Reinsurers are caught in a zero-sum game. For more than 40 years, the industry has grown in lockstep with GDP. The top few companies fight to hold off challengers from the next tier down as they compete for customers’ business and investors’ capital. Across the industry, companies wrestle to pry a few points of market share away from their competitors. Can anyone break the paradigm and outperform? If so, how?

The More Things Change…

Between 1980 and 2022, reinsurance gross written premiums increased at a steady annual rate of 5%, mirroring the pace of GDP expansion. Our analysis shows that large and smaller companies were engaged in a tough battle for share of that growth. How segments and individual companies have fared has shifted over time.

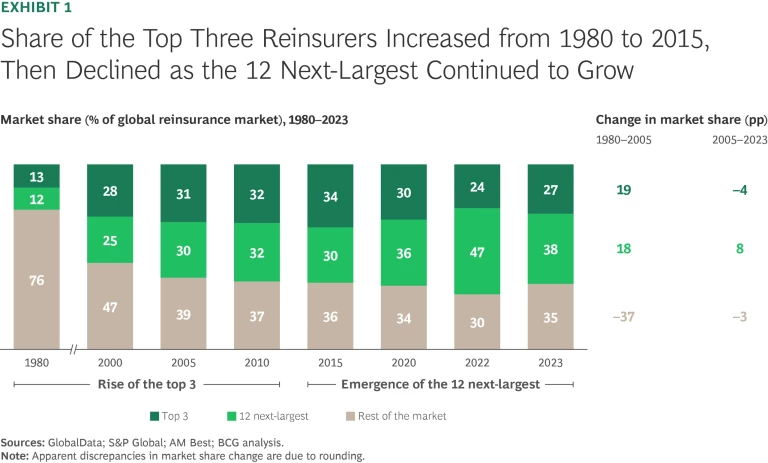

In 1980, three major players—Munich Re, Swiss Re, and Hannover Re—emerged from a highly fragmented reinsurance market. Since then, these companies have gained significant combined market share, reaching 34% in 2015, 20 points more than in 1980. (See Exhibit 1.) But from 2015 to 2023, their share fell 7 points, to 27%. During that same period, the combined share of the 12 next-largest companies grew steadily, from 12% in 1980 to 30% in 2015 to 38% in 2023.

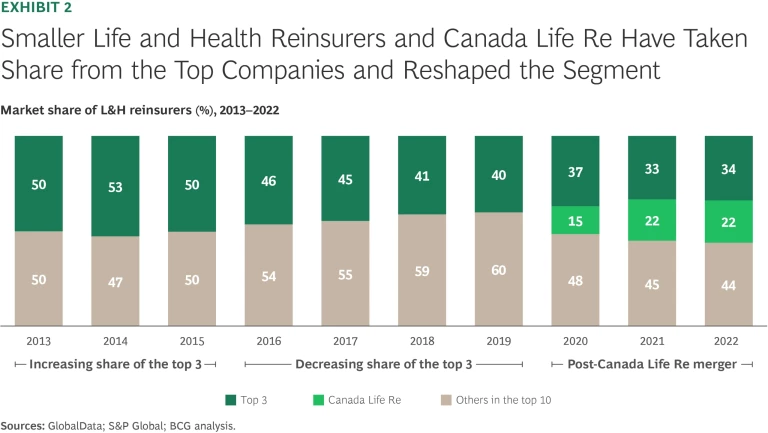

Much of this midtier growth resulted from the creation of Canada Life Re in 2019–2020 through the combination of several companies. Canada Life has steadily gained share through further consolidation to become one of the biggest players in life and health. (See Exhibit 2.)

M&A has been a big cause of shifts within the sector, and activity correlates with the top three companies’ share of growth. Munich Re leads the group with more than 100 deals from 1996 through 2024. Since 2010, though, a decline in deal count and volume for the top three—from about $100 billion in the period 1996–2010 to only about $12 billion in 2010–2024—has coincided with a lower growth rate for these companies. This has paved the way for midsize players (the 12 next-largest companies referred to above) to increase their share of the market.

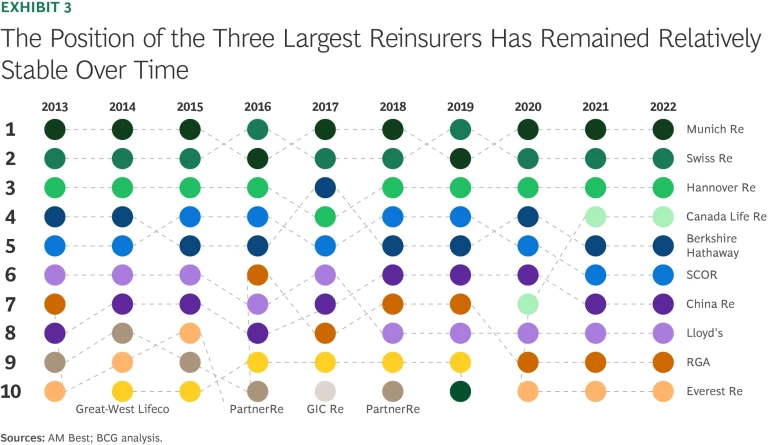

The result is that sustaining position is difficult: only 50% of the top 15 reinsurers have maintained continuous leadership over the past decade. (See Exhibit 3, which shows how the top 10 have fared.) While the three largest reinsurers have held their positions (although Hannover Re lost its place to Berkshire Hathaway for one year in 2017), fewer than 10 companies have been able to remain in the top 15.

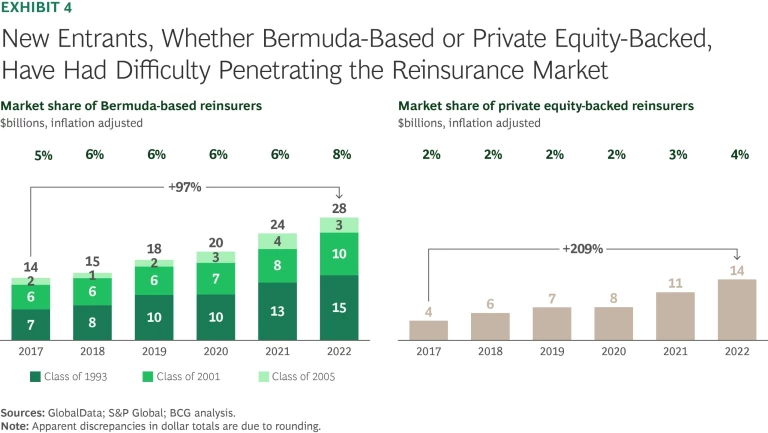

New entrants—both Bermuda-based startups and private equity-backed companies—have captured only limited market share. (See Exhibit 4.) Arch Capital, RenaissanceRe, and PartnerRe are the only three of these companies currently among the 15 largest reinsurers globally.

So What?

So where’s the growth? In a market that has not outpaced overall GDP and in which every segment faces its own challenges, companies need to determine where they can generate new sources of revenue. Key strategic questions include:

- Can the top three players continue to grow in line with—or even outpace—the market? Are there viable alternatives to inorganic growth? Do these players face the risk of mounting competition—and shrinking share—from lower-tier competitors?

- How do the 12 next-largest companies strengthen their competitive advantage and overcome suboptimal scale (beyond relying on specialization)?

- Is it feasible for reinsurance startups to achieve market relevance, and what is the anticipated timeframe for doing so?

- What do smaller established players stand for in the market? Should they be concerned about losing capital to attractive investment alternatives for their shareholders?

Stay ahead with BCG insights on the insurance industry

Now What?

As concentration in reinsurance increases, the path to relevance for individual companies is narrowing. Players that want to secure a stronger place in the market—or just stay in the game—have three organic options:

- Expand Their Offering. Uncertainty has become a global watchword, and reinsurance can be a powerful tool for managing volatility. Reinsurers can open new avenues for growth by going beyond their traditional sources of business. Specialty segments and coverages, such as cyber, climate, and parametric policies, are gaining traction. Alternative risk management solutions that diversify the ways in which risks are managed or provide access to alternative sources of risk capital can efficiently serve evolving client needs.

- Expand Where They Play. Opportunities for geographic expansion often remain untapped. Clients frequently are looking for support when they enter new markets. Being there—or leading the way—can strengthen existing relationships and open long-term prospects, especially in high-growth regions with rising insurance demand. The big geopolitical shifts now underway in response to tariffs and trade policy may provide new expansion possibilities for reinsurers.

- Expand Their Relationships. Deepening relationships with existing clients and brokers is the surest path to new business (and is essential to holding onto current revenue). Reinsurers can capture a greater share of wallet by offering value beyond simple capacity in such fields as analytics, advisory, and capital solutions.

Move faster through M&A. The experience of Canada Life Re and numerous other reinsurers going back 40 years shows that M&A can be a fast and effective way to grow. Acquisitions increase scale quickly and bring new capabilities in-house—an important consideration in today’s fast-changing marketplace. They can also establish footholds in new countries or emerging business lines (while simultaneously de-risking entry into new markets). The challenge is that inorganic growth can be a narrow path for most players. For most potential acquirers, few targets exist that are a good strategic and operational match and are large enough to make a financial impact.

Or step aside. Sometimes, the best move is a hard-nosed decision to withdraw. For some insurance groups and investors, reinsurance may no longer be an attractive strategic play, despite being a powerful tool for managing volatility in today’s uncertain environment. Capital and leadership attention might yield stronger returns elsewhere. Exit may be the best path, but it requires its own process of careful planning and precise execution.

Act decisively. Whatever course they choose, reinsurers need to act with boldness. This requires a sharp, unbiased analysis of the landscape (including opportunities and internal and competitive obstacles), a clear strategy, and decisive execution.