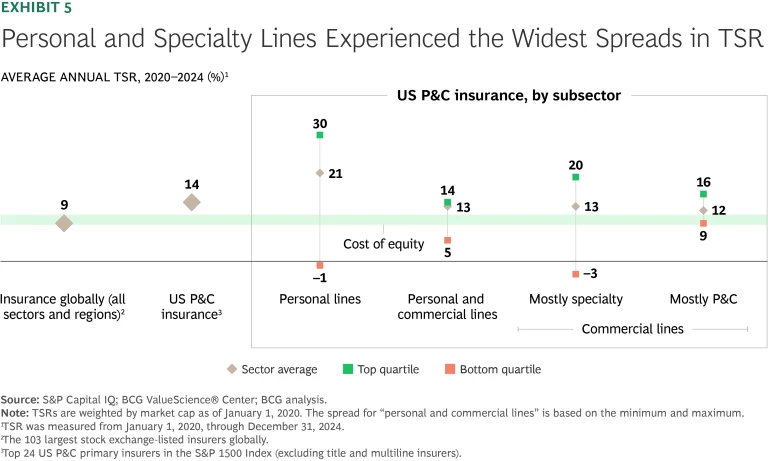

Shareholders in US property and casualty (P&C) insurers have had a strong run. From January 2020 through December 2024, average total shareholder returns (TSR) climbed to 14% for the segment as a whole and an impressive 23% for top-quartile performers—well ahead of the all-industry average of 9%. Over this period, US P&C players added $250 billion in market capitalization, driving most of the global insurance industry’s gains. (See Exhibit 1.)

Beneath these headline figures lies a more nuanced story, however. More than half of the market cap growth came from just two companies, and the performance gap between the top and bottom quartiles has widened. Favorable pricing conditions appear to be turning, while adverse trends such as those from severe weather and social inflation are not abating.

These pressures come at the cusp of profound change. The industry stands at the threshold of an AI-driven transformation that promises to reshape underwriting, claims, distribution, and customer engagement. Against this backdrop, a critical question emerges: Can today’s leaders maintain their edge, and what does the future hold for those whose performance is lagging?

A Wide Competitive Gap, Driven by Underwriting

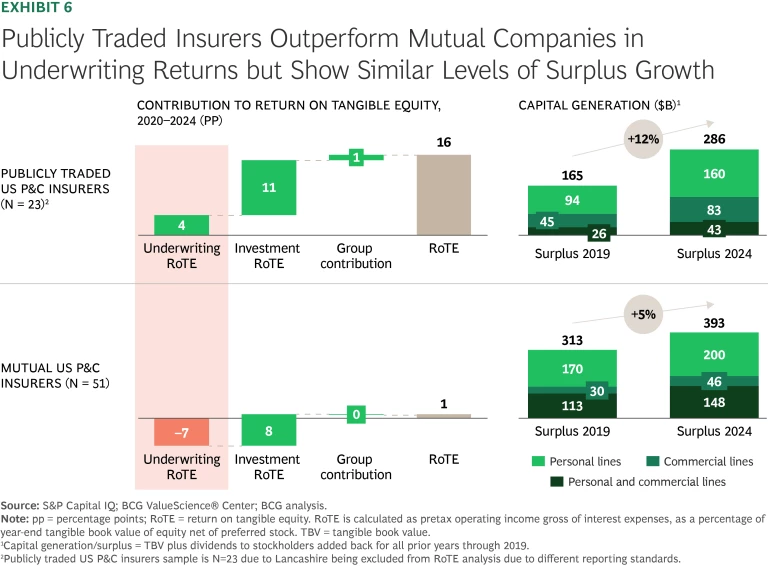

While pricing multiples have expanded across the US P&C segment—not only for top-quartile companies but for the industry as a whole—the primary driver of growth, and the true differentiator of returns, has been the expansion of underlying tangible book value. For top performers, tangible book value growth delivered almost twice the TSR impact compared with the segment average, underscoring its central role in value creation. (See Exhibit 2.)

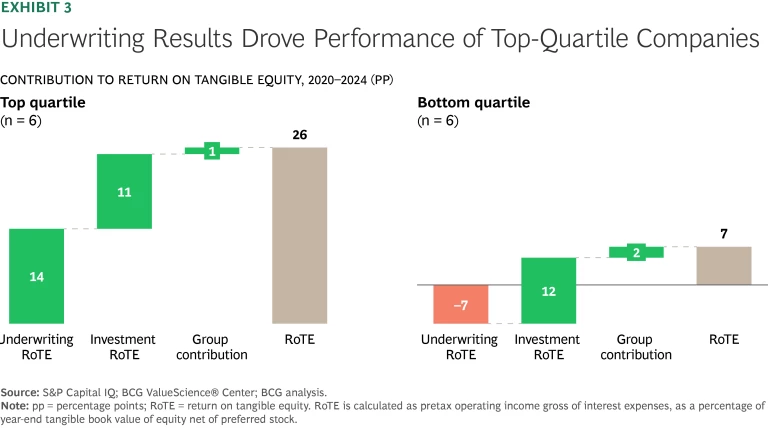

To break this down further, look at return on tangible equity (RoTE) and compare sources of return between top and bottom quartile companies. (See Exhibit 3.) Underwriting is the clear differentiator and fully explains the extraordinary 21 percentage-point gap in returns (which compares with 15 points in 2024 and 25 points in 2023). It’s notable that while bottom-quartile companies were able to generate a positive total return, they did not generate a positive underwriting return or exceed their cost of equity.

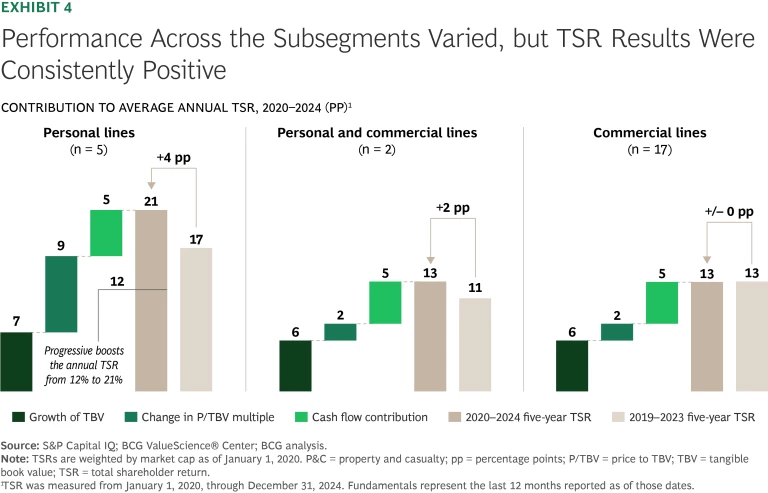

Over-under performance isn’t simply a function of which subsegments companies operate in. All three subsegments—personal, commercial, and mixed—outperformed their cost of equity and the global insurance average. While personal lines had a notably higher TSR than the others, removing Progressive causes personal lines TSR to drop from 21% to 12%, putting it roughly in line with commercial lines and mixed. (See Exhibit 4.)

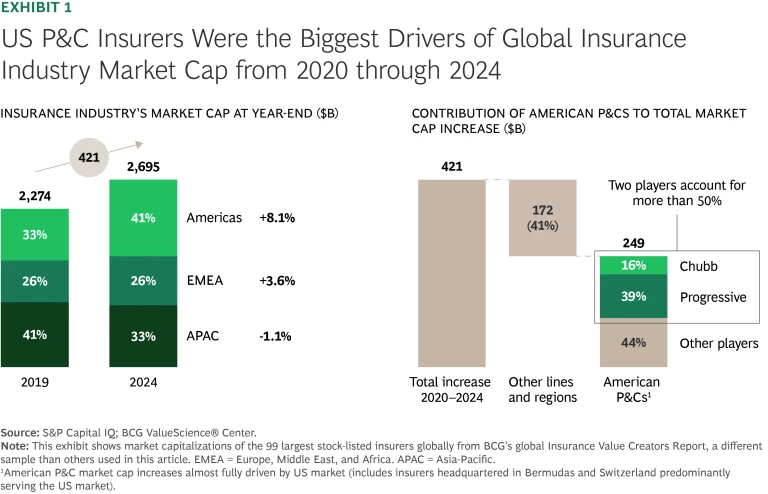

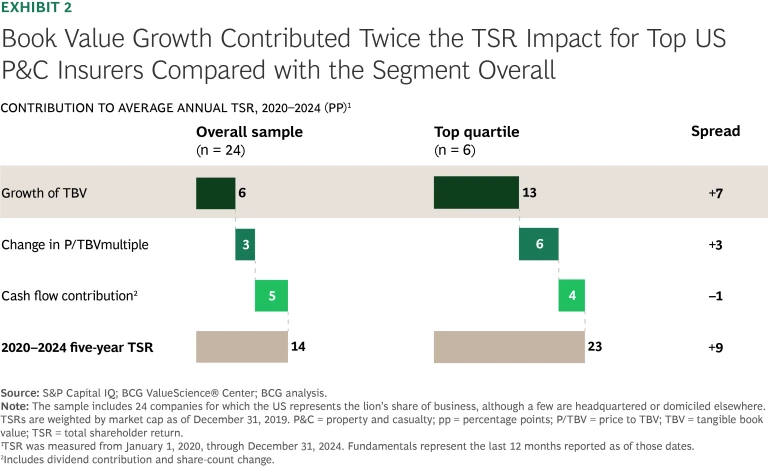

Looking more closely, the biggest spreads between leaders and laggards are found in personal and specialty lines. (See Exhibit 5.) Players in both subsegments have had pronounced opportunities to differentiate their underwriting in recent years. Personal lines carriers that were agile and accurate were able to better recover from, and capitalize on, the whipsawing effects of COVID-19. Profitability in specialty insurance, by its nature, requires deep, niche underwriting expertise. The fact that four of the six top performers were specialty insurers serves as a reminder of the rewards of being able to succeed in these niches. (See Exhibit 6.)

Mixed Performance for Mutual Companies

Analysis of TSR necessarily excludes mutual companies, which are not beholden to shareholders. However, as we have noted in previous reports, mutuals are a significant competitive force for other insurers to contend with. This is in part because of their size and share and also because they play by different rules, the most important being they can be oriented more toward the long term. Nonetheless, they must preserve and grow their capital to continue providing a viable alternative to policyholders.

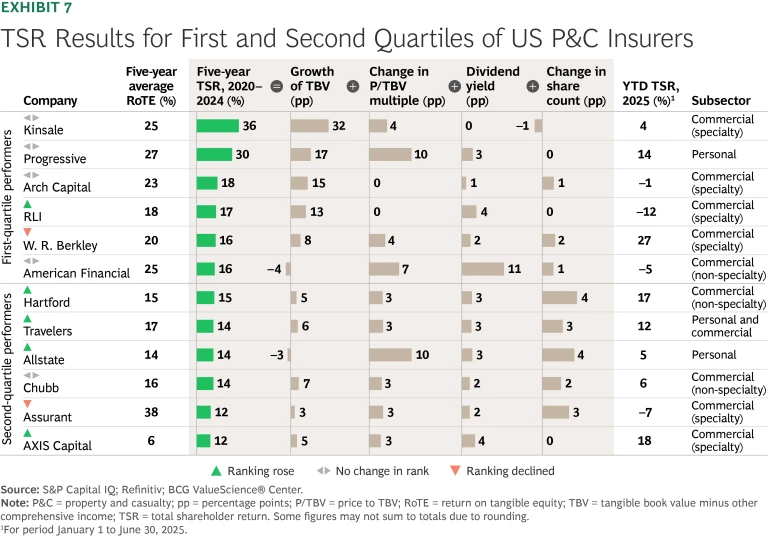

From an RoTE perspective, public companies significantly outperformed mutual companies. (See Exhibit 7.) The primary driver is again underwriting return, where mutual companies on average have produced underwriting losses. From a capital generation perspective this gap is narrower, though it remains substantial. While overall performance of mutuals improved markedly in the last year, the gap between these firms and stock companies has not changed substantially.

Stay ahead with BCG insights on the insurance industry

An Inflection Point in the Market

Previous BCG insurance value creators reports, such as the 2024 report on the US P&C business, have detailed the formidable challenges facing the industry. These include macro factors, such as economic uncertainty and climate change, industry-specific issues such as social inflation and new sources of competition, and two-edged swords that both portend disruption and offer opportunity, such as the rapid development of AI, generative AI, and most recently, agentic AI. The expanding breadth and depth of the challenges put both personal and commercial insurers at a critical juncture, and they are not going to get any help from the market. While there is no question that insurance companies have benefited from favorable pricing conditions over the past few years, this appears to be changing fast in both personal and commercial lines.

- Personal Lines. Carriers have successfully pushed through substantial rate increases while simultaneously restricting coverage and reducing exposure. These defensive moves have restored profitability for now, but a rising tide lifts all boats, and persistent loss trends may quickly erode gains for slower-moving players. Homeowners’ combined ratios in 2024 remained only just below 100%, despite rate hikes. Elevated catastrophe activity is undermining results so far in 2025. In personal auto, softening markets threaten to outpace rates, leaving carriers exposed to structural loss drivers, such as the higher costs of repairing electric vehicles and advanced driver assistance systems and increased accident frequency linked to distracted driving. P&C insurers must confront these headwinds while also adapting to macroeconomic shifts, evolving customer shopping behaviors, and delivering on the potential of AI.

Commercial Lines. Carriers have benefited from a hard market since 2019, but conditions are moderating and commercial insurers will need to find ways to grow as margins tighten. According to the Council of Insurance Agents and Brokers, overall rate increases slowed to 3.7% in the first quarter of 2025 from 4.2% in the first, when commercial property rates halved from the prior quarter. At the same time, social inflation continues to drive outsized casualty losses, creating risks of underpricing and under-reserving. Carriers are responding in multiple ways, including unconventional steps such as leading carriers’ refusal to work with financial institutions that support third-party litigation funding. The challenge will be sustaining this kind of discipline as the underwriting cycle turns.

Simultaneously, commercial lines players must address structural issues brought on by evolving market dynamics. These include brokers moving closer to customers in consolidating retail and wholesale markets; the expansion of alternative channels as current markets fall short at addressing complex risks; and the increasing leverage of brokers in value chains that are being altered by trade tensions, economic and geopolitical shifts, and technological advances.

The Road Ahead

For under-performing competitors, all of these trends present an urgent call to action: strengthen core capabilities in underwriting, claims management, distribution, and portfolio management—or risk falling further behind. Leaders know that TSR has no memory, and they will continue to up their game with innovative products and better service that meet clients’ evolving needs.

But as our colleagues wrote recently about changing global business conditions, even as insurers deal with immediate priorities they also must broaden their focus to longer-term considerations if they are to establish competitive advantage for the future. CEOs and their C-suite colleagues need to take a number of steps at the core of how they serve clients and compete:

- Sharpen underwriting and claims operations to improve accuracy, speed, and efficiency, especially through better use of data, automation, and AI.

- Modernize distribution and customer engagement to reflect shifting expectations across both personal and commercial lines.

- Transform the workforce and ways of working by redefining roles, building digital and analytical capabilities, and enabling effective human–AI collaboration.

- Accelerate adoption of new technologies and partnerships that expand access to data, improve agility, and enhance the speed of innovation.

- Embed accountability and faster decision making into core processes to better respond to market, climate, and regulatory volatility.

The challenges facing issuers are not new, but they are coalescing fast. The need to address them, mitigating risk while seizing opportunity, grows more urgent. TSRs are in the rear-view mirror. Insurers need a sharp eye on the road ahead.

For further insights, see the reports BCG has produced on the global insurance and reinsurance segments.