Blended finance is entering a new phase. Its true size is hard to pin down—but it’s larger than it appears and ready to be built by banks, investors, and public-sector partners. As structural barriers fall, the question is no longer whether the market will scale, but who will shape it.

So What?

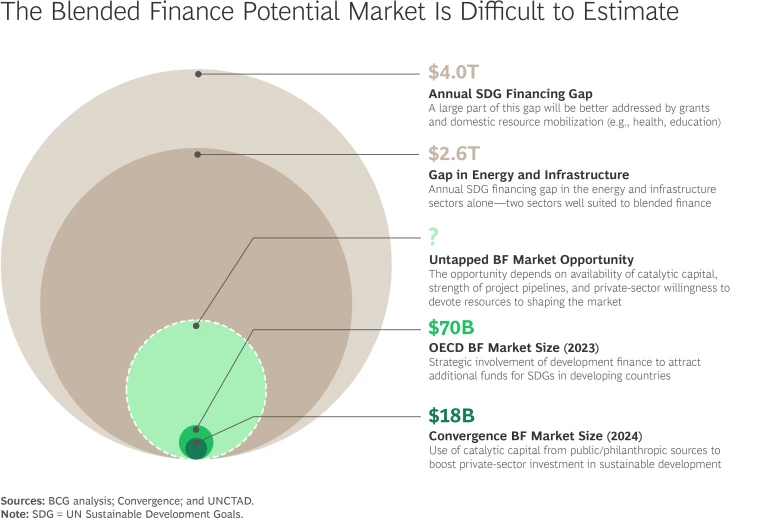

Estimates of the current measurable blended finance market size vary widely—from roughly $18 billion (Convergence, 2024) to $70 billion (OECD, 2023).

We believe the real opportunity is likely much bigger—and still being built. A $4 trillion annual financing gap stands between current capital flows and the UN’s Sustainable Development Goals. While much of the capital to close that gap will require grants or public spending, $2.6 trillion sits in energy and infrastructure—areas well suited to blended structures. (See the exhibit.)

A lack of shared definitions, fragmented data, and shifting factors—such as availability of catalytic capital, leverage ratios, and pipeline strength—make precise estimates difficult. But that doesn’t mean the opportunity is small. It means it’s there to be shaped.

Dive Deeper: Why Now Is the Time

While blended finance growth has been limited in recent years, momentum is shifting. Two major forces suggest that we may be at an inflection point, making the blended finance market’s potential more accessible and addressable than ever.

Structural barriers that once constrained blended finance uptake are now being addressed. Recent efforts are making blended finance easier to originate, structure, and execute. Standardized capital stacks and fund archetypes, such as those developed by BCG and British International Investment, are helping reduce friction and enhance replicability. Multilateral development banks (MDBs), development finance institutions (DFIs), and other concessional capital providers are refining guarantees and risk-sharing instruments with clearer terms and better alignment with commercial expectations. Regulatory conversations are progressing on how guarantees and concessional capital are treated under prudential rules. Tools like the GEMs database are improving insight into default and recovery rates.

Recent shifts in capital flows and donor strategies are creating new openings for private finance mobilization. With a projected $50 billion to $70 billion decline in official development assistance, development actors are being pushed to do more with less and may use available capital in more catalytic ways. Philanthropy is stepping up: the Gates Foundation plans to double its spending to $200 billion over the next 20 years, and 11 new signatories joined the Giving Pledge. If deployed efficiently, this philanthropic capital could have greater flexibility and catalytic impact than it has in the past. MDBs and DFIs are under increasing pressure to revamp their mandates and private capital mobilization targets, accelerating long-standing reform efforts. As an example, the Business Steering Committee of the UN-led Fourth International Conference on Financing for Development recently recommended a 5:1 ratio.

With a few targeted steps, banks can adapt existing capabilities to grow their blended finance market.

Now What?

Banks already have some of the tools required to make blended finance viable—experience in public-private finance, capabilities in structured and project finance, global reach. With a few targeted steps, they can adapt these capabilities to grow the blended finance market.

For Newcomers: Build the Foundation. To turn blended finance into a core business, banks should:

- Appoint a senior blended finance lead with clear mandate. Choose a leader who can cut across business lines, risk, ESG, and coverage. This role needs full-time ownership, clear accountability, and support from senior leadership.

- Treat blended finance like a core product line. Choose a few sectors or regions where concessional capital can unlock meaningful value. Define your role (investor, arranger, codeveloper) and build a scalable model.

- Develop a risk playbook specific to blended transactions. Transactions often stall in risk review. Build clear internal guidance on how to assess guarantees, concessional terms, and other de-risking tools. Use real-world cases to demonstrate mitigation and support faster decisions.

- Equip your frontline teams to identify and originate deals. Train coverage and product teams to spot opportunities for blended finance. Provide simple tools and templates to support origination. Make this part of their commercial mandate, especially in emerging and frontier markets.

- Engage early with external partners to shape pipeline. Don’t wait for finished deals. Work with DFIs, donors, and sovereign platforms from the design phase. Early engagement helps shape terms, reduce complexity, and strengthen your strategic relevance.

For More Advanced Players: Scale What Works. If you’re already active in blended finance, now is the time to scale impact and shape the market:

- Move to a platform model. Formalize learnings from past deals. Standardize structures, pricing, and partnership approaches across key markets and sectors, and move to a full product and advisory platform.

- Embed blended finance in core business planning. Make it part of annual targets, commercial strategy, and P&L. Link performance to sustainability goals and client demand in priority regions.

- Formalize partnerships with public capital partners. Move from informal coordination to structured partnerships with DFIs, export credit agencies, and green banks. Set shared goals, origination targets, and repeatable co-development processes.

- Build internal data and tracking systems. Track concessional capital use, mobilization ratios, and impact metrics. Use this data to improve deal design, enhance reporting, and strengthen your market positioning.

- Shape the market through thought leadership and co-investment platforms. Join or create platforms that align public and private capital in priority sectors. Contribute to setting standards, sharing risk, and unlocking new capital flows. Leadership is not just about volume—it’s about influence.

Blended finance is a business opportunity waiting to be built. Its ultimate size will reflect the ambition of the institutions willing to lead. With the right structures in place, commercial banks can generate real returns and real-world impact.