This material was generated in collaboration with Women’s Wear Daily (WWD).

BCG and Women’s Wear Daily recently set out to better understand the next generation of beauty consumers through a comprehensive survey of US teens and their families.

We reached out to over 1,200 teens aged 13 to 18 across the US—plus 1,200 of their parents—and got the perspectives of an additional 700 Gen X and millennial adults, who reflected on their own teen experiences to help us track the changing market.

Our findings confirm what many in the industry have sensed: today’s teens are stepping into the beauty market earlier, spending more, and reshaping the category in real time. Our new report, US Teens are Shaking Up the World of Beauty, unpacks this data to understand how teens shop, what brands they prefer, and who really influences them along the way.

Teens Are Shopping More, and Earlier, Than Ever

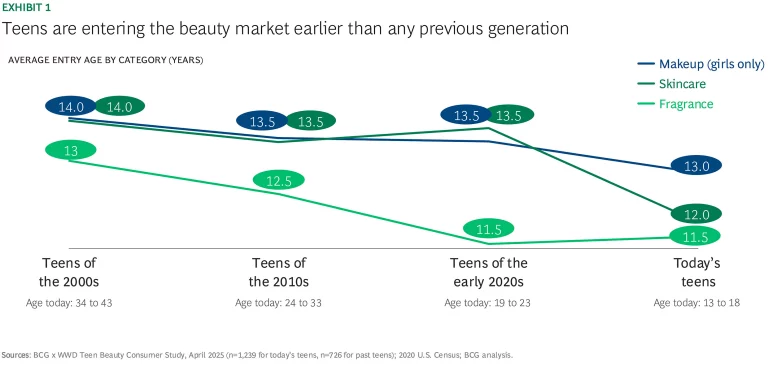

US teenagers now begin buying beauty products at an average age of 12, about a year earlier than teens just a decade ago. (See Exhibit 1.) And teen girls are immersing themselves in beauty culture and content, with more than half seeing beauty as a form of self-expression. The takeaway? Beauty is becoming more normalized in early teen life. It’s shaping how young people care for themselves and express who they are.

Teens already represent about 10% of the US consumer beauty market—spending around $1.5 billion on makeup, $1.7 billion on skincare, and $1.7 billion on fragrance each year. What really stands out, however, is the growth trajectory. In 2023, teen beauty spending grew 23% year over year—more than double the growth of the overall beauty market, which rose just 9%.

It’s Not Just Teen Girls Anymore

Teen boys have stepped into the beauty conversation. Around 70% of teen boys say they feel comfortable discussing beauty with their friends, compared to just 50% in the 2010s.

Among the boys who made any beauty purchase, including cologne and deodorant, about 90% say they feel comfortable using skincare products. That’s far higher than earlier generations. And in fragrance, boys are leading the charge in prestige. In fact, 55% choose higher-end brands, compared to just 40% of girls.

Social Media is Key to Discovery

The discovery of beauty products and brands has evolved well beyond TV and magazines, which once led the way. Social media now plays a much more active role in the growing teen interest in beauty, with today’s teens discovering brands in places that were unknown to past generations—on TikTok, Instagram, and Google searches. And around 75% of teen girls consume beauty content on social media at least once a day.

Purchasing Takes Place Everywhere

Teens are true omnichannel shoppers, with more than 80% shopping both online and in-store, using their beauty knowledge to buy products both online and offline. And nearly half say they prefer to shop in-store.

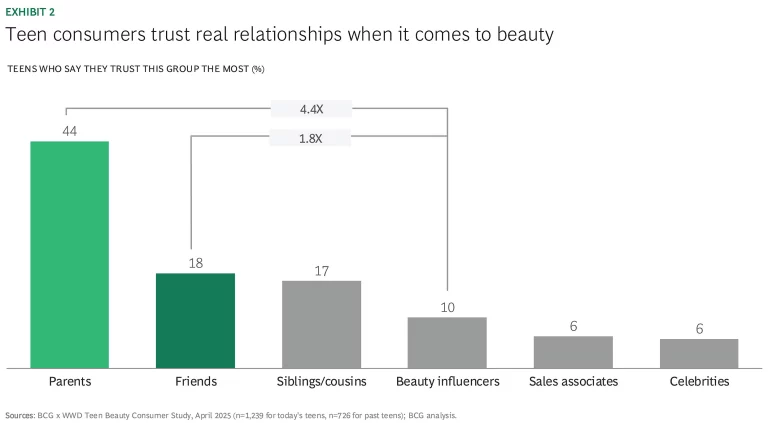

But don’t expect them to want in-store help: today’s teens say they would rather not interact with sales associates. In fact, 40% say they distrust them, and 15% say they shop online just to avoid that interaction.

Nonetheless, teens look more like adult beauty shoppers than we might expect. They often favor multi-brand retailers such as Target, Walmart, and Sephora that offer variety, convenience, and a mix of price points. And in-store shopping is a social experience. Many teens enjoy visiting a store with their friends and parents to test products and socialize, much as teens always have.

Teens are Not as Trend-Driven as We Think

We often hear that teenagers love new trends and following influencers’ advice. But our research finds that the list of top choices for teen girls is led by well-established, widely available mass brands such as Bath & Body Works, CeraVe, and e.l.f. Beauty.

While teens do like to explore new brands, it’s at similar rate to past generations. Instead, they are showing brand loyalty, practicality, and a real focus on what works—whether it’s trending or not.

Meanwhile, parents have a strong influence: 50% make most their teens’ beauty purchases for them. And, while beauty influencers may spark an interest, teens say they trust their parents, friends, and family members more than the influencers and celebrities they find online. (See Exhibit 2.)

Today’s teens are poised to become the largest and most influential consumer group in the US beauty market, spending more on beauty products than any previous generation. The way they discover and purchase beauty is shaping the future of the industry.

Are you ready to shape it with them?