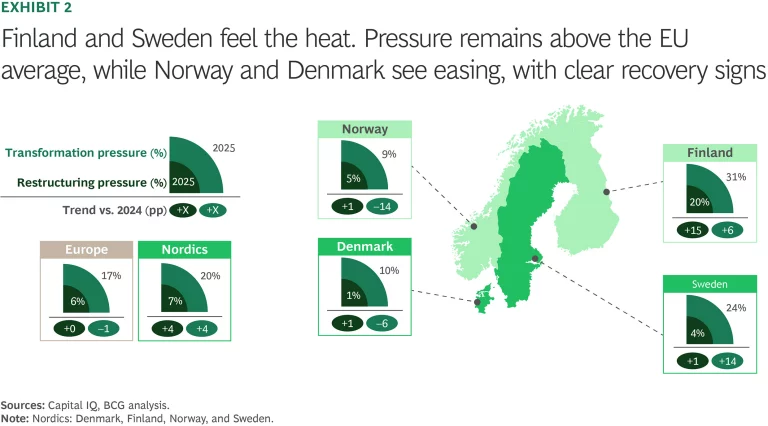

Around 20% of companies in the Nordics—Denmark, Finland, Norway, and Sweden—are under financial pressure. For 7%, that pressure is severe enough to warrant restructuring. However, the situation is highly deaveraged between the countries, with some experiencing greater financial stress than others.

That’s according to BCG’s third annual Transform and Special Situations (TSS) Index, which tracks the number of publicly held companies in Europe and select Asia-Pacific countries facing financial and operational stress. Our study assessed approximately 400 listed Nordic companies based on 12 performance and financial stability KPIs and companies’ exposure to macroeconomic risks.

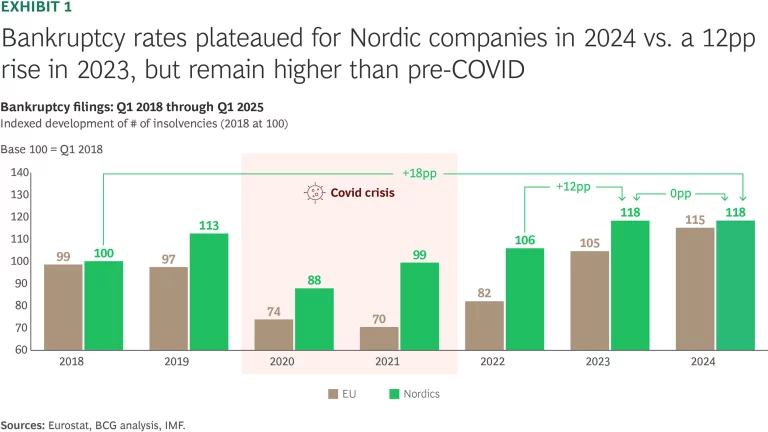

After increasing steadily for several years and surging in 2023, bankruptcy rates region-wide plateaued in 2024. That said, situation is highly deaveraged across the countries; in Finland bankruptcies continued to increase, while bankruptcy rates declined in other Nordic countries. While the rate of increase in bankruptcies has been lower in the Nordics than in the EU overall, the absolute level of bankruptcies remains on par with or slightly above the European average.

Stay ahead with BCG insights on business transformation

Business and macro environment

Leading indicators reveal a mixed picture. Inflation region-wide has fallen substantially in the past three years; at 2.2%, it is approaching historical levels. Interest rates have declined, and GDP has been slowly but steadily climbing since 2023. Yet business confidence is down, as geopolitical headwinds threaten. Tariff volatility is inflaming pricing uncertainty and weakening investor confidence, and supply chain and shipping disruptions triggered by the Ukraine war and Red Sea turmoil are raising costs and increasing delays.

Transform and Special Situations

Looking forward, around 20% of companies in Nordics are under financial pressure based on BCG's annual Transform and Special situations (TSS) index. That said, the pressure vary significantly by country; Finland is facing the most severe stress, with the highest share of companies under pressure with a Transformation Pressure at 31%. Sweden follows closely behind at 24%, also experiencing elevated transformation needs. In contrast, Denmark (10%) and Norway (9%) are clearly in recovery mode, with pressures across sectors falling below the EU average.

In Finland and Sweden, the picture is notably de-averaged: while some sectors are coping well, others such as automotive, energy, and chemicals are experiencing acute distress.

The implications are serious: 220,000 jobs and $25 billion in GDP are under pressure region-wide.Finland and Sweden represent the lion’s share, with 150,000 jobs and $16 billion in GDP under pressure.

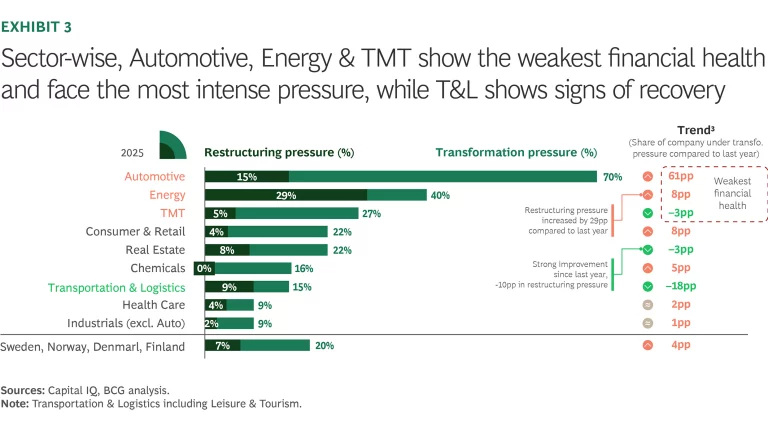

Sector Wide: Sector-wise, automotive, energy, and telecommunications, media and technology are under the greatest strain.

Automotive was hit especially hard in 2024. Flat passenger car sales (including EVs), margin pressure from rising input costs, high inventories, and major R&D spending on electrification left 70% of companies in stress—15% in severe stress. When factoring in macro risks like tariffs and supply chain disruption, automotive emerges as the Nordics’ most vulnerable sector, and one of the top three most at-risk in Europe.

Energy companies are also under mounting pressure: 29% now require restructuring (up 29 points year over year), driven by volatile commodity prices, regulatory uncertainty, and high investment costs for renewables and climate compliance.

Technology, Media, and Telecommunications performance has been mixed. While pressure has declined slightly overall, more than a quarter of companies remain under transformation stress due to flat telecom revenues and the continued decline in legacy media. However, growing data demand and strong investment in 5G and fiber have offered a lift.

One bright spot is Transportation & Logistics (T&L), which has seen significant relief over the past year. Real estate is also recovering modestly, with the share of companies under severe pressure falling by 10 percentage points.

Way Forward

So, what can executives do to weather the macro storm and shore up resilience? From our AI-based analysis of earnings calls, we know that CEOs are focusing on revenue and M&A opportunities, while overlooking the power of cost and liquidity measures. Among some of the most pivotal measures:shock proofing supply chains by diversifying across regions; making innovation a strategic engine; turning working capital into a liquidity engine to subsidize investment without compounding financial pressures; and rewiring the balance sheet for agility.

For highly stressed companies—especially those in export-reliant sectors that are competing with lower-cost global producers—pulling every possible lever is a high priority. Delayed action is lost opportunity. Happily, the opportunities for transformation are many.