Big changes are brewing in the commercial vehicle market. The advent of new types of powertrains, rapid progress in autonomous driving technology, and the explosion in connectivity are spurring unprecedented changes in attitudes and expectations—of buyers as well as of the general public—and in regulation. We anticipate that by 2030 these developments will have fundamentally transformed the market.

To understand the pace of adoption of these evolving technologies and the implications for OEMs, we interviewed more than 100 global manufacturers, industry suppliers, and experts. We also created a bottom-up adoption model to forecast trends in key markets.

While our research suggests that adoption rates for new powertrains and autonomous vehicles will vary by region and use, connectivity is a different story. It is quickly becoming ubiquitous, and the new business models that it spawns will shift the sources of profit throughout the value chain.

What does this mean for OEMs? What bets should they make, given their strengths, and what capabilities will they need? How can they set themselves up to maintain current operations while navigating the transition to a very different future?

The Sales Outlook for Commercial Vehicles

In 2018, there were about 120 million commercial vehicles on the road worldwide. Of the 14.7 million units sold last year, 11.4 million were light commercial vehicles (LCVs) and 3.3 million were either heavy-duty trucks (HDTs) or medium-duty trucks (MDTs).

Overall, commercial vehicle sales are growing slowly and will level out over the next ten years. From 2018 through 2030, we anticipate annual growth of 2%. Growth across the world’s major markets—the US, Europe, and China—will be negligible. Overall industry growth will depend on smaller markets throughout the rest of the world, where the modernization of road networks and commercial transportation is an ongoing project.

As OEMs gear up production of new-energy vehicles, and as existing vehicles that use internal combustion engines age, adoption will begin in earnest. For example, by 2030, we expect that more than 35% of all LCVs sold will be new-energy vehicles, of which more than 70% will be battery-powered electric vehicles. Roughly 26% of all HDTs will be new-energy vehicles. In the meantime, a handful of technologies will be in use, as battery technology and new-vehicle manufacturing evolve.

Overall, commercial vehicle sales are growing slowly and will level out over the next ten years.

The New-Energy Powertrains

Three new-energy technologies show especially strong commercial promise:

- Liquefied natural gas (LNG). Its fast refueling ability and its support for long-range transport are among LNG’s most appealing qualities. Yet its commercial viability depends on the presence of an ample natural supply or on public policy support, as well as on adequate infrastructure (fueling stations and a distribution network). These conditions favor adoption in countries such as the US and China.

- Hydrogen fuel cell. Its advantages—zero emissions, quick refueling, and long-range capabilities—make this expensive technology attractive. But the viability of hydrogen fuel cell powertrains depends on the availability of cheap electric power, which makes countries such as China and France the most likely candidates for adopting it. Fuel cell technology will be most favorable for long-distance uses because of its quick refueling abilities.

- Battery-powered electric. Fully battery-powered electric vehicles tapping a zero-emissions power source are ideal for LCVs used for in-town, short-distance driving. By 2025, the total cost of ownership for such vehicles will drop below that for vehicles that run on internal combustion engines. A major drawback of batteries is their output relative to weight, which restricts payload. Large-scale adoption for long-distance applications (that is, for MDTs and HDTs) is unlikely.

Beyond 2030, battery-powered electric will most likely become the most mainstream of the three technologies globally, at least for shorter-distance uses. For one thing, as a zero-emissions solution, battery-powered electric vehicles enjoy broad support from the public and from policymakers. For this reason, battery technology has captured most of the global research effort in the passenger and commercial vehicle markets and continues to improve rapidly, producing increasingly high-energy-density batteries. Altogether, battery cell manufacturers have publicly committed to adding 1000 GWh of capacity over the next ten years.

Adoption Trends by Region

The US, Europe, and China are at the forefront of implementing these new powertrain technologies. Adoption rates will vary, of course, by regional market, by vehicle type, and (importantly) by use—whether for deliveries in town or between cities, and whether for long-haul or closed environments, such as construction sites and harbors.

Such factors as energy supply, manufacturing capability, infrastructure, and government policy (regulation as well as economic incentives) will help determine which powertrains dominate in each vehicle class in each major market. By 2030, across key markets, the overall adoption of new-energy vehicles for LCVs will exceed 35% and for HDTs will be around 26%.

By 2030, across key markets, the overall adoption of new-energy vehicles for LCVs will exceed 35% and for HDTs will be around 26%.

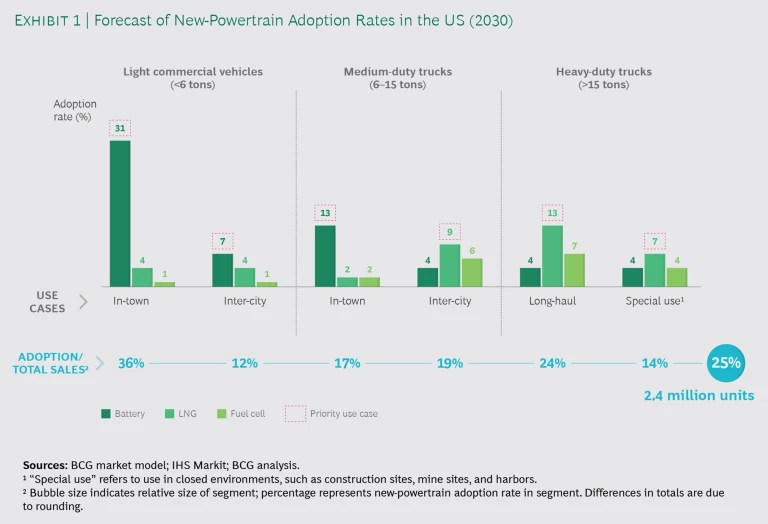

The US. By 2030, new-energy vehicle adoption in the US will be about 25%. (See Exhibit 1.) That figure is lower than the corresponding percentages anticipated for other leading markets, largely because of the downward influence of HDT sales: it will take longer for the new powertrains to be viable in HDTs, given the US’s huge travel distances and lower population density. Overall, the biggest chunk of new-energy vehicle sales will be for in-town LCVs (36% of total LCV sales); battery powertrains will account for the lion’s share of new-energy vehicle sales (31%) within that segment. Battery-powered electric vehicles will also lead new-energy vehicle sales for LCVs used for inter-city delivery and for MDTs used for in-town delivery. This isn’t surprising: battery-powered vehicles can be charged overnight, and all of these driving uses involve short-range travel.

For medium- and heavy-duty trucks—especially for long-haul transport—LNG and fuel cell come out ahead. However, although the supply of LNG is abundant, its distribution infrastructure is not yet well developed. In specific corridors such as California, LNG will be viable, but it will not become mainstream nationally. Long-distance transport in the US is often transcontinental, which favors the use of hydrogen fuel cell technology. Battery isn’t yet up to the task; and furthermore, its charging infrastructure will take longer to establish.

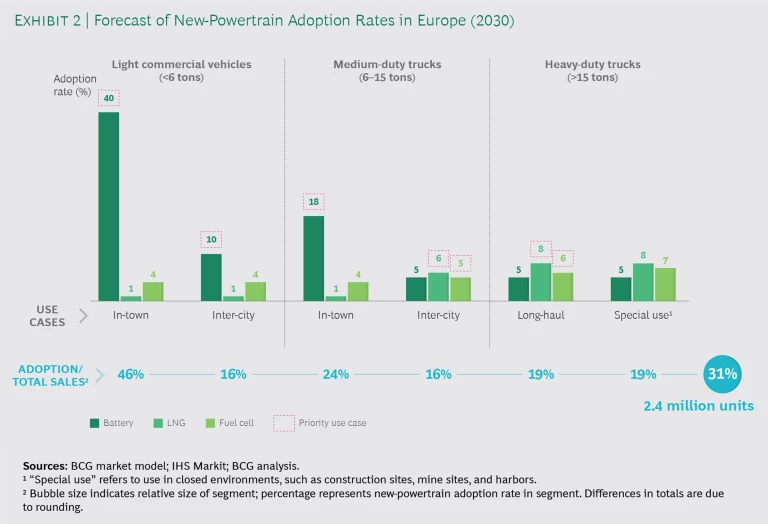

Europe. New-energy vehicles will account for a bigger share of total sales in Europe (31%) than in the US, but a slightly smaller share than in China. (See Exhibit 2.) As will be the case in the US, most new-energy vehicle sales in Europe will be for in-town LCVs (46% of total sales, with battery-powered electric vehicles accounting for 40% of that quantity).

Battery will be the hands-down winner among the four technologies for LCVs and MDTs in in-town use because distances are relatively short and the necessary infrastructure is easy to build. For inter-city MDT use and long-haul HDTs, LNG will prevail (at least in regions with sufficient supply, such as Italy), but hydrogen fuel cell will be a serious contender.

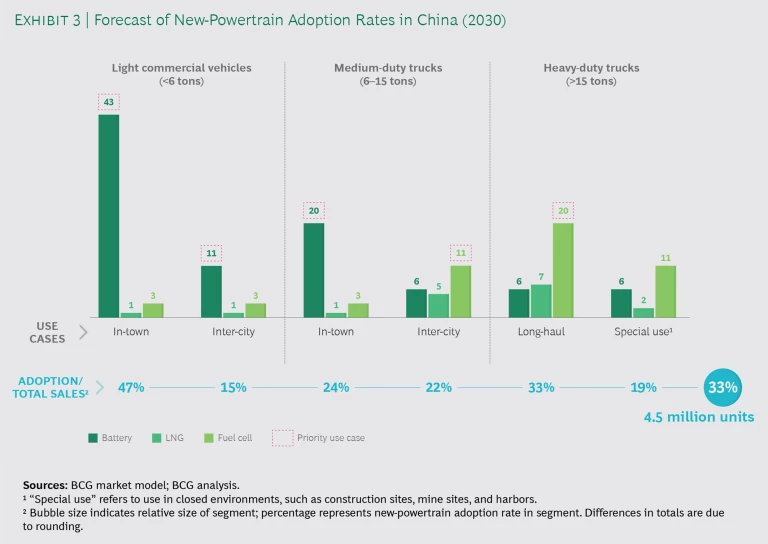

China. As noted, China will have a slight edge over Europe in new-energy vehicle sales (33% of total commercial sales) by 2030. (See Exhibit 3.) The nation’s lead position in battery-powered electric vehicles will be due in large part to policy support that has spurred the rise of a number of battery producers. Battery-powered vehicles will account for 43% of the total 47% of new-energy LCVs sold for in-town use. For MDTs used in town, 20% of the total 24% of new-energy vehicles sold will be battery powered. For MDTs used for inter-city transport and for HDTs, fuel cell powertrains will be the dominant new technology.

It’s easy to see why, in their early stages of vehicle development, battery-based powertrains will grab the largest percentage of sales of new-energy LCVs. Because their main function is in-town transport, LCVs cover shorter distances and travel at slower speeds, so they don’t require massive power storage. And as primarily daytime-use vehicles, they can be recharged overnight.

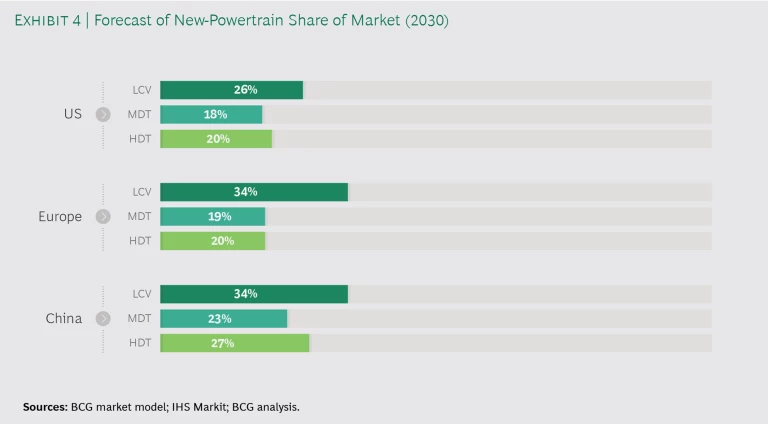

Adoption rates for LCVs in Europe and China are likely to be about the same, constituting one-third of sales. (See Exhibit 4.) Likewise, adoption rates for new powertrain MDTs and HDTs in the US and Europe will be almost identical. China comes out considerably ahead in the MDT market and especially in the HDT market. A less far-flung road network, greater population density, and the government’s goals to reduce auto emissions explain China’s more rapid adoption rates in these subcategories.

Autonomous Technology: HDTs as Early Adopters

The pace of adoption of fully autonomous vehicle technology will be less directly tied to new-energy vehicle development in the commercial vehicle sector than in the passenger vehicle market. Because commercial customers tend to be more sensitive to the total cost of ownership, the internal combustion engine will likely continue to dominate in the initial stages of AV adoption in the commercial sector.

The internal combustion engine will likely continue to dominate in the initial stages of AV adoption in the commercial sector.

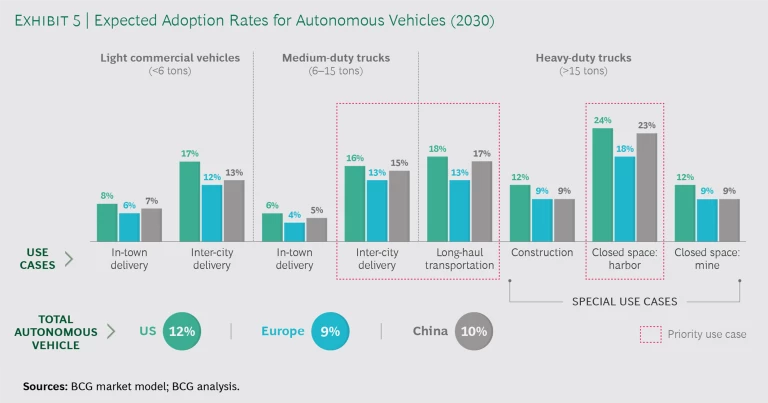

We expect only about 10% of new LCVs to be autonomous by 2030. (See Exhibit 5.) The technology is not yet ready for the rigors of typical light-vehicle applications, and regulatory frameworks have yet to be worked out. On a practical level, the payoff can be less compelling; delivery vans, for example, will still require a driver to handle deliveries.

In contrast, approximately 20% of HDTs will be autonomous. In fact, of the three classes of commercial vehicles, HDTs will most likely be quickest to gain widespread adoption, for two reasons: unlike navigating in-town traffic, long-haul highway driving is more straightforward; and the total cost advantage is significantly greater. This scenario is consistent across all three major markets, with the US accounting for the largest share of adoption for both inter-city and long-haul transportation.

Closed driving environments (such as mine sites, construction sites, and harbors) will experience the highest percentage of adoption of autonomous vehicles across all three markets: close to 25% of new sales. The economics favor autonomous equipment because it can operate 24/7 and it makes for a safer work environment. Moreover, closed environments present no risk to the public, and the development of sensor technology (a critical determinant of autonomous vehicle viability) for specific uses is more straightforward.

As is the case with the different energy sources, adoption of autonomous technology will depend on more than just its technological virtues. Other factors include the level of government and public support, perceptions of potential risks, and the response from regulatory agencies. In the US, for example, the importance of unconstrained interstate commerce will likely mitigate policy roadblocks arising from differences among the 50 state governments. Demographics count, too: the expected driver shortage in the coming years favors adoption of autonomous vehicles. In China, public acceptance may spring from the widespread press coverage that autonomous vehicle testing receives, the nation’s tendency to embrace new technology, and the sheer number of leading technology companies that are Chinese. In the EU, in contrast, autonomous technology could face obstacles to adoption, given the likelihood of legislative differences among member nations.

Securing the Core Business by Locking in Critical Components

In view of the uncertainties—the unpredictability surrounding technological advances, public and buyer sentiment, and regulatory tendencies—we expect multiple powertrain solutions to coexist. But maintaining a technology whose sales will at best be flat, while at the same time developing multiple technologies (at a cost exceeding $1 billion each), puts OEMs under enormous pressure.

Maintaining a technology whose sales will at best be flat, while at the same time developing multiple expensive new technologies, puts OEMs under enormous pressure.

As buyers embrace new-energy vehicles, profits from vehicles with internal combustion engines will, by 2030, fall by more than 10% (a drop of $2.5 billion) compared with 2018 figures. To secure profits from new-energy vehicles and autonomous technology, OEMs must integrate the new technological components—most critically, battery cells and autonomous driving algorithms and software—into their value chain. Those new components include everything from GPS antennas and battery modules to LiDar, radar, and algorithms and software for autonomous vehicles. OEMs must consider every component along two dimensions: how accessible the technology is, and to what extent superior quality translates into competitive advantage. When dealing with more numerous and more technologically complex components, OEMs must vigilantly preserve supply control so that they are never beholden to suppliers. As batteries come to control a bigger proportion of the vehicle’s value, ownership of the technology becomes increasingly important.

Battery Cells. Demand for battery cells now exceeds supply, and it will continue to do so for the foreseeable future. And because manufacturing these cells requires technical know-how, OEMs are either pursuing joint ventures or partnering with the current leaders in battery manufacture. After calculating that it would need 150 GWh of annual capacity through 2025, Volkswagen Group signed deals with four leading battery makers to ensure a long-term supply of cells for the three key markets (North America, Europe, and China). China’s Dongfeng Motors and CATL formed a joint venture in 2018 to conduct R&D and to manufacture and sell battery systems. Daimler announced that it intends to spend €20 billion ($22.8 billion) by 2030 on lithium-ion batteries to power its electrified vehicles.

Algorithms and Software for Autonomous-Driving Technology. Technology companies continue to pour big money into R&D in the race to produce the first commercial autonomous vehicle. As yet, there is no commercially viable integrated solution for trucks. Leaders in this niche include Waymo and Uber (US), Bosch (Europe), and Baidu and TuSimple (China).

OEMs are either building their own capabilities or partnering or making other arrangements to acquire them. In 2017, Dongfeng Motors and more than ten other OEMs entered into a partnership with Baidu to produce an open software platform on which the truck manufacturers can develop their own autonomous driving systems. Volvo Trucks, in partnership with Brønnøy Kalk of Norway, has successfully tested an off-highway autonomous driving package for transporting ore from a mine to a port; the company anticipates a commercial launch by the end of 2019. For its part, Hyundai, which has been developing the technology internally, completed limited testing of an autonomous semi-trailer truck in 2018 and plans to roll out fully autonomous convoy capability in the 2020s.

The Road to Profitability Means Moving Downstream

By 2030, profits from aggregate new sales of traditionally powered commercial vehicles will have declined by $2.5 billion from 2018 sales. Securing the core won’t be enough to enable OEMs to preserve their market might. New market players, new suppliers, and tech companies are already encroaching on the profit pools traditionally held by mainstream OEMs and suppliers. These competitive pressures, along with evolving mobility trends, mean that OEMs must look beyond their conventional manufacturing revenue sources.

Downstream businesses allow OEMs to capitalize on synergies in their core business, including existing resources, expertise, and customer relationships.

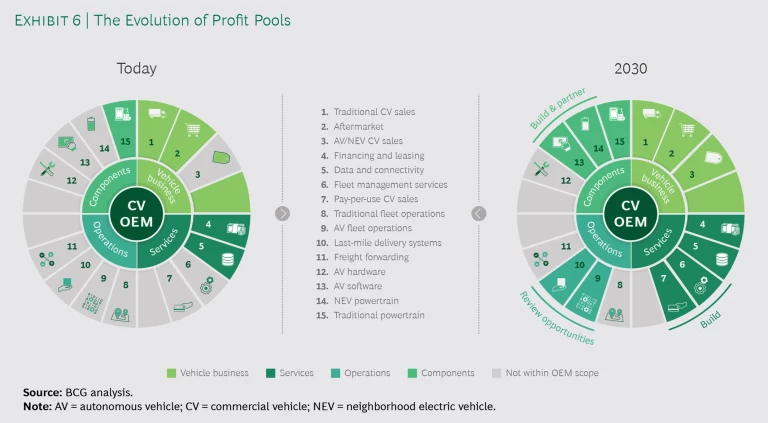

This imperative is far from being merely a defensive move. Downstream businesses offer great opportunities for OEMs, allowing them to capitalize on synergies in their core business, including existing resources, expertise, and customer relationships. (See Exhibit 6.) Two examples are fleet management and pay-per-use sales. Both lie in the sweet spot for OEMs: high in profit potential and high in synergies. OEMs can sell these mobility services through established channels to existing customers, enhancing the current commercial offering.

Combined with new technologies and components, these services, which accounted for just $1 billion in profits in 2018, will explode to account for nearly $10 billion by 2030—creating profit pools almost four times the size of the internal combustion engine shortfall. This shift in value-chain profit pools will make expanding downstream a tempting prospect for OEMs.

Fleet Management Services. Thanks to telematics and new types of connectivity built into new vehicles, fleet management services are emerging as an attractive new opportunity for OEMs, with substantial profit potential.

Traton Group is adopting RIO, the fleet management platform, throughout its product line. Daimler’s Van2Share (originally Car2Share Cargo), operating since 2015, has built-in driver and order management. OEMs should pay attention to new entrants in this emerging area, such as Foton, which joined forces with G7 in 2017 to launch SuperFleet. (G7 is a leading platform in China, serving most of the nation’s biggest logistics providers.)

Pay per Use. New technologies raise the price of vehicles. As the total cost of ownership increases, more customers will be interested in pay-per-use options—for example, buying loading capacity or uptime, rather than buying a truck outright. At the moment, pay per use is limited to short-term rentals and van-sharing schemes. Daimler’s CharterWay makes vehicles in its fleet of 8,000 Mercedes-Benz and FUSO trucks and trailers available for short- or long-term rental. In 2018, Renault Mobility launched a rental service with commercial and passenger vehicles to deliver IKEA furniture to customers’ homes. And Bosch is poised to expand its sharing service for electric vans (which it launched in 2018 specifically for hardware stores) if it proves popular. The next step will almost certainly be the expansion of pay-per-use schemes.

Creating a Path to Transformation

The year 2030—the endpoint of the ten-year period needed to bring a new-energy powertrain from conception to commercial release—will be pivotal. At around that time, trucks manufactured between now and 2020 will need to be replaced. We estimate that up to 30% of commercial vehicle sales will be new-energy vehicles by 2030.

OEMs’ path to transformation will proceed along two parallel tracks. One track will involve securing and integrating critical technologies. In this regard, forging new supplier relationships, including ones with hotly sought-after software makers, will be as important as building the necessary design and engineering capabilities. The second track will involve expanding downstream to tap into emerging profit pools. As they develop new products and services, OEMs will need to modify their business and sales models accordingly. Over time, the role of OEMs in the industry’s logistics ecosystems could evolve further.

Up to 30% of commercial vehicle sales will be new-energy vehicles by 2030.

Between now and 2030, two or three powertrain technologies will emerge as the leading contenders. Commercial vehicle sales will be slack. Consolidation is inevitable. With profits flat and R&D expenses ballooning, OEMs (especially smaller ones) face the pivotal decision of choosing which technology will be most important to them. Understanding their strengths, balancing their R&D investments, and betting wisely on the technology most attractive in their key markets will be critical for securing their competitive position in tomorrow’s vastly different industry environment.