Producers can address critical challenges by designing flexible factories, sharing assets, and decoupling factory ownership and use.

Imagine subscribing to a factory. Instead of owning facilities that manufacture its products, a producer pays a usage fee to share a highly flexible factory with other companies. To make the arrangement financially attractive, third-party investors own the assets. In a nutshell, this is the concept called “Production as a Service” (PaaS).

A recent study conducted by BCG, FlexFactory, and WHU – Otto Beisheim School of Management examined the motivations for adopting PaaS and developed a detailed vision of the fully realized approach. The study builds on the results of a global survey of more than 1,500 executives from producing companies engaged in a broad range of industries. (See “About the Study.”)

About the Study

We selected the survey participants at random from 1,513 global companies that had at least 250 employees each. The companies represent a broad array of producing industries: automotive, capital goods, consumer goods, energy, health care, information technology, process industries, and transportation and logistics. Survey participants were based in 15 countries with industrialized or emerging economies that include a substantial industrial sector: Austria, Brazil, Canada, China, France, Germany, India, Italy, Japan, Mexico, Poland, South Korea, Spain, the UK, and the US.

The survey sought to evaluate the current priorities of the participants’ companies and the applicability of the as-a-service offering to production. In addition, the survey asked participants about the challenges they would expect to face if they chose to implement a PaaS model.

The study found growing demand among companies for regional production and resilient supply chains with low CO2 footprints. However, pursuing these objectives creates challenges. For example, companies need more flexible production processes to manufacture a high variety of products locally. They also need to manage investment risks if lower volumes in regionalized production cause inefficient asset utilization.

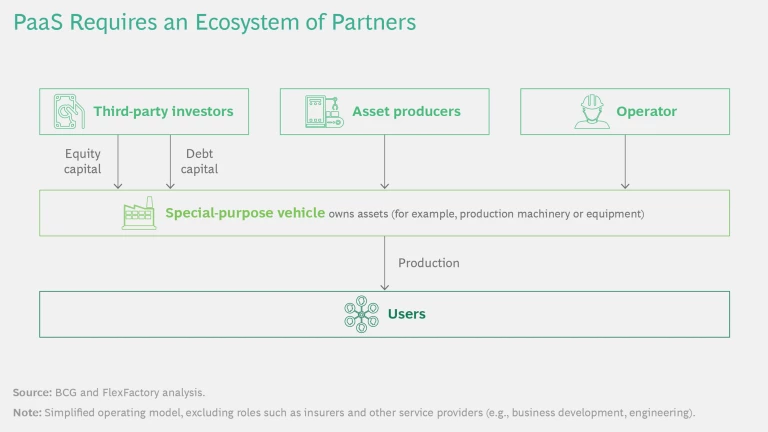

PaaS offers solutions. Just as companies such as Netflix and Spotify have transformed traditional ownership models in entertainment, innovative producers can rethink their production, financial, and commercial models to meet today’s most pressing challenges. By decoupling factory ownership from utilization and by sharing production facilities, PaaS increases financial resilience and promotes cost advantages. Because it enables smaller-scale regional production, it is particularly valuable for companies with asset-heavy production processes that rely on high utilization. The approach is globally applicable. Successful implementation requires developing a business ecosystem that includes third-party investors, asset producers, operators, and users. (See “The PaaS Players.”) Each of these participants plays an important role in bringing the PaaS model to life.

The PaaS Players

- A special-purpose vehicle (SPV) owns the production plant’s assets (such as machinery, production equipment, and tooling). It is a legal entity created exclusively for this purpose.

- Third-party investors provide equity and debt capital to fund the SPV. Equity investors become shareholders of the SPV.

- Asset producers manufacture the equipment used in the production plant. They also participate in developing the production concept and required technology.

- The operator runs the plant. In some cases, the SPV uses its own staff, service providers, or contractors to operate the plant. In other cases, users must provide staff to operate the equipment.

- Users reserve portions of the plant’s production capacity on a subscription basis to have their products manufactured. They typically guarantee a certain level of utilization.

Major Trends Demand Flexibility with Low Risk

Successful producers have traditionally optimized their operations for cost efficiency, seeking to attain the required product quality at the lowest cost. Today, however, the objectives that producers must pursue to ensure competitiveness have evolved. Major global trends require producers to address three key strategic objectives, which our study participants confirmed as relevant to their operations:

- Strengthening operational resilience to address supply chain disruptions

- Improving responsiveness to changing customer requirements

- Pursuing sustainability targets

Strengthening Resilience. Producers need to find solutions to the increased risks arising from the globalization of supply chains. During the past 20 years, Western industrial companies have aggressively moved production abroad to reduce labor costs and to enter new markets. However, such shifts in location have forced producers to depend heavily on production facilities and contract manufacturers in other countries. Supply chains have become longer and more complex as companies move goods across borders, continents, and oceans.

The COVID-19 pandemic and the war in Ukraine have exposed the inherent risks of global supply chains. Material supplies and prices have exhibited extreme volatility, and some producers have struggled to obtain essential inputs—such as semiconductors—at any price. Trade routes, too, are vulnerable to geopolitical conflicts and economic sanctions. Even before the recent major disruptions, producers had to cope with growing protectionism in many regions. In 2019, for example, the World Trade Organization received over 3,300 notifications of “technical barriers to trade” from member states, more than 170% of the number in 2009. Reflecting the impact of such disruptions on capacity planning, 27% of study participants said that their average utilization during the next three years will likely fall below their targeted utilization.

To address these challenges, companies need to strengthen their resilience—their capacity to absorb stress caused by disruptions, recover critical functionality, and thrive in altered circumstances. In our study, 44% of participants said that challenges related to resilience are among their top concerns.

Increasingly, companies are regionalizing production in order to manufacture goods closer to their core markets. Among other things, regionalization enables companies to avoid the impact of tariffs, shorten lead times, shield production from geopolitical disruptions, and gain greater control of supply chains.

In our study, 43% of participants said that they plan to increase the resilience of their global supply chain network through regionalization. Leading companies have already announced plans to regionalize their production capacity. For example, European retail chain C&A intends to produce 800,000 jeans per year in a German factory, and Walmart has committed to spend an additional $350 billion through 2030 on items made, grown, or assembled in the US.

Relocating production to high-cost countries creates an investment risk for producers. It is not economically viable to replicate the labor-intensive production setups and technology used in low-cost countries. Instead, companies must invest in automating and digitizing their production processes. For example, European bicycle manufacturers had previously offshored frame production to a location where producers use highly manual processes. The first European players to relocate frame production to high-cost countries are using fully automated processes. But this entails substantial investments, increasing financial risks related to utilization and performance. Moreover, regionalized production requires smaller factories with smaller output volume, which can lead to lower equipment utilization, less efficient use of material, and reduced benefits from scale.

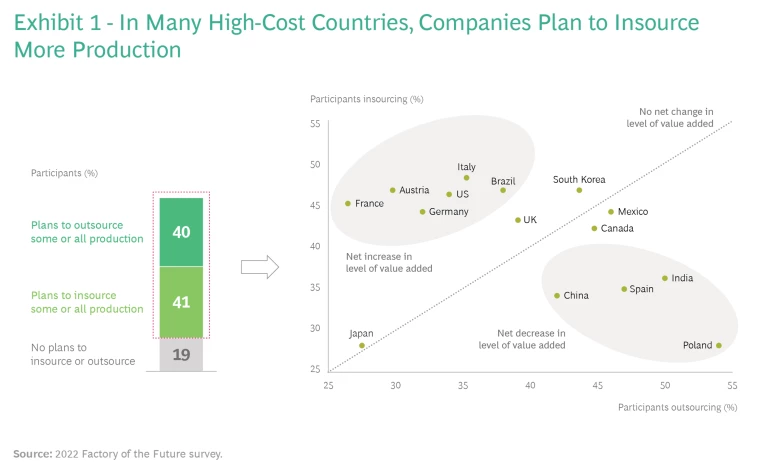

To adjust their financial risk and increase resilience, companies can change the level of value they add through in-house production. Insourcing increases the value added, while outsourcing decreases it. Our study found that companies have different near-term plans in this regard. Nearly 41% of participants said that their company plans to insource at least a portion of its value chain from suppliers or contract manufacturers, and nearly 40% said that their company plans to outsource at least a portion of their production to external service providers. (See Exhibit 1.) We found a net increase in planned insourcing among companies in many high-cost countries, and a net increase in planned outsourcing in many low-cost countries. In many cases, insourcing triggers the need to invest in more production capacity, which could require significant capital expenditures in high-cost countries.

Improving Market Responsiveness. Producers need a new value proposition to meet rising consumer demand, especially among millennials, for highly customized products. Such demand is evident across industries and products ranging from cars to watches to cosmetics. To compete in this environment, producers must have the flexibility to manufacture many different product variants and to quickly adjust output volume in response to fast-changing demand patterns.

Producers recognize the need for more flexible production systems: 77% of study participants said that they plan to design their next production setup for greater flexibility so they can be more responsive to market demands. Only 23% said that they intend to focus on operational efficiency to achieve the lowest possible cost.

Nevertheless, even as producers emphasize flexibility for market responsiveness, they also want to optimize their setup for low costs. Considering the recent spike in inflation, particularly in Europe and the US, managing costs will continue to be an imperative across industries.

Pursuing Sustainability. CO2-intensive global supply chains make it difficult for companies to achieve their emissions-reduction targets. For example, freight transport is responsible for approximately one-third of transport-related CO2 emissions from fuel combustion. In addition, global supply chains can impede compliance with new regulations on traceability or ethical standards. For example, the European Union may soon require batteries to have a digital passport that specifies their carbon footprint and sourcing, among other attributes.

Some producers are regionalizing their operations in response to pressure to improve sustainability. Shortening supply chains reduces CO2 emissions from freight and facilitates compliance with social and ethical standards. At the same time, however, regionalization creates scale challenges. To make regionalization sustainable and economically feasible, companies must find ways to increase the level of regionally produced volumes. Sharing equipment, buildings, and land is foremost among the most promising solutions.

Exploring the Concept and Benefits of PaaS

PaaS allows companies to produce their goods without the burden of ownership. The “as a service” concept first gained scale in IT, when software providers shifted to a subscription model for their products. The concept expanded to include IT infrastructure and platforms and has migrated to other business sectors as well. Content consumption (for example, Netflix or Spotify) and mobility (such as Care by Volvo and TIER Mobility) are among the most visible applications of the model.

The as-a-service model has not yet proliferated in industrial settings, although small-scale offerings related to the use of specific equipment have appeared. Relevant longstanding as-a-service offerings include heat treatment from ALD Vacuum Technologies and compressed air from Kaeser. Since 2020, Trumpf and Munich Re have joined forces to offer a laser cutting machine as a service. PaaS expands this approach to the scope of an entire factory.

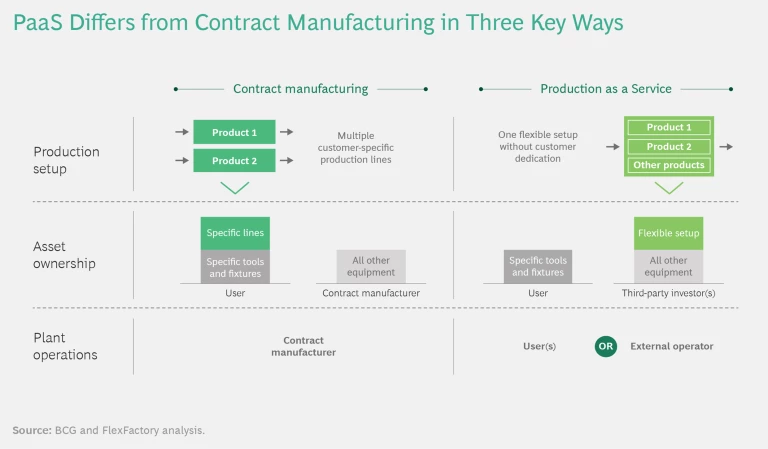

There are several important differences between PaaS and contract manufacturing. (See “Comparing PaaS and Contract Manufacturing.”) The fully realized PaaS concept has three elements: flexible production, asset sharing, and financial transformation.

Comparing PaaS and Contract Manufacturing

- Production Setup. Contract manufacturers maintain multiple production lines, each dedicated to a specific project. This reflects their tendency to focus on individual customer projects. In contrast, PaaS facilities have a single flexible production setup designed to handle different projects—an arrangement that reduces project-specific investment costs.

- Asset Ownership. In contract manufacturing, the contract manufacturer and/or the user owns the assets (such as machinery, equipment, and tools) involved in the production process. In a PaaS setting, third-party investors own the production assets and finance the capital expenses. The user’s financial responsibility is limited to payments for factory utilization. A key advantage of PaaS is its protection of intellectual property (IP). Because the investor has a passive role in the operations, it has no interest in or access to the user’s IP.

- Plant Operations. The contract manufacturer manages production operations in its factory, which often serves customers globally. In PaaS, the user or a third-party operates production, typically to serve a regional market. For example, if a manufacturer decides to set up its own PaaS (funded by third-party investors), it can offer capacity to other users and operate production for them. This opens a new line of business, as production shifts from being purely a source of costs to being a source of income.

Flexible Production. A PaaS setting requires flexible production systems that allow operators to efficiently manufacture multiple products and quickly adapt to fluctuating cycle times and volumes. This necessitates new approaches to automation, such as advanced robots, automated guided vehicles (AGVs), and Internet of Things (IoT) technology. The setup also demands robust processes (including logistics) to enable quick changeovers between tools, technologies, and fixtures. The flexible production system receives critical support from an IoT platform that can connect to multiple systems, devices, and equipment, leading to a fully digitized value chain. The new automation approaches and digital backbone permit companies to respond swiftly to changing customer requirements.

Highly flexible production systems exist in many different sectors. For example, Fendt, a manufacturer of agricultural machinery, has developed the VarioTakt system to master its mixed-model assembly lines. Porsche has developed the Multi Product Line, a highly flexible body-in-white production line (for assembling car bodies’ frames) that operates with minimum changeover times. The company can reduce production cost per assembled part by up to 20%, depending on the mix of production projects. A BCG study using simulations found that flexible-cell manufacturing can yield significant benefits in automotive assembly.

Sharing. Multiple users share PaaS assets and compensate the equipment owner via a pay-per-use model. Sharing capacity enables a factory to operate larger assets, while users benefit from economies of scale. The arrangement also helps companies build resilience by addressing the scale challenges that arise from regionalization.

In addition, sharing can increase equipment utilization by enabling producers to offer unused capacity as a service—whether to affiliated companies or to unrelated ones. High utilization is especially important for asset-intensive companies that rely on three or more shifts to distribute depreciation costs across more products. Small-series producers, which do not have sufficient volumes to run three or more shifts, gain the option of setting up a new production facility that they can share with other companies.

In our study, 62% of survey participants said that they could imagine sharing their current production facility with other companies. Of these, 48% said that they would be willing to share only with affiliated companies, 39% would share with unrelated but noncompeting companies, and 13% would share with any unrelated company. Among participants who said that they could not imagine sharing production facilities, 32% pointed to technical reasons as the basis for their concern. Going forward, however, companies are much more open to sharing: 85% of participants could imagine sharing their production facility if they were to build their production facility from scratch.

Financial Transformation. Parties that share production must address issues of asset ownership and risk allocation. A core concept of as-a-service models is the decoupling of equipment utilization from ownership. From the user’s perspective, spending undergoes a categorical shift from high capital expenditure (capex) to ongoing operational expenditure (opex). In addition to avoiding investment outlays, users mitigate risks related to owning production equipment, including technical failures and poor utilization. Depending on how the parties allocate risk, users may be able to move production assets off their balance sheet.

In order for users to capture these advantages, an external party must own the production assets. One option is for the asset producer to maintain ownership and make the machinery available as a service. This creates several challenges, however. First, maintaining ownership creates a balance-sheet extension that negatively affects financial KPIs (for example, return on capital employed and asset turnover) and may require debt refinancing. Balance sheet issues have hindered past efforts by asset producers to scale as-a-service models beyond a single project. Second, the asset producer will experience a temporary drop in revenue when transitioning from one-time sales to recurring revenue streams. Third, the asset producer bears the risk of lost revenue from underutilized assets.

Given these challenges, parties need to look beyond the asset producer when seeking an owner in the PaaS model. The solution is ownership by third-party investors, together with risk transfer protection:

- Third-Party Investors. The current equipment owner (the asset producer or user) transfers ownership to a special-purpose vehicle (SPV)—a legal entity created expressly for this purpose. Third-party investors then provide funding to the SPV, thereby shifting the capex burden away from the asset producer or user. This arrangement addresses the balance-sheet issues that have impeded previous attempts to scale a PaaS model.

- Risk Transfer. To make the SPV attractive to investors, the parties must address the risk of asset underutilization. One option is for insurers to offer risk-transfer products that cover the potential costs of low asset productivity. For example, an insurer could offer an availability guarantee, the extent of which depends on each party’s risk tolerance. Such a guarantee might cover additional costs arising from the need to pay for night shifts to raise asset productivity. At the equipment level, Maschinenfabrik Reinhausen offers maintenance services for industrial transformers and agrees to compensate the transformer operator in case of unexpected downtime. Munich Re provides insurance to back up this availability guarantee.

In our study, 80% of participants said that they could imagine not owning some or all of their production equipment, indicating that producers are willing to consider an innovative model that transfers ownership. Reducing financial risk to increase resilience is among the main motivations that participants cited.

Taking Intermediate Steps

Although the fully realized vision of PaaS comprises these three elements, companies can take intermediate steps toward implementing the model. For example, some companies may pair flexible production with sharing or financial transformation, but not all three at once.

Flexible Production and Sharing. Companies can make their production available to other organizations—either affiliated or unaffiliated—to produce small lot sizes economically. For example, Porsche wanted to build its own press shop to gain access to modern technology and promote efficiency. Flexibility was essential, because the shift to using aluminum rather than steel for hang-on parts had increased the complexity of ramping up production. Because Porsche is a small-series producer, however, it could not fully utilize a new press shop that met its technical requirements. The automaker decided to take an unconventional approach. It established the Smart Press Shop as a 50-50 joint venture with Schuler, a press manufacturer. This highly flexible facility can efficiently produce small lot sizes, enabling it to offer its asset-heavy presses to other automakers.

Flexible Production and Financial Transformation. A producer can reduce the burden of ownership and gain financial flexibility if a supplier operates and owns a facility dedicated to its products. For example, after separating from Daimler in 2008, Chrysler sought to reduce the financial and operational risks related to its newly built Jeep body shop in Toledo, Ohio. KUKA, a factory automation manufacturer, offered a solution by setting up KUKA Toledo Production Operations (KTPO), a wholly owned subsidiary. KTPO finances and operates the body shop and offers the parts to Jeep using a pay-on-production model. Jeep pays for only the components it needs to meet demand and does not incur overhead or other fixed costs. This arrangement transforms Jeep’s fixed costs associated with the plant and equipment into variable costs. The automaker can allocate the freed-up money to other purposes, such as product development.

Setting Up All Three Elements: Local Production of Bicycle Frames

A producer of bicycle frames is using a PaaS model to economically ramp up European production. The company developed an innovative technology that reduces lead times for production and improves sustainability. To meet high demand, it needs to scale up frame production quickly without jeopardizing the growth of affiliated companies that use the technology to produce other products.

Because the frame producer is a startup that uses a new technology, it had trouble securing conventional external financing, such as debt financing, to scale production. The company was reluctant to raise capital by selling shares because it wanted to maintain full control of its operations and protect its IP.

To finance its expanded operations without losing control, the frame producer is adopting PaaS. Third-party investors will own the production assets and grant access to the producer to manufacture its bicycle frames. The parties designed the operating model so that the producer retains full control over both its IP and the production process.

Other users will share the production assets to manufacture different products. They have committed to contributing up to 30% of the facility’s total asset utilization during the first five years of operation. Equipment sharing will reduce the cost per frame by 12%, on average, during this period. It will also diversify the utilization risks for the third-party investors to accommodate its specific risk profile.

Assessing the Potential Market

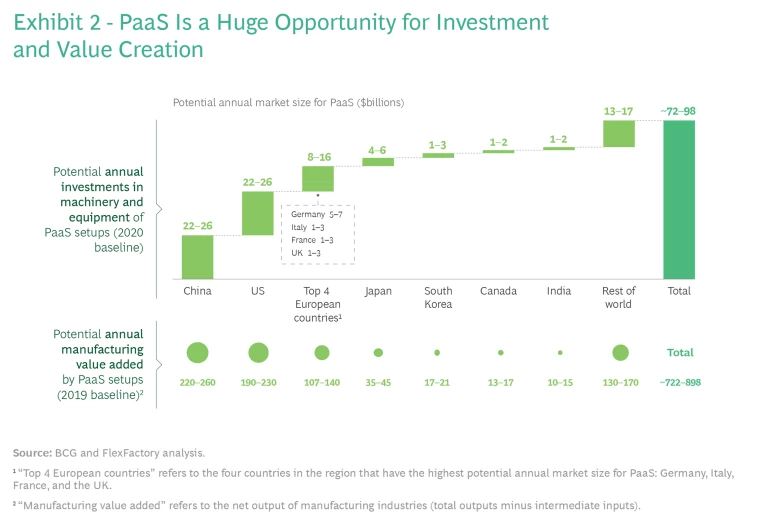

To derive the addressable market for PaaS, BCG and FlexFactory evaluated two metrics: first, the potential annual investments in production assets that could be set up in a full-fledged PaaS model; and second, the potential annual manufacturing value added by PaaS setups (that is, the net output produced). Our market analysis considered the feasibility of applying PaaS as well as the key findings from our study. We validated the results with experts from across industries.

We used several criteria to assess the attractiveness of PaaS, including the following:

- High Asset Intensity. To interest external investors, production processes must rely heavily on equipment. For example, machining processes are better candidates for PaaS than manual assembly processes. The economics of dedicated financing require a minimum investment threshold to justify the related expenses, such as fees paid for structuring and setting up the SPV.

- Low Volume. PaaS is particularly relevant for companies that cannot fully utilize their equipment owing to insufficient production volume. For example, a producer of small-series goods is more likely than a manufacturer of mass products to benefit from PaaS.

- Efficient Changeovers. Production processes that accommodate efficient changeovers to produce different products or variants are well suited to PaaS. Examples include injection molding and 3D printing.

Our market analysis determined that annual investments in production assets used in a PaaS model could reach approximately $70 billion to $100 billion globally, while the annual manufacturing value added by PaaS setups could reach approximately $720 billion to $900 billion. (See Exhibit 2.)

Up to 15% of production operations can be set up in a PaaS model depending on the specific industry and country. Typically, industries that produce specialized products in small volumes and with a high number of variants are a better fit for PaaS. This includes, for instance, premium cars in the automotive industry, specialized bricks in building materials, and packaging in pharmaceuticals.

PaaS might be more relevant in high-cost countries because companies in those countries use higher levels of automation and seek to fully utilize these capital-intensive assets. Since companies’ absolute investment in equipment is quite high, industrialized countries such as China, the US, Germany, and Japan have the highest market potential for PaaS.

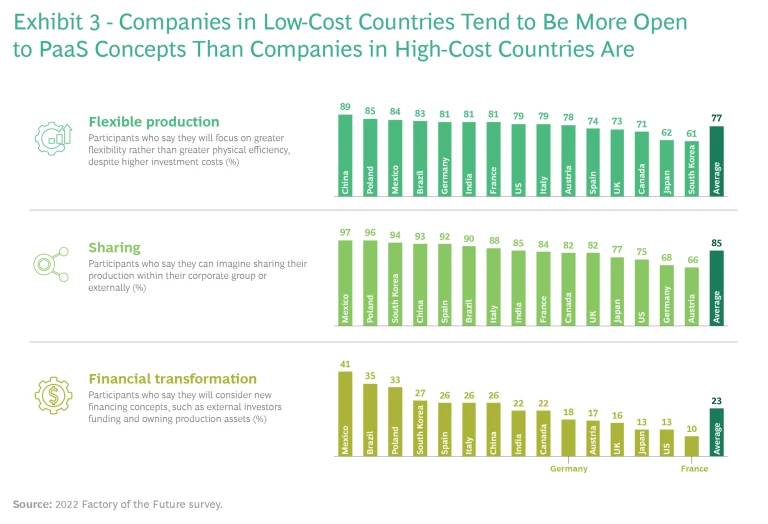

In our study, however, companies in high-cost countries expressed less willingness than those in low-cost countries to adapt their production and business models to each of the three elements of PaaS. (See Exhibit 3.) Companies in low-cost countries, such as Mexico and Poland, may be motivated to adopt PaaS to maintain local operations even as rising wages undermine their competitiveness. The comparative reluctance of companies in high-cost countries to adopt PaaS may reflect concerns about disrupting well-established legacy operations and financing structures. Even so, in coming years, the need to boost resilience and reduce financial risk will likely motivate more companies in developed markets to consider PaaS. All in all, we see strong potential for adoption globally.

What Are the Challenges?

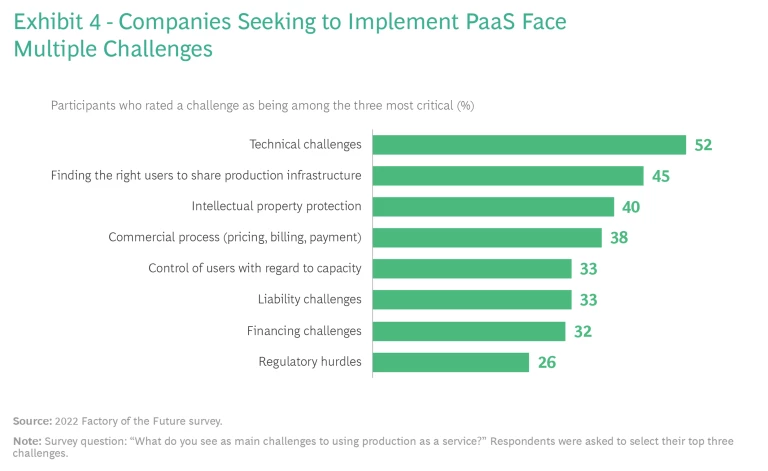

Our study found that companies need to overcome multiple challenges to make PaaS work. (See Exhibit 4.) In particular, study participants most frequently cited four challenges as being among their top concerns about adopting the approach.

Technical Challenges. Approximately 52% of study participants pointed to technical issues as one of the most critical challenges in implementing PaaS. Setting up a facility to produce different products or product variants for multiple users raises issues with respect to hardware and software. For example, adding products or variants with different process times to a conventional production line setup might interfere with the line’s takt (or pace of production). This would reduce equipment utilization, increase idle time for workers, or require more overtime work.

To overcome technical hurdles, PaaS participants can use new flexible production concepts such as flexible cell manufacturing, lines that produce multiple products, or lines with variable takt time. They can also enable virtual commissioning of an entire production line by linking R&D data from the digital twin of a product to the digital twin of the production line.

Finding the Right Users. Approximately 45% of study participants said that finding the right users to share production is among the biggest challenges to implementing PaaS. Some users may be reluctant to allow an external party to run or utilize their production operations. One way to address this concern is to design a setup in which users can provide their own staff to run the operations. A related issue is that, some users may be unwilling to share production facilities, especially with unaffiliated parties.

Operators may also need to address users’ concerns about quality when sharing assets. Assets that all users share (such as robots and machining centers) must meet the standards of the user whose quality requirements are highest. Assets dedicated to specific users (for example, product carriers or tools) will incorporate the applicable quality standards. The operator may choose to tailor plant processes such as quality loops to satisfy each user’s quality standards, rather than to meet the highest standard, after weighing the tradeoff between process stability and costs.

In the early stages of setting up PaaS, managing the expectations of many different users simultaneously can be difficult. A more practical approach is to line up at least one highly committed “anchor user” that commits to producing high volumes of output and is closely involved in designing the operations.

IP Protection. About 40% of study participants cited IP protection as a major PaaS challenge. This reflects companies’ concerns about safeguarding their IP—such as patents, process know-how, or technical designs—when sharing production. However, these IP-related risks are similar to those commonly encountered when a supplier or contract manufacturer produces components or even entire vehicles for multiple OEMs. IP protections established in supply relationships can also be used in PaaS. Moreover, as noted earlier, the third-party investors that own the PaaS plant have no interest in or interaction with a user’s IP.

Control of Operations. In our study, 33% of participants pointed to insufficient control over their production operations as a critical challenge. This concern is understandable given that the SPV or another operator coordinates the utilization of capacity by setting production targets and deciding which user’s production has priority. However, users can address production targets and priorities when negotiating contracts with the SPV. Moreover, the parties can agree on KPIs and quality measurements and can implement digital tools that track performance at the level of production area or line. The operator can share performance results at an actionable level of detail with all parties on a continuous basis. Users can also implement approaches to trade capacity in order to allocate it efficiently, depending on their needs. These contractual requirements and control mechanisms can reassure users that they will receive high-quality and timely production services.

Strategic Considerations

Companies interested in participating in PaaS should consider strategic questions that are specific to their role in the model.

Asset Producers. Companies acting as asset producers need to consider whether to transition from engaging in one-time sales of equipment to providing services for operations and maintenance. Providing ongoing services offers multiple advantages for asset producers, including recurring, predictable cash flow and more customer touch points to strengthen customer relationships. Moreover, customers in a PaaS setting assess a service provider’s performance by evaluating production output, not machine functionality, which can lead to improved customer satisfaction. Asset producers can also access data generated during equipment usage. They can monetize that data by, for example, offering preventive maintenance services.

Because asset producers design and build machinery and are intimately familiar with every aspect of it, they are ideal service providers. Indeed, 71% of study participants from the machinery industry either plan to or already offer as-a-service models for their portfolio. As noted, however, transitioning from one-time sales to a subscription model creates revenue challenges in the short term. Companies can address balance-sheet issues, another important challenge in service models, by transferring ownership to an SPV.

Investors. Third-party investors need to determine their risk appetite and expectations for return on capital. For example, venture capital investors generally have a high appetite for risk and expect a high return on capital, while more conservative investors, such as banks or insurance companies, have a lower appetite for risk and expect a lower return on capital.

Investors with expertise in asset management and collateralized financing are well suited to own production assets. Nevertheless, ownership comes with risks—such as underutilization and technical failures—that are unpredictable and challenging to quantify monetarily. Beyond agreeing with the other parties about the expected return on capital, investors can mitigate these risks through volume guarantees from users and technical performance guarantees from asset producers.

Users. Two strategic issues are critical for users. First, they need to determine whether they are comfortable sharing production facilities with other users. This requires weighing the cost advantages arising from larger scale and greater flexibility against any loss of control that they cannot manage contractually. Second, users must assess the tradeoff between paying a risk premium to investors and taking on risk themselves. In our study, 33% of participants said that they are willing to pay a premium of 10% or more for externally funded production to gain more financial flexibility (shifting capex to opex). To reduce the premium paid for externally funded production, users can retain some risks, such as through volume guarantees. More than 70% of participants in our study said that they would be willing to guarantee volumes in order to enable externally funded production. However, users should be mindful that volume guarantees count as liabilities on the balance sheet.

The pandemic, climate change, protectionism, and geopolitical conflicts are forcing producers to fundamentally rethink their operations. PaaS offers a solution to critical challenges through flexibility, sharing, and financial transformation. By enabling efficient and economical regional production, PaaS promotes supply chain resilience, market responsiveness, and sustainability. Although early implementations have demonstrated value, each producer should assess whether PaaS is right for its specific context. Taking intermediate steps to test the concept may enable a company to uncover substantial opportunities to capture enduring competitive advantage.

About FlexFactory

About WHU

The authors are grateful to the following colleagues for their contributions to this report: Johannes Benedikter, Daniel Dietz, Philipp Kölbel, and Philip Plattmeier of Flex-Factory; and Marcus Ehrhardt, Christian Guse, Harald Jordan, Jonas Kanwischer, Marc Schmidt, and Christian Stockmann of BCG.