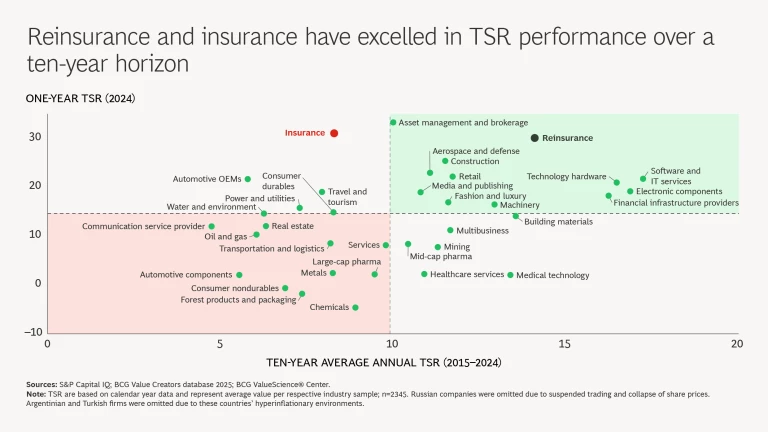

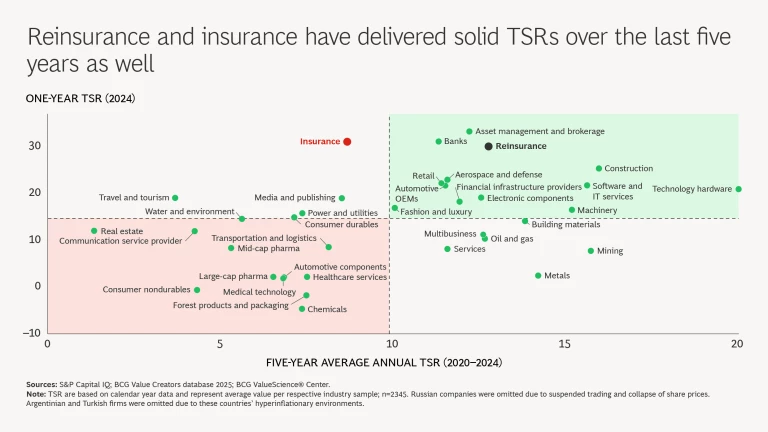

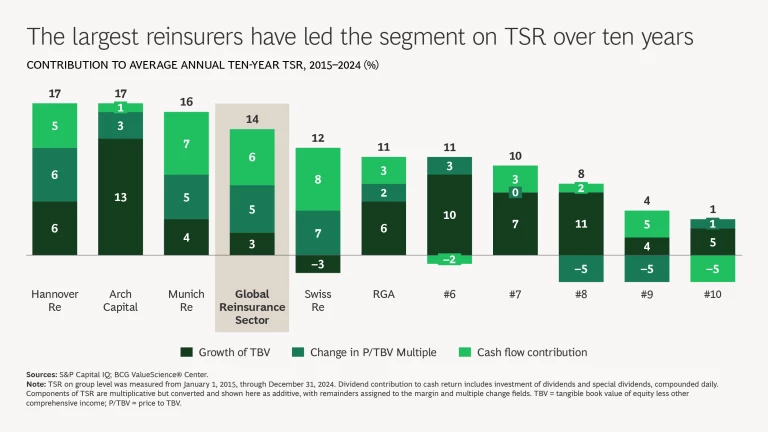

Reinsurers have been riding a strong market, and they have the shareholder returns to show for it. Total shareholder returns (TSR) topped 14% for the ten years ended December 31, 2024, and were almost 13% for the five years 2020–2024. Reinsurance outperformed the insurance industry as a whole and many other industries and sectors as well, especially over the ten-year horizon.

The slide show below provides a detailed look at the reinsurance industry’s 2020–2024 TSR story. For further insights, see the reports BCG has produced on the global insurance and US P&C segments.

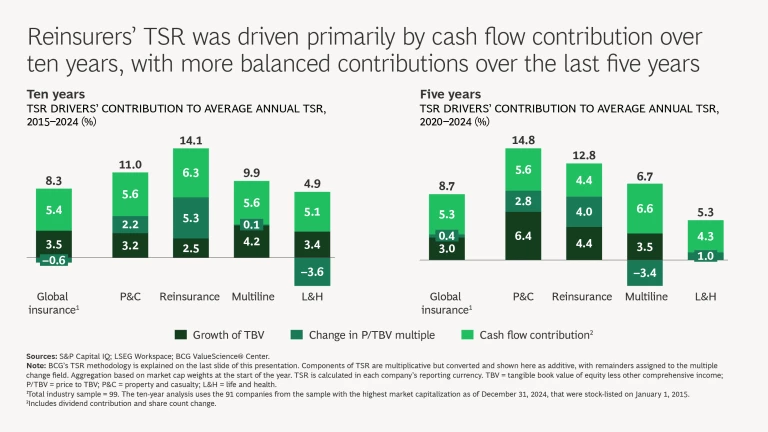

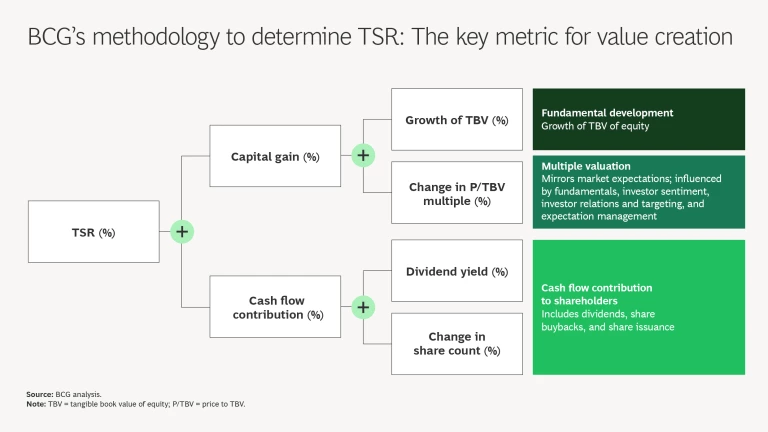

TSRs for both reinsurance and insurance were driven substantially by cash returned to shareholders (through dividends and share buybacks) over the ten-year period. Both the reinsurance sector and the entire insurance industry show better balance among the three drivers of TSR for the five-year horizon with growth in tangible book value (TBV) and multiple expansion contributing equally with cash flow. Reinsurers’ growth in TBV does lag the property and casualty sector on both horizons.

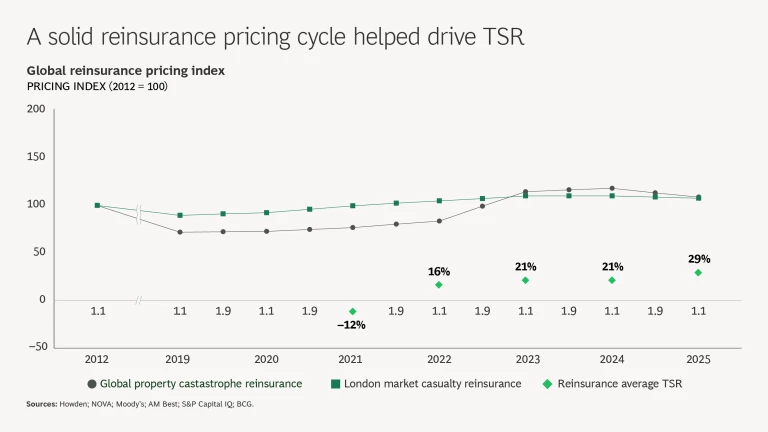

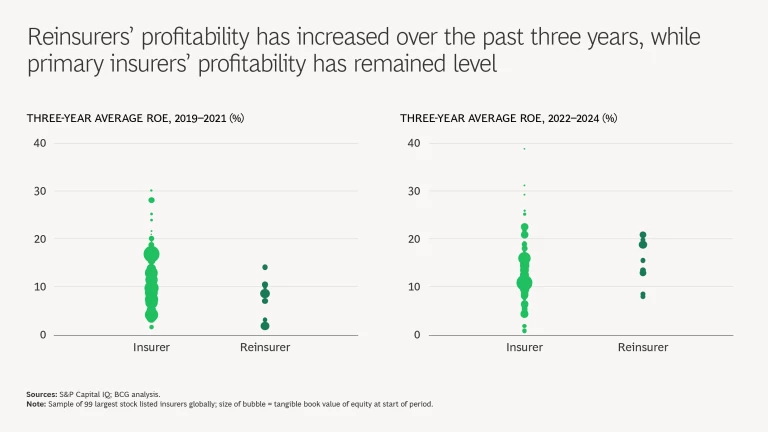

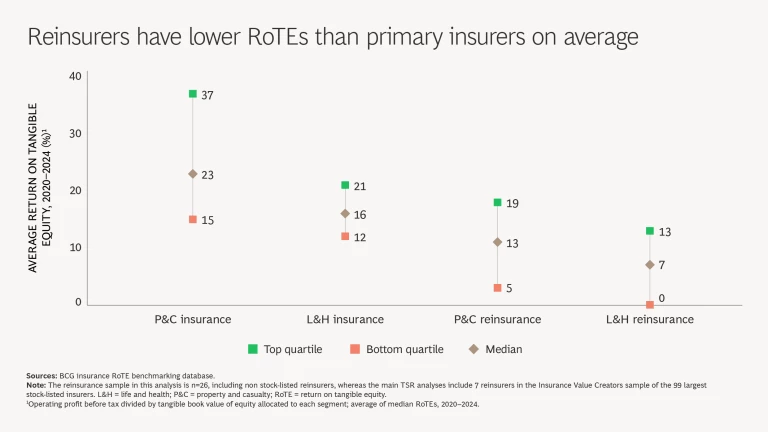

A strong pricing cycle for reinsurance correlates with rising TSR over the last several years. While profitability of primary insurers has remained roughly even, reinsurers’ profitability has increased. That said, not all reinsurers have operated at or above their cost of equity. Reinsurers report lower returns on tangible equity (RoTEs) than primary insurers.

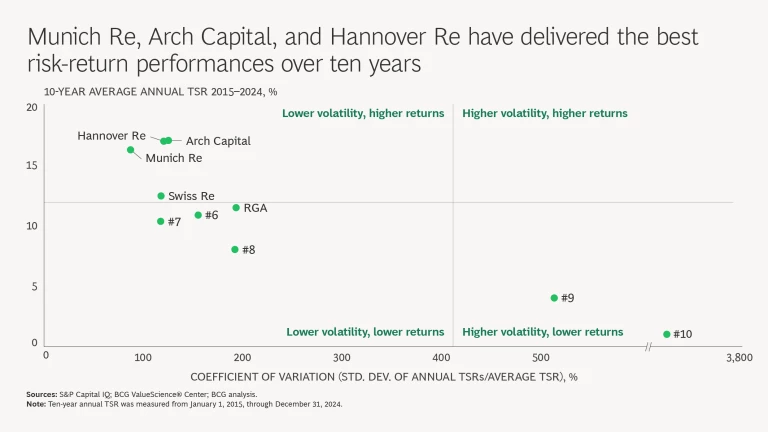

Size has helped the biggest reinsurers deliver the best risk-return performance and the highest shareholder returns. Munich Re, Arch Capital, and Hannover Re have delivered the best risk-return performances over ten years.

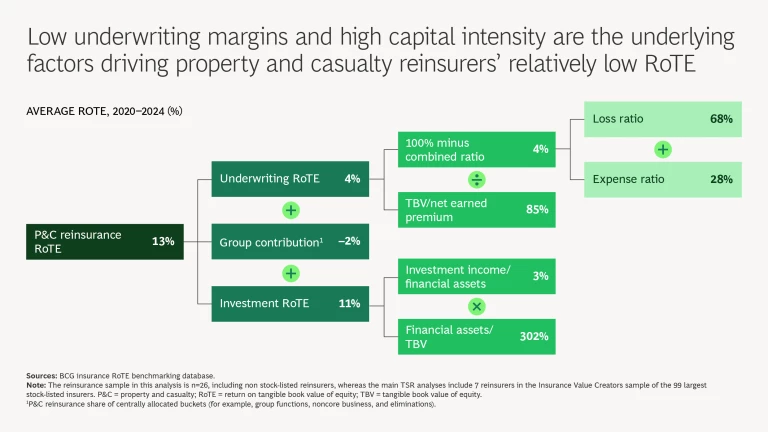

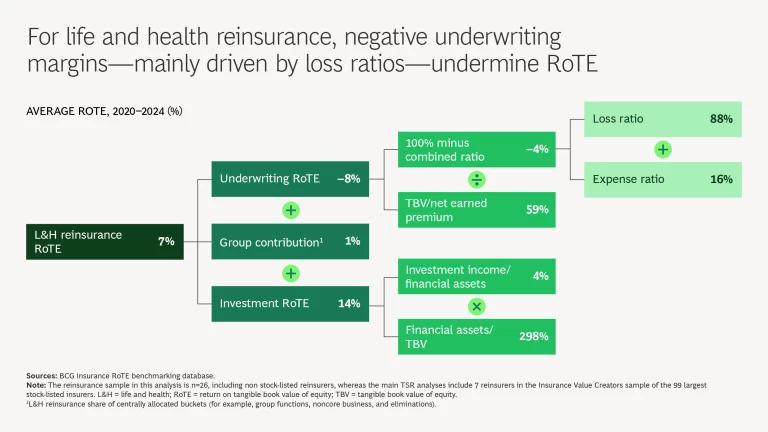

Among reinsurance subsegments, low underwriting margins and high capital intensity are the underlying factors driving property and casualty reinsurers’ relatively low RoTE. Negative underwriting margins, mainly driven by loss ratios, undermined RoTE for life and health reinsurers.

The balanced contributions of the three main drivers to reinsurers’ TSR is admirable, but the looming question is whether companies can maintain growth in TBV as pricing weakens. Looking ahead, the big task facing all reinsurers is how to increase TBV growth over time, since supporting TSR primarily through dividend increases and share buybacks has its limits and can leave companies in weakened positions in a softening market. The well-reported challenges of rising catastrophic weather-related events and increasing global geopolitical and economic tensions do not help. Management teams will be tested to deliver smart risk selection and pricing discipline while trying to maintain profitable growth.

Reinsurers have had a good run, but the road ahead could get bumpy.

The authors are grateful to Martin Link, Teresa Schreiber, and Nitish Suddhoo for their assistance with this year’s research and report.