As 2025 began, optimism was high among dealmakers worldwide. Elections in major economies had concluded, central banks seemed poised to deliver clarity on interest rates, and many players anticipated that these factors would revive the M&A market. Yet our analysis at the time—reflecting insights from BCG’s M&A Sentiment Index—offered a more tempered outlook. Last January, the index stood at 73, signaling an undercurrent of caution beneath the prevailing

This caution proved prescient. The global M&A landscape soon faced headwinds as financial markets reacted sharply to the US tariff announcements, introducing volatility that dampened M&A activity. Although sentiment has partially rebounded from the lows of early 2025, our latest measurements indicate that it remains below the long-term average of 100, suggesting that the market continues to navigate significant uncertainty.

Stay ahead with BCG insights on M&A, transactions, and PMI

Sentiment Rebounds in Most Regions, But Asia-Pacific Lags

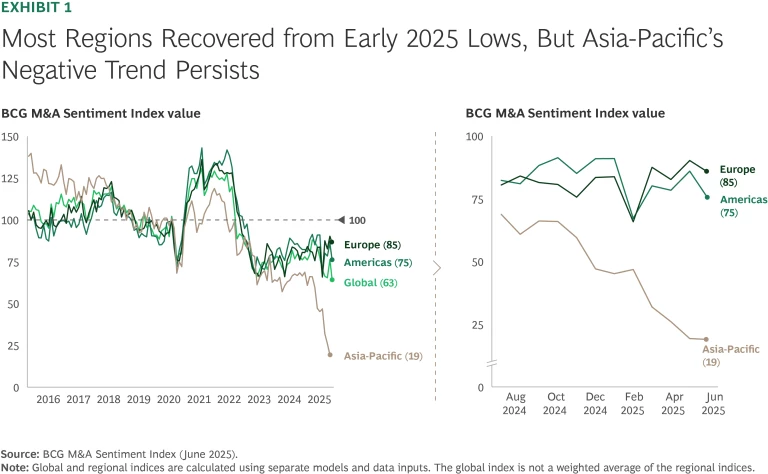

After plunging to an all-time low in April 2025 amid heightening volatility and policy uncertainty, BCG’s global M&A Sentiment Index rebounded modestly in May. But that recovery proved short-lived. By June, the index had dropped again to a new low of 63—37% below its long-term average. Beneath this global trend, however, regional and industry dynamics reveal a more nuanced story.

North America and Europe have recovered from their first-quarter lows, stabilizing near an index score of 80, well above the current global average. Asia-Pacific, however, continues to struggle, sinking to a new low of 19. (See Exhibit 1.)

In North America, optimism about deregulation and stabilizing interest rates is creating a more favorable backdrop for dealmaking. Combined with a large pool of available capital from corporations and private equity firms, these factors could spark a resurgence of megadeals, particularly in sectors driven by technological advances in areas such as AI, semiconductors, and chips. Beyond AI-specific mergers, traditional growth-focused transactions persist, exemplified by Google's recent acquisition of cloud security startup Wiz. The shifting political landscape is affecting M&A, too. Notably, in March, a BlackRock-led investor group announced that it would acquire critical Panama Canal infrastructure from CK Hutchison Holding, a Hong Kong-based conglomerate.

With a score of 85 in June 2025, Europe’s sentiment index showing is especially strong, surpassing North America’s for the first time in two years. The region’s attractiveness to investors, amid heightened uncertainty in North America, reflects broader capital market trends. Europe's financial services and insurance sectors continue to be quite active, highlighted by Banca Monte dei Paschi's bid for Mediobanca in Italy and Helvetia’s acquisition of Baloise in Switzerland.

Meanwhile, Asia-Pacific faces ongoing headwinds. The region's anemic sentiment index score of 19 reflects continued economic policy uncertainty, compounded by recent US trade actions. Nevertheless, significant fiscal stimulus in China could eventually revive its M&A activity. In Japan, corporate governance and capital market reforms—coupled with growing investor pressure to enhance valuations—are fostering greater deal activity.

Middle Eastern investors and financial sponsors will likely continue to seek international opportunities, reflecting their strategic goals for growth and diversification. Africa also shows early signs of recovery, notably in South Africa and in the continent-wide materials sector, buoyed by global demand for rare earths and other essential resources.

Industry trends reveal a split between two broad groups. Cyclical sectors, particularly consumer goods and industrials, remain more cautious than others, with sentiment scores of approximately 50. Companies in these industries face challenges from restrained consumer spending and reduced corporate investment, dampening enthusiasm for acquisitions. Other sectors’ scores align closely with the global index, bounded by energy and utilities at 74 and health care at 63.

Finally, IPO activity—which often correlates with broader M&A trends—began strong in early 2025 but slowed amid market volatility in the second quarter. Even so, a healthy pipeline suggests that calmer conditions could quickly reignite moves for new public market listings.

Slower-Than-Expected Activity in the First Half of 2025

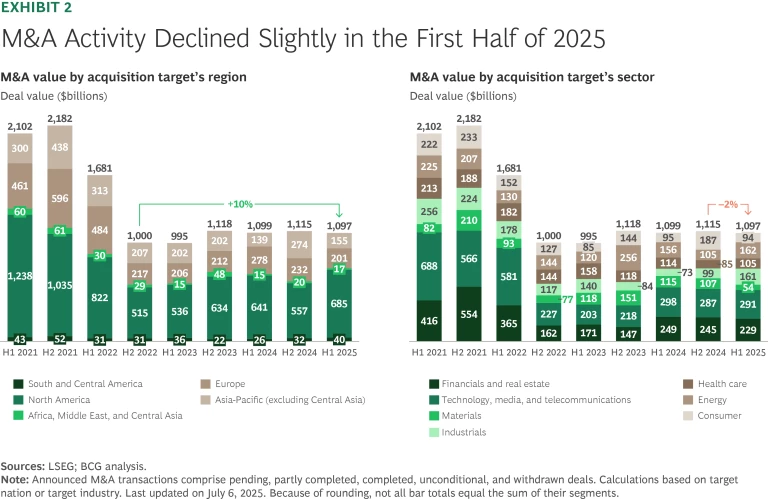

Global M&A activity in the first half of 2025 remained fairly robust, despite falling short of the strong rebound that many analysts had anticipated. Lingering market volatility and uncertainty—which were particularly prominent during the second quarter—tempered overall dealmaking. (See Exhibit 2.)

Total global M&A deal value reached $1.1 trillion, marking a decline of approximately 2% from the preceding six months and remaining below historical averages.

Regional differences during the first six months of the year were significant:

- M&A transactions involving targets in the Americas reached $724 billion, up 23% from the second half of 2024. North America, particularly the US, dominated this activity, accounting for $685 billion—equal to 62% of global deal value.

- European deal value totaled $201 billion, a 14% decrease from the previous half-year. Despite recent optimism surrounding Europe's dealmaking climate, its actual share of global M&A declined notably in early 2025.

- Deal activity in Asia-Pacific declined by 43%, to $155 billion. Ongoing geopolitical tensions and local challenges continued to dampen investor sentiment.

At the sector level, activity varied markedly. The industrials sector witnessed the most significant rebound compared with the second half of 2024, seeing a 62% rise in aggregate deal value, followed by energy (54%) and health care (23%). In contrast, the materials and consumer sectors saw substantial declines of 49% and 50%, respectively, reflecting fewer large transactions.

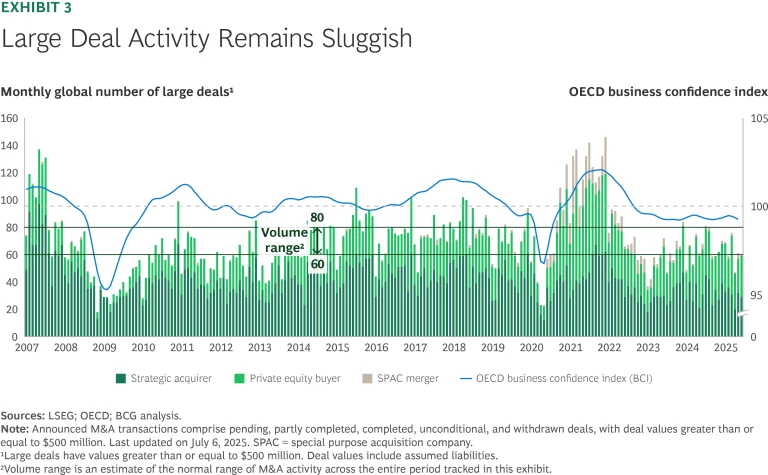

Megadeal activity (transactions valued at more than $10 billion) remained constant, as companies announced 24 such deals in the first half of 2025—the same number as in the previous six months. More broadly, however, the number of large deals (those valued at more than $500 million) fell below the long-term average range of 60 to 80 globally per month, reflecting dealmakers’ cautious mindset even as business conditions have improved. (See Exhibit 3.)

The three largest announced transactions of the first half of 2025 underscore the prominence of high-profile strategic maneuvers:

- Rasner Media’s proposed $47.4 billion acquisition of TikTok’s US assets—a move that is subject to significant political and regulatory scrutiny

- Toyota Motor’s bid to acquire its auto parts supplier, Toyota Industries, for $46.6 billion

- Sycamore Partners’ attempt to take private the US-based pharmacy chain Walgreens Boots Alliance, valued at $43.7 billion

Private equity deal activity trended higher during the first six months of 2025. Financial sponsors continue to feel pressure to invest their large amounts of dry powder. In contrast, early- and later-stage funding for startups is lagging, despite strong enthusiasm for AI startups.

The Winning M&A Strategies amid High Uncertainty

Following the tariff shocks of April 2025, we identified five archetypes that are likely to dominate dealmaking. These strategies include establishing local operations to bypass tariffs, consolidating within sectors to reduce cost pressures, strengthening the core business to build resilience, unlocking new sources of value across sectors, and forming joint ventures or alliances to pursue opportunities that may arise from new trade agreements.

Evidence indicates that companies are already swiftly adapting their strategies to the new reality. In a recent BCG survey, for example, a majority of executives indicated that they expect the importance of joint ventures and alliances to increase in the near term. This highlights the growing preference for alternative deal structures in the current environment.

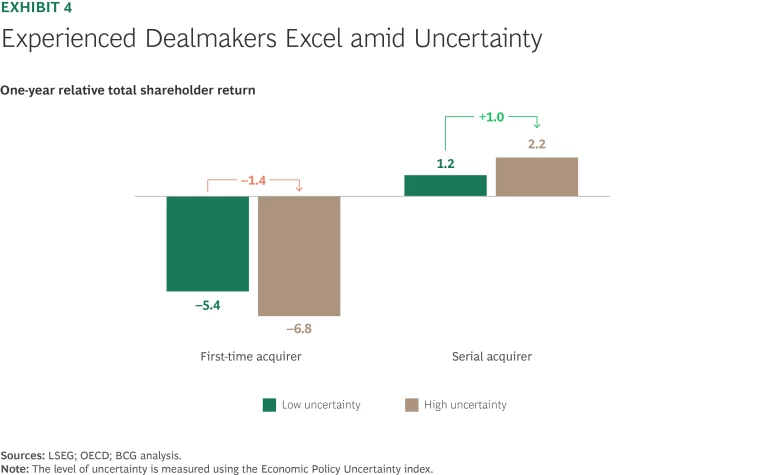

Though the root causes of today's market volatility are unique, dealmakers have had to cope with high levels of uncertainty before. Our analysis of more than 30 years of M&A data reveals that experience is the key attribute that distinguishes the winners. Serial acquirers consistently outperform first-time dealmakers in uncertain environments. Although first-time dealmakers tend to destroy even more value than usual when uncertainty is high, serial acquirers excel during these periods and create almost twice as much value from the deals they conclude at such times as from deals that they make during low-uncertainty times. (See Exhibit 4.)

Lessons derived from experienced dealmakers’ playbooks suggest that dealmakers should recognize several imperatives if they are to maximize value creation in the current environment:

- Pursue bold yet strategically sound deals with clear synergies—whether in costs, revenues, or capabilities.

- Use scenario-based planning to proactively prepare for acquisitions and divestitures while factoring in uncertainty.

- Prioritize flexible deal structures—such as stepwise acquisitions, joint ventures, or earn-out clauses—to enable adaptive integration and effective risk mitigation.

- Seek resilient, undervalued assets temporarily affected by market volatility.

- Anticipate heightened regulatory scrutiny, especially in deals involving cross-border or sensitive sectors.

- Remain agile and prepared, recognizing how digitization, AI, and sustainability increasingly shape competitive advantage.

Although dealmaking conditions in 2025 have undeniably grown more challenging, the long-term drivers of M&A remain in place. As businesses adapt, deal activity is likely to rebound—supported by ample capital and pent-up demand from corporations and financial investors. Bold, strategically minded dealmakers will uncover opportunities for significant acquisitions and divestitures, even amid heightened uncertainty. In this evolving landscape, success will hinge on the speed and adaptability with which companies respond to the shifting dynamics.