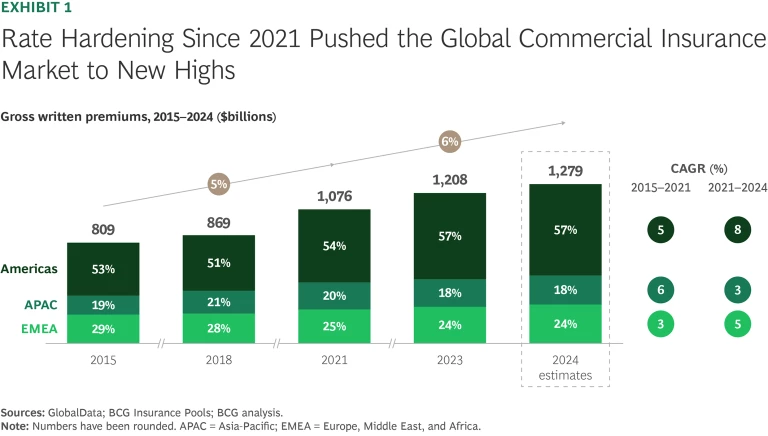

The past five years have been good to many companies in the commercial insurance industry. Insurance rates hardened, for the most part, and premiums grew at a healthy pace. The industry took in close to an estimated $1.3 trillion worldwide in 2024, led by the Americas, which accounted for most of the premium growth since 2021 and now make up 57% of the market.

Few companies took full advantage of the industry’s strong performance during the past five years.

Few companies took full advantage of the industry’s overall strong performance, however. Those that succeeded in boosting their market share since the beginning of the hardening cycle in 2021 boasted considerably more efficient operations than their rivals, enabling them to concentrate on growth. Less financially strong companies focused their attention on increasing their profitability rather than aggressively chasing market share.

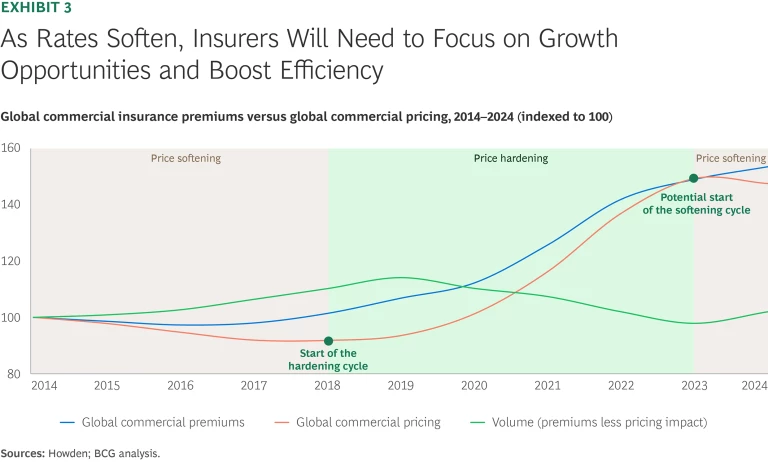

Now the rate cycle appears to be turning, and the commercial insurance industry faces a period of rate softening brought on by various factors, including increased capacity driven by the rising availability of capital and individual companies’ strong financial positions, as well as more competition. How companies manage their balance sheets in response will largely determine their success over the course of the coming cycle.

Stay ahead with BCG insights on the insurance industry

The Winning Formula

The recent cycle of rate hardening, beginning with the pandemic slowdown, lifted the commercial insurance industry to new highs in gross written premiums (GWP). Overall, the industry’s GWP grew 6% annually from 2021 to 2024 (see Exhibit 1) and is expected to keep rising 7% annually until 2029.

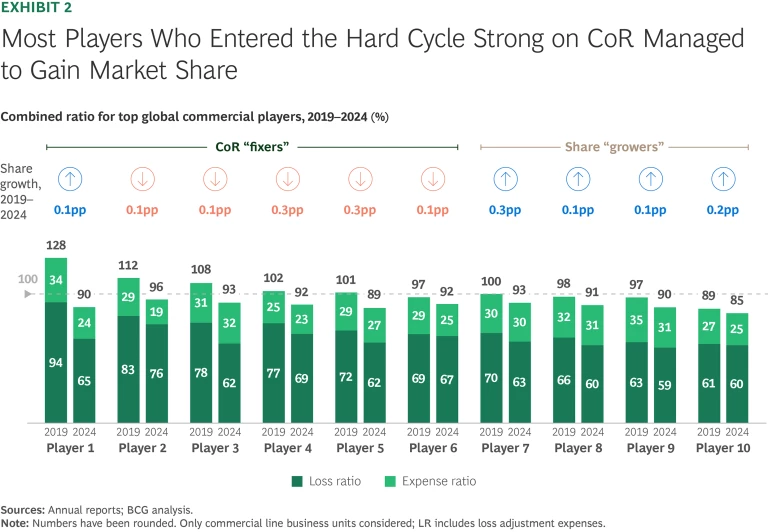

How companies performed during this rate-hardening period depended to a great extent on their starting position. By and large, the most profitable companies—those on the lower side of the combined ratio (CoR) range (less than 100%)—were able to gain share, while their less efficient rivals were not.

What distinguished the companies that captured market share from their rivals? While most companies managed to increase their premiums to some degree as rates hardened, the most profitable ones had the leeway in their balance sheets to keep their premiums low and thus boost their share. In contrast, those with a CoR above 100% focused their efforts on improving profits, mainly via portfolio steering—including strategic adjustments across products, segments, and geographies—to optimize profitability and diminish risk exposure, enabling them to reduce their loss ratio over the rate-hardening period. (See Exhibit 2.)

A Turning Tide

The period of rate hardening is coming to an end. Beginning in 2023, rates appeared to start softening and volume increased, even as premiums continued to grow, at least for the time being. (See Exhibit 3.) The softening trend, however, varies depending on the specific market. For instance, softening in rates for US middle-market businesses is limited, whereas large commercial lines are seeing considerably more softening—a trend that is already evident in the market’s underwriting results and earnings. There are several reasons for this. Interest rates have been stable or falling, while capital has become more readily available, the result of the increased profitability of the hard-rate market. This in turn has boosted competition and capacity and thus driven down rates.

What does this mean for companies’ results? Those that succeeded in gaining share over the past several years will likely face increased competition as rates soften. Those that focused on trying to improve profits and reduce loss ratio will probably continue to do so. These insurers may even find themselves well positioned to compete and begin capturing share again, assuming they can make further improvements in their balance sheets. But that depends on how they prepare to compete in the new rate-softening cycle.

Taking Action

In the likelihood that commercial rates soften, commercial insurers will find it increasingly challenging to boost both the topline and market share, and efficiency will become a deciding success factor. To protect margins and navigate the cycle, insurers will need to take action in three key areas: focusing on strengths, continuing to improve technical margins, and doubling down on data and technology.

Focus on Strengths

Where should commercial invest for growth in the new cycle? At present, growth forecasts vary considerably by region and line of business; in the US, GWP for lines such as fire is expected to increase by 7%, while rates in Europe will likely keep softening.

In this environment, insurers with a strong presence in specific regions or lines of business should leverage their accumulated experience and data to reinforce their competitive advantage. A targeted approach that focuses on the most profitable lines while considering divestment from underperforming segments will be key to sustaining margins.

To make the most of their strengths, insurers should ensure that the strategic decisions they make regarding issues such as pricing and distribution are tuned specifically to their strongest regions and lines of business. This will enable them to successfully navigate these areas’ distinct market dynamics and softening cycles.

Maximize Talent and Technology to Boost Underwriting Performance

During the recent hard cycle, most commercial insurers succeeded in improving their combined ratio to varying degrees. Yet significant opportunities remain to optimize both their loss ratio, by driving underwriting performance, and their expense ratio, by adopting efficiency measures.

Underwriting performance is the cornerstone for margin improvement in commercial insurance. The large, complex policies inherent to the business should be handled by the company’s top talent, to ensure that proper decisions are made. Insurers should double down on their employee value proposition and branding to attract and retain underwriting talent while leveraging strong underwriting governance and technology, including potential new generative AI capabilities.

In fact, global insurers are already beginning to invest and leverage GenAI to improve their underwriting performance. Zurich has recently implemented more than 500 GenAI solutions, for example, while Chubb has been exploring GenAI applications in underwriting and claims. AIG launched a GenAI-driven underwriting system in 2024, and Liberty has established a $25 million collaboration with MIT to help drive GenAI research in decision making and other areas.

Global insurers are already beginning to invest and leverage GenAI to improve their underwriting performance.

Drive Expense Ratio Reduction Through Digital Capabilities

Declines in insurers’ expense ratio played only a marginal role in decreasing their combined ratio during the hardening cycle, just 1 to 3 percentage points. Still, expanding the use of technology and automation—through AI agents, for example—can help companies understand and address efficiency pain points in areas such as claims and daily operations, including support functions.

By investing in and rolling out GenAI-supported technology in everyday work such as claims and compliance, companies including Zurich, Chubb, and AIG have been able to reduce manual work and improve efficiency, in some cases enabling them to consolidate some operations.

Efficiency improvements have also played a critical role in large transformation efforts at global insurers. Automation enabled Chubb to cut more than $500 million in costs from 2018 to 2023, by eliminating low-value tasks and enhancing operational efficiencies.

With automation technology becoming increasingly accessible, insurers should take advantage of the wide variety of opportunities that these capabilities offer to reduce costs and protect—and potentially increase—profitability as rates soften.

A new rate-softening cycle is now upon the commercial insurance industry. In this environment, insurers must boost efficiency to protect margins. But that doesn’t mean there won’t be opportunities to increase premiums and gain market share, if companies concentrate on their strengths.