Much of the action in the technology sector is moving to emerging markets.

Discussions of the technology business, especially digital technology, tend to focus on the two “gold coasts”—the western coast of the US and the eastern coast of China. But the global tech industry is a much more diverse and dynamic sector than it might seem to be from the slice captured in those two high-powered regions. Much of the most exciting action is taking place in emerging markets.

While tech companies from Africa, Asia, Israel, Latin America, Russia, Turkey, and the UAE have not yet achieved the global scale of Apple or Alibaba, they are bringing products and services to market, often in new ways, and growing fast in both size and number. They are reinventing their industries and charting their own paths to scale and success. They are also gaining the attention of major industry incumbents, in the tech industry itself and in other industries, that must determine how best to deal with the rise of these new potential adversaries and allies.

In this latest addition to BCG’s global challengers series, which originated in 2006, we focus on 100 emerging-market tech challengers—companies with the ambition and potential to reinvent and reshape the industries in which they operate. Their innovative advances, rapid growth, and expanding global positions merit close attention.

In this article, we present the highlights.

Geographic Diversity—and Leadership

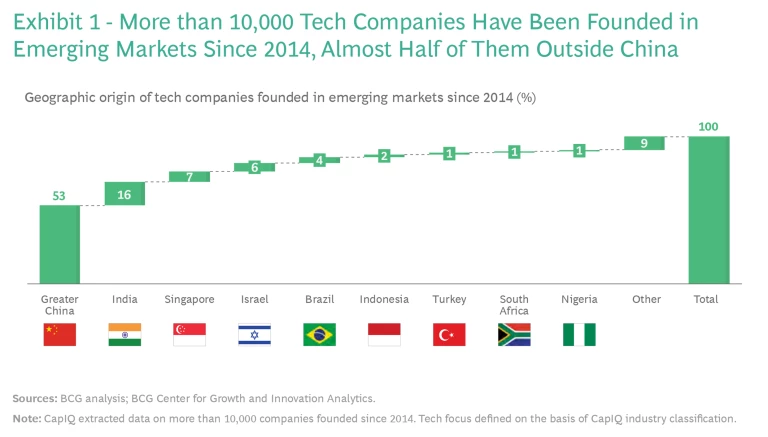

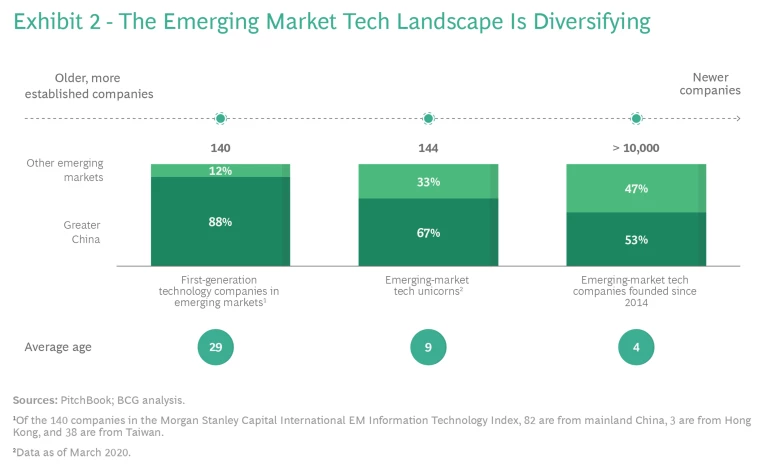

Although China has dominated the tech scene in emerging markets for years, the situation is changing as other markets grow in sophistication, and as entrepreneurs and others improve their access to technology, ideas, and capital. A new generation of younger, smaller, and much more diverse tech companies is making its presence felt. More than 10,000 tech companies have been founded in emerging markets since 2014, almost half of them outside China. Among emerging-market tech unicorns (companies valued at $1 billion or more), one-third hail from countries other than China.

The 100 global tech challengers on our 2020 list are a truly global group, representing 14 countries from all major regions. (See Exhibits 1 and 2.) They are active in multiple sectors, spanning B2C and B2B. Indeed, while two-thirds of the challengers focus on consumer apps or services, fully one-third are active in B2B, transforming how other companies work. More than half of the tech challengers have already expanded beyond their home market, and 40% are active in developed markets.

Expansion strategies vary by region and sector. How quickly tech challengers move to replicate their success in other emerging markets or to set up shop in developed markets depends in part on the size of their home country or region. Southeast Asian challengers tend to focus on their region, while Chinese and Indian companies split between their large home markets and others. Faced with a limited local market, challengers from such countries as Israel and the UAE tend to “go global” from birth.

Although the tech challengers average $2 billion in revenues each, they are still growing at an average annual rate of almost 70%, which is six times faster than the tech sector in developed markets. (See Exhibit 3.) Their average valuation of $6.3 billion puts most of them well beyond unicorn status. Companies based in China and Southeast Asia have the highest valuations—a reflection, in part, of their large local or regional markets. As a group, our challengers seem to be weathering the COVID-19 crisis well, with increases in both customers and usage frequency. Indeed, some sectors, such as gaming, edtech, and video streaming, have seen accelerated growth.

Innovation Reigns

Conventional wisdom often ascribes the success of the tech sector in emerging markets to two factors: an advantage in labor costs, and the ability of companies in these markets to quickly copy and reproduce innovative technology invented elsewhere. Our tech challengers put the lie to both assumptions. These companies are innovative in their own right and in several different ways. Some develop products and services designed to solve problems that are prevalent in emerging markets. Others go beyond new products and services to innovate transformative business models in their industries. Still others take their innovations beyond their home markets and bring them to a global level.

Many tech challengers are using their technical capabilities to address such challenges as socioeconomic problems related to lack of infrastructure, limited financial inclusion, and inadequate health services in remote or poor areas. They often leapfrog more mature markets to develop new solutions, using innovative business models to reshape markets, address inefficiencies, and establish new industries. Increasingly, tech challengers are challenging multinational competitors from developed markets and gaining recognition on the global stage.

New Models for Getting Started—and for Growth

Emerging-market startups have drawn on multiple potential sources of early funding and assistance—including government backing, corporate venture capital funds or incubators, and conglomerates—depending in part on where they are located. It is not unusual for the backing to extend beyond funds to include access to the backers’ resources, know-how, and customers, all of which can provide early advantage.

Corporate backing of early tech startups primarily takes two forms. One is corporate venture capital support. Established tech giants from the US, China, and elsewhere are now investing in emerging-market tech companies, and our challengers are leveraging this influx of funds and know-how to fuel their growth. The other is large companies or conglomerates setting up their own ventures. Several factors distinguish successful corporate ventures, including a clear vision and ambition on the part of the corporate parent, separation of the startup entity so that it has room to experiment at scale, and identification of unmet needs in emerging markets that new technology can effectively address.

Young tech challengers pursue multiple paths to growth and expansion. Many transcend industry boundaries and the online-offline divide through partnerships and M&A. Emerging-market players tend to embrace ecosystems—both within the tech sector and across the online-offline divide, more often and much earlier than developed-market companies do. Although it is important, money is far from the only means of exchange among participants in many ecosystems. Knowledge, data, skills, expertise, contacts, and market access are other currencies that link ecosystem players.

Challenges for Incumbents

Incumbents, take note. Emerging-market tech challengers are reshaping the tech sector, as well as many other industries where they see opportunities for innovation, and many are keen to expand beyond their initial market or sector.

Tech challengers are already generating intense competition across industry sectors. They face incumbents on three main types of battlegrounds. The first is existing revenues and profit pools in local markets, which challengers attack through technological and business innovation.

The contours of the second battleground are less sharply defined but involve a focus on future value pools of emerging markets. The ongoing competition for the Indian e-commerce market is a prime example, pitting complex alliances of local tech companies and industry giants against one another. The third battleground is global, as some tech challengers reach far beyond their local markets to establish an international presence.

Intensifying the competition on all of these battlegrounds are challengers’ appetite for growth, their ability to innovate, and their willingness to attack new sectors beyond their core businesses.

Challengers also provide opportunities for partnership and collaboration. Their tendency to work through ecosystems encourages them to be more open to collaborative models than many of their predecessors were. Some have staked out useful places in their industries’ value chain, offering established incumbents new products and services as well as better models for serving customers. Partnerships between challengers and incumbents sometimes take stronger forms as they join forces to innovate in their markets and attack new sectors. Recognizing the value and the collaboration potential of challengers, many incumbents see challengers as attractive opportunities for investment or even acquisition.

Whether as adversaries or as allies, emerging-market tech challengers are a force to reckon with. They are growing fast and reshaping industries, markets, and value chains. Incumbents need a clear strategy and a pragmatic approach to prepare themselves for potentially disruptive sources of competition and to capture opportunities to collaborate with these up-and-coming companies.