Published monthly, the Covid-19 Australian Consumer Sentiment Snapshot highlights information drawn from a BCG consumer survey that we execute every four weeks with our coding and sampling partner, Dynata. Our research is designed to uncover consumer perceptions, attitudes, and behaviour and spending changes related to Covid-19 as they evolve. This snapshot presents insights from wave 2 research completed in the Australian market and other countries from May 21st to May 26th, 2020. We have also drawn comparisons with research completed in wave 1 from April 20th to April 24th, 2020.

After being closed for almost eight weeks, an ease in Australia’s lockdown has prompted celebrations. People ventured out, reconnected with people they haven’t been able to see, and dined out with loved ones. With the initial reopening underway, Australia is hoping to turn the page and write a new chapter of personal and economic revival.

With this easing in restrictions, consumers are beginning to show positive sentiment. We see an improvement in the number of consumers who say the worst of coronavirus is over (24% compared to 20% in wave 1). The improvement is most evident in NSW (28% up from 21%) and in South Australia (22% up from 16%) which eased restrictions faster than Victoria (21% up from 18%). Queensland, with its tough border closure remaining, had only a marginal improvement (25% up from 23%).

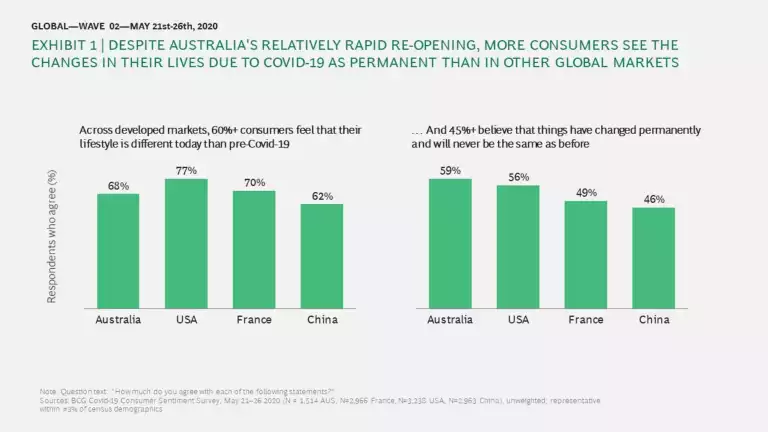

Despite the positive turn, more consumers in Australia than those in other markets believe that there is still a long way to go before they resume a ‘new-reality’ life. Most not only believe that their lives are different today than pre-Covid-19, but also that this change is likely to be permanent (refer Exhibit 1).

MARGINAL IMPROVEMENT IN CONSUMER CONFIDENCE YET CAUTIOUS REVIVAL PLAN

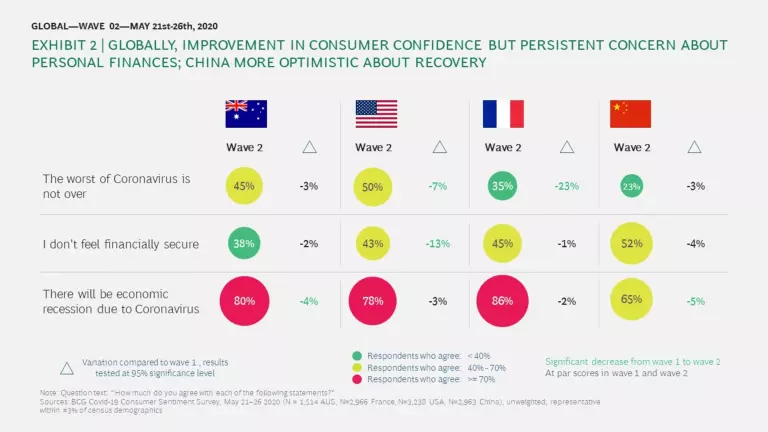

In China, where restrictions were lifted earlier, fewer consumers believe that there will be an economic recession. In Australia however, we see only a slight improvement in the perception that ‘the worst of coronavirus is over’. Concern about financial security continues, with Australian consumers feeling slightly more positive than consumers in other markets in this regard, and the France shows the greatest improvement here over the last four weeks (refer Exhibit 2).

The path to recovery is not straightforward. Despite a marginal positive spike, most consumers in Australia continue to be sceptical of economic recovery, with 80% believing there will be an economic recession as a result of Covid-19 restrictions, a perception that is mirrored in other mature markets. As a result, consumers are likely to step cautiously as they move to resume a ‘new-normal’ life.

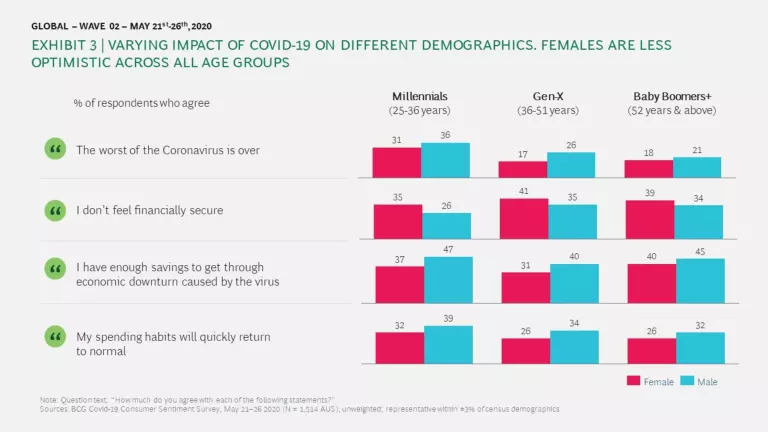

In this report we de-averaged sentiment of consumers from different age groups and gender in Australia and revealed some quite striking results. Put simply, female consumers across all age groups are feeling less financially secure than male consumers. Post Covid-19, females say they are less likely to return to their pre-Covid-19 spending habits than their male counterparts (refer Exhibit 3).

COVID-19 HAS HAD A PROFOUND IMPACT ON CONSUMERS’ LIFESTYLE AND SPENDING BEHAVIOUR.

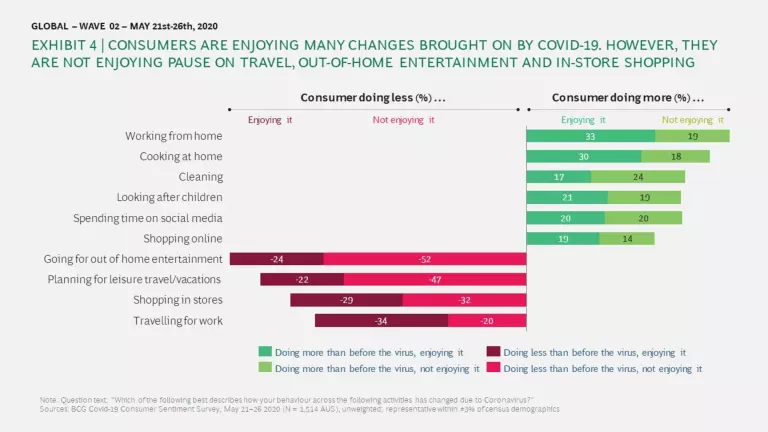

Our survey suggests that consumers are finding many positives in the changes brought about by Covid-19-related restrictions, and that they are coming to terms with other changes.

Almost half of the population is working from home, with two-thirds enjoying this change. Forty percent of consumers are spending more time on social media, and half say they are enjoying this shift. Fifty-four percent of consumers have signed up for at least one new virtual coaching/learning session in the past two months. On the other hand, 69% of consumers said that they did not do much planning for leisure travel or vacations during the lockdown period and two-thirds did not enjoy this change. As soon as restrictions eased, approximately 40% of consumers started planning for air travel.

Overall, 33% of consumers are shopping online more since Covid-19 emerged, and they have mixed views regarding which products they will continue to shop for online post Covid-19 (refer Exhibit 4).

What is clear is that 30% consumers agree that their spending habits will never return to pre-Covid normal, with 52% of consumers continuing to plan to reduce spending on luxury products even after the crisis is over. Fear brought on by Covid-19 has led consumers to adopt a ‘save more, spend less’ approach, a sentiment that looks set to persist: approximately 50% of consumers claim that they will cut spending and save more over the next 12 months. Spending reductions will be more aggressive among those whose earnings have fallen below their pre-Covid-19 income levels, with 63% of consumers who took a cut in income reducing spending in the last two months.

A DESIRE TO RETURN TO PRE-COVID LIFESTYLE CONTRASTS WITH CHANGES IN SPENDING PATTERNS THAT ARE LIKELY TO PERSIST

As the Covid-19 fallout evolves, consumers are evaluating their choices and adjusting plans to spend their money. For this reason, we assess consumer intentions around spending patterns through a series of waves.

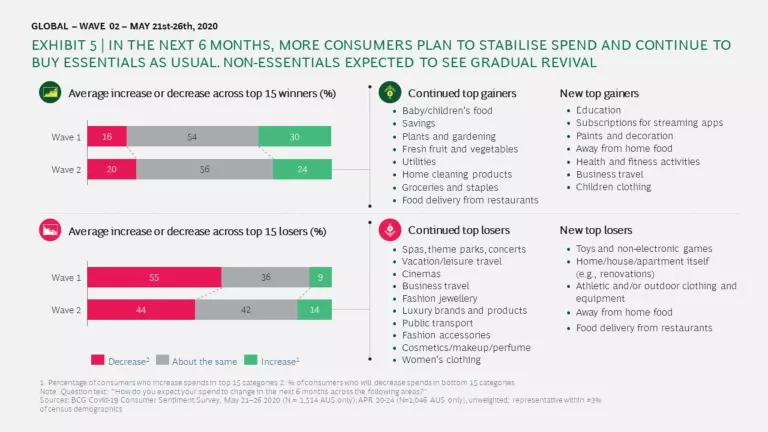

Our recent wave 2 results show that planned spending over the next six months is relatively stable across most essential products and services compared to wave 1 results. As restrictions continue to ease, consumers plan to gradually increase their spending in a number of categories including education, streaming apps, health & fitness activities, eating out and business travel. Compared to survey results from wave 1, we found that some consumers have dropped their plans to spend more on alcohol, household care products, pet food & supplies and vitamins & supplements.

Travel, entertainment and luxury products continue to be top losers in spend intentions in the next six months. In wave 2, consumers have added toys, and non-electronic games and athletic clothing and equipment to this list – all items they had stocked up on in the previous two months (refer Exhibit 5).

to spend more in the top 15 winning categories, whereas 27% of Gen-X and 20% of Baby Boomer and Silvers intend to spend more in these categories.

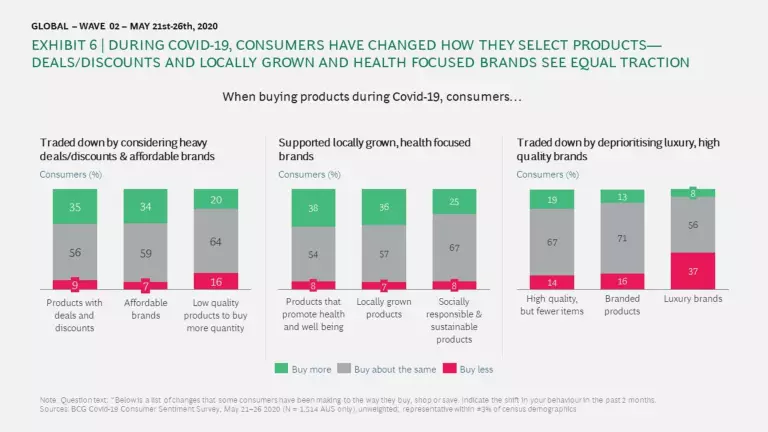

The impact of Covid-19 is not only evident in which categories consumers are buying, but also in how consumers evaluate options for buying products from these categories. Our survey showed that in the past two months, 35% of consumers focused more of their spending on deals and discounted products, and 37% reduced purchase of luxury brands. Consumers are trading down to manage their budgets.

At the same time a noteworthy impact of Covid-19 on consumers’ purchasing behaviour is an increasing shift to locally grown brands (36% in last two months compared to 23% pre-Covid-19), and to brands that promote health and well-being (38%). One-in-four consumers in Australia supported brands that promote sustainability or bring tangible benefits to the local economy. This trend is persistent over the past two months (refer Exhibit 6).

In summary, uncertain and recessionary times have prompted consumers to make three major shifts in their spending patterns:

- reduce spending on discretionary products

- trade down on essential products

- buy products which support sustainability and local economy

While all three shifts have persisted over the past two months, consumers continue to evaluate which of their old spending habits they can resume. As the situation gradually reaches a more stable ‘new-normal’, consumers are likely to continue expanding their spending beyond essential categories. For example, 44% of consumers say they are saving to travel as soon as the situation returns to normal.

Companies need to closely monitor consumers’ evolving spending patterns and prepare to respond to consumer needs now, rather than later.

Digital continues to fuel the economy

The role of the digital economy has been growing in importance for long before Covid-19, with approximately 2x growth in digital purchasing over the last five years, signalling that digital is established as the new way of buying products and services.

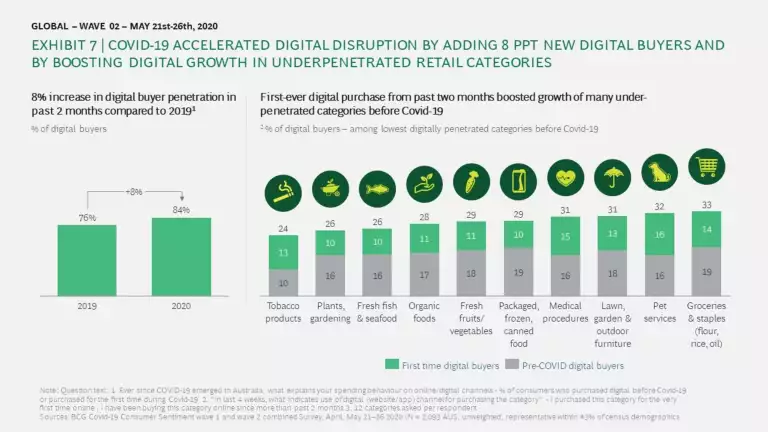

Nonetheless, during Covid-19 digital penetration has increased even further, explained by three positive shifts (refer Exhibit 7):

- New digital buyers: Covid-19-related disruptions have accelerated digital adoption. The number of digital buyers increased from 76% to 84% in the last two months compared to our 2019 baseline.

- Digital buyers making more purchases: in the past two months, 33% of consumers did more shopping online compared to the pre-Covid-19 period. Forty-seven percent of consumers now believe that online shopping is an inevitable part of their lives and that this will continue post Covid-19.

- Existing digital buyers expanding to new online shopping categories: 28% of consumers shopped online in at least one new category in the past two months (continuing growth seen in wave 1). Before Covid-19, tobacco products, pet services, medical services, gardening, fresh meat & other food, packaged food were not strong digital performers (<20% digital buyers). With Covid-19, digital purchasing in these categories almost doubled.

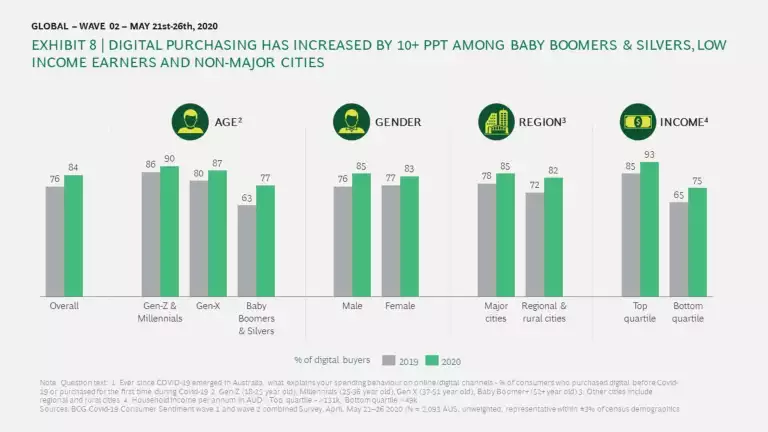

Not only is digital purchasing becoming more common across multiple product categories, but Covid-19 has driven growth in digital purchasing across all demographics (refer Exhibit 8).

Age groups –Baby boomers and Silvers drove the uptick in new digital purchases, with 14 percentage points added to the digital buyers’ baseline in the last two months.

Locations – The number of people purchasing online increased by 10 percentage points in rural and regional areas in the last two months.

Income segments - High income segments led digital purchasing pre-Covid-19; during the lockdown period, the number of low-income earners shopping online grew by 10 percentage points.

WILL DIGITAL SHOPPING PATTERNS PERSIST?

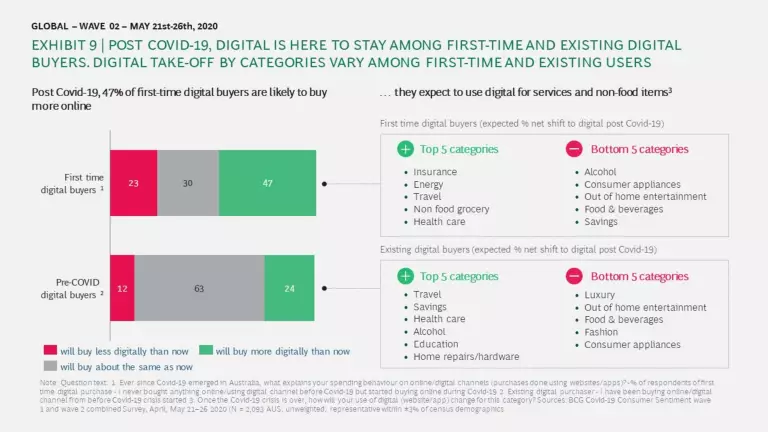

Given that many of the drivers of digital purchasing behaviour relate to convenience, we expect the shift to persist. Our wave 2 survey results suggest that 47% of first-time digital buyers will buy more online post Covid-19 than they do currently, and 87% of pre-existing digital buyers will continue to buy the same or more online post Covid-19.

However, conversion of first-time digital purchasers to consistent digital purchasers varies by category. Food & beverages are likely to see a reduction in digital purchases post the Covid-19 period among new and pre-Covid digital buyers. New digital buyers are likely to increase their purchasing in service categories such as travel, insurance and utilities. They also plan to increase online purchasing in the non-food grocery category. Existing digital buyers have different plans compared with new digital buyers: in addition to service categories, they plan to buy alcohol, home repair products and in-home entertainment products online. They plan to reduce digital spending on fashion, appliances, luxury and out-of-home entertainment (refer Exhibit 9).

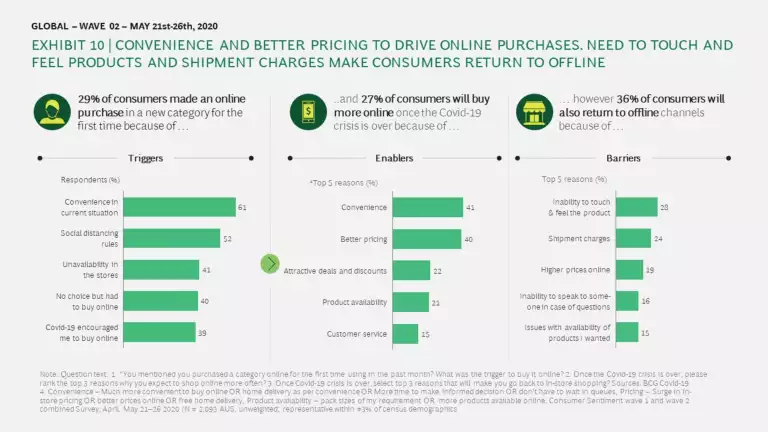

During Covid-19, existing consumers bought online for convenience and to secure the best deals. For new digital buyers the digital channel meant convenience under challenging circumstances. Consumers tell us that they will buy more online post Covid-19 in exchange for convenience, better pricing and better deals and discounts, while 36% of consumers plan to go back to offline stores to buy in at least one category. These consumers say that they miss the touch and feel of products, find shipment charges to be high, and 19% believe that online prices are higher than prices offered offline in stores (refer Exhibit 10).

WHAT DROVE THE CHANGE IN ‘TRUST’ FOR SOME INSTITUTIONS?

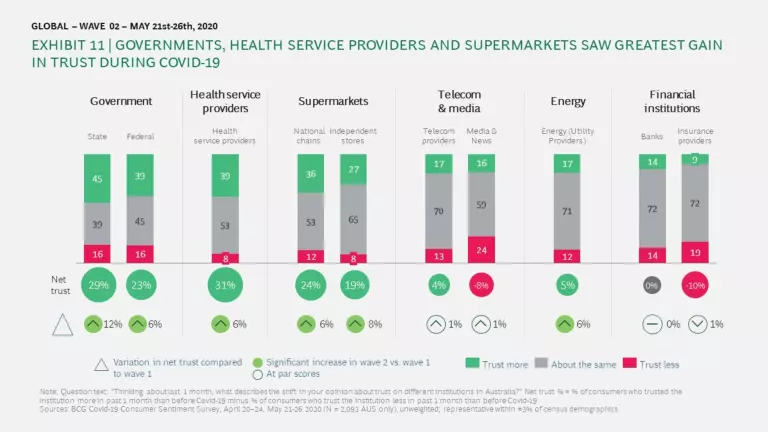

In Snapshot 1, we reported that net trust had lifted significantly for health service providers, supermarkets and government. In the last four weeks these trends have bedded down, with further increases in net trust for all these institutions.

At the same time, we continued to see little change in net trust for banks, and a decline in net trust for insurers (refer Exhibit 11).

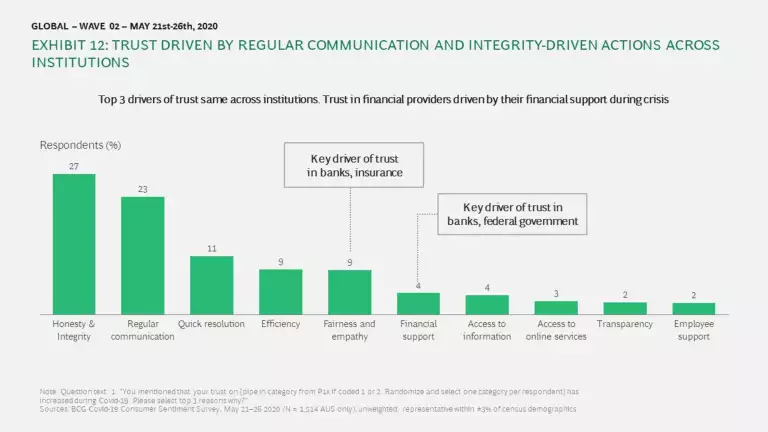

We were keen to dig beneath these results to understand what drove the change in Trust for some institutions. We found a strong correlation between an organisation’s response to Covid-19 and a net increase in trust. The top three drivers were honesty and integrity in dealings with consumers, regular communication, and speedy resolution of any issues via access to online and call centre support. Trust in organisations fell when consumers perceived there was a lack of innovation, issues with data security and confusion around constantly changing policies.

Let’s take a few examples.

Government - Both federal and state governments have won consumer trust for their response to Covid-19, with net trust gains of 29 and 23 percentage points respectively observed over the past two months. Respondents believe governments have been honest, clear and timely in helping people navigate the crisis.

Supermarkets – We observed significant uplifts in net trust for supermarkets overall, including a 24 percentage point net gain for national grocery chains in the past two months.

Consumers claim that Aldi continues to delight the ‘budget-conscious’ consumer segment, and Woolworths has been praised for actively contributing to society in difficult times which has helped boost the local economy. In particular, their priority assistance program for vulnerable customers and hunger relief program for the most in-need Australians solidified trust among Woolworth’s customers. Respondents are satisfied with the online purchase experience from both Coles and Woolworths.

Banks – Net trust in banks has not shifted over the past two months. However, there was some polarisation, with 14% of consumers increasing trust and 14% decreasing trust.

Those who increased their trust in banks cited honesty, regular communication and fairness & empathy as the key reasons (similar to other institutions). For banks specifically, financial support and fairness and empathy played a role. No one bank managed to deliver on all criteria that built overall positive trust.

Digging deeper into the perception of individual banks shows NAB and ANZ praised for ‘responding well to the crisis’. ING and UBank clearly win in ‘delivering value for money’, and are perceived to be ‘modern brands’, while Westpac was appreciated for its ‘innovative customer support’ during Covid-19 and ‘contribution to society’. CBA was associated with being the ‘most trusted bank in difficult times’, and a clear winner on ‘seamless digital and omni-channel customer experience’.

Insurance providers – Trust in insurance providers did not improve during Covid-19 with a net fall in trust of 10 percentage points.

In health insurance, Medibank performed most strongly on its response to the Covid-19 crisis, and its contribution to society. BUPA was by far the strongest on ‘a modern brand that moves with the times’, while HBF showed slightly higher levels of ‘trust and reliability’ with consumers relative to other insurers.

In general insurance, Budget Direct performed strongest on ‘value for money’, and together with Youi, Allianz and AAMI was perceived as a ‘modern brand that moves with the times’. QBE scored highest for ‘keeping personal information secure’, and RACV strongest for its ‘active contribution to society’ and for ‘reliability’. NRMA also performed relatively well on ‘contribution to society’ and as an organisation that ‘helps boost the local economy’.

Overall, as with the banks, no individual insurer performed strongly across all the dimensions required to build trust in a time of crisis. In particular, no insurers were associated with ‘best digital experience’ or a ‘seamless multi-channel experience’, both critical considerations for consumers during the Covid-19 lockdown.

Telecommunications providers – Net trust of telecoms providers improved slightly over the past two months (up 4 percentage points). Telstra was appreciated for its ability to ‘adapt to a difficult situation’ and for ‘keeping customers’ information secure’. Optus was praised for its ‘seamless multi-channel experience’. No clear winner emerged among telecoms providers in terms of response to Covid-19.

‘Trust’ has long been a critical catalyst for company growth. Companies whose customers feel ‘we are there for you, and not only in good times, but also bad times’ tend to experience a long-lasting positive impact on customer loyalty and spend with them. In our study, close to 40% of consumers said that the more they believe that a brand demonstrates care for their Australian consumers, the more likely they are to give them their custom.

CALL FOR ACTION

As we move closer towards recovery, there are number of actions for companies to consider in response to Covid-19:

Scan ahead to predict the future – consumer needs and behaviours will continue to change as will the size and shape of demand. It is imperative that companies monitor a wide-variety of indicators to analyse shifts in consumer behaviour. Rapidly adjusting decisions based on what they learn will help companies to navigate successfully through the new reality.

One Australian innovation to address this challenge has been the Woolworths’s Basics Box. Woolworths partnered with DHL and Australia Post to package up a bundle of essential groceries, delivered to the doorstep for an all-inclusive cost of $80. By standardising the box contents and including only ambient products (e.g. packaged snacks), Woolworths was able to shift picking to a warehouse and delivery to the postal service, easing the burden on stores and on its fleet of vans. Woolworths predicted the surge in demand well in advance to build a robust supply chain and meet customers’ needs.

Build a brand that consumers wish to see – 2020 has been an extremely challenging year. Crises unite people. Covid-19 boosted national pride among Australian consumers and the proportion of people determined to buy locally grown, environmentally friendly brands is at an all-time high. Consumers also actively consider brands that care for their customers and struggling companies in difficult times. Brands that build targeted propositions around value, sustainability and local-support attributes will be rewarded.

Deliver an end-to-end experience – Consumers’ dependency on digital is not confined to the purchase of goods online but extends to research and post-purchase support across product and services. Even though consumers are not buying today, they are evaluating what is available, and planning to buy. Companies who tap into customers’ journeys in the early stages are likely to enjoy long-term success.

Mecca launched personalised beauty consultations accessed via FaceTime or via an online booking tool. Customers can choose a quick 15-minute beauty pow wow, or a 45-minute skin or make up consultation with in-store hosts. An in-store consultant calls the customer on FaceTime and demonstrates everything a customer would typically see in store. They also launched Mecca Live, a 24/7 beauty broadcasting program sending daily beauty updates across Mecca TV, Mecca Chit Chat and Facebook Live sessions.

Create a new-normal shopping environment in stores – Today’s consumer is far more informed about the importance of health and well-being than consumers who have faced crises in the past. They are prioritising health and wellness like never before, with 38% of consumers planning to buy health and wellness related products, and 21% of consumers planning to shift their focus to health and wellness activities. Stores that are clear on how they will maintain a healthy shopping environment will win more custom than those that don’t.

As we look forward and support Australia out of lockdown, we see that disruption has created many opportunities, with consumer behaviours and spending in flux. Companies willing to be bold in the face of uncertainty, who develop a deep understanding of changes in consumer behaviour and shape their proposition to meet these changes will emerge from this crisis stronger than they were when it began.