We are pleased to present the 2025 edition of our annual report on sustainability in the private markets. This is our third edition of the report, which outlines the sustainability performance of the industry and its impact on value creation.

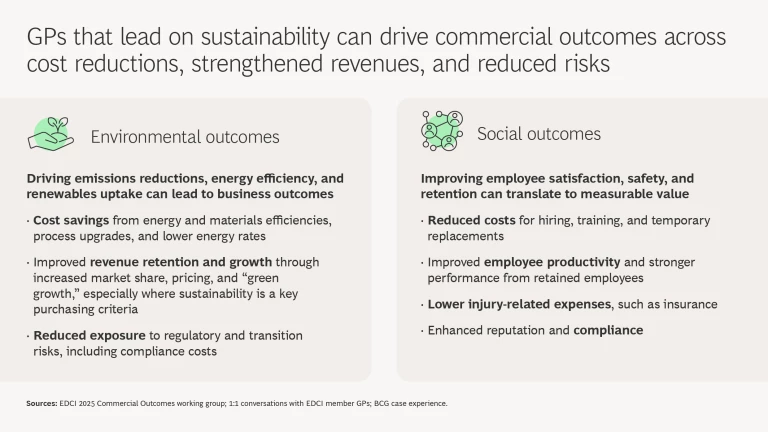

While less prominent than in prior years, the effective integration of sustainability considerations into investment activities continues to grow and deepen across the industry. The reasons are clear: Many firms have found that driving decarbonization and improving the employee experience can reduce costs and strengthen revenues.

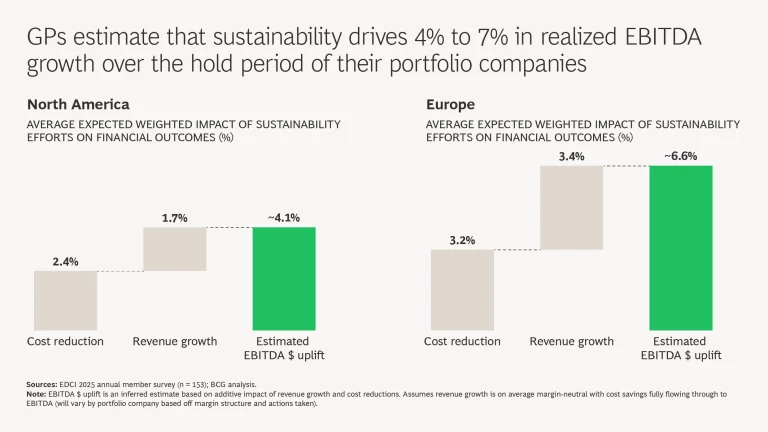

Produced in collaboration with the ESG Data Convergence Initiative (EDCI), this year’s report compiles a wealth of data from over 9,000 portfolio companies—more than four times the number of companies as in the inaugural edition of the initiative—and 320 general partners (GPs) spanning private equity, infrastructure, and private credit. These GPs estimate that, on average, their sustainability efforts improve realized EBITDA by 4% to 7% over the hold period of their portfolio companies.

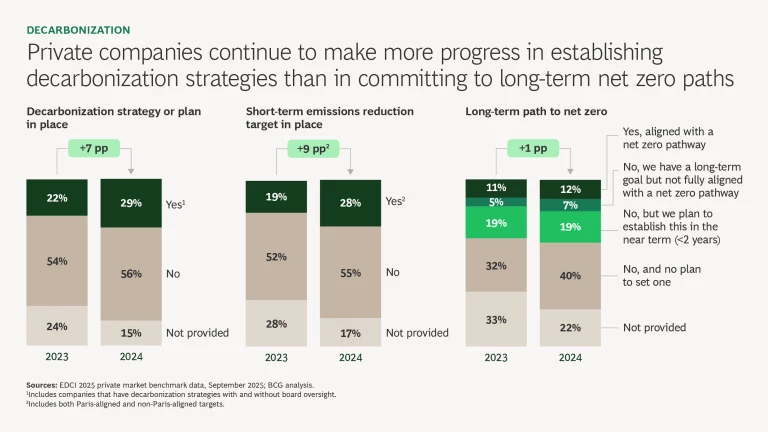

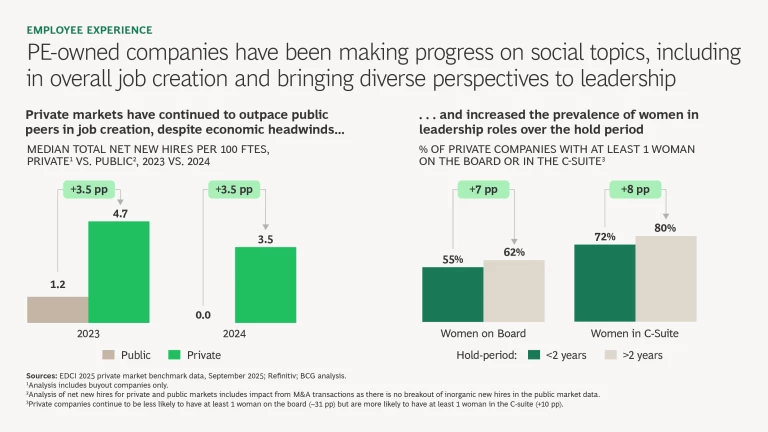

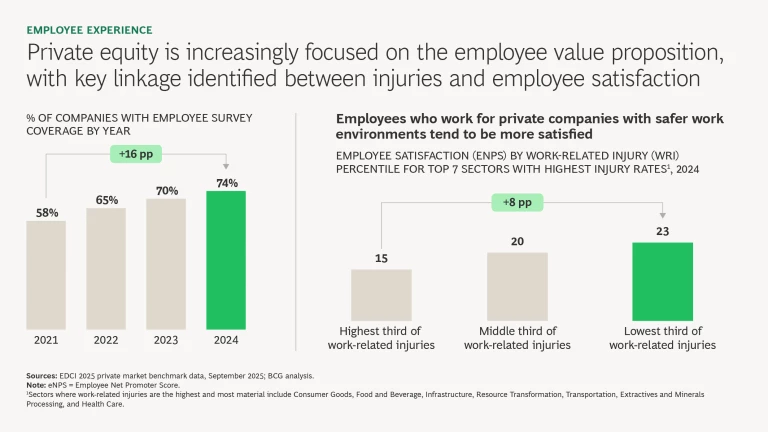

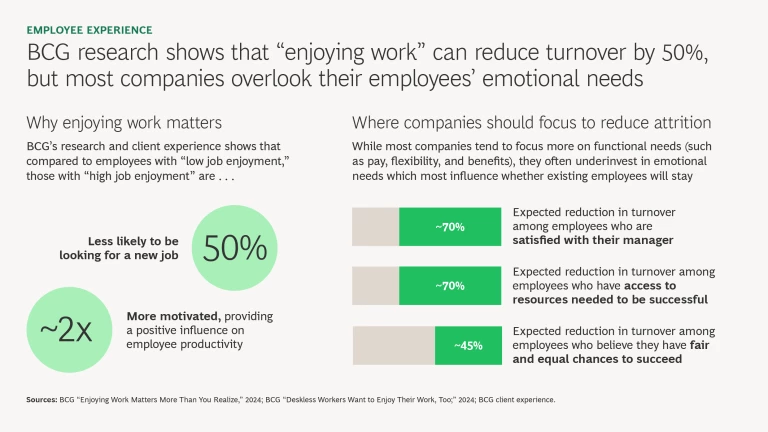

Since last year’s report, private companies have continued to make progress on environmental sustainability. The proportion of companies with decarbonization strategies and short-term emissions reduction targets each increased by 7 to 9 percentage points. This contrasts with the smaller 1 percentage point improvement in long-term net zero commitments, suggesting that in today’s climate GPs are more focused on rolling up their sleeves and driving near-term real-world outcomes than on making long-term public commitments. Meanwhile, job growth at PE-owned companies continues to outpace public companies, while GPs are increasingly focused on how improvements to the employee experience can boost retention and productivity and reduce injury-related expenses.

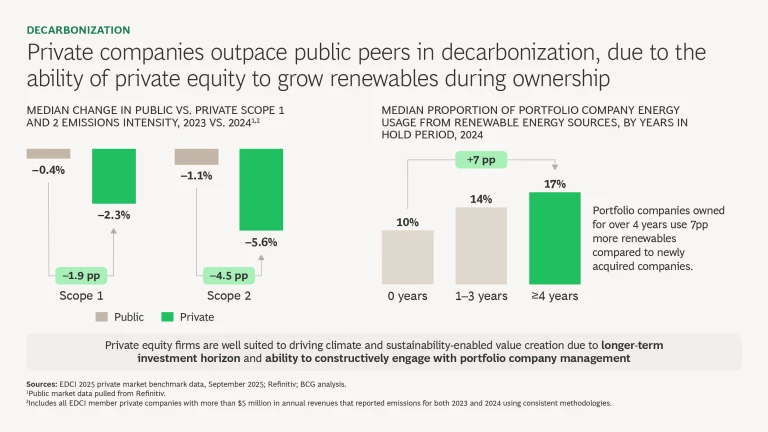

The private markets do lag the public markets in some areas, including board diversity and renewable energy usage. Still, during their hold periods private companies continue to make improvements across various sustainability metrics that often outpace their public peers. The inherent investment approach of PE firms—their long-term focus and considerable influence over the management of their portfolio companies—positions them to effectively drive sustainable value creation, where such efforts are material to business performance.

Taken together, our analysis of this year’s data continues to deepen our understanding of the important role that the private markets play in driving sustainable value creation. The slideshow offers a more comprehensive summary of our research.

Clearly, the private markets can create value through sustainability. But it takes hard work on the part of both the general partners and the management teams at the companies they own. Together, they must continue to identify and prioritize opportunities that offer high returns, embed initiatives into broader value creation plans, clearly track the impact on financial performance, and share lessons learned across the portfolio. (See “Methodology.”)

Methodology

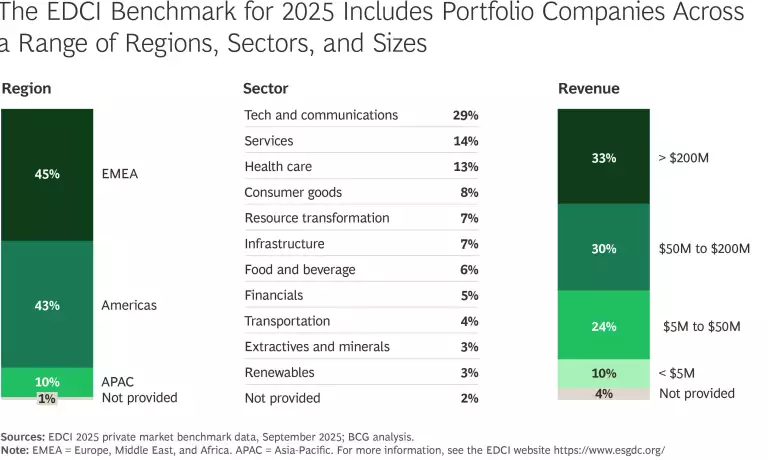

To create the EDCI benchmark, participating GPs gather sustainability metrics from their underlying portfolio companies and share them with BCG in its role as the benchmarking partner to the initiative. BCG’s Expand Research benchmarking team then reviews and validates the data before aggregating it centrally into the final benchmark. The exhibit shows the distribution of the more than 9,000 participating portfolio companies by region, sector, and size.

The data set for the publicly traded companies referenced in the report was drawn from more than 6,700 public companies, with a comparable mix of regions, industries, and company sizes, sourced from Refinitiv. Companies with market caps above $2 billion were excluded to allow for a more accurate comparison with the EDCI benchmark.

As the results of this year’s analysis confirm yet again, sustainability is not a zero-sum game. It is becoming a critical element of value creation for both PE firms and the companies they own.

If you are interested in learning more, please visit the EDCI website for information about the initiative, including membership benefits and how to participate.