For procurement teams across industries, the need to obtain quality components and services from suppliers has never been greater. Failures can greatly boost costs—in the form of warranty claims, product recalls, and lawsuits—and damage revenue and branding irrevocably.

Best-in-class companies have used a variety of practices to mitigate quality failures across the entire supply chain. They have focused on identifying which components require the highest quality, where quality issues have occurred and are likely to occur, and how best to reduce the risk of future failures.

Digital technologies have the potential to boost procurement quality management to a whole new level. Big data, advanced analytics, artificial intelligence, and collaboration platforms provide a high degree of precision, enabling companies to predict and mitigate quality failures much more effectively than in the past. The potential benefits of deploying digital are significant. By our estimate, these technologies can reduce procurement quality problems by as much as 60% to 70%. Here’s how companies can start realizing digital’s benefits.

Digital technologies have the potential to boost procurement quality management to a whole new level.

The Starting Position: Conventional Best Practices

The goal of procurement is to ensure that a company has on hand the components with the right level of quality for creating products and services that meet customers’ needs. Best-in-class companies follow a three-step approach.

Determine Where Quality Is Most Important

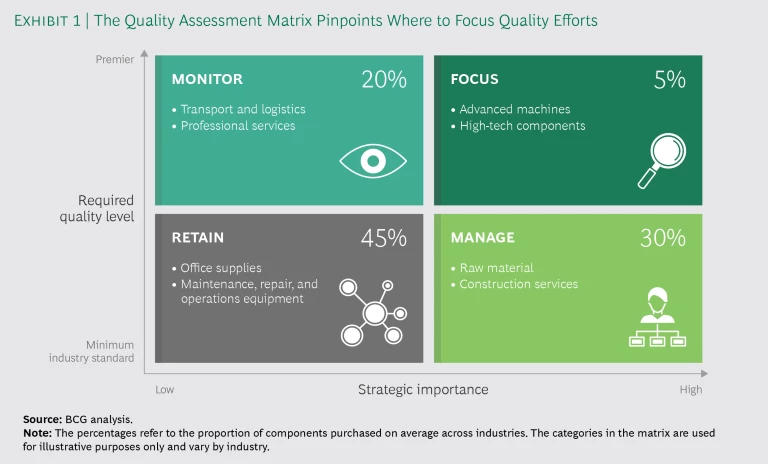

It’s critical to begin by determining where quality is most needed and how tailored the specifications need to be for each product or service component; companies do not have the resources to give the same level of attention to every product in a large portfolio. Best-in-class companies typically assess their portfolio along two dimensions (see Exhibit 1):

- The strategic importance of a component (the value it provides to customers)

- The level of quality required, which ranges from the minimum industry standard to a premier level usually associated with innovative offerings

But even best-in-class procurement teams struggle to get the right quality requirements in place for every product. Generally speaking, a small number of functions (usually sales and operations) are responsible for deciding which requirements are needed, and they frequently do so without considering costs or taking a comprehensive view of the value generated. As a result, the bar can be set too high for many components and services. For example, road transports are often handled as dangerous goods, whether they need this level of care or not. The quality bar can also be set too low, resulting in disappointed customers. In either case, the procurement function has only a limited ability to challenge these requirement decisions.

In addition, procurement teams simply don’t have the capacity to collect and formulate detailed quality requirements for every product and service that’s purchased. So they prioritize the ones that are strategically important and that require a premier level of quality.

Pinpoint Where Quality Failures Occur

A company should be able to identify exactly where product failures occur in the supply chain in order to prevent them from recurring. This is no easy task. Global companies typically produce thousands of different products, each based on components or services from hundreds or thousands of suppliers.

Leading companies rely on frameworks, such as the Eight Disciplines of Problem Solving or the Five Whys, to determine the root cause of a defect. And they use multivariate analysis to continually monitor the quality of strategically important components that need to be of the highest quality.

The frameworks are useful as far as they go—the problem is, they don’t go far enough. Even when frameworks can help trace a failure back to a particular supplier, the precise reason for the failure may be hard to determine. Getting that degree of specificity requires manually combining all the insights generated from many reports and frameworks, which is a monumental task.

Even when frameworks can help trace a failure back to a particular supplier, the precise reason for the failure may be hard to determine.

Multivariate analyses, too, are limited. They can help identify the causes of quality problems for the components that require premium quality. But they are likely to overlook defects in components that don’t, which has an impact on overall product quality.

An equally important challenge is that quality detection is typically backward looking—it’s based on the assumption that future quality failures are likely to occur where they happened in the past. But as product portfolios change more and more rapidly, this assumption is no longer valid.

Identify Initiatives to Mitigate Quality Risk

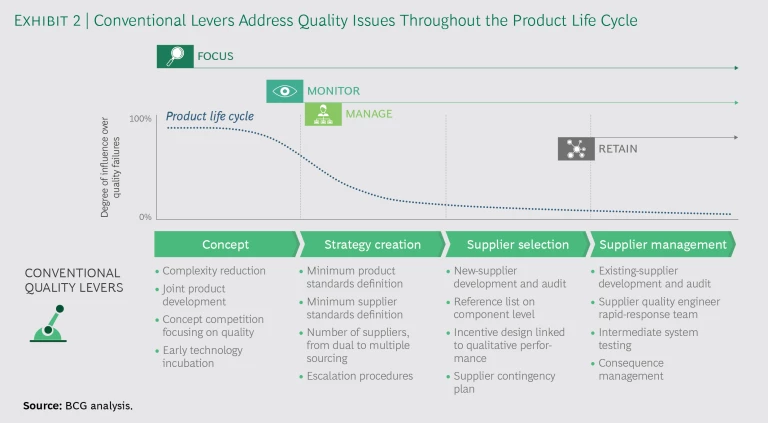

With the information gleaned from their assessments, leading companies deploy all levers available to mitigate risks of quality failure. The quality assessment matrix (shown earlier in Exhibit 1) helps them select the appropriate lever. The more crucial the part or service, the earlier in its life cycle the lever is implemented. (See Exhibit 2.) Products developed jointly with a supplier require proactive, early-stage mitigation, while reactive measures are sufficient for products that are less important strategically.

This proactive-reactive approach clearly has its merits. But it’s too labor intensive to be effective for the thousands of goods and services procured.

How Digital Can Help

Digital is a major step forward in each of the three conventional steps: it helps companies understand where quality is most important, identify where quality problems occur throughout the supply chain, and predict potential failures—all with greater accuracy than in the past. And it allows companies to take the most appropriate actions to mitigate failures in the future.

Gain Clarity on Where Quality Brings Value

Collaboration platforms, big data, and advanced analytics (AA) are critical for determining the specific quality requirements for all components and services, no matter where they are in the quality matrix:

- Collaboration Platforms. Online collaboration platforms can be used for many purposes. Besides offering a way to communicate efficiently, they process and archive the documents that are being exchanged and make the data available for analysis. Platforms are useful, for example, when companies conduct quality audits of suppliers.

- Big Data and AA. AA can be used to assess the data from these evaluations and determine the right quality level for every product in the matrix, not just the ones that require premium quality. The AA assessments also look at scenario analysis to understand, for example, the role that each part of a car seat plays in protecting a baby in different kinds of car accidents.

Once companies have a good understanding of where quality is important, they can formulate specific KPIs and service-level agreements (SLAs) for all the products and services in the matrix. Having such requirements also allows the procurement team to question internal stakeholders who want to use different metrics.

For example, a large burger chain’s procurement team did an advanced conjoint analysis with more than 2,000 consumers on what mattered most to the burger’s taste—the beef, salad, bun, ketchup, onions, or tomato. The group used AA to assess the value that each component delivered relative to the burger’s overall cost; it also analyzed the standard deviation of the quality of products procured from suppliers. The bun turned out to be much more important than they had thought, coming in second only to the beef itself. But at the same time, the quality of the buns proved to be the most uneven. Using this feedback, the firm focused more attention on controlling bun quality, which led to much greater customer satisfaction.

Acquire Visibility into Product and Service Failures

After generating a more precise view of where quality is needed and what level is required, companies can use digital to combine information from various sources into one comprehensive overview of the supply chain. Some of that data is generated automatically, such as statements containing quality claims that are produced when parts are delivered to a plant. But this information is usually not enough to build a complete picture.

To fill in the gaps, the staff in the receiving department who accept and approve incoming goods and services can enter the necessary information in an easy-to-use app on their smartphone. Typically, this input includes other details, such as which products and services arrived late or were in need of quality adjustments. An augmented reality app is especially useful in this context because it facilitates the evaluation of a product’s weight, material, density, and inner contents. Companies can also ask their suppliers to use such apps to assess their products before shipping. These technologies need to be used in conjunction with a dashboard that can constantly analyze data from the different channels and provide an overview for procurement, internal business partners, and suppliers alike.

Once the information on the incoming products is combined with other data such as invoices, quality reports, and supplier balance sheets, AI algorithms can predict where the next quality failure will occur. They weight different data points and information learned from past experience to provide a shortlist of the suppliers and components that are most likely to experience quality failures.

For example, a chemical manufacturer recently installed a system that could predict where in the company’s vast portfolio quality was likely to drop. The algorithm consistently listed 20 to 50 parts (out of 3,000) that merited closer monitoring. Over a 12-month timeframe, the system detected quality failures with more than 80% accuracy. To do so, the algorithm weighted 22 variables such as the trend in internal quality feedback, past quality problems, and the size and even location of each supplier. Some of the most influential factors came as a surprise. For example, invoices sent earlier than usual sometimes revealed that a supplier was in financial distress. And it turned out that these suppliers were highly likely to be responsible for some of the quality failures. Acting on insights like these, the company reduced quality problems by 51%.

Deploy Digitally Enhanced Quality Levers

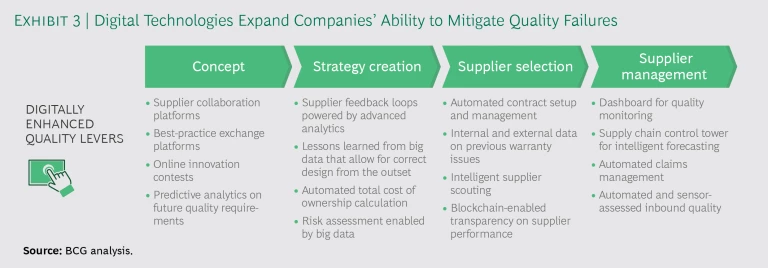

When it comes to using levers to mitigate quality failures, digital offers two advantages. It expands the number of actions companies can take to reduce problems, and it provides guidance on which levers to apply in which situations.

Digital levers can be used to reduce the risk of quality failures throughout the product and service life cycle. Supplier collaboration platforms, for example, greatly facilitate joint efforts with suppliers in the concept phase, while sensors make it easier to collect and assess relevant performance data in the supplier management phase. (See Exhibit 3.)

In one example, a chemical producer discovered that some of its raw-material inputs contained traces of a different material. An analysis revealed that the contamination happened during transport: the logistics provider had not cleaned the silo trailers sufficiently after transporting another material. The manufacturer added KPIs to logistics contracts to spell out the cleaning requirements. And it installed dedicated sensors in the plant to monitor the quality of inbound materials and a quality-tracking and response system to compare the results with the KPIs. These technologies allowed the company to reject full truckloads right at the point of unloading in cases where the supplier did not meet the KPIs. The system also allowed the buyer to expedite claims against the supplier and manage the relationship more effectively.

In addition, digital can guide buyers on which lever—conventional or digital—is the most powerful in the purchasing situation at hand. For example, for individual and advanced production machinery, the best lever might be online innovation contests, while for maintenance, repair, and operations (MRO) parts, automated claims management might be beneficial. The AI algorithm makes recommendations that are nonbinding. Using big data and learning from the past, the algorithm can perceive not only where quality failures may occur but how to prevent them. Buyers can base their decisions on this information. Over time, the algorithm learns which levers are the most powerful in each situation and continually improves its recommendations.

The Vital Role of the Underlying Foundation

Using the right digital tools for the right circumstances does not guarantee success. To derive full benefit, the supporting elements need to be in place. While many enablers have a role to play in boosting procurement quality, three are especially important: processes, people, and performance management.

Processes

Quality management needs to be deeply embedded in the sourcing processes. This is particularly critical for key categories. In source-to-contract (S2C) processes, which start with the defining of individual projects and their needs and end with the signing of supplier contracts, quality requirements for suppliers should already be embedded in category strategies. In procure-to-pay (P2P) processes, which begin with the decision to buy a good or service and end with delivery and payment, technical quality tests can be used in situations where only one supplier is involved. In addition, companies should develop feedback apps and other tools that promote the transparency integral to quality processes.

People

We recommend that companies create a quality management team comprising digitally skilled people from procurement and other functions to deal with quality issues proactively. In contrast with existing continuous-improvement teams that fix problems mainly after they happen, this team would focus on using predictive analytics to understand where quality is most important and on working with suppliers to resolve potential quality failures before they occur. In addition, companies should implement training programs for all core procurement staff so that they can learn how to leverage digital skills to understand where quality matters most.

No less important, purchasing and supplying companies alike need to make people aware that maintaining high quality standards is essential. Four groups need to get this message: employees in the quality unit, the cross-functional procurement team, other functions that work with suppliers, and the relevant people on the supplier’s side.

Performance Management

Employees across procurement and other relevant functions should be measured and rewarded similarly to ensure that they work toward the same quality goals. This is a departure from conventional practice—procurement teams typically don’t include supplier quality in performance management efforts. But they should for one very important reason: high-performing suppliers help reduce the total cost of ownership.

It’s no longer sufficient to rely on traditional best-in-class quality management approaches. Digital technologies are now crucial for defining, monitoring, and improving the quality of inbound products and services. And transparency generated through digital solutions can be leveraged even further.

To make the most of digital, procurement functions first need to analyze their current methods for managing supplier quality in order to determine where their methods are not best in class. Once they have addressed these shortcomings, procurement teams can prioritize their digital agenda. A concerted effort is essential if digital investments are to pay off.

That payoff can be substantial. Companies that use digital technologies to their fullest potential stand to improve the quality of their inputs while increasing revenue, reducing costs, and boosting innovation.