What do tariffs and evolving trade regulations mean for the auto industry—and what will this mean for consumer demand? Can OEMs manage the potential disruption? What would a high-tariff scenario mean for automakers? How should they prepare?

These and other questions are top of mind for leaders across the automotive value chain. While the possibility of new, retracted, or otherwise adjusted tariffs makes it difficult to answer these questions with precision, BCG’s supply-and-demand model offers fresh insight into possible scenarios and the implications for the auto industry. This same model offers a perspective into potential auto sales in the US in the years ahead.

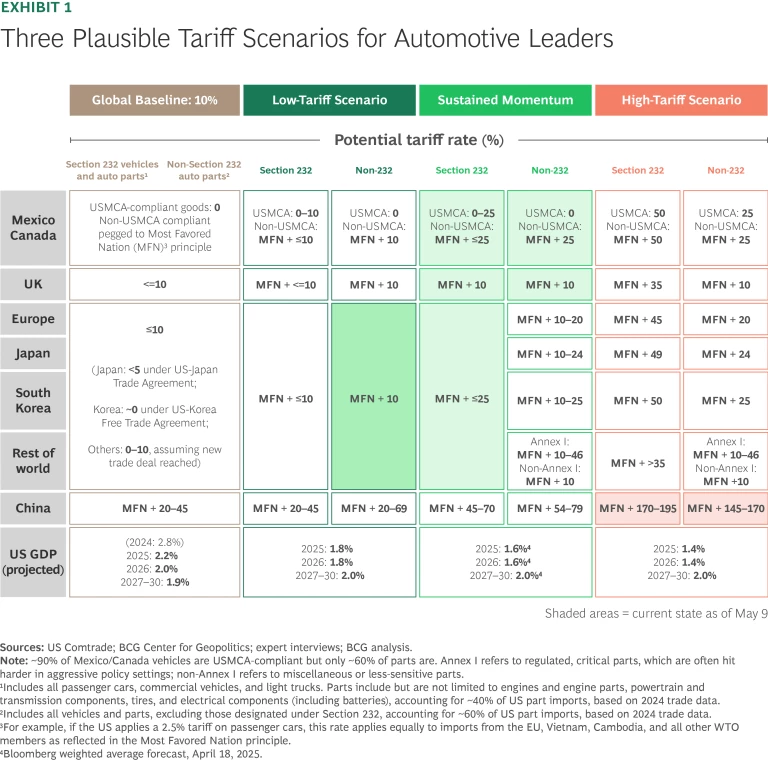

Our analysis considers three scenarios, based on the level of tariffs levied on key auto exporters to the US. These include a “momentum case,” grounded in our best projection of the trajectory of trade activities and tariffs today, as well as a low- and high-tariff scenario. Leaders can leverage these contingencies as bookends for their scenario planning analysis.

Three Tariff Scenarios

Given the dynamic nature of trade policy—illustrated by the recent tariff agreement between the US and the UK—the following scenarios should be considered directional and subject to change as new agreements and regulatory shifts continue to unfold.

Low Tariff Scenario. Despite tariff uncertainty, trade negotiations may result in modest shifts. In this scenario, we expect vehicles and parts compliant with the United States-Mexico-Canada Agreement (USMCA) to be subject to tariffs of <10%, with tariffs levied on noncompliant parts not to exceed 10% of the baseline applicable to most favored nations (MFNs). Vehicles and critical auto parts (powertrains, transmissions, and other components subject to Section 232 duties) from Europe, Japan, and South Korea could once again fall to no more than 10% above the current MFN rate, with peripheral parts not to exceed 10%. In this first scenario, tariffs placed on China could be as low as 20%. (See Exhibit 1.)

Momentum Scenario. Should trade policy continue to evolve as it has to date (early May 2025), auto leaders can anticipate a broader range of tariffs and greater level of nuance across geographic and component markets. Once again, China is likely to see the highest duties—approaching 70%, possibly—while other nations will be subject to varying degrees based on compliance with existing treaties, Section 232 designation, and other factors. We believe this scenario to be the most likely and advise leaders to incorporate these ranges into their scenario planning.

High Tariff Scenario. Auto leaders should also plan for a higher-tariff world, with many current trade partners facing a minimum of 20%. In this scenario, Europe, Japan, and South Korea could face significant tariffs on vehicles and critical parts. The preferential treatment afforded USMCA-compliant pieces might no longer be material in a strongly protectionist environment, while China could see tariffs on vehicles approach 200%.

The Future of Automotive Sales

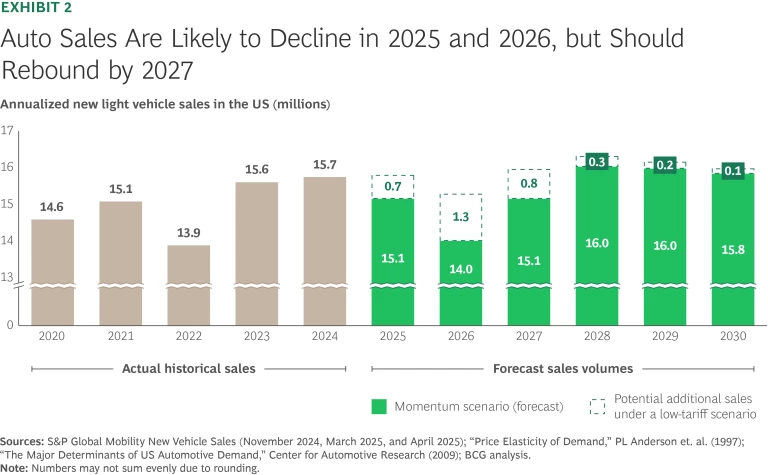

Assuming a momentum tariff case, our model suggests that 15.1 million passenger and light vehicles will be sold in the US in 2025. We anticipate an approximate 7% decrease to 14 million in 2026 and a recovery in 2027. (See Exhibit 2.) A lower-tariff scenario would likely yield a less significant drop in 2026 and a stronger recovery the year after. We expect prices to rise relatively quickly once trade negotiations and the full tariff picture become clear, with prices then stabilizing in about 6 to 12 months. The need to manage residual values as well as relative price positions (within own portfolios and compared to the competition) will result in less immediate price changes than in other industries. However, once price changes occur, they will likely be stickier, even as supply chains rebalance and/or tariff levels adjust.

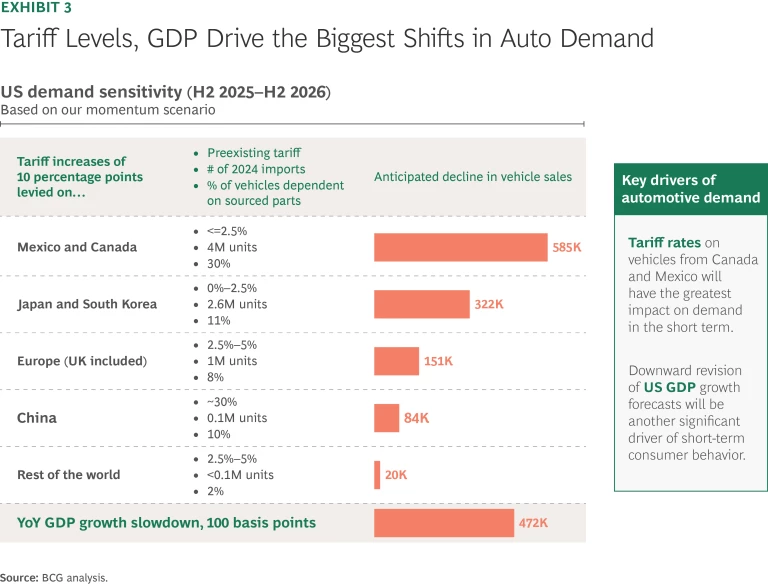

Major sales impacts will be driven by tariff levels on Mexico, Canada, Japan, and South Korea in addition to the overall GDP growth of the US economy. (See Exhibit 3.) Irrespective of the scenario, China is expected to maintain its recent trajectory of declining auto exports to the US. Auto leaders must closely monitor rising or already established export markets and prepare for the broader competitive and supply chain implications.

The Implications for Automakers and Suppliers

Regardless of how the tariff situation continues to unfold, auto leaders must prepare short and longer-term responses to withstand any immediate shocks and build longer-term resilience. Immediately, they should focus on:

Quantifying their exposure and developing short-term scenario plans. Assess your own susceptibility to rising costs as well as your competitors’. Speed is critical: free up capacity by moving quickly with current or alternative suppliers. Be willing to make capex investments to support relocation and new production sites.

Managing inventory in high-risk areas. Based on your initial analysis, build up key tactical stock to buy time for reaching full compliance and mitigate manufacturing uncertainty.

Updating the go-to-market strategy. Adjust pricing and product assortment to balance margin preservation, sales volume, and customer relationships. Incorporate competitor pricing moves into your strategy; establish a "lighthouse" mechanism to continuously monitor competitor moves. Avoid overreacting in the short term in ways that might erode long-term market share, particularly if your cost position will improve through supply chain rebalancing.

Looking beyond the near term, auto leaders need to identify new sources of opportunity and rethink their strategies for navigating prolonged trade uncertainty. Even as they grapple with the possibility of declining sales, they should simultaneously position themselves to emerge in a position of strength—ready to capitalize on new opportunities and withstand additional shocks. Accomplish this by:

Evaluating production and sourcing plans. Assess and adjust production locations, supply chain strategies, and procurement to optimize efficiency. Be prepared to shift sourcing based on where tariffs land and where cost efficiency can still be preserved.

Bolstering trade compliance. Evaluate and cultivate optionality to reduce the impact of tariffs on your supply chain. Demonstrate USMCA compliance and evaluate future suppliers, material sources, as well as capital allocation plans and returns.

Review partnerships and platform sharing. Collaborate with US-based OEMs to manage capacity, or even coproduce shared platforms, such as the collaboration between Ford and Volkswagen.