One of the most remarkable developments of the 21st century global marketplace is the rapid growth and evolution of the sharing economy. Today, ordinary people can rent, short-term, everything from luxury handbags to high-end homes to powerboats to designer pets to musical instruments. And also cars. BCG has researched the potential growth of the car-sharing market and estimated its impact on new-car sales in 2021. We found that although car sharing will expand relatively quickly and widely, it will have only a minimal effect on new-car sales, both because most drivers will not forgo car ownership entirely and because some share of lost car sales will be partially offset by sales into car-sharing fleets in large urban areas.

The trend toward car sharing should nonetheless make automotive OEMs consider reconceiving their mission, at least in part. While continuing to serve as manufacturers and distributors of personally owned vehicles, OEMs should also experiment with providing mobility services and devise new business models accordingly. Manufacturers can set up units to provide vehicles to consumers on an as-needed basis, substituting a stream of fee income for sales revenues. At the same time, this can give them access to potential customers who might buy a car at some point in the future.

In this report, we examine the development of the car-sharing market and quantify the economic impact of the shift to shared vehicles.

Principles of the Sharing Economy

The basic premise of the sharing economy is simple: everything—every product and every service—is sharable, for a price. The sharing economy addresses and meets the needs of both buyers and sellers. Those needs can be seen as the three core principles of the sharing model: value, coverage, and trust.

- Value in the sharing economy takes shape along several dimensions. For example, sharing enables users to bypass the up-front investment in an asset or service as well as the greater costs that come with ownership. Instead, they pay for the asset or service only when it’s needed, and they can change the type of asset or service, or the timing of its use, whenever necessary. For a driver who needs a car infrequently and for short trips, the cost of renting for a few hours is significantly less than the total cost of ownership.

- Coverage in the sharing economy refers to the geographical reach of a sharing service, its availability at a given time, and the ease of user access. Availability requires that car-sharing services have relatively large fleets on the road to handle times of peak demand. In some cities, that can pose problems. In London, for example, some services are available in only a few boroughs, because companies have to negotiate terms of service with each borough council individually.

- Participants in the sharing economy must quickly build the trust and confidence necessary for transactions to move forward. In the business-to-consumer (B2C) car-sharing environment, trust is usually established by the brand and reputation of the service provider, which is most often an automotive OEM or a well-known car-rental company.

Car Sharing Today

Car sharing is an umbrella term that covers multiple modes of sharing. It is distinct from ride sharing, which involves being driven rather than driving, and has existed on an informal basis for as long as there have been cars, ultimately evolving into organized taxi services and more recently into new models such as Uber and Lyft. Car sharing includes both B2C offerings and largely informal peer-to-peer (P2P) arrangements. In Europe, the list of players includes, among others, DriveNow and Car2Go, which operate around the globe; Flinkster, which can be found in several European countries; Autolib, mainly covering France; and CarUnity and Tamyca, which are P2P services in Germany. Players in North America include DriveNow and Zipcar, which (along with Car2Go) are global operators, and Turo (formerly RelayRides), a P2P service. In Asia-Pacific there are Orix and Park24 in Japan and, in China, PPzuche, a P2P service, and EVCard, as well as many small players with limited geographic range. Cars may be available at fixed stations—in effect, dedicated parking spots—located around a city, or on a free-floating basis, which allows users to park their vehicle at any legal spot, where it awaits the next user.

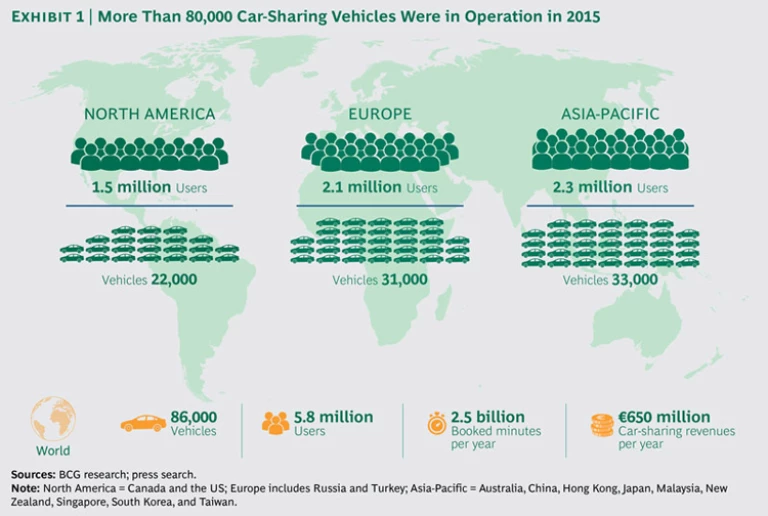

Car sharing is taking hold in large urban areas in both the developed and the developing world. Although the largest market is the Asia-Pacific region (including Australia, China, Hong Kong, Japan, Malaysia, New Zealand, Singapore, South Korea, and Taiwan), with 2.3 million users and 33,000 vehicles, Europe (including Turkey and Russia) boasts the largest service per capita, with 2.1 million users and 31,000 vehicles. North America (including Canada and the United States) brings up the rear, with 1.5 million users sharing 22,000 vehicles. Together the three regions account for 2.5 billion booked minutes per year and €650 million in revenues.

The car-sharing business has grown rapidly in areas that clear certain social, economic, and demographic thresholds. In Germany, for example, some 140 different services are in operation, controlling a car-sharing fleet that has grown from about 1,000 vehicles in 2001 to more than 15,400 today—about 50% of the total European fleet—with most of the growth occurring since 2011. The customer base has grown from a mere handful of early adopters in 2001 to more than 1 million, again with a sharp increase since 2011. Station-based car sharing is now available in 490 German cities serving a population of 36 million potential users. And 13 cities with a total population of 10 million potential customers are home to free-floating car services.

Yet even in Germany—and particularly in Berlin, one of the world capitals of car sharing and home to an installed fleet of 2,900 vehicles—the service is only one of several mobility options, and far from the most widely used. B2C car-sharing services, operated by either OEMs or new entrants, account for only 0.1% of mobility options, compared with 29.5% for private cars and 12.5% for bicycles. At €4.95, the cost of traveling 7.5 kilometers (the average distance of a car-sharing trip) via a car-sharing service is considerably less than the €18.90 cost of a taxi for the same distance, but more than the €3.45 cost of a private car and the €2.70 fare on public transportation.

Three Market Evolution Scenarios

What combination of coverage, value, and trust makes car sharing relevant for a critical mass of consumers, and what would it take to persuade some of them to forgo ownership of their own car? To answer those questions, we formulated three scenarios—which we refer to as disruption, continuation, and evolution—to project the market potential and user base for the service.

The disruption scenario assumes that a sweeping change in consumer mind-set occurs virtually overnight and coverage mushrooms to meet demand. Rather than viewing cars as status symbols and expressions of the owner’s personality, consumers see them as more or less fungible utilities, the only criterion for choosing one over the other being availability when and where the user needs it. This is our most aggressive projection. The number of people forgoing private vehicles would have a sizable impact on new-car sales, although the necessary growth in car-sharing fleets would constitute a new market opportunity for OEMs. It is also the least likely scenario, because the shift would be massively disruptive, not just for OEMs but also for consumers.

The continuation scenario is the most conservative and assumes that car sharing will grow at a limited pace and create no major disruptions. Relatively few drivers will forgo ownership, and there will be little impact on sales of new private vehicles. Growth will be highest in Asia-Pacific, where the potential user population relative to the market penetration of car-sharing services is greatest and where the cost of ownership, including license plates and user permits, is high, especially in urban areas. Elsewhere, car-sharing fleets will remain at roughly their current sizes, limiting the opportunity for OEMs to replacement sales. Because consumers are increasingly willing to at least consider sharing and market players are steadily increasing their offerings, we believe the market’s growth will accelerate and therefore regard this scenario as fairly unlikely.

Most likely is the evolution scenario, which assumes that the development of the sharing economy in general and of car sharing in particular will accelerate, albeit with private ownership retaining its social importance. A growing number of drivers will stop owning cars, but their conversion will proceed at a manageable pace. New-car sales will take a modest hit, but accelerated car sharing and expanded car-sharing fleets, as well as vehicle replacement, will create an opportunity for OEMs.

When Car Sharing Makes Sense

What specifically will induce drivers to forgo private ownership? First, car-sharing services will have to offer value by providing vehicles that meet users’ needs at a fair price. Second, they must ensure extensive coverage; cars will have to be readily available when users want them, and the rental process must be easy to negotiate. Finally, users will have to trust the ability of car-sharing services to provide reliable vehicles, deliver on their promises, and resolve disputes fairly. Under these conditions—and assuming rational consumer behavior—some (but by no means all, or even most) owners of private vehicles could be convinced to make the switch.

Value. In general, car sharing enjoys the largest cost advantage in the case of drivers who accumulate low annual mileage. Car ownership entails several fixed costs, including depreciation, insurance, and maintenance, which add significantly to the total cost of ownership. Car-sharing users pay only when they use a vehicle (usually a time-based rather than distance-based fee), though they pay more per trip than they would to use their own car.

In Europe, city-car drivers who drive less than 7,500 kilometers a year would pay less to share than to own, as would drivers of compact cars who drive less than 12,500 kilometers a year. Drivers of midsize cars would have to drive less than 16,000 kilometers a year to gain an advantage from sharing, and drivers of large cars would have to drive less than 24,500 kilometers a year. Overall, 17% of city-car drivers, 46% of compact drivers, and the majority of midsize and large-car drivers would incur a lower total cost of ownership with car sharing, based on their annual mileage.

Car sharing will also have to fulfill individual consumer needs if it is to replace car ownership. In all regions, the largest pool of potential customers is owners of compact and city cars. These consumers represent the typical target group for car sharing, mostly for short trips within a limited radius. Yet not all of these people will actually forgo car ownership. Many will still prefer the certainty of having a car at their disposal whenever they need it, while others will continue to opt for private ownership because they need to drive unusual routes, because they desire a certain model with a specific interior configuration, or simply because they prefer not to use shared cars.

Our baseline evolution scenario suggests that car sharing will best meet the needs of some 40% of city-car drivers and 20% of compact-car drivers in Europe, given their usage and driving patterns. We expect these shares to be somewhat lower in the US and in Asia-Pacific. Drivers of large and midsize cars tend to drive longer distances more frequently and to carry larger payloads and regard their vehicles as signifiers of status and achievement. Neither of these groups of drivers is therefore likely to forgo car ownership.

Coverage. Car-sharing services require a critical population mass in order to be profitable. We have found that in Europe and North America, that means a population of at least 500,000. Car sharing in most countries in those regions will therefore be economically viable only in the capital city, or possibly in the three largest cities. In Asia-Pacific, by contrast, where per capita incomes are generally lower and the transportation infrastructure is less developed, car sharing will be economically viable in cities with populations of 5 million or more. Asia-Pacific will nonetheless be the largest market in absolute terms, because of its very large and growing population.

Trust. When a service is offered by a recognized and respected brand, such as an automotive OEM, trust is naturally established by the provider’s reputation. But start-ups and P2P services will have to establish trust by other means, such as peer-to-peer reviews, service guarantees, and consumer review services.

The Most Likely Course

We ran a simulation based on the evolution scenario to determine the impact of car sharing on new-car sales in Asia-Pacific, Europe, and the US. We found that, given the necessary value, coverage, and trust, car sharing would decrease purchases by 792,000 vehicles worldwide in 2021—the equivalent of slightly more than 1% of projected unit sales of 78.4 million new cars in markets where sharing is available.

Local and regional trends affect the penetration rate of car sharing. In Europe, for example, municipal authorities strongly discourage driving in city centers, which creates a disincentive for ownership. The changing consumption habits of young Europeans also foster the growth of car sharing. Older people, however, who are the largest customer segment for new-car sales, are unlikely to get rid of their private vehicles.

The US is different. Because residents of the country’s sprawling and sparsely populated interior regularly drive long distances, the potential for car sharing is almost nil across most regions. Car sharing stands a much better chance of catching on in densely populated urban centers such as Boston, New York, and San Francisco. But the comparatively low total cost of vehicle ownership and the convenience of driving one’s own car will encourage many people in the US to purchase a new car rather than forgo ownership.

China presents a mixed picture. In tier 1 cities such as Beijing, Guangzhou, and Shanghai, young people are turning away from car ownership because of congestion and the difficulty and cost of obtaining a license plate. In lower-tier cities, however, private cars remain a potent status symbol for the emerging middle class. Nonetheless, as both business and private travel steadily increase, many people will opt for the convenience and flexibility of car sharing and other innovative mobility options.

Japan has more limited potential as a car-sharing market. Although young people in urban centers are increasingly turning to car sharing, middle-aged and older drivers are reluctant to give up their private vehicles. That dynamic places a low ceiling on the market’s growth.

In general, we believe that car sharing is likely to penetrate deepest in Europe, followed by Asia-Pacific, although Asia-Pacific will require a larger fleet size.

Trajectory of Growth and Revenues

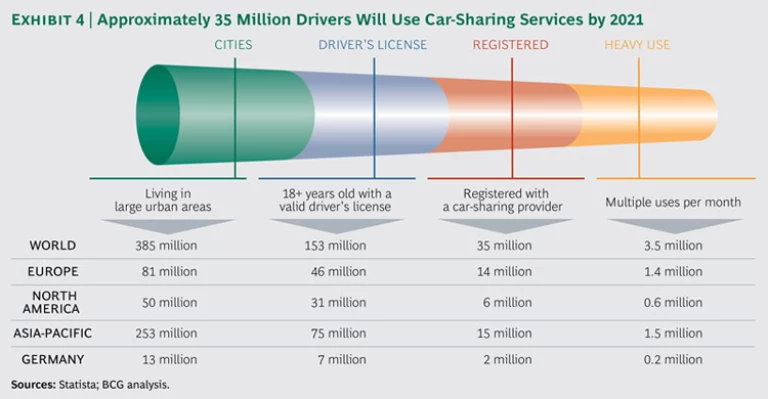

The size of the urban population and the number of licensed drivers will determine the growth of car sharing in Europe, North America, and Asia-Pacific.

In Europe, some 81 million people will be living in large urban areas in 2021, 46 million of whom will have a valid driver’s license. About 14 million people will be registered with a car-sharing service and 1.4 million of them will be heavy users who take multiple trips per month. The North American urban population is expected to reach 50 million by 2021; 31 million people will be licensed drivers, of whom 6 million will be registered users of a car-sharing service. Some 600,000 people will be heavy users. Asia-Pacific’s urban population will grow to 253 million, and there will be 75 million licensed drivers. Roughly 15 million will be registered with sharing services, and 1.5 million will use them for multiple monthly trips.

All these patrons of car-sharing services will generate global revenues of €4.7 billion in 2021, with the bulk of revenues—€3.2 billion—coming from light users who need a car only for occasional trips. Europe will be the biggest revenue-generating region, throwing off €2.1 billion, followed by Asia-Pacific, which will account for €1.5 billion, and North America, with €1.1 billion.

Mobility service providers are trying to calculate how large their fleets will have to be to provide adequate coverage to these drivers at a profit. Several inputs go into their calculation: the number of minutes booked per month, the maximum utilization rate (calculated as a percentage of the entire fleet), and the frequency with which vehicles are replaced. According to our evolution scenario, some 35 million users will book some 1.5 billion minutes of driving time each month by 2021, and each car will run at a utilization rate of 15%, which allows time for fueling, maintenance, and repositioning. Service providers will maintain what may sound like a lower-than-expected usage rate in order to ensure that vehicles are available during peak periods. Cars will be replaced every 12 months. At those rates, sales into global car fleets would reach 246,000 in 2021, with the global fleet comprising 228,000 cars—89,000 in Europe, 98,000 in Asia-Pacific, and 41,000 in North America.

Vehicle Sales, Autonomous Vehicles, and Ride Sharing

So what will be the overall impact of car sharing on vehicle sales? And how will the advent of autonomous vehicles and ride-sharing services such as Uber affect the car-sharing market?

Vehicle Sales. We assessed the number of vehicles that will be purchased for car-sharing fleets in 2021 and the share of forgone private purchases those sales will offset. Our estimate is that fleet sales will equal about one-third of forgone car sales. By region, that works out to 96,000 fleet sales and 278,000 forgone private sales in Europe, 44,000 fleet sales and 52,000 forgone private sales in North America, and 106,000 fleet sales and 462,000 forgone private sales in Asia-Pacific. In sum, car sharing will cost OEMs approximately 550,000 units in worldwide vehicle sales. In revenue terms, that works out to €7.4 billion in net lost revenues, once the impact of forgone purchases, increased car sharing, and car-sharing fleet sales is taken into account.

AVs. In the long run, autonomous vehicles will have a much greater impact on new-car sales than car sharing will. AVs are not expected to arrive until 2021 though, and even then their use will be limited. Therefore, they are not likely to affect large-scale mobility patterns until 2027. (See Revolution in the Driver’s Seat: The Road to Autonomous Vehicles, BCG report, April 2015, and Revolution Versus Regulation: The Make-or-Break Questions About Autonomous Vehicles, BCG report, September 2015.) But when that day comes, car-sharing services will gain a powerful new enabler thanks to AVs’ low operating costs, maneuverability, and ability to be exactly where users need them exactly when they want to drive. At that point, ride sharing and car sharing will converge. AVs’ low operating costs will enable operators of mobility services to provide adequate coverage in smaller cities, resulting in an upsurge of registered users, an influx of car-sharing fleets into smaller cities, and increasing forgone car sales.

Because AVs can offer greater convenience, AV car-sharing services will likely attract new registered users and may be able to charge higher prices than conventional car-sharing services. At the same time, the extremely high utilization rates of AVs will likely limit sales into car-sharing fleets.

That day is still far off, however. AVs will probably be used first as so-called robo-taxis, which will initially operate only in highly regulated and protected environments, driving in designated lanes on dedicated routes. Moreover, autonomous features will by that time represent a large percentage of the total cost of typical urban cars, such as city cars and compacts. And the economics of shared AV fleets will remain very challenging for some time to come, despite the vehicles’ high utilization rates.

Ride Sharing. Uber and other ride-sharing services, such as Lyft, pose a serious threat to car sharing—now and in the long term. Both ride sharing and car sharing compete for the same set of users, who are drawn to the ease and convenience of summoning a ride or accessing a nearby car for temporary use with a few taps on a smartphone. Both are well-suited to spontaneous one-way trips of less than 15 minutes. But in cities with serious parking constraints—which is to say, nearly every large, dense city on Earth—ride sharing offers tangible benefits, although cost-conscious consumers might opt for car sharing, which is cheaper. Nonetheless, the continued growth and reach of ride sharing will act as a brake on car sharing’s growth.

With ample financial backing, Uber is pressing ahead with expansion plans into new territories and across the regions it already serves. Its ambitions may be somewhat constrained by regulation, despite the laissez-aller tenor of most enabling legislation in Japan and the US. In several European countries, however, especially those in the western part of the continent, popular resistance to ride sharing is likely to gain some legislative support.

Car sharing will certainly bring about changes in urban driving, driver behavior, and the business models of OEMs and new entrants. It will expose new revenue pools and become increasingly relevant to a cohort of mostly younger drivers. It is not, however, a true game changer. It will not do to the automotive business what iTunes did to music: it will not redirect a stream of revenues to a disruptive upstart, and it will not spark a widespread change in consumption. AVs, however, will change the game, erasing the distinction between car sharing and ride sharing and offering users a significant edge in the total cost of ownership. But since AVs will not arrive on the market in force until 2027, there is still ample time for the car-sharing market to evolve and for players to prepare for a period of accelerating change.