Digital technologies are reshaping the restaurant industry just as they are other consumer and retail sectors. But ask ten restaurant executives to describe the impact, and you’re likely to get ten different answers. Every company sees the hazards and the opportunities differently. One result is that the role of digital in companies’ future strategies varies. Some brands are focusing on improving execution, such as by reducing order and wait times. Others see digital as a marketing tool that can broaden reach or deepen customer engagement.

Different perspectives are to be expected, especially in an industry as diverse as dining. But plenty of companies are underestimating digital’s impact altogether, which is dangerous. In our work, we see many brands that are hesitant to pursue significant digital development. They are concerned about the capital investments required, which admittedly are neither small nor one-time, as well as about payback periods that are measured in years (far longer than the typical industry ROI window). They rationalize their reluctance by playing down the long-term disruption digital will cause. This is a mistake.

Four clear conclusions emerge from the recent evolution of digital in the restaurant industry:

- Consumers have embraced digital, and it is changing the game more quickly than many appreciate.

- Early movers have a significant advantage.

- In order to compete, brands need a well-defined digital strategy backed by well-chosen investment priorities.

- There is no one-size-fits-all answer, although there are some common “table stakes” moves that all brands should consider.

The tension between these truths—especially the fast pace of change—and the investment/payback conundrum clouds decision-making about where and how to invest for many companies. The lack of commonality in the industry is another complicating factor.

This report, which includes the results of a recent BCG survey of senior industry executives representing more than 30 brands on their digital expectations and intentions, provides a roadmap for sorting out the most important issues.

Digital’s Impact—Today and Tomorrow

In the restaurant industry, digital technology is influencing behavior in all phases of the consumer journey (discover, search, locate, buy, postpurchase). Consumers are increasingly turning to a range of digital tools to gather information, make reservations, pay for meals, and share their experiences.

Digital has already reshuffled the consumer journey. Restaurant customers like digital—especially mobile—and they make broad use of websites and apps from both restaurant brands and increasingly influential third parties. In fact, consumers have been much quicker than most companies to embrace digital and mobile. More than 35% of restaurant customers have downloaded at least one restaurant brand’s mobile app. A quarter of consumers now regularly use restaurants’ own websites to gather information, and some 20% regularly consult user-generated reviews on third-party sites or apps such as Yelp. Consumers say that these two sources of information are among the most influential, behind only word of mouth.

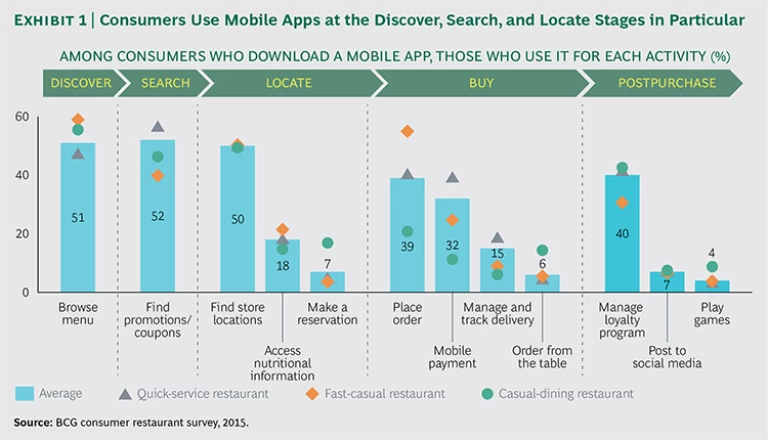

In the discover, search, and locate stages of the consumer journey, half or more of those who have downloaded mobile apps use them to browse the menu, check for promotions, or find restaurant locations. (See Exhibit 1.) We expect this number to grow as restaurants and third-party services add features. For example, Outback’s CEO, Elizabeth Smith, says her brand’s new app will “solve a lot of pain points; it’s going to allow you to virtually check in to see where you are in the wait list, to pay at the table, and go.”

Digitally enabled purchasing activity is on the rise as well. Brands’ mobile apps and online interfaces increasingly let customers order and pay before they get to the restaurant. Almost 40% of the users of such apps use them to place orders, a figure that rises to almost 60% in the fast-casual segment. A third of restaurant app users, including almost 40% of quick-service restaurant customers, use the apps to pay for their meal. Third parties and brands are driving innovation. The digital reservation service OpenTable has added payment capabilities to its app at participating restaurants. Starbucks CEO Howard Shultz told investors on the company’s third-quarter 2015 earnings conference call, “Mobile Order & Pay is enabling us to serve more customers more quickly and efficiently and to significantly reduce attrition off the line. … By enabling our customers to order ahead and avoid waiting in line, Mobile Order & Pay is enabling us to capture more on-the-go customer occasions, and the data is clear.”

In the postpurchase phase, the mobile apps of popular rating and review sites, such as Yelp, have made it easier than ever for consumers to share their opinions about a brand. And digital has increasingly become the face of the brand to consumers—loyalty programs are often the hook for mobile app adoption. In fact, 40% of the adopters of restaurant brands’ mobile apps use them to manage their loyalty program memberships.

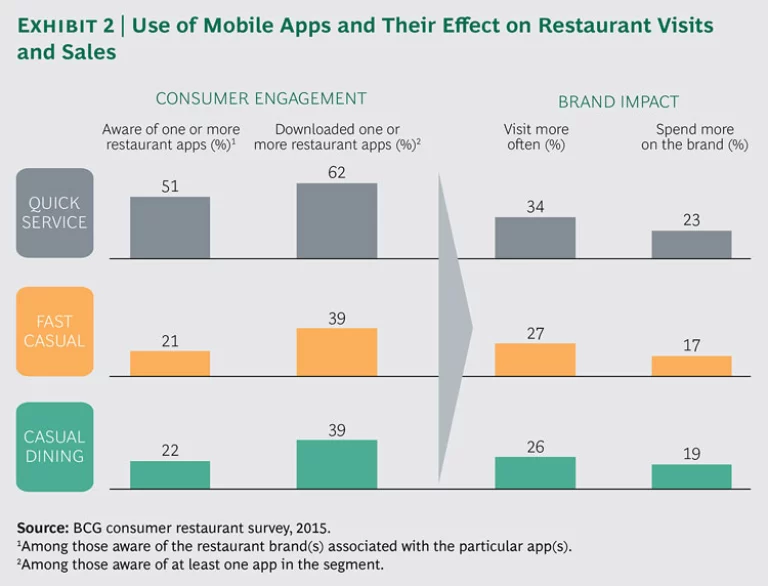

Not all brands have achieved the same degree of engagement, however. Best-in-class companies have mobile app adoption rates as high as 60%, while adoption rates among lagging brands can be as low as 10%. At the high end, the quick-service segment is leading the way in awareness, adoption, and usage. More than 50% of consumers are aware of at least one quick-service restaurant’s mobile app, and more than 60% of those consumers have downloaded at least one of them. (See Exhibit 2.) Casual dining and fast casual trail quick service—but even in these segments, nearly 40% of those who are aware of at least one mobile app have downloaded one. Higher awareness and adoption in quick service reflect the fact that digital has been widely used to solve fundamental operational challenges related to speed, whereas in casual dining, many applications of digital to date have focused more on the periphery than on core operational issues.

All this activity can have a big impact on sales. Consumers report more frequent visits and more total spending when they interact with a brand’s digital presence. According to our research, around 30% of those who download a brand’s app, on average, increase their visits to the company’s restaurants, and about 20% increase their total spending on the brand. The impact on visits and spending is even greater among those who join a brand’s loyalty program—nearly 40% of program members report increased visits and about 25% report increased spending.

Companies see this top-line impact clearly. One fast-casual chain reported that online orders now make up 13% of total sales. A quick-service chain reported that 20% of transactions are paid for through the brand’s mobile app, with those purchases averaging 12% more than the overall average. Another fast-casual chain reported 25% to 50% higher average spending on online orders than on in-store or call-in orders.

Smart companies will adjust to new trends and players. The pace of digital change is already fast, and it is accelerating. Big technology players are flexing their muscles in the restaurant business, while new entrants disrupt industry dynamics with new services. For example, Google acquired the Zagat restaurant review brand in 2011, and last year, Priceline shelled out $2.6 billion for OpenTable. Flash-sale and daily-deal sites have become an industry fact of life—restaurant offers are staples on Groupon, Foursquare, and Amazon Local. Social media plays an increasingly prominent role. As of June 30, 2015, Yelp averaged 83 million unique mobile visitors and 79 million unique desktop visitors monthly—and more than 83 million reviews have been posted on the service, of which 19% are about restaurants.

The history of digital disruption in other industries—media, retail, and travel, for example—shows that early movers can build big advantages, while slower companies risk finding themselves in very deep holes. Amazon has a bigger market cap than Walmart; Expedia’s market value is on a par with that of many airlines and hotel companies. Dining executives understand the need and the opportunity. In our recent survey, 96% of senior industry executives (100% in the fast-casual and quick-service segments) said digital is somewhat or very important in their three- to five-year corporate strategies, but only 36% are satisfied with their company’s current level of digital sophistication. Half the executives said they believe their company is somewhat or significantly behind its peers when it comes to digital development; the number was even higher among fast-casual and quick-service respondents.

Digital can deliver a range of benefits for brands, including increased penetration, higher conversion rates, improved product mix, increased consumption, greater brand loyalty, and reduced costs. But brands need a strategy to guide trade-offs in the prioritization of these objectives. They also need a strategy to deal with the plethora of third parties that are changing customer behavior in a variety of ways, from providing simple information to pushing promotions and special offers to mounting their own consumer engagement programs. And since the investment required to build digital capabilities is often large, and the payback period often longer than many restaurant companies are used to, brands need a digital strategy to focus investment where it will have the greatest impact. As we shall see, all these factors make it difficult for many restaurant brands to get started.

The Conundrum of Scale, Speed, and ROI

Restaurant companies face a quandary that complicates digital-strategy development and investment decision-making. It involves the interplay of three factors: the need for scale, the speed at which digital channels are evolving, and industry and investor expectations with respect to ROI. The first two, in particular, are giving rise to new players that are inserting themselves between restaurant companies and consumers—and undermining restaurants’ control over their brands. The third complicates the development of a response.

The Need for Scale and Speed. Scale and speed matter. Scale makes digital investments, which can be big, financially efficient by spreading development costs across a large number of units. Scale also enables companies to play at multiple points along the consumer journey, giving them greater influence over customers by simplifying the purchasing process into a one-stop operation. Conversely, brands that do not have digital scale or scope risk losing customers to third-party sites and apps, many of which seek to cover as many points on the consumer journey as they can, ultimately giving them more influence than the brand has over consumers’ ultimate decision.

Nimble new entrants are geared for speed and move much faster than traditional restaurants; they can scale up quickly. They insert themselves between companies and consumers with new services that provide added convenience, or they address consumers’ needs on an industry- or segment-wide basis. Consider how Amazon, in the span of a few short years, became the most disruptive company in retail—to the point where it not only competes with traditional retailers but has also become a digital channel through which many traditional stores reach online consumers. Or consider how the travel industry has been transformed by online travel agencies and metamediaries—Expedia, in particular, in the US—that quickly built scale in the reservations process and took over control of the consumer from hotel, airline, and car rental brands.

In the restaurant industry, aggressive, fast-moving third parties have already established strong positions at different stages of the consumer journey. At the discover stage, branded websites still play a big role, but online review and social media sites, such as TripAdvisor, MenuPages, and Yelp, provide consumers with a single, cross-brand destination for information (and, increasingly, for other services). In the search and locate phases, external reservation systems and ordering platforms—OpenTable and GrubHub, for example—are taking control of a growing share of restaurant reservations and delivery orders. OpenTable says it seats more than 17 million diners a month. When they merged in 2014, Seamless and GrubHub were processing 130,000 orders a day. How long will it be before companies such as these use their scale and influence with consumers to sway dining decisions, as TripAdvisor has done in travel? In the postpurchase phase, social media and online review sites such as Google and TripAdvisor have built clear strength and scale.

Even the buy stage, which has long been primarily the territory of the brand, is under attack. Purchases have traditionally been tightly linked to the in-store experience or to the brand’s interaction with customers through loyalty programs and other tools. But as remote ordering, payment, and delivery become increasingly prevalent, they open the door for third parties to gain scale. Online and mobile ordering and delivery providers, such as GrubHub, are growing more sophisticated and are consolidating nationally.

Even strong brands have little control over this incursion, especially in a franchise environment. Restaurants used to ask themselves, Are delivery and takeout good for the brand? Does our food travel well? Today, like it or not it, delivery is fast becoming a fact of life for all kinds of restaurants, and there is little that brands can do about it, regardless of whether the customer’s fries arrive soggy.

The Realities of ROI. Restaurant brands, especially larger companies that are more advanced on the digital journey, may be able to leverage their own digital initiatives and platforms to create scale. The bigger challenge is for smaller brands or those that are just beginning to expand their digital presence. Complicating matters for just about all restaurant brands is the pressure to demonstrate near-term ROI.

Restaurant companies and their investors are used to realizing short-term returns on their investments. Companies expect to see initial returns on new-product introductions, for example, in a matter of months. Investors watch quarterly results closely and expect management to deliver on expectations. But the time horizon for digital investments can be long—two or three years is not uncommon—and the investments themselves are substantial. Moreover, digital investment is not a one-time proposition. Rapidly advancing technologies require digital leaders to upgrade their capabilities and skills on a continuing basis.

Many companies struggle with this short-term/long-term dichotomy. In our work with digital decision-makers, the need to balance near-term objectives with long-term payback is cited frequently as one of the greatest challenges companies face in achieving their digital aspirations. Current investment levels vary across the industry. Executives responding to our survey reported annual investment of 0.5% of net sales or less, while others are investing 2% or more. The majority are investing between 0.5% and 1.5%. But 86% of respondents said they expect to increase their digital investment over the next three to five years.

Restaurant executives also disagree about the financial impact they believe digital can deliver. Most see greater potential for digital to drive top-line growth (as opposed to reduced costs). And 90% of our fast-casual respondents said they expect digital to deliver ongoing incremental same-store sales growth of 1% to 5%, while expectations are considerably lower among quick-service and casual-dining executives. 44% of quick-service and 25% of casual-dining respondents said they anticipate impact of less than 1%. With long-term payoffs and uncertain returns, digital initiatives often don’t survive typical budgeting processes—one big reason why restaurants underinvest even though most executives feel they should do more.

Restaurants need to find ways to balance their digital investments against investor expectations. For example, Panera Bread’s 2.0 initiative, which involves updated in-store systems that increase speed and accuracy, as well as new mobile order and payment platforms to “reduce friction” across the consumer journey, has proven successful in driving same-store sales growth, but the impact was not immediate. As CEO Ron Shaich said on the company’s second-quarter 2015 earnings call, “Panera 2.0 is not turning on a light switch. Its impact is seen over time. … Sales in Panera 2.0 cafés gain momentum three to four quarters after conversion.” This kind of CEO commitment is critical for companies looking to achieve digital breakthroughs.

A Framework for Digital Investment

In an uncertain and fast-changing environment, where there are many more points of difference than agreement, how should companies go about deciding how and where to invest? For example, 50% of casual-dining executives said that a loyalty program is the most important digital capability for them to invest in over the next three to five years, compared with 35% of fast-casual and only 11% of quick-service restaurant executives. Among the latter, 22% said that delivery is the most important digital capability, while only 9% of fast-casual executives and no casual-dining executives cited delivery as key.

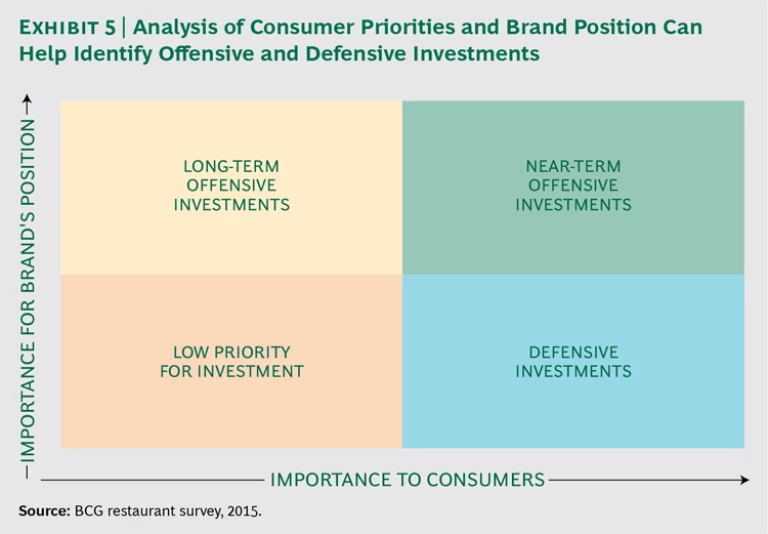

We believe the answer lies in assessing two factors: what matters most to consumers and what is most important to a brand’s position in the marketplace. Combined with top-level executive support, such an analysis allows a company to set the priorities that will determine its digital investments and avoid chasing fads or short-term trends with low return potential. Once its investment priorities are set, a brand can decide where it needs to play offense—building a new competitive advantage or an industry leadership position—and where it needs to invest defensively to protect share or keep pace with industry table stakes.

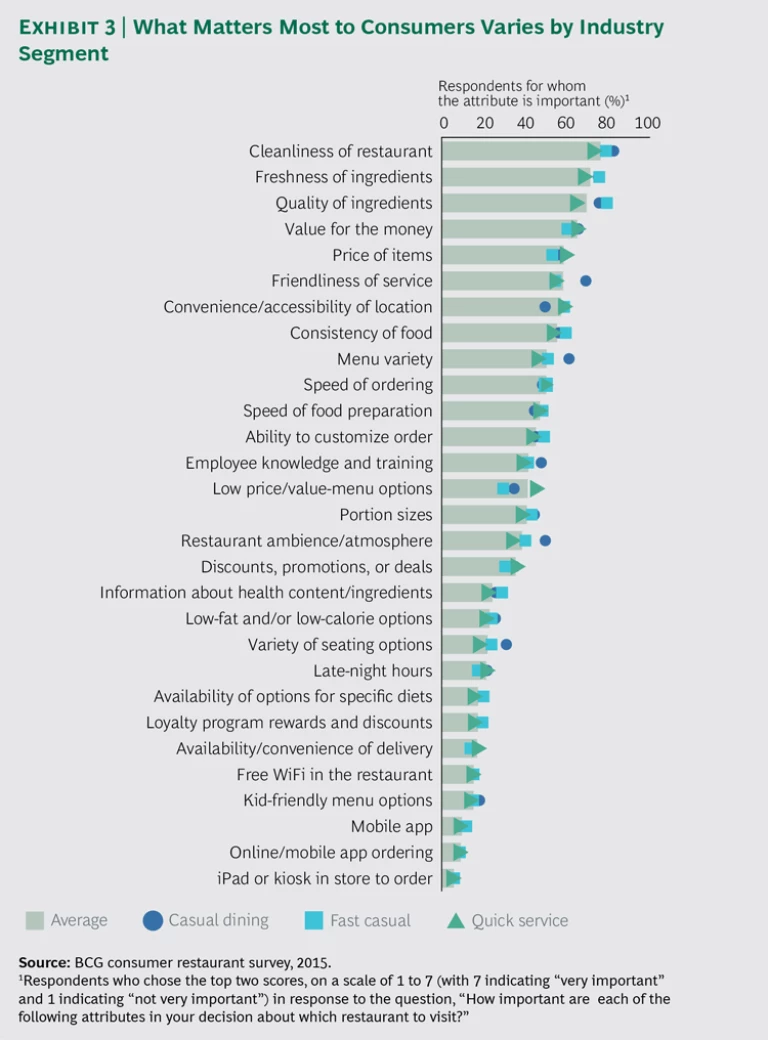

What Consumers Want. Since digital channels are first and foremost about broadening and deepening customer engagement, investments should focus first on what matters most to consumers—which, of course, is their experience with the brand. Some of the factors that make up this experience are similar across all restaurant brands: the cleanliness of the restaurant or the friendliness of the staff, for example. The significance of other factors, such as speed and fresh ingredients, varies by brand and segment. (See Exhibit 3.) In the quick-service segment, technical attributes relating to low prices and discounts, delivery, convenience, and late hours are more important to consumers than they are in other segments. In the fast-casual segment, ingredient quality, offerings that meet dietary requirements, and the availability of a mobile app and loyalty program rewards take precedence. In casual dining, wait time before seating, seating variety, restaurant atmosphere, and menu variety are more important.

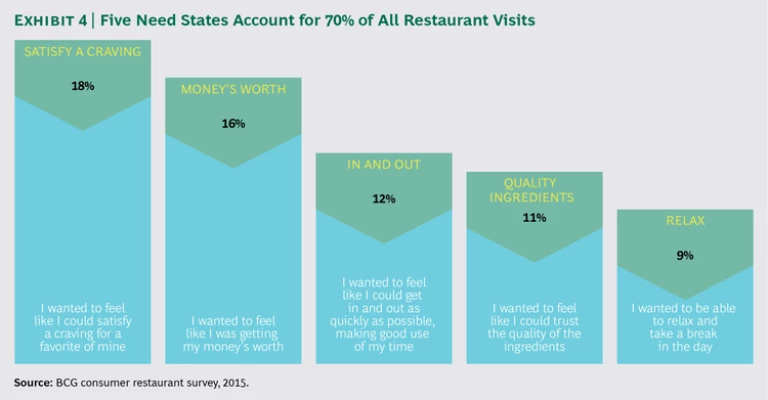

What Brands (and Consumers) Need. Digital investments must also support the “emotional need states” in which a brand seeks to beat the competition. Need states describe how consumers want to feel when they visit a restaurant and, therefore, what they expect the restaurant to deliver. Our research shows that need states are the single biggest factor in choosing a restaurant. (See Casual Dining: How Brands Can Pivot from Irrelevance to Growth, BCG Focus, November 2014.)

The top five need states—which we refer to as satisfy a craving, money’s worth, in and out, quality ingredients, and relax—account for about 70% of all restaurant visits. (See Exhibit 4.) Consumers must believe that a brand will satisfy a certain need state in order for them to choose it when that particular need is paramount. Of course, consumer expectations vary across need states. In the in and out need state, for example, consumers especially value fast ordering and food preparation and convenient and accessible restaurant locations. In the quality ingredients need state, they value the quality and freshness of ingredients, the ability to customize orders, and overall consistent food quality. Digital attributes, such as the availability of apps to speed ordering and delivery, are important in supporting a need state.

As brands prioritize their digital investments, the need states in which they want to establish a differentiated position and the requirements of consumers in those need states provide valuable filters for setting investment priorities. Brands need to analyze these two dimensions together and isolate the pain points that can serve as a focus for investment. Often these involve operational challenges, such as speed or throughput, where digital can provide a powerful platform for improvement. The companies that have been most successful so far in leveraging digital technologies have targeted their investments based on this kind of analysis.

Making Offensive and Defensive Investments. By analyzing what matters most to consumers and to the brand’s market position, a company can also set its priorities for making offensive and defensive investments in digital. (See Exhibit 5.) Offensive investments are used to build new competitive advantage or industry leadership; they should focus on enhancing the technical requirements that are of greatest importance to consumers and to the need state that the company wants to satisfy. Defensive investments are primarily intended to protect share or keep up with industry table stakes; they should focus on technical requirements that are important to consumers but less critical to satisfying the targeted need state. This framework can guide brands as they develop an investment model for capturing their desired ROI. It can also help management explain investment rationale, targets, and time frames to investors.

The degree to which companies follow this general rule varies by brand and segment, however. A large majority of digital decision-makers (71%) see digital as an offensive strategy. But executives in the fast-casual segment (91%) are much more likely than those in quick service (67%) to see digital this way. And only 50% of casual-dining executives look to digital as an offensive strategy. Many of the challenges that digital can address, such as service speed and ease of use, are not critical in the casual-dining segment, where there is more emphasis on the relax need state and on attributes such as ambience and menu variety. Digital can have only a limited impact in these areas, so a more defensive digital position would therefore make sense in casual dining.

Companies have a range of options for managing their digital solutions, from developing them exclusively in-house to outsourcing development entirely to partners or vendors. Internal development generally allows for greater customization and control; third-party partnerships or other approaches to outsourcing are less costly and can help capture scale more quickly. They enable companies to more easily concentrate their investments where they matter most. Internal development is also likely to be preferable for offensive investments intended to address attributes of great importance to both consumers and the brand’s position. In contrast, externally developed solutions may be more appropriate for defensive investments, especially those intended to keep pace with industry table stakes.

Companies should also take into account whether an internal solution can deliver a better outcome and achieve the same scale and reach with consumers as an established external solution. For example, OpenTable has established functionality and scale for online reservations that no restaurant brand’s internally developed system is likely to equal. Many brands therefore leverage OpenTable’s technology rather than investing limited resources against that element of the consumer experience.

We see brands pursuing both internal and external approaches to the same digital platforms. For example, two companies in the quick-serve segment, Starbucks and Subway, have taken very different approaches, reflecting the different technical requirements of the need states they seek to address.

As Starbucks looks to increase its share in all the occasions that make up the typical consumer’s day (breakfast, lunch, running an errand, and meeting a friend, for example), it seeks to build strength in the in and out need state. The company made an offensive investment in designing its own mobile payment platform—the foundation of a digital ecosystem that allows it to address consumers’ demand for convenience and speed. Starbucks uses the app to manage throughput at peak times, thereby meeting specific operational challenges and earning a measurable return.

Meanwhile, Subway must address a different need state: healthy choice. The technical requirements of convenience and speed are important to this brand’s customers, but not as much as to in and out customers. So Subway’s mobile payment solution is more defensive. It takes advantage of third-party payment platforms, including Apple Pay, Android Pay, and, most recently, PayPal. At the same time, however, Subway has invested in building unique capabilities into its mobile and online ordering platforms that allow consumers to customize their order—an important technical requirement of the healthy choice need state. Using the app, customers can virtually build their own sandwich, even specifying whether they want more or less of a certain ingredient.

Likewise, when it comes to other digitally enabled platforms, such as delivery, best-in-class brands make different choices about where and how to invest. Jimmy John’s serves the in and out need state, and delivery plays a critical role in meeting its customers’ requirements. The company developed and manages its delivery network internally as an offensive investment. In contrast, Taco Bell serves the satisfy a craving need state, where speed and convenience, though not irrelevant, are less important; this company is testing a delivery network with an external partner as a defensive move.

Four Steps Brands Can Take Now

Where should a restaurant brand begin? We see are four “no regrets” moves that any company can take now to begin to tackle digital investments.

Develop an integrated digital strategy. Winning in digital is not simply about developing an app to increase purchase frequency or implementing a new order management system to reduce wait times. To truly deliver impact, digital must be approached as an integrated activity system that ties across all aspects of the organization and its operations. This requires an integrated, cross-functional digital strategy.

Companies can use the consumer priorities/brand position framework to identify the most important areas to tackle through digital and to determine whether an offensive or a defensive solution is best. This framework should be used to develop a three- to five-year digital strategy that is established from the top and defines the objectives of the digital investment in order to guide the hard trade-offs that will be required. Based on this longer-term strategy, management can then set near-term investment priorities and tactics.

Build a digitally capable organization. Even the best digital strategy will fail if the organization does not have the right structure and skills to execute it. There is no single organization model that works for every brand; the “right” answer depends on the company’s goals, its structure and culture, and its access to talent. Some companies centralize digital within a single function or “center of excellence” that works across functions, while others find that a more decentralized model, integrating digital expertise within each function (marketing and operations, for example), yields better outcomes. In our survey, 36% of respondents said that digital is a stand-alone, centralized function in their companies, 50% said it is decentralized, and 14% reported a hybrid model, with digital strategy directed centrally but execution decentralized. Regardless of the specific model, the organizational structure should support true cross-functional integration of decision-making and execution. Most companies will find that they need to at least start with a centralized function to get their digital strategy off the ground.

In a similar fashion, most companies rely on a hybrid model to ensure access to the capabilities they need, such as advanced skills in data analysis. Social media, digital marketing, and the brand’s website or online presence are more likely to be developed internally, while front- or back-of-house technology and delivery are more likely to be fully outsourced.

Develop an agile culture around digital. The rapid pace of digital change has introduced a new degree of turbulence and uncertainty into the dining industry. For example, while companies in the past had too little data to inform decisions, today they are contending with information overload. To be successful, brands must develop the ability to process internal and external information quickly and to reallocate resources at short notice in response to changing trends. This can be a big source of advantage for those that get it right.

Across many consumer-facing industries, best-in-class companies have taken a page from “agile” software development and are learning to test, learn, and scale up capabilities with the goal of accelerating the development of new initiatives and timelines. For restaurants, agile development could take the form of setting aside some investment capital for experimentation, with the understanding that some ideas may fail. Many restaurant executives say their companies are following this path: 70% believe their company is as agile—or more agile—than its industry peers. Among quick-service restaurant executives, nearly 90% feel they are at least as agile as their peers. Casual-dining executives see their companies as slower to adapt—only 50% believe they are at least at parity with their peers, while the other 50% see themselves as less agile.

Support and build on brands’ digital presence. While many brands are still at an early stage on the digital journey, most have established at least some online presence—for example, through a branded website. Leveraging these online outlets, including social media and digital marketing, to engage consumers is a relatively low-cost way for brands to increase consumer awareness, manage brand perceptions, and build organizational muscle around digital. Regardless of the brand’s longer-term digital strategy, these channels will remain critical for connecting and communicating with digitally connected consumers.

The restaurant business has always been susceptible to big trends, such as consumer tastes, and to evolving priorities. Digital is one more big trend—with the singular difference that the pace of change is faster than ever before. Every brand is different, but all companies need to adapt with sound digital strategies that are rooted in their particular circumstances and objectives. Only with such strategies in hand can they decide where to invest for the biggest impact—and how to set investor expectations for the future.

Acknowledgments

The authors are grateful to Kelsey Brandon, Brad Brewer, and Julia Slater for their assistance in the preparation of this report. They also thank David Duffy for writing assistance and Katherine Andrews, Gary Callahan, Kim Friedman, Abby Garland, Gina Goldstein, Sara Strassenreiter, and Jenifer Zacharias for contributions to editing, design, production, and distribution.