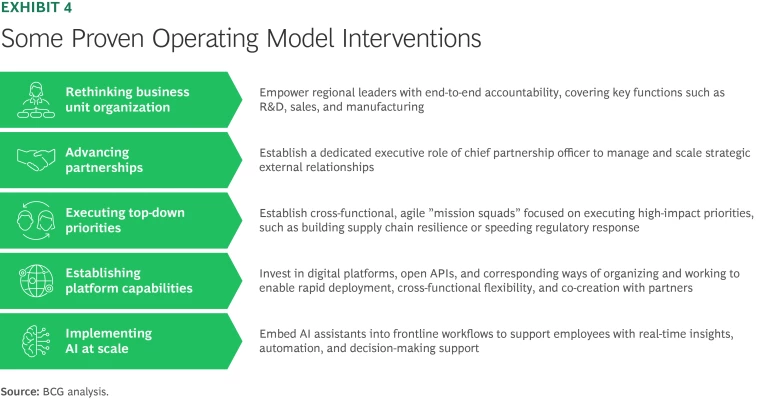

Even in the midst of market turmoil, leading businesses are finding innovative ways to augment their operating models. (See Exhibit 4.)

- Rethinking Business Unit Organization. A major auto manufacturer restructured its North American operations, establishing a CEO role with authority over R&D and sales and marketing, including pricing, product adaptation, and distribution. A global financial institution split its organizational structure into eastern and western divisions to better position itself for clients in both parts of the world.

- Advancing Partnerships. A global food and beverage marketer created the role of chief commercial and partnership officer, with combined responsibility for certain assigned operations and partner relationship management. An international payments company recently appointed a chief partnership officer to streamline and centralize the management of more than 100 global partnerships across various sectors and geographies.

- Executing Top-Down Priorities. An international restaurant chain has launched cross-functional “mission squads” focused on enhancing responsiveness to regulatory changes and improving supply chain efficiency.

- Establishing Platform Capabilities. Companies in the telecommunications and automotive industries, among others, have invested in modular digital platforms that facilitate flexibility, scalability, and partner access. They have also adopted ways of working and organizing based on platforms. One company developed a technology architecture that combines the Internet of things, network-as-a-service, and other digital capabilities and is accessible on demand by global partners and markets. Another introduced a modular IoT platform that supports manufacturing operations with real-time services that enable customers to innovate more quickly and efficiently.

- Implementing AI at Scale. More and more companies have embedded AI agents into frontline operations to boost productivity and enhance service outcomes. One global giant deployed AI-driven systems in its warehouses to monitor worker performance, flag safety issues, and optimize task management. Another rolled out a Google Cloud AI assistant— trained on 15,000 internal documents—to over 28,000 customer service representatives, equipping them with real-time support and shifting service roles toward sales and advisory functions. It contributed to a 40% increase in sales via support channels in early 2025.

In recent years, the dominant factor in the design of global operating models has been scale because of its impact on costs. Scale remains critically important today, but there is no way around the need for a careful tradeoff with flexibility and adaptability. The art of exceptional management lies in effecting this tradeoff in such a way that the cost disadvantage is minimal. Leaders are already moving. Slower movers will quickly fall behind, and many will need to resort to a radical restructuring of their operations down the road to put them back on track.

The authors are grateful to Shishir Agarwal, Lin An, Yotam Ariav, Julie Bedard, Sarah Berhalter, Saurabh Chhajer, Sylvain Duranton, Changwook Kim, Geraldine Rhodes, Nikolaos Siamisiis, Douglas Silva, Felix Stellmaszek, Harrison Xue, and Michal Ziolkowski for their insights and assistance.