The tariffs imposed by the Trump administration—and the uncertainty surrounding them—are having an enormous impact on many industries around the world, and the agriculture sector is no exception. That’s because agriculture, and the food system generally, involves an enormously complex dance of trade across international borders worth hundreds of billions of dollars. Regional disruptions to this system can have global consequences, with the potential to affect both rural producers and urban consumers alike.

The past decade has already seen significant disruptions and commodity price fluctuations to the agrifood system as a result of evolving geopolitics and increasing climate variability. It began with the US-China trade war in President Trump’s first term and continued with climate change-induced yield reductions, the impact of the pandemic, the Russia-Ukraine war’s effect on wheat prices, and India’s export restrictions on rice.

In its early months, the war in Ukraine caused a 28% spike in wheat prices, which eventually settled 2% to 3% higher than before the war. Meanwhile, India’s restrictions on rice exports, initiated in 2022, caused prices to rise in emerging markets. However, when the restrictions were eased in early 2025, other major exporters such as Thailand faced farmer protests as prices fell by 30%.

The Trump administration’s recent tariffs—as well as the potential for reciprocal tariffs—could accelerate these shifts in the agriculture system, both in the short term and for many years to come. And it won’t just be farmers who are affected: the industry supports a vast array of seed, fertilizer, and crop protection companies and distributors; machinery makers; and logistics and transport providers, as well as the food companies and retailers who make and sell the world’s food.

The near-term impacts of the current trade disruptions are coming into focus, even as the longer-term effects remain uncertain. What are the implications for the many players with stakes in the game, and for the agricultural industry as a whole?

Areas of Potential Impact to Watch

The immediate impact of the new tariffs varies considerably from country to country and crop to crop but can be broadly classified into three major categories:

The integrated North American food system

Farmers within the North American food system, knitted together through the US-Mexico-Canada Agreement (USMCA), have been afforded a relative degree of protection via tariff exemptions by the Trump administration. Total trade within North America, worth $1.88 trillion in 2023, includes a wide variety of agricultural products—both human-consumed food like fresh produce and meat and critical farm inputs like fertilizer and feed. Yet any disruption to production or inputs will be felt not only on North American farms but also at the dinner table, creating a strong incentive to maintain protections from tariffs for agricultural products traded within the USMCA.

Global value chains reliant on US demand

Producers who export to the US face a different set of challenges. Tariffs can translate into higher prices for US consumers, causing demand shocks for produce and commodity growers that could amplify the effects of reduced yields on prices that are already occurring due to climate change. Coffee is a case in point: commodity prices are already at a 50-year high. Under the International Emergency Economic Powers Act (IEEPA), tariffs on Vietnam, which sends 8% of its coffee exports to the US, were initially announced at a staggering 46%. (This rate has not yet been enforced, and where the tariffs finally land remains to be seen.)

US exports exposed to trade retaliation

Counter-tariffs on US products by affected nations could also impact the sector. For example, China responded to the IEEPA tariffs by levying a flat 10% duty on all US goods (down from 125% following the US-China discussions in Geneva) and an extra 10% to 15% surcharge on targeted agribusiness products, affecting roughly $23.7 billion in US farm exports to China in 2024. This is where we see the highest risk of disruption and the potential for a wider spread between winners and losers.

Why Soybeans Matter

The current environment of price volatility for major agricultural commodities is unlike anything seen in the past few decades. And no commodity is likely to be affected as much as soybeans.

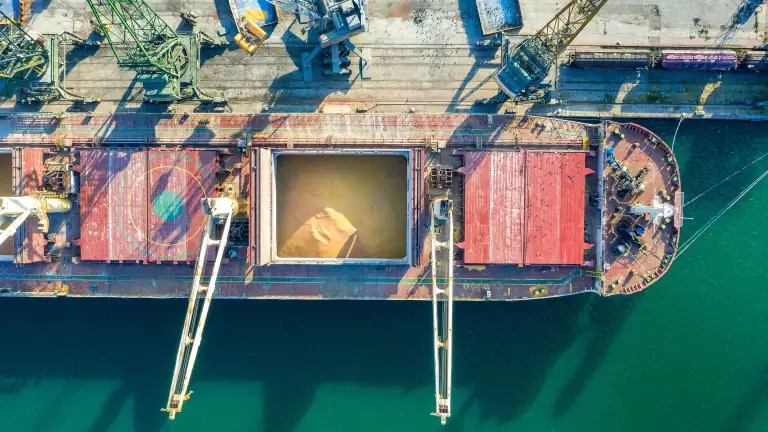

China’s willingness to enforce counter-tariffs on US goods creates a vulnerability for soybean farmers in particular. Considering the two largest US crops, consumption of corn is largely domestic, but more than 50% of the country’s soy is exported. Of the $44 billion of US soybeans grown in 2024, $25 billion was exported, with more than half of that going to China.

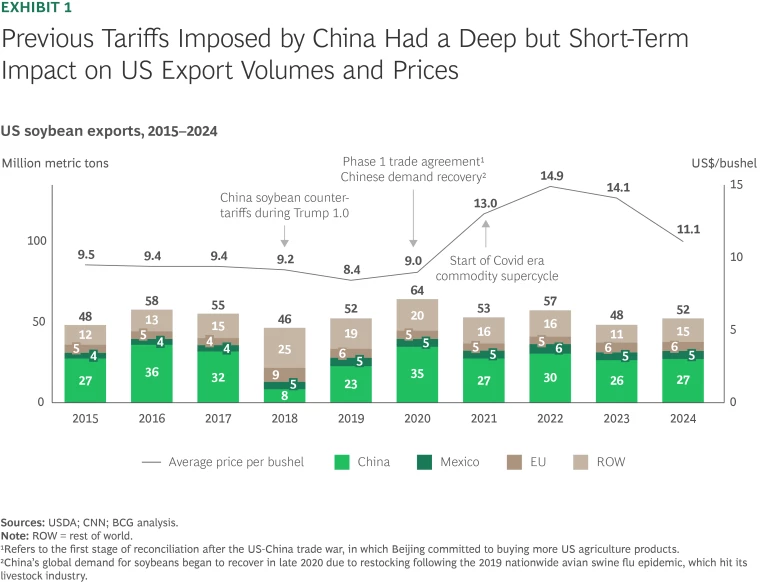

It is still unclear how the tariffs will impact soy trade. Tariffs imposed during the first Trump administration in 2018 offer some indication. Exports to China fell by 75%, to 8 million metric tons from 32 million the year before, and the per-bushel price fell by almost 10%. (See Exhibit 1.) By 2020, however, both the volume and price of exports to China had essentially recovered to pre-2018 levels, partly due to a trade truce under which China removed its punitive tariffs on the US. This historical precedent suggests that tariff increases can have immediate impact and increase volatility for the sector.

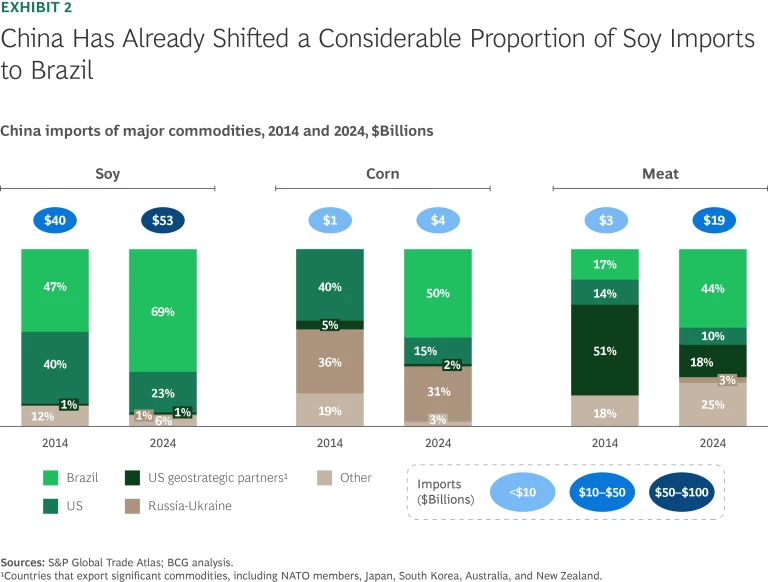

While China had already been looking to reduce its dependence on the US for its food security, those earlier tariffs created a stronger incentive for the country to diversify supply away from the US. As a result, China has shifted a considerable portion of its soy imports to Brazil over the past ten years, reducing the proportion of US imports to just 23% in 2024, down from 40% in 2014. (See Exhibit 2.) Given these circumstances, Brazil has come out ahead of the game and will likely continue building on the growth of its soy trade with China. Argentina, too, has been making investments to increase soy production and further develop the infrastructure needed to boost its exports.

In contrast, while the impact of this shift on US soy farmers has been mitigated to some extent by an increase in volume, the longer-term effects are likely to be more permanent. Significantly limited demand for soy may lower profits for US farmers and for their input and equipment suppliers. And it will ultimately affect the entire grain trading ecosystem, whose economics are driven by volume and exports.

Planting for the Future

The constant shifts in trade policy—and the accompanying uncertainty—pose a significant challenge to farmers and other stakeholders in the sector. This is especially true given that the agriculture industry, like the enormous tractors they use, cannot turn on a dime. Crops can’t be replanted mid-season, and even shifting fields to new crops can take years.

As a result, farmers will be forced to make tough choices regarding how to spend and allocate capital. In an environment of high tariffs and strained demand, how much are they willing to spend on inputs? Are they comfortable making large equipment purchases? The decisions they make will impact other value chain players—in fertilizers, crop protection, farm equipment, and beyond.

While tariff policy is hard to predict, all players in the agriculture industry can benefit from monitoring policy developments and preparing for different scenarios. One leading indicator could come in the form of signals from certain countries that they are looking to offer carve-outs for certain goods, as the US has offered Canada for potash imports. Another could be new investments in the storage and logistics infrastructure needed to import or export a certain crop, as Argentina is now doing to boost soy exports to China.

Depending on their degree of tariff exposure, every player in the agricultural value chain faces a complex risk equation in response to tariffs. Mitigating risk will require careful attention to current and prospective trade policy and greater flexibility in every aspect of the business, from product strategy to capital allocation to supply chain resilience. Be prepared.