This October, our Consumer Sentiment Snapshot finds that consumer spending continues to be a drag on the UK economy due to a series of cyclical and structural trends.

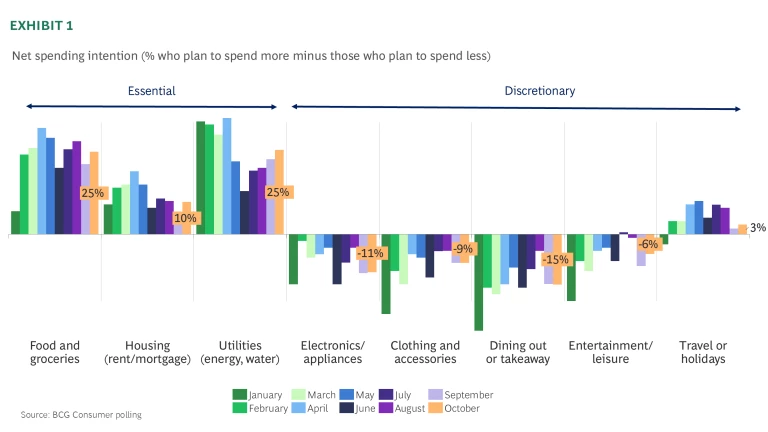

Despite expectations of a consumer recovery, a number of factors are continuing to put downward pressure on consumer spending. The first is inflation. Even though inflation has come down, consumers are still dealing with the high cost of essentials. Our survey shows the public are 25% more likely to say they will increase food and energy spending than they are to say they will reduce this spending. The second consideration is around consumer savings. The public continue to save more than they did pre-Covid and when they do spend, they are slightly more willing to spend on discretionary services over goods.

Key findings:

Consumer spending on essentials continues to rise, driven by higher spending on utilities and food. Spending on energy and water increased for the fourth consecutive month in October, with a net 25% of respondents expecting to spend more, the strongest rise since April. Food spending intentions also rose to a net 25%, reflecting both persistent food inflation and differing income effects across households. Higher-income households are the group that thinks their spending will increase most, particularly for discretionary items and services.

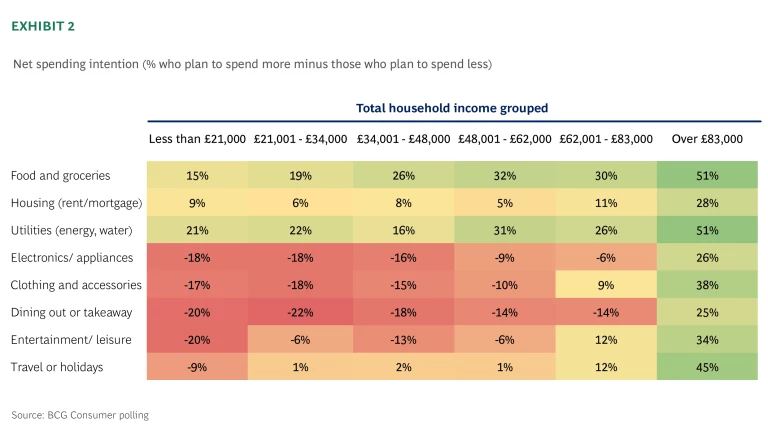

Over half of those with household incomes above £83,000 reported plans to increase spending on food and utilities. By contrast, households earning below £63,000 expect to reduce spending across most discretionary categories, particularly dining and leisure, though travel spending remains stable. The drivers of this divergence can be seen when studying food spending. Lower-income households are eight percentage points more likely to attribute higher spending to rising prices, while wealthier households are more likely to cite higher incomes or temporary factors such as holidays as leading them to spend more on food.

Essentials spending continues to rise, with spending on energy and water bills has increased for the 4th month in a row. The net spending intention for utilities was 25%, suggesting a quarter more people plan to increase their spending on energy and water than those who think their spending will reduce in October. This scale of increase in utilities spending hasn’t been seen since April. While some of this is due to seasonal effects (18%), the most common reason – cited by over 50% of respondents – was prices increasing. Meanwhile, the share of those who believe food spending will rise has also increased to 25%. People are still cutting back on discretionary spending, but mostly with the same intensity as in September.

Wealthier households are driving the majority of spending increases, while discretionary activities (dining out or leisure activities) are where lower households are planning to cut back most. For the wealthiest group studied – those with a combined household income of over £83K – over half (net) report plans to spend more on food and utilities. For those earning less than £63K, which is two thirds of individuals surveyed, they plan to cut back on all discretionary spending categories with the exception of travel or holidays, where spending intentions remain level.

There are different factors driving higher food and utilities spending for different income groups. While all respondents appear to be impacted by higher food inflation, poorer households are 8 percentage points more likely to cite higher prices as the cause of increasing food spending than wealthier households. On the other hand, wealthier households are 8pp more likely to cite a higher income as the reason for spending more on food, and 3pp more likely to cite a holiday or special event as the reason for the shift. A similar pattern is seen when considering drivers of utilities spending.

Raoul Ruparel, Senior Director for BCG’s Centre for Growth, said:

"Despite hopes of a consumer recovery, we’re still seeing a downward pressure on discretionary spending. Relatively high – and likely climbing - inflation on food and energy means consumers are still dealing with the higher costs of essentials, and households are choosing to save more than they were before the pandemic.

“Where we do see glimmers of optimism, it is overwhelmingly driven by higher-income households who are actively choosing to spend more, while the rest of the country is cutting back on almost all discretionary goods and services and blaming price rises on any increased spending on essentials.

“Combined, this conservative consumer spending continues to be a drag on UK economic growth. Ahead of next month’s Autumn statement it brings into sharp focus the importance of avoiding any inflationary tax or spending increases as well as challenges to revenue raising from consumer-focused taxes like VAT.”

Details on the survey:

These results are from a nationally representative poll of UK adults with a sample size of 1,500. Fieldwork was conducted between the 26th and 29th of September. The poll results were weighted to the latest UK figures for gender, age, education, and region to ensure overall representativeness.

For further information on the findings, please contact Graham Ackerman.