Recent years have been challenging for maritime shipping companies across all vessel segments. Soaring bunker costs and plunging freight prices have combined to dramatically dampen industry performance—and the market is not likely to recover soon. To build a competitive advantage, as well as to relieve pressure on margins, shipping companies must focus on reining in their costs. And they should start by reducing their biggest one: bunker.

Bunker costs, which have been known to exceed 50 percent of total costs, have not only reached record highs in recent years, but they have also become extremely volatile due to broad fluctuations in crude oil prices. The chemical industry has moved refinery capacity away from bunker production because of increased demand for high-distillate products and improved refining methods. The resulting decrease in bunker supply has, in turn, caused greater increases in prices for bunker than for crude oil.

Environmental regulations, particularly those imposed by the International Maritime Organization, are also raising bunker costs. The growing number of IMO Emission Control Areas, for example, has forced shipping companies to shift a greater share of fuel consumption from bunker to more expensive, but environmentally friendlier, low-sulfur fuel. Companies must also comply with the IMO’s limitations on carbon dioxide emissions. What’s more, the IMO has required all vessels to have a Ship Energy Efficiency Management Plan by January 1, 2013, emphasizing even further the immediate need for stronger fuel-management initiatives.

Expenditures for bunker also depend heavily on how effectively a company procures the fuel, manages consumption, and implements efficiency measures. Performance varies widely. For example, BCG’s Container Benchmarking Initiative (CBI) found that bunker consumption among participants fluctuated by as much as 30 percent within any given vessel class.

Since bunker costs are susceptible to performance-based improvements and have a direct impact on the bottom line, reducing those expenditures is critical for companies that want to create and sustain a competitive advantage. Achieving cost reductions, however, can be quite difficult. Establishing a baseline for performance and then identifying improvement opportunities, along with potential cost reductions, is analytically complex. Moreover, internal organizational dynamics can hinder cost-reduction initiatives. Responsibilities for actions that affect bunker costs are typically scattered throughout an organization, both on shore and at sea, and the various teams involved often resist new ways of tackling familiar tasks. Indeed, making the necessary changes within a company is often the toughest obstacle to overcome.

Optimizing Costs End to End

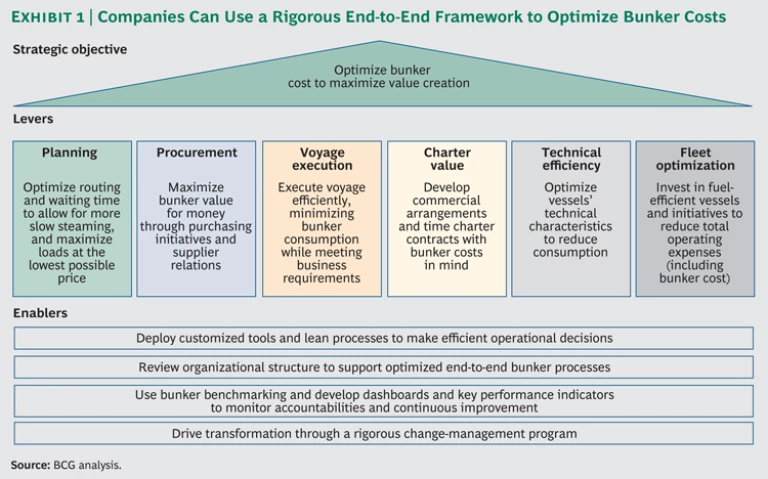

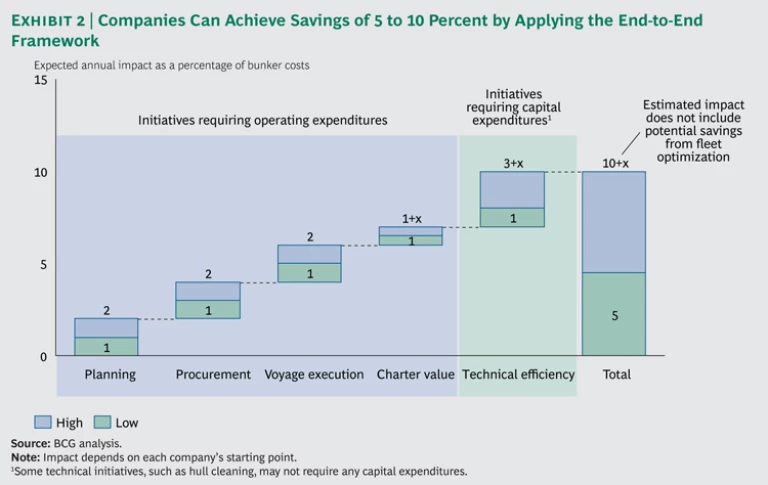

To help shipping companies address these challenges, BCG has developed an end-to-end framework for reducing bunker costs. The framework comprises ten elements—six levers and four enablers—each with distinct objectives. (See Exhibit 1.) Each company will need to select the levers that apply to its own particular situation. But all companies should apply all of the enablers to unleash the full potential of the identified initiatives. By following this framework, a company can realize annual savings of 5 to 10 percent. (See Exhibit 2.)

One global tanker management company operating a large fleet, for example, used this framework to identify initiatives that the organization hoped would achieve annual savings on bunker costs of approximately 8 percent. A top-quartile performer in most dimensions of BCG’s Tanker Benchmarking Initiative, the company recognized that it needed to optimize its end-to-end bunker process for even greater performance. To gather information and design an improvement program, the company formed cross-functional teams comprising representatives from the operations, bunker procurement, chartering, technical, IT, strategy, and finance departments. The teams identified more than 30 initiatives—emphasizing planning, procurement, and voyage execution—and developed decision-support tools to facilitate “lifting” (the process of taking on fuel) and fuel tank utilization.

To mobilize the organization for implementation, the company undertook change-management and capability-building initiatives: The leaders responsible for bunker cost management honed their implementation skills. Members of the relevant departments became highly engaged, supporting the initiatives and transferring capabilities deep into the organization. And top management closely monitored progress through monthly performance reviews. The company has now begun implementing the end-to-end approach, and the initial results have been encouraging.

A leading global container-ship management company also applied the framework, hoping to realize annual bunker cost savings of up to 7 percent. The company was particularly interested in freeing-up cash in the short term to implement a turnaround strategy. Consequently, time- and resource-consuming initiatives, such as optimizing the fleet and improving port operations, were not considered. Instead, the company focused on shorter-term initiatives, such as streamlined port approaches, accelerated hull cleaning, efficient engine operation, and optimized trim (the distribution of load and ballast). After an eight-week diagnostic period, the company rolled out a pilot in stages across six service lines, led by a cross-functional team. The first pilots achieved cost reductions in the range of 4 to 11 percent.

The Keys to Success: Going Beyond Slow Steaming

Overall, shipping companies have made significant progress in implementing reduced sailing speed, known as “slow steaming,” to consume less bunker. Most companies have also improved the way they procure bunker. Yet very few players have gone beyond those basics. To establish bunker cost management as a clear strategic priority, companies need to mobilize cross-functional teams to address costs end to end, consider all possible improvement levers, and lock-in savings with diligence and discipline. In our work with shipping companies, we have identified seven tactics that foster continuous improvement and help companies build a sustainable competitive advantage.

Go for the quick wins first. To build momentum and motivate the organization, companies should pursue immediate initial successes and then celebrate those gains with the company and reward the employees responsible for the results. Examples of quick wins include optimizing the frequency of hull cleaning to reduce water resistance and improving ship-to-shore communication to maximize sailing time and allow for slow steaming.

Use customized decision-support tools. Companies should develop customized decision-support tools, which solve complex issues by using the same principles that traditional planners apply but achieve results more quickly and with greater accuracy. Leading tanker companies already use such tools for lifting optimization and tank utilization. The lifting-optimization tool helps a company develop a plan that minimizes bunker costs while allowing the vessel to deliver its cargo on time at the designated port. The tank-utilization tool is used to generate a report with specific directions regarding all bunker-related activities, such as the sequence of tanks from which fuel is burned, placement of new loads in empty tanks, transfers of fuels among tanks, and fuel mixing.

Streamline processes from end to end. Instead of focusing on specific steps, companies should examine the entire bunker process—including technical efficiency, voyage execution, commercial functions, and the link between teams on shore and at sea. Consider trim optimization, for instance. Traditionally, shipping companies have focused on optimizing the distribution of load and ballast at departure. But since the cargo has already been loaded by then, the potential for improvement is limited. Greater opportunities arise when companies identify the actual and optimal trim at all stages of the end-to-end process (cargo uptake, planning, departure, and during the voyage). Continuous communication to vessel crews, owners, and planners regarding optimal trim is also critical, as is evaluating all tradeoffs in monetary terms. For the container-ship management company in the example discussed above, trim optimization accounted for half of the estimated bunker savings—a tenfold improvement over its previous approach.

Strengthen skills. Building stronger skills throughout the organization, including the leaders and teams on shore and at sea, will help lower costs. Skills that enhance cross-departmental collaboration—such as early communication of changes in voyage prospects—are especially important for achieving rapid savings. Companies should also train maritime staff on cost-conscious practices with respect to voyage planning and execution. Additionally, companies should seek insights from their maritime staff, such as by dedicating time during monthly performance reviews to discuss any ideas for improvement they may have.

Define clear responsibilities and accountabilities. Clearly communicating bunker responsibilities and accountabilities will ensure coordination and collaboration among multiple departments and between personnel on shore and at sea. To make sound lifting decisions, for instance, operators on shore must receive pricing information from procurement, a list of eligible fuel types from technical, and voyage prospects from chartering. The officers and crew, for their part, must implement slow steaming and offer feedback to procurement on the service level provided by different suppliers.

Delineate clear goals for the organization and monitor performance. Shipping companies must instill a performance-management culture in their organizations: stating clear goals and closely monitoring performance are essential for achieving and sustaining positive impact. Key performance indicators (KPIs), such as adherence to the schedule and compliance with slow steaming, should be established to promote more efficient bunker use, and they should be linked to departments or cross-department teams so that the company can improve accountability, ownership, and collaboration. They should also be defined to exclude uncontrollable factors, such as region-specific price volatility, to the greatest extent possible. Perhaps most important, KPIs should be sufficiently detailed for the company to be able to determine what is causing underperformance and then begin improving it.

Dashboards can also increase operational awareness and create value by communicating best practices between teams on shore and at sea. For example, enhanced performance monitoring and improved communications can help minimize variations in speed and thereby reduce bunker consumption.

Finally, industry benchmarks—including KPIs that cover both consumption and procurement performance—can highlight best practices, and reveal areas needing improvement, for each vessel class. Companies can use these benchmarks to set tangible goals and to evaluate the success of improvement initiatives.

Create partnerships. Partnerships between ship operators and ship owners, ports, or bunker suppliers can play a key role in lowering costs. When implemented correctly, partnerships between operators and owners can produce wins for both parties. These partnerships are especially valuable for container carriers that operate time charter vessels. BCG’s CBI has found that such vessels have slightly higher bunker costs than vessels owned by carriers. Because the carriers pay for bunker in a time charter arrangement, ship owners and their crews typically lack incentives to curtail bunker consumption. To address this, carriers should work with the owners of time charter vessels to apply best practices in fuel efficiency and to permit the installation of consumption-monitoring equipment and energy-saving devices. The parties can agree to share the savings, with the owner receiving higher charter rates if the carrier can reduce its bunker costs as a result of these efforts. Shipping companies can also partner with ports and bunker suppliers to identify ways to create value, such as by agreeing to fuel-type availability, pumping rates, minimum hours of delay, and flexible delivery dates. Carefully selecting partners and managing relationships will promote success.

Shipping companies that want to reduce bunker costs should evaluate each step of their current bunker processes and determine which departments and functions are involved. They should look for clear communication of responsibilities and accountabilities, performance-monitoring mechanisms, and competitor benchmarking. An absence of any of those elements would indicate an opportunity for significant improvement. To create a distinctive source of competitive advantage, shipping companies should take action now.