In October 2025, the global M&A market’s volatile recovery continues, marked by renewed optimism. After navigating significant turbulence earlier this year, the market has shown its resilience, driven by strategic adaptability among experienced dealmakers.

The trend in BCG’s M&A Sentiment Index, a leading indicator of future deal activity, has been increasingly positive across all sectors recently, with particularly strong confidence in the technology and energy industries going forward. Yet this recovery unfolds amid persistent geopolitical tensions, regulatory shifts, and economic uncertainties, all of which continue to affect market dynamics.

Rather than being deterred, successful dealmakers are strategically harnessing these uncertainties. Forward-looking executives are transforming their business portfolios through targeted acquisitions and divestitures. They are also applying AI and advanced analytics to accelerate and enhance dealmaking—from identifying high-potential targets and conducting deeper due diligence to streamlining integration. For these leaders, M&A is no longer merely opportunistic; it has become an indispensable strategic tool for shaping the future of their organizations.

The M&A Market Defies Headwinds

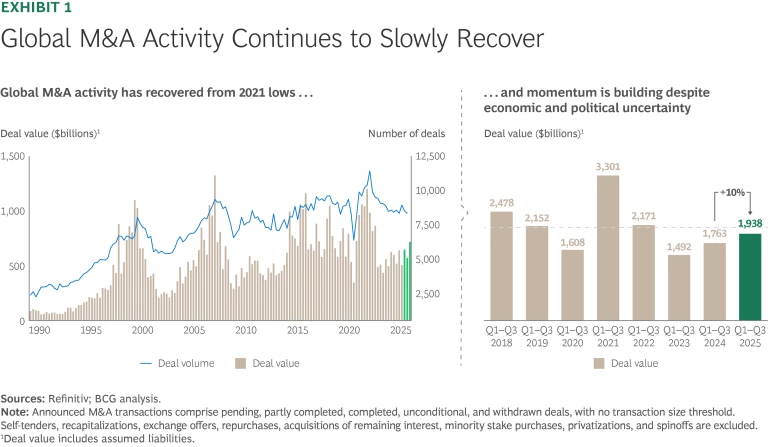

The global M&A market continues to demonstrate resilience, steadily recovering despite ongoing challenges. In the first nine months of 2025, aggregate deal value rose by 10% compared with the same period last year. (See Exhibit 1.)

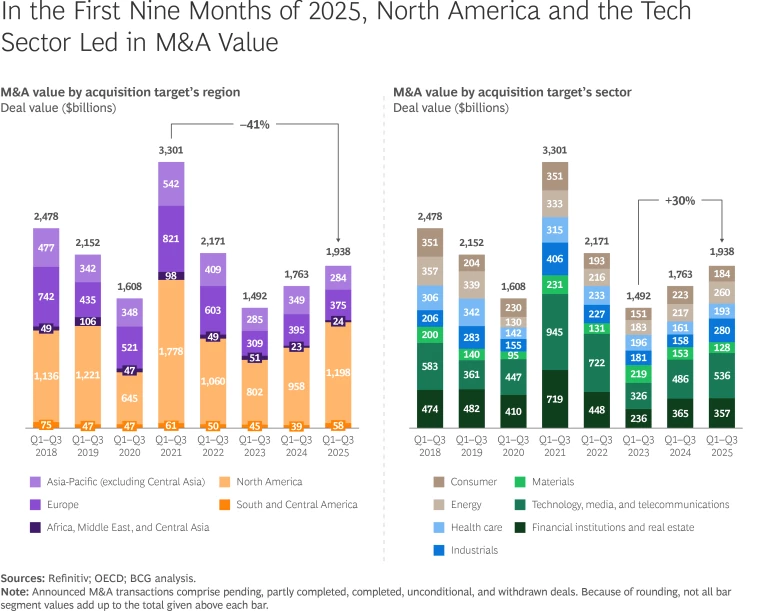

While headwinds such as geopolitical tensions and changing tariff policies have caused some dealmakers to pause, many others have pressed forward strategically. Transactions with a regional focus, particularly in the small- and mid-cap market sectors, have proven to be more insulated from geopolitical and tariff disruptions. Similarly, deals driven by strategic growth, capability enhancement, or improving resilience continue to advance. North America has been the most active region for acquisitions in terms of value, while the technology sector has led among industries. (See “Region and Sector Insights.”)

Region and Sector Insights

The data for 2025 reveals several key developments:

- Deals involving targets in the Americas had a total value of $1.26 trillion, an increase of approximately 26% versus the first nine months of 2024. The vast majority of these deals (worth $1.20 trillion) involved targets in North America, which accounted for 62% of overall global M&A activity. US companies acquired most of these targets. Canada saw an uptick of 96%, returning to above-average levels, and South and Central America grew by 47%.

- The value of European M&A totaled $375 billion, a 5% decline against the first nine months of 2024. The UK remained the largest M&A market in Europe, although deal value there decreased by 35%. Deal value also declined strongly in Spain (–58%) and France (–29%). In contrast, aggregate deal value was significantly higher in the Netherlands (263%), Switzerland (109%), Italy (28%), Germany (45%), and the Nordics (31%), the last mostly driven by upticks in Norway (61%) and Sweden (36%).

- In Africa, the Middle East, and Central Asia, M&A activity—in terms of aggregate deal value—increased slightly (6%) but remains significantly below the average level of the past ten years.

- Deal value in Asia-Pacific declined by 19% to a ten-year low of $284 billion. Bright spots included Singapore (38%), mainland China (11%), and Australia (1%). However, the rise in aggregate deal value in these areas did not counter downward trends in other places, such as South Korea (–13%), India (–20%), and Hong Kong (–73%).

The sectors demonstrating the most significant increases in M&A deal value compared with the same period last year were industrials (77%); technology, media, and telecommunications (10%); energy (20%); and health care (20%). Large transactions involving transportation and infrastructure companies were primarily responsible for the industrials sector’s strong gains, indicating heightened activity and strategic investment. Conversely, the materials (–16%) and consumer (–17%) sectors saw substantial declines in deal value during the same period, owing mainly to a slowdown in large-scale transactions in these sectors.

Stay ahead with BCG insights on M&A, transactions, and PMI

Large-scale M&A activity continues to rebound. During the first nine months of this year, the number of megadeals—those valued at $10 billion or more—reached 27, up from 21 over the first nine months of 2024. While still below the record 40 megadeals in the frenzy of 2021, this uptick signals growing optimism in the market.

Notably, most of the year’s largest transactions have been US-focused:

- Union Pacific announced its $71.5 billion acquisition of railroad operator Norfolk Southern, marking a major consolidation in US freight transportation.

- A consortium comprising Silver Lake Group, Saudi Arabia’s Public Investment Fund, and Affinity Partners acquired gaming company Electronic Arts in a deal that values the company at approximately $55 billion. If completed, it will be the largest leveraged buyout ever (not adjusting for inflation).

- Tech giant Alphabet pursued strategic growth in cloud security by acquiring software company Wiz for $32 billion.

- Electric utility Constellation Energy expanded its footprint through a $26.9 billion deal for power generator Calpine.

- Palo Alto Networks reinforced its competitive position by acquiring CyberArk for $25.1 billion, with the aim of creating an end-to-end security platform tailored for AI.

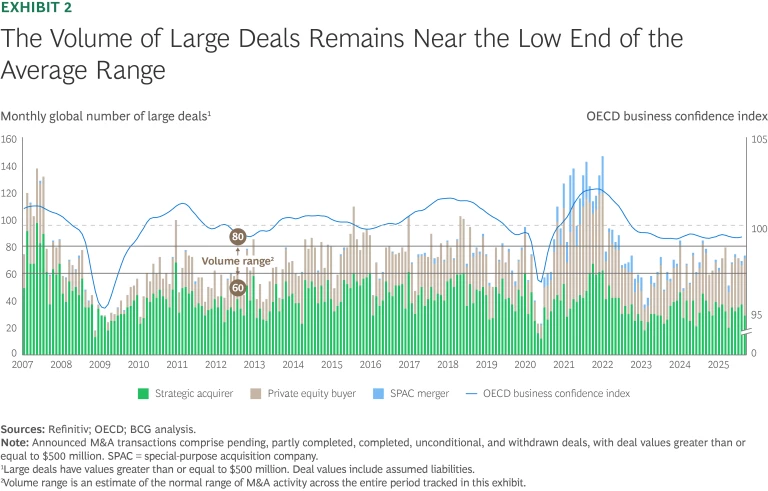

Despite this positive momentum, the number of large M&A deals (those valued at $500 million or more) remains near the low end of historical averages. (See Exhibit 2.) This is consistent with broader market sentiment and aligns closely with the BCG M&A Sentiment Index. Meanwhile, SPAC mergers, prominent from 2020 to 2022, have largely reverted to a peripheral role in the broader M&A landscape.

Private equity (PE) and venture capital (VC) activity is trending higher. Global PE deal value rose 38% year-to-date through the first three quarters of 2025 compared with the same period last year, driven by large deal activity such as the mega buyout of Electronic Arts. Similar to the overall M&A market, PE deal volume was broadly on the same level as last year. Technology, media, and telecommunications, industrials, and energy were the three most attractive sectors for financial sponsors.

PE firms continue to sit on substantial dry powder—approximately $2 trillion in undeployed capital as of early October 2025—maintaining pressure on investors to invest these resources strategically. However, global fundraising for PE has notably slowed since the 2021 peak, evidence of a more challenging environment for attracting fresh capital.

In the VC landscape, funding levels climbed by approximately 36% globally during the first nine months of 2025 compared with the previous year, according to Crunchbase data. Nevertheless, the current level remains below the highs recorded in 2021 and 2022. AI companies continue to be a primary focus for VC investment, especially mega funding rounds, despite ongoing market concerns about high valuations, market saturation, and less certain growth trajectories.

Improving Sentiment and a Positive Outlook

BCG’s M&A Sentiment Index suggests a mixed picture of deal activity across sectors over the next six months. Sentiment is particularly optimistic in the technology and energy sectors, with industrials and consumer showing weaker momentum.

Substantial capital for investment comes not only from PE funds but also from many companies worldwide with robust balance sheets, providing ample resources for strategic acquisitions. Adding impetus, interest rates have generally stabilized or even declined, while valuation levels have recovered.

The market currently reflects substantial pent-up supply and demand. On the sell side, divestiture activity has been modest, as many PE and corporate sellers have strategically delayed asset sales and carve-outs as they await more favorable conditions. On the buy side, many large-scale and cross-border transactions remain temporarily on hold, pending greater clarity for business planning. A similar situation exists for IPOs, with a healthy pipeline of companies ready to go public when the market environment turns more favorable.

Sector-specific trends highlight areas of strong activity: technology remains a key focus that is especially attractive to PE investors. Europe has seen persistent dealmaking activity and rumors involving media companies and financial institutions, including banks, asset managers, and insurers. The energy and utilities sectors are similarly positioned for robust dealmaking activity. The materials, metals, and mining sectors are expected to remain active, too, as certain critical materials gain importance and global supply chains continue to realign. These dynamics are driving large-scale transactions, such as the recently announced merger of two mining giants, the UK’s Anglo American and Canada’s Teck Resources—a $20.1 billion transaction to form a copper and critical minerals powerhouse. Meanwhile, thanks to high valuations and sustained business momentum, the defense sector presents notable opportunities, particularly for capital raising and IPO activities.

Despite numerous positive fundamental factors, volatility remains a persistent challenge. Political tensions, geopolitical shifts, economic policy uncertainties, regulatory complexities, and rapid technological developments—especially advances in AI and computing—continue to generate market volatility, reinforcing the importance of strategic flexibility and resilience in M&A planning.

Get Ready for the Brave New World

Amid the uncertainty and complexity, executives must prepare to pursue deals in a landscape that differs in critical aspects from the environment they have been accustomed to. To succeed in this new world, dealmakers need to address several imperatives.

Learn to cope with uncertainties beyond your control. Seasoned dealmakers view uncertainty not as an obstacle, but as an environment in which strategic opportunities emerge. Although recent market disruptions have led to postponed or restructured deals, most transactions ultimately return to the table once conditions stabilize.

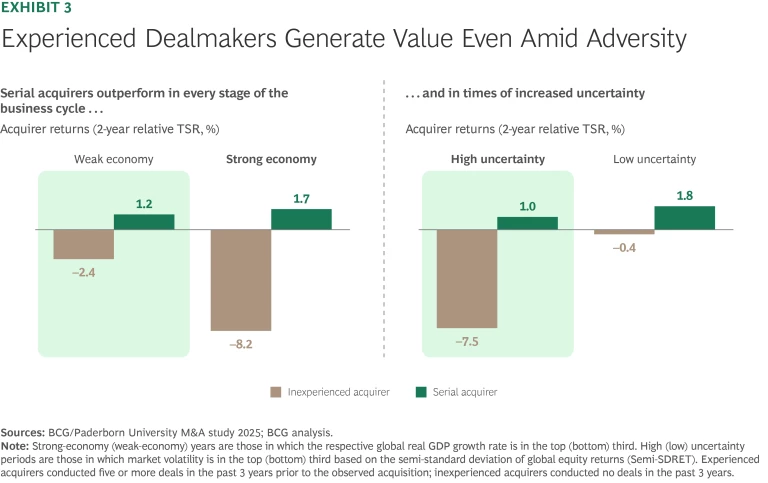

Indeed, history shows that periods of turbulence often have the greatest potential for value creation. BCG’s analysis highlights that experienced dealmakers consistently outperform peers during downturns or volatile periods. (See Exhibit 3.)

To manage risk and enhance flexibility, expert dealmakers employ alternative, collaborative structures—such as joint ventures and alliances—and embed optionality through seller financing, material adverse change clauses, and purchase price adjustments. They also rely on rigorous scenario planning during due diligence to stress-test the deal thesis and ensure value creation across a range of outcomes. Above all, they stay anchored in a rock-solid business case, ensuring that every move aligns with strategic intent and delivers upside potential with downside protection.

By acting decisively and strategically, these masters of M&A demonstrate that adversity can provide fertile ground for transformative deals, sometimes outperforming those made under calmer conditions.

Integrate M&A into your strategic toolkit. Today, mergers, acquisitions, and divestitures have become essential components of corporate strategy. Corporations use such transactions alongside organic growth initiatives, and deals are foundational to PE firms’ business models. Strategic M&A is no longer seen as risky or optional—it is critical for executing business transformations and achieving ambitious growth objectives. To succeed, companies must build an always-on M&A capability that is tightly integrated into corporate strategy, owned and led by senior leadership, and enabled by a best-in-class corporate development function.

In an era marked by technological disruption, geopolitical risks, and evolving regulatory environments, maintaining the status quo is rarely a viable option. Companies face challenges ranging from shifting customer behaviors and fragile supply chains to the demands posed by the energy transition and evolving regulations. In this environment, acquisitions and divestitures are essential for resilience and competitive advantage, and their importance will only increase. We expect a surge in transformational deals, including those targeting assets adjacent to or outside a company’s traditional core.

Acquisitions offer pathways to secure growth, gain efficiencies, access new technologies, and attract talent. Conversely, divestitures allow companies to shed noncore or underperforming assets, refining their strategic focus and unlocking capital for reinvestment. Investors increasingly expect corporate leaders to proactively reshape portfolios, leveraging M&A not merely to expand but to drive sustainable value creation. Leaders must position their company to capitalize on emerging opportunities, ensuring that every transaction strengthens their market standing and ultimately enhances shareholder value.

Apply game-changing AI and advanced analytics capabilities. AI and advanced analytics have shifted from theoretical concepts to operational realities, transforming the M&A landscape. AI-driven innovations are reshaping deal processes, streamlining due diligence, and enhancing transaction efficiency. The question facing dealmakers is no longer whether AI will impact their operations, but how quickly and effectively they can integrate these tools into their daily workflows.

Already, GenAI capabilities are accelerating the review of thousands of documents in virtual data rooms, and advanced analytics are supporting rigorous due diligence, uncovering risks, and revealing hidden value drivers. Early adopters are piloting AI agents for routine tasks such as drafting documents and monitoring compliance, freeing professionals to focus on strategic decisions and negotiations.

Although many AI applications in M&A remain in the exploratory phase, their growing importance is undeniable. PE firms may lead adoption owing to their frequent dealmaking cycles, but corporates should prioritize integrating AI into their strategies as well. To remain fast and competitive in deal situations, organizations must leverage AI to unlock tangible advantages in their M&A execution.

Maintain a long-term perspective. M&A is fundamentally about long-term strategic positioning rather than short-term gains or adjustments. Successful deals must align closely with a company’s broader strategic vision, purpose, and culture. Without clear cultural alignment and shared goals, even strategically compelling and financially sound deals can falter during integration.

Moreover, for many companies, long-term considerations such as technological improvement and sustainability are essential aspects of dealmaking strategy. Global CEOs continue to prioritize digitization and AI. For many, ensuring access to resources (including strategic materials and energy) and, more broadly, securing supply chains remain central to the M&A agenda.

Companies leverage M&A to acquire sustainable capabilities, enter new environmentally focused markets, or divest assets misaligned with future sustainability goals. Evidence across industries shows that capital markets reward green growth and that well-executed sustainability-focused deals can generate significant long-term value.

M&A has returned to the forefront—and it is more essential than ever. Seasoned dealmakers view today’s volatility as an opening not merely to grow or to shrink, but to transform. Amid the prevailing uncertainty, the investment community now expects portfolio moves and growth pivots that it once viewed as optional. At the same time, AI is streamlining deal processes and surfacing hidden value, making transactions faster and smarter. In this new world, the mandate for dealmakers is clear: make selective bold moves, embrace emerging technology, and play for long-term advantage.