Most Nordic construction companies find themselves at a crossroads: a look into five-year total shareholder returns reveals that they have clearly fallen behind their American and European peers and most other industries (see Exhibit 1). These results are driven by both limited growth amid challenging market conditions and generally low profitability levels.

While the best-in-class Nordic construction players have achieved 4%–5% EBIT, their European counterparts, including integrated players, manage up to 10+% EBIT—indicating not only that the Nordics have some catching up to do but also that better numbers are clearly achievable.

Stay ahead with BCG insights on business transformation

Several factors complicate the path to better performance for the construction industry in the Nordics—chiefly, the declining outlook for the industry’s growth over the next decade, which is predicted to hold steady at 2.4% through 2029 but is subsequently expected to fall to 1.6%. Further, high short- and long-term macroeconomic uncertainty increases the market’s volatility and cost pressure. The demands for sustainability and a rapid transformation to digital/AI platforms put additional pressure on companies to make their businesses future-proof. Best-in-class players are already witnessing significant financial yields from their digital and AI efforts, leading others to take action to avoid falling behind.

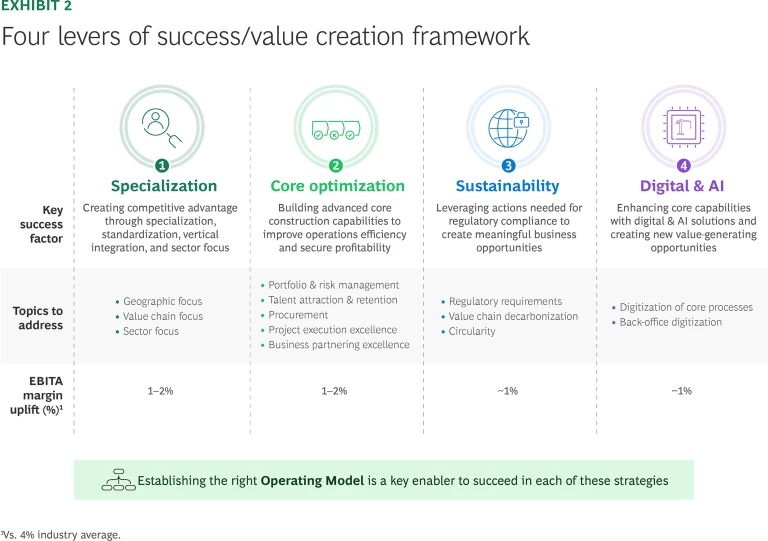

Staying competitive in this environment demands bold action. According to a recent BCG study, 1 in 5 Nordic companies are under significant transformation pressure. Nordic construction players must act now to step-change their performance. BCG believes that by proactively focusing on these four levers—specialization, core optimization, sustainability, and digitization/AI (see Exhibit 2)—Nordic construction companies can achieve up to 10% profitability and also establish themselves as industry leaders in the years ahead.

Specialization: Finding a Strategic Edge

Given the slow growth outlook for the Nordic construction market, BCG believes that being a generalist is not a winning strategy. Companies that wish to succeed must clearly define their specific playing field and select those markets—across sectors, geography, and their value chain—both where they can most profitably focus their expertise and where the potential for growth is greatest.

Across the Nordics, different sectors present opportunities for growth. These include infrastructure—more specifically, transportation and water—along with institutional buildings and offices. This included significant growth in defence and total defence infrastructure with strong double-digit growth across the Nordic markets. Companies must clearly define and focus their efforts on the most promising areas for their expertise rather than dilute resources over sectors that are already close to or fully saturated.

Geography is another lens through which to prioritize efforts. Examining sub-sector growth in the Nordics shows that construction market trends differ by both sector and country, while also highlighting attractive segments worth pursuing. Achieving success requires a careful understanding of the operating environment, whether a company competes on a local, regional, or global scale. Strategic geographic positioning can significantly affect their pipeline, whether they’re going local, regional, or global. For instance, nearby markets might present less-attractive opportunities for expansion because of labor or legislation issues. Before a country or region is selected for focus, a holistic assessment of such issues must be undertaken.

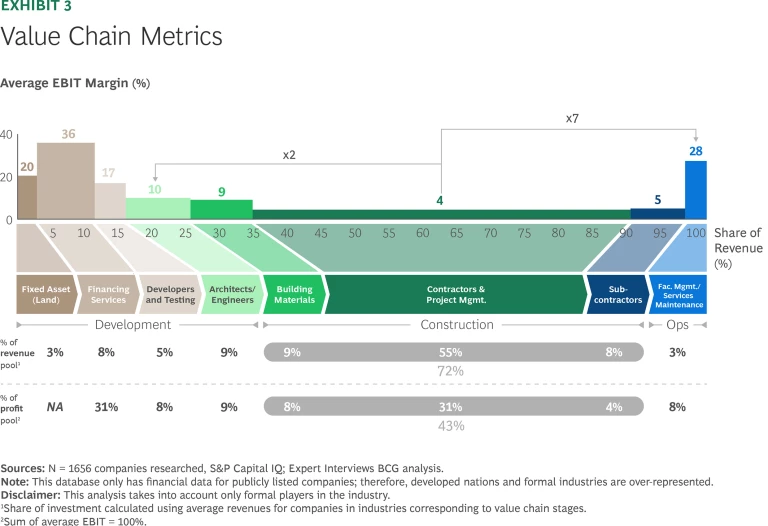

The value chain presents similarly rich opportunities to find efficiencies and improve profitability. The metrics when breaking down the overall construction industry value chain are striking: BCG’s analysis shows that while construction activities contribute over 70% of revenue, they generate less than 45% of profits (see Exhibit 3). This imbalance signals an urgent need to reassess where and how to create and capture value within the construction ecosystem. Some players are successfully exploring opportunities to play both up- and downstream—for example, moving into operations and concessions—and tap into new and sizable profit pools.

BCG engaged with a leading construction company to take a systemic approach to evaluating specialization opportunities in one geography by segmenting the market, assessing attractiveness across sub-sectors, and analyzing the company’s potential advantages through benchmarking and strategic frameworks. The team identified high-growth areas, mapped regulatory and technological uncertainties, and proposed a focused market entry and expansion strategy. The outcome equipped the client to pursue high-margin niches and vertically integrate in select sub-sectors for increased margin potential.

Core Optimization: Elevating Operational Excellence

Leading companies in the construction industry have developed advanced core capabilities across several key dimensions in order to enhance profitability.

Portfolio management is a critical skill, with top players implementing sophisticated project-selection protocols that systematically evaluate risk versus opportunity, apply probabilistic assessment techniques, and conduct thorough bid and post-project analyses. This disciplined approach yields higher hit rates, reduced project losses, and improved resource utilization. Companies that have undertaken these moves have achieved bid success of 30%–35%.

Procurement is another area with significant value potential. Leading players focus on three levers: restructuring procurement governance, implementing systematic cost-saving initiatives, and optimizing plant and equipment decisions through total-cost-of-ownership approaches and standardized buy-versus-rent business cases. In our work with players in the construction industry across indirect categories and capital expenditure, we have observed clients achieve sustainable run-rate procurement savings of 8%–18%

Project execution can be improved by implementing lean principles, including synchronized scheduling, just-in-time resource allocation, and modular techniques. These approaches have delivered time reductions of 30%, cost savings up to 15%, and margin improvements of 2%–3% for BCG clients.

Similarly, companies must trim overhead costs, for example, by renegotiating contracts, reviewing discretionary spending, and scaling back non-core activities. They might also consider making structural improvements by delayering their organizations, moving to shared services and centralization, and optimizing out- and in-sourcing. BCG estimates that each of these moves can produce improvements of 3% to upwards of 25% in effectiveness and efficiency.

Sustainability: Beyond Compliance to Value Creation

Sustainability is becoming a prerequisite for legislators, customers, and investors alike. Forward-thinking construction firms recognize that sustainability is also a strategic opportunity.

Companies can take an active role in forging value chain collaborations to achieve decarbonization goals and reinforce circularity in core operations by minimizing consumption of nonrenewable resources, reusing rather than discarding, and being disciplined with recycling of materials—for instance, crushing and reusing concrete. Waste can also be converted into energy.

Innovative construction firms embrace a circular approach and have become some of the largest recyclers globally. They have turned recycling into a business opportunity for third parties by providing a common platform for recycling waste from other building contractors at a lower cost, minimizing landfill waste and input for manufacturing and selling a wide range of construction materials including gravel, crushed concrete, compost, sand, topsoil gravel, and even ready-mix concrete.

Digital Transformation and AI: Driving Value Through Technology

BCG research ranks the construction industry among the least digitally mature sectors globally. The Nordic construction sector has 2.5 times fewer companies that are “scaling” in terms of core digital capabilities compared with the global average across industries.

Our research shows that Nordic construction companies compare well to other industries on the overall digital strategic aspiration as well as putting the right technology enablers in place for digital and AI. But the Nordic construction industry performs significantly worse when it comes to the actual deployment of digital tools into the core business and then extracting real business value from them.

This represents both a challenge for the industry overall and an opportunity for individual companies.

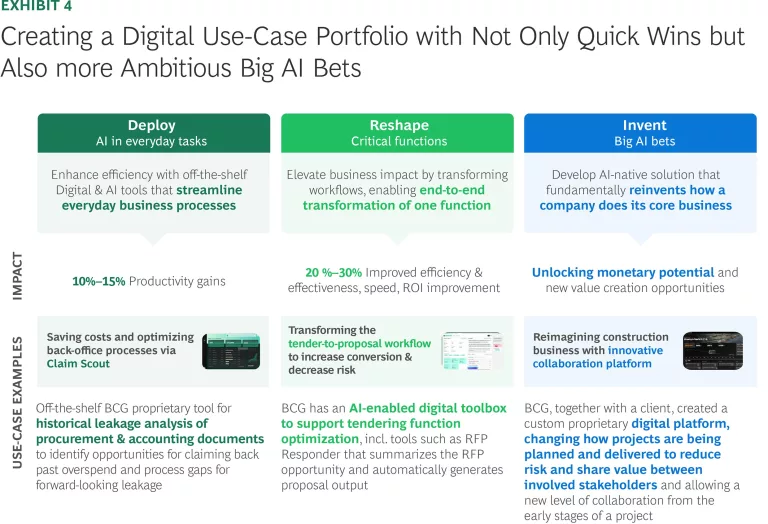

Construction players that make the systematic deployment of digital and AI-enabled tools a strategic priority have the opportunity to become market leaders and set new standards for the industry.

To that end, Nordic construction companies should define a targeted portfolio of potential digital and AI use cases and start implementing them in order to demonstrate value across different parts of their businesses.

The Path Forward

Given the slow-growth outlook for the next decade, the Nordic construction sector must move decisively and take bold steps to improve performance.

There are gains to be made across the board that have the potential to improve both performance and margins for the leading players.

Companies must “specialize” and actively choose where to play strategically across geographies, market segments, and the value chain.

At the same time, they must rigorously optimize the core processes of their businesses.

Opportunities in sustainability as well as digital and GenAI should be pursued to capture value and drive transformation of the construction sector.

BCG believes that by proactively focusing on these four levers—specialization, core optimization, sustainability, and digitization/AI—Nordic construction companies can achieve significantly greater profitability to break through the 10% margin barrier, and also establish themselves as industry leaders in the years ahead.

Acknowledgements

We would like to thank the following colleagues for their valuable input to this study: Maria Sorkina, Daniel Yeates and Orestis Lagouvardos. Their contributions have been instrumental in shaping the findings.