The world may run short of critical raw materials by 2030. But this article is not a business-as-usual discussion about scarcity, and the solution to the looming materials shortages is not a simple matter of “use less of this and more of that.” Some obvious substitute materials are also under scarcity pressure, geopolitical tensions are raising the stakes around concentration risk even in cases where supply is abundant, and tariff shocks are introducing further complexity.

As they look to the future, company leaders and policymakers need to possess a deep understanding of the industrial value chains that deliver the materials, components, and technologies necessary for the energy transition. Uncertainty about how these value chains grow and evolve is a source of risk, but also opportunity. By combining smart investment with targeted innovation, early movers will not just adapt to scarcity but also create competitive advantage. Those that start now will define the future.

Unfortunately, efforts to achieve this level of understanding have often fallen short. Many institutional estimates have failed to accurately predict the speed of deployment of different clean energy sources, which has impeded planning and capital allocation. And shifting government policies—such as those related to new energy adoption, sudden tariffs, or export controls and bans—make planning even more challenging.

Three Categories of Risk

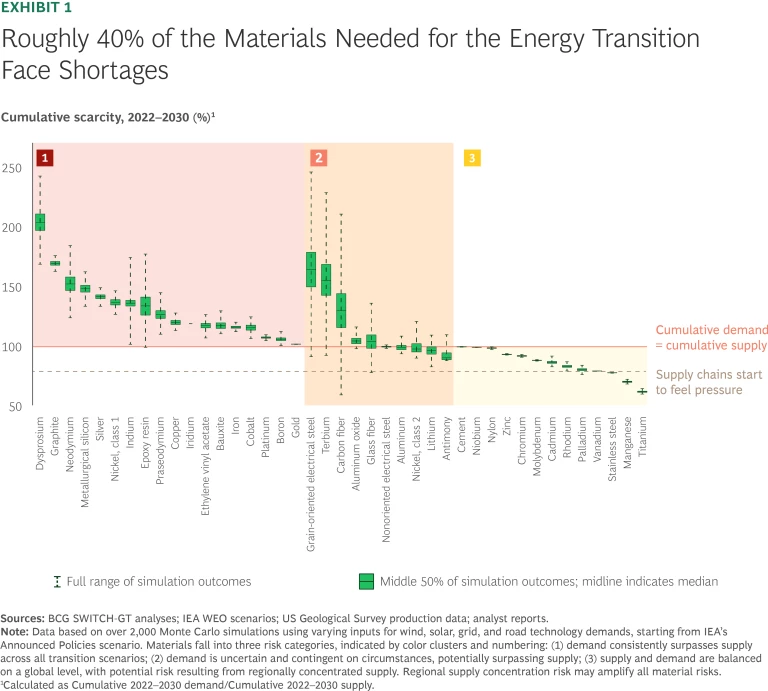

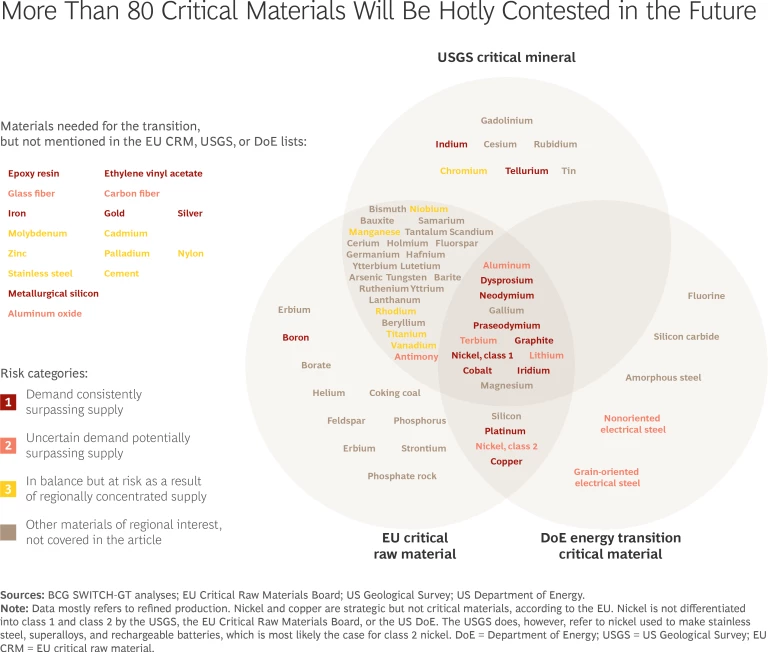

To help leaders untangle this complexity, we charted the pathways for clean energy technologies such as solar panels, wind turbines, and electric vehicles, from material to component to finished product. (See the sidebar “About SWITCH-GT.”) Specifically, we broke down 130 technologies into 14,000 material-to-technology pathways. We found 135 materials for which demand is growing faster than global GDP, driven strongly by the energy transition. We varied combinations of parameters 6,000 times—for example, changing the assumptions around onshore versus offshore wind ratios—and ultimately we identified a core group of materials that are at some form of risk by 2030. The specifics of the risks they face differ in meaningful ways, but they fall into three broad categories. (See Exhibit 1.)

About SWITCH-GT

For this analysis, we used SWITCH-GT in two ways: to bracket uncertainty through scenarios and simulations and to project demand and supply of critical material with reliable data.

Bracketing Uncertainty Through Scenarios and Simulations

To test the industrial demands required under a wide range of energy transition scenarios, we used the three widely accepted IEA World Energy Outlook scenarios as baselines: Stated Policies (STEPS), Announced Policies (APS), and Net Zero (NZE). Against each of these baseline scenarios, we simulated 2,000 different mixes of end demand, relying on guidance from over 120 BCG subject matter experts to set median values.

Projecting Demand and Supply of Critical Materials with Reliable Data

We focused our detailed risk analysis on 40 materials for which reliable supply reference data exists. These materials span multiple technologies and appear across most of the modeled pathways. For these 40 materials, we calculated the material demands for all 6,000 scenarios (2,000 each for STEPS, APS, and NZE).

We compared each material’s projected demand with its projected supply, insisting on at least two third-party supply projections for each material, understanding that supply may increase over time with clear market signals. We incorporated supplementary analyses to consider variables such as the speed with which new capacity can be added, trade flows and dependencies, and the physical and geographic concentration profiles of each material.

1. Secure the Supply in the Face of Persistent Shortages

In the first category of materials at risk, demand surpasses supply across all transition scenarios. Innovation—through recycling, substitution, or efficiency—can help close part of the gap, but it likely won’t be enough. Even when progress is possible, an advance in one area often shifts pressure to somewhere else in the system. That’s because materials are deeply interconnected. When you trace the full value chain—from extraction to processing to end use—it becomes clear: materials shortages cannot be solved in isolation.

Consider permanent magnets. These components, which are essential for electric vehicle (EV) motors and wind turbine generators, require rare earth elements such as neodymium, dysprosium, and praseodymium. All three elements are subject to supply pressure in all 6,000 transition scenarios that we modeled. Demand for them is driven not by a single sector, but by overlapping growth in e-mobility and offshore wind, which amplifies scarcity risks and leaves no slack in the system. A surge in one sector intensifies shortages in another, exposing companies to cascading supply shocks.

Cobalt presents a different kind of constraint. About 99% of the supply of this element is co-produced with copper and nickel, so scaling output is not straightforward—and most supply comes from the Democratic Republic of Congo, where mining conditions raise ethical and geopolitical concerns. Solutions to the supply shortfall will require a mix of material substitution, diversified sourcing, and battery recycling at scale.

Even lesser-known materials such as epoxy resin offer evidence of the hidden complexity of transition demand. Although not as high profile as rare earths or cobalt, epoxy resin underpins at least 7 of the 13 sectors we modeled, ranging across more than 1,500 unique transition pathways—for example, wind turbine blades, EV electronics, and power grid insulation. Because demand comes from multiple fast-growing sectors, the challenge with epoxy resin isn’t just a matter of securing the necessary sources of supply; it extends to ensuring that the right volume is available at the right time, amid increasingly volatile and hard-to-predict usage patterns.

2. Manage Risk That Is Uncertain and Contingent on Circumstance

Materials in our second risk category are subject to extreme uncertainty. These materials have a wide range of potential demand that may or may not ultimately result in a supply shortage. Unlike materials that are consistently scarce, these materials do not have a clear trajectory of supply and demand. That trajectory will depend on the speed and scale of evolving industrial needs, technology adoption, and shifting market dynamics.

To illustrate how the resulting uncertainty takes shape, consider the materials required for large power transformers in the electrical grid. Demand for these power transformers is driven by the expansion of power networks, which is highly uncertain. The speed and scale of rollout will determine the number of transformers needed and, in turn, the demand for critical materials such as grain-oriented electrical steel (GOES).

Adding to this uncertainty, current and future growth in GOES production is limited. Producing it is technically complex and costly, and profit margins for it are historically lower than for other types of steel. As a result, GOES production remains concentrated and slow to scale—especially outside Asia—creating a bottleneck in transformer supply and, ultimately, in the pace of grid expansion.

3. Beware Concentration Risk, Even When Global Scarcity Is Low

The materials in our third category do not face imminent global shortages, as demand currently remains closely balanced with supply. But because material production is often highly concentrated at both the firm level and the geographic level, geopolitical and trade factors will increasingly shape material availability, making concentration risk a critical concern. To ensure a reliable supply of materials that fall into this category of risk, companies need to understand how the import and export dynamics of the interconnected supply chains function and where materials end up in the transition economy.

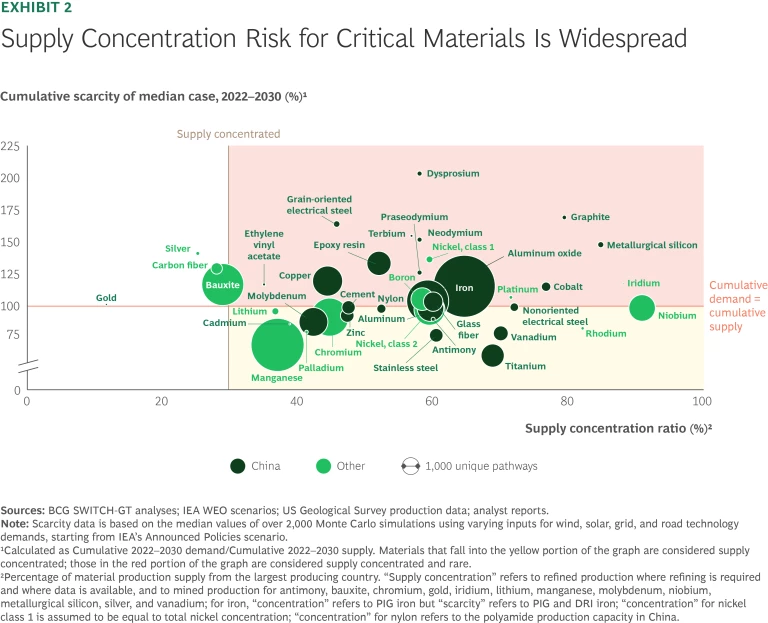

In fact, our analysis reveals that all materials not at risk of global scarcity are subject to supply concentration risk. For 60% of such materials, the supply is concentrated in China. (See Exhibit 2.) Unsurprisingly, this emphasizes the world’s heavy dependence on China for key refined materials such as molybdenum, titanium, vanadium, and antimony. Companies exposed to such concentration in their supply chains are vulnerable to geopolitical disruptions, trade restrictions, and price volatility.

From December 2024 to April 2025, China gradually announced a series of export controls—for example, on items related to gallium, germanium, tellurium, and indium (used in solar panels), molybdenum (essential for alloys used in wind turbines), and dysprosium and terbium (required for permanent magnets for EVs and wind turbines). China controls 40% or more of the global refined production of all of these materials. Diversifying supply sources and investing in alternative production capabilities are essential to mitigate these risks and ensure long-term supply chain resilience.

Even when global supply and demand appear balanced, concentration of materials at the country or company level effectively gives international regulations, trade policies, and the actions of dominant market players the power to generate outsized impacts, exacerbating existing materials scarcities due to cross-sector competition or creating new shortages in regional markets.

Stay ahead with BCG insights on climate change and sustainability

Leading Through Uncertainty in the Energy Transition

The global energy transition presents a clear challenge. Securing and scaling production of materials are critical to success, but the complexity of the interconnected value chains, concentration risk, and uncertainties around the transition constrain these efforts. Although this article focuses on material shortages, the same logic applies to components and labor. Regardless of the type of shortage, leaders cannot afford to wait for it to emerge before acting.

Understand Interconnected Supply Chain Dynamics

For suppliers, buyers, and policymakers, success will depend on anticipating disruptions, mitigating supply chain shocks, navigating interconnected value chains, and driving innovation in critical areas. Ensuring material security is not just a company-level challenge. It is an economic and national security imperative.

Leaders of organizations across the supply chain must understand and anticipate technology deployment trends across industries, as these trends will directly impact the materials needed. The earlier and more accurately leaders can foresee potential shortages, the sooner they can start mitigating risks.

Identify and Diversify New Supply Streams

To build supply chain resilience, companies must proactively identify and secure alternative sources of critical materials. This includes ensuring geographic diversification—reducing overreliance on a single country or region—and tapping into nontraditional suppliers and secondary sources, such as tailings (mining residues that remain after extraction of the target minerals from ore), urban mining, and industrial waste recovery.

Companies can also expand closed-loop systems by scaling up their recycling and reprocessing capabilities. Strategic partnerships or co-investments with upstream suppliers can help secure future availability, especially for materials and components for which demand is projected to outpace supply. These steps reduce exposure to geopolitical risk, price volatility, and regulatory bottlenecks, making the overall system more resilient to disruption.

Innovate and Substitute

To reduce dependence on scarce materials, companies can pursue innovation and substitution across multiple layers. Relevant actions include technology substitution (shifting to entirely different systems that use alternative inputs), component substitution (swapping specific parts within a product), and material substitution (replacing a constrained material with a functionally similar one). Demand elasticity often drives substitutions, reflecting market self-adjustment.

In addition, companies can design for circularity and invest in material innovation to optimize usage over time and reduce demand intensity. Together, these approaches offer a flexible way to enhance long-term material security and resilience.

Collaborate to Scale and Solve

Companies, industry associations, and governments can pursue collaborative strategies such as cross-sector partnerships to proactively address supply chain vulnerabilities while jointly accelerating innovation in critical materials. For example, the European Battery Alliance brought together more than 800 industrial and public stakeholders to build a competitive and sustainable battery value chain in the EU. The industrial program is managed by InnoEnergy, which—together with EIT Raw Materials—was awarded a critical minerals project by the European Commission in March 2025.

A major enabler of these efforts is data. Today, many decision makers lack timely visibility into the granular data needed to adequately understand material flows, anticipate bottlenecks, and coordinate investment across industrial value chains.

Advocate for Enabling Policies

Companies can play a direct role in shaping and advocating for national policies. In the US, the metals company Freeport-McMoRan has advocated for designating copper a critical mineral—a material foundational to power grids, electric vehicles, and clean energy infrastructure. (See the sidebar “How to Understand Material Criticality.”) Freeport-McMoRan is one of the world’s largest publicly traded producers of copper and is also a significant producer of gold and molybdenum.

How to Understand Material Criticality

- Supply Risk. This factor reflects how scarce, concentrated, or geopolitically exposed the supply is, including reliance on a small number of producers or countries.

- Economic or Strategic Importance. This element relates to the role that the material plays in enabling key technologies or sectors (such as energy, defense, and digital).

- Impact of Disruption. The focus here is on the consequences of supply interruptions, especially for technologies with limited substitutes or long ramp-up times.

- Sustainability Considerations. This factor encompasses the environmental and social implications of sourcing, recycling potential, and circular economy relevance.

We advise leaders not to rely entirely on any single list of critical materials. Instead, they should assess the specific risks, dependencies, and strategic relevance of each potentially critical material across their supply chains and in their regional contexts. Doing so will permit more resilient planning tailored to individual business or policy objectives.

Designating copper as a critical mineral could unlock production tax credits, accelerate permitting, and drive public-private investment. For the US government, it could strengthen supply chain resilience, reduce reliance on imported copper, and support clean energy deployment. For Freeport-McMoRan and other copper miners and producers, it could lower costs, improve project economics, and enhance their strategic role as key domestic suppliers of a material central to the energy transition.

Turning Material Scarcity and Uncertainty into Competitive Advantage

Developing foresight about potential risks and opportunities is essential because mitigating supply risks, identifying substitution or recycling options, and recognizing deep interdependencies will determine which businesses and nations emerge as leaders in the transition economy.

In addition, companies and governments can invest with an eye toward profiting from future scarcity. For example, while a material is still undervalued, they can secure supply through long-term contracts, backward integration, or investment in recycling infrastructure. Another path to value is innovation—developing and selling alternative materials, components, or technologies that reduce or eliminate the need for scarce inputs. For instance, some wind turbine producers are designing systems that avoid rare earth magnets, thereby minimizing exposure to fragile supply chains.

The call to action is clear: identifying potential scarcities can reveal value creation opportunities. When we calculated demand on the basis of technology growth across interconnected value chains, we found that the resulting projections aligned with past analyst summaries but consistently exceeded their future growth estimates. This suggests that the untapped opportunity for value creation is probably greater than currently expected. Companies that read and act on these signals correctly won’t just stay ahead of scarcity—they will shape the economy of the future.